Answered step by step

Verified Expert Solution

Question

1 Approved Answer

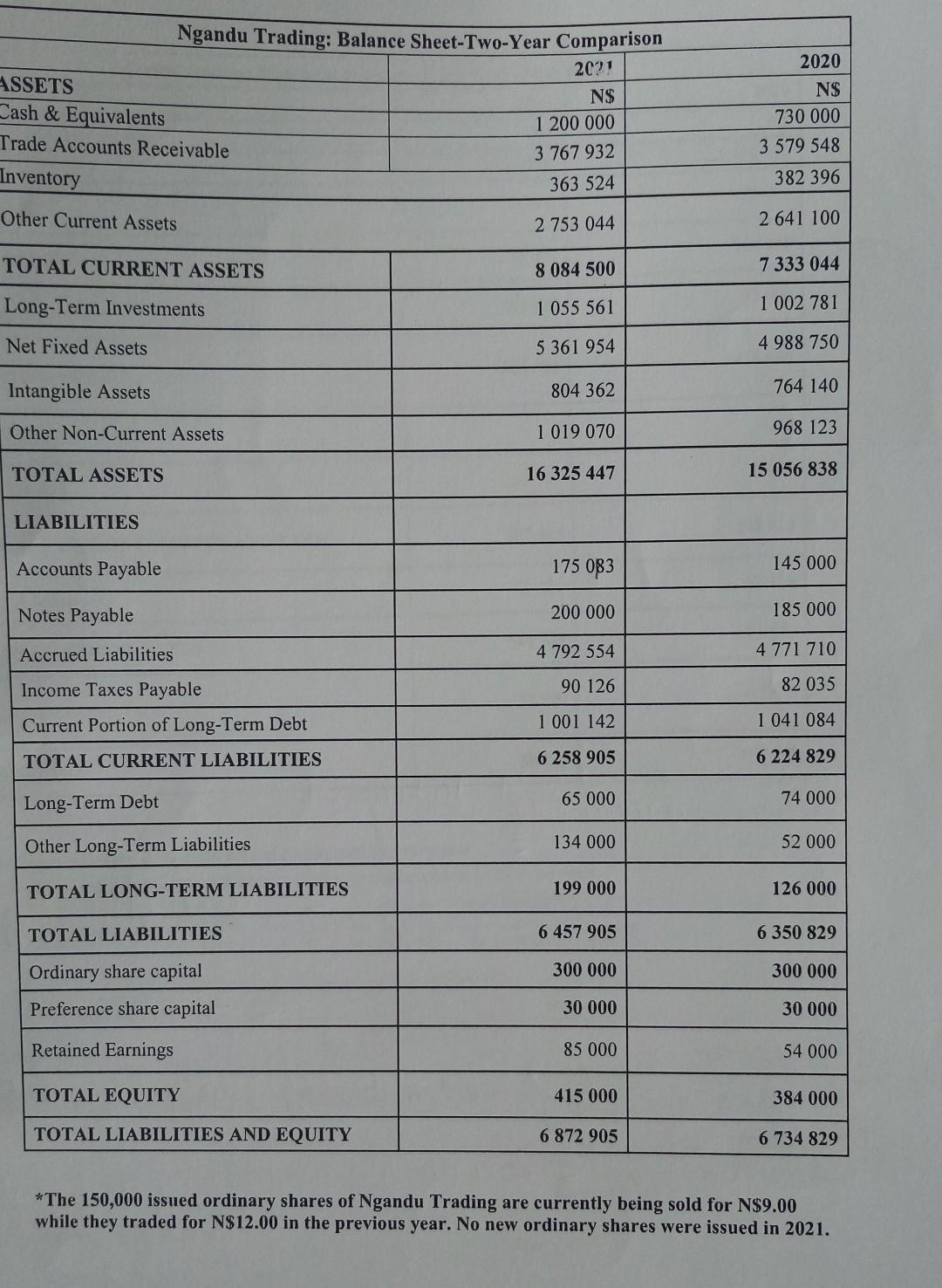

Please assist me with this ASSETS Cash & Equivalents Trade Accounts Receivable Inventory Ngandu Trading: Balance Sheet-Two-Year Comparison 2021 NS 1 200 000 3 767

