Please assist with helping record business transactions using a general journal by putting entries into various ledger accounts. Must analyse and record each transaction (including the opening balances) into the General Journal. Proceeding this journal entries must be posted in general ledger sections. Then the unadjusted trial balance is the final step to be completed to help check balances. Thank you.

hh