Please assist me with this

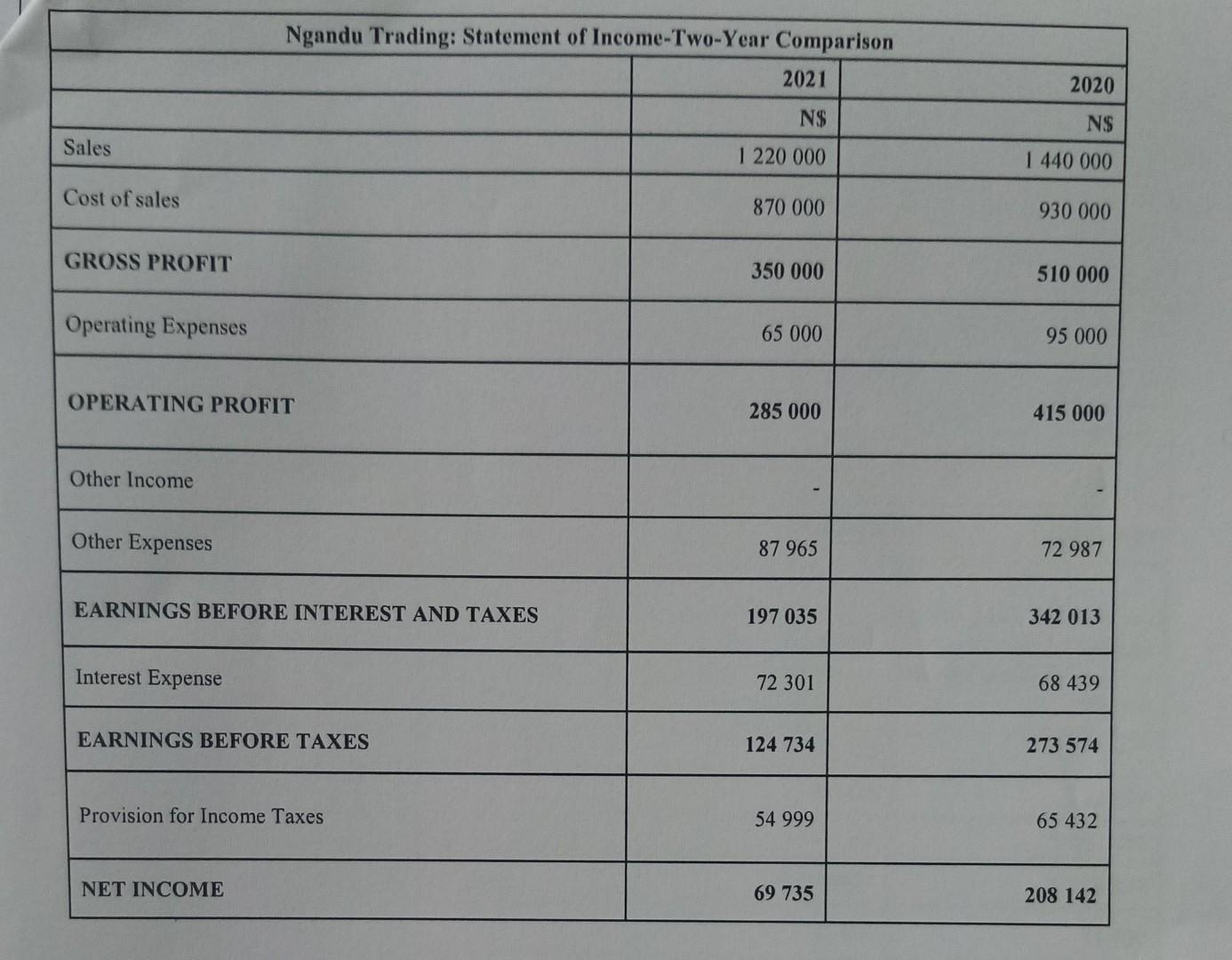

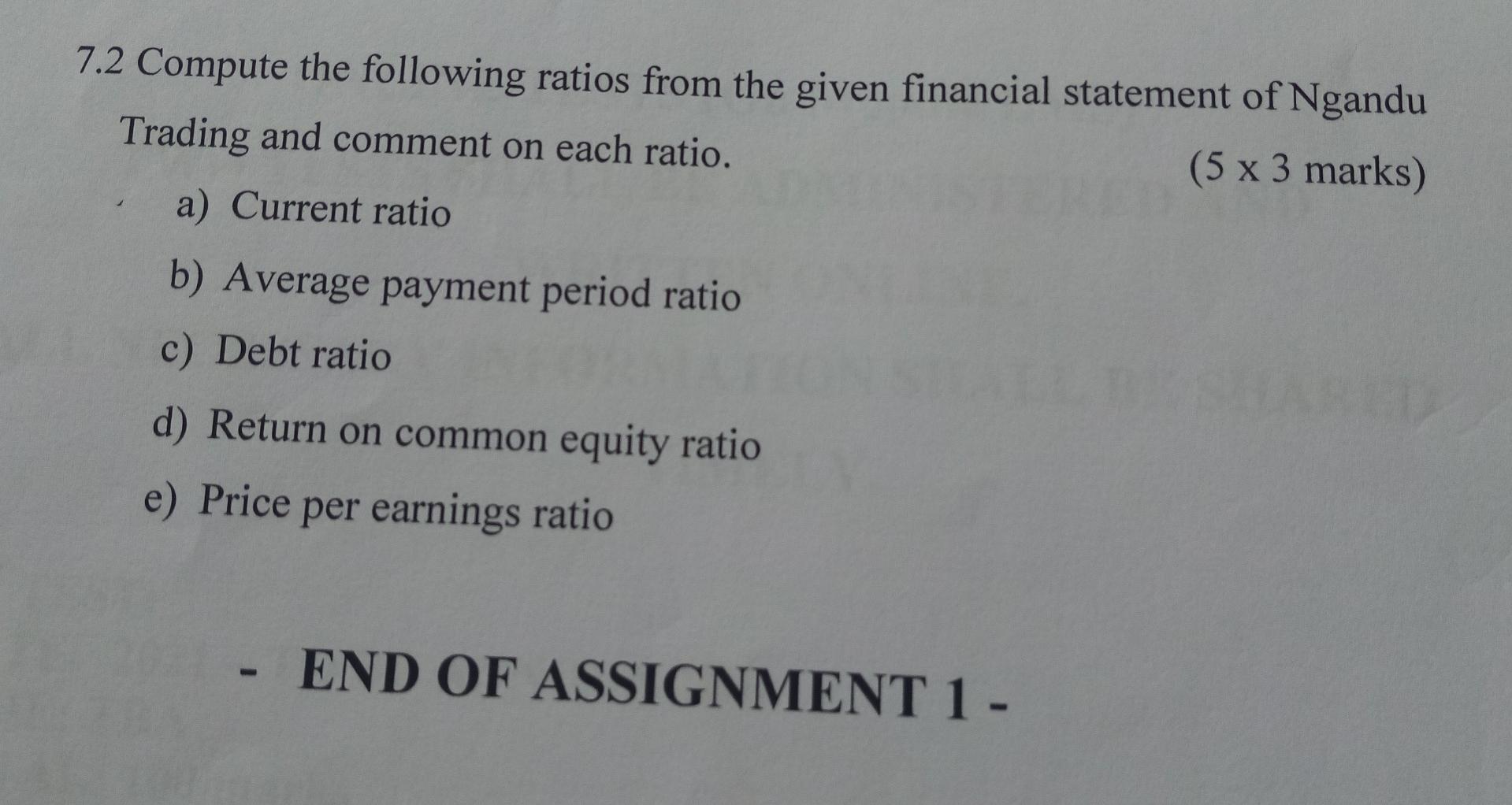

ASSETS Cash & Equivalents Trade Accounts Receivable Inventory Ngandu Trading: Balance Sheet-Two-Year Comparison 2021 NS 1 200 000 3 767 932 2020 N$ 730 000 3 579 548 382 396 363 524 Other Current Assets 2 753 044 2 641 100 TOTAL CURRENT ASSETS 8 084 500 7333 044 Long-Term Investments 1 055 561 1 002 781 Net Fixed Assets 5 361 954 4 988 750 Intangible Assets 804 362 764 140 Other Non-Current Assets 1 019 070 968 123 TOTAL ASSETS 16 325 447 15 056 838 LIABILITIES Accounts Payable 175 083 145 000 Notes Payable 200 000 185 000 Accrued Liabilities 4 792 554 4 771 710 Income Taxes Payable 90 126 82 035 Current Portion of Long-Term Debt 1 001 142 1 041 084 TOTAL CURRENT LIABILITIES 6 258 905 6 224 829 65 000 74 000 Long-Term Debt Other Long-Term Liabilities 134 000 52 000 TOTAL LONG-TERM LIABILITIES 199 000 126 000 TOTAL LIABILITIES 6 457 905 6 350 829 Ordinary share capital 300 000 300 000 Preference share capital 30 000 30 000 Retained Earnings 85 000 54 000 TOTAL EQUITY 415 000 384 000 TOTAL LIABILITIES AND EQUITY 6 872 905 6 734 829 *The 150,000 issued ordinary shares of Ngandu Trading are currently being sold for N$9.00 while they traded for N$12.00 in the previous year. No new ordinary shares were issued in 2021. Ngandu Trading: Statement of Income-Two-Year Comparison 2021 2020 N$ N$ Sales 1 220 000 1 440 000 Cost of sales 870 000 930 000 GROSS PROFIT 350 000 510 000 Operating Expenses 65 000 95 000 OPERATING PROFIT 285 000 415 000 Other Income Other Expenses 87 965 72 987 EARNINGS BEFORE INTEREST AND TAXES 197 035 342 013 Interest Expense 72 301 68 439 EARNINGS BEFORE TAXES 124 734 273 574 Provision for Income Taxes 54 999 65 432 NET INCOME 69 735 208 142 7.2 Compute the following ratios from the given financial statement of Ngandu Trading and comment on each ratio. (5 x 3 marks) a) Current ratio b) Average payment period ratio c) Debt ratio d) Return on common equity ratio e) Price per earnings ratio END OF ASSIGNMENT 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started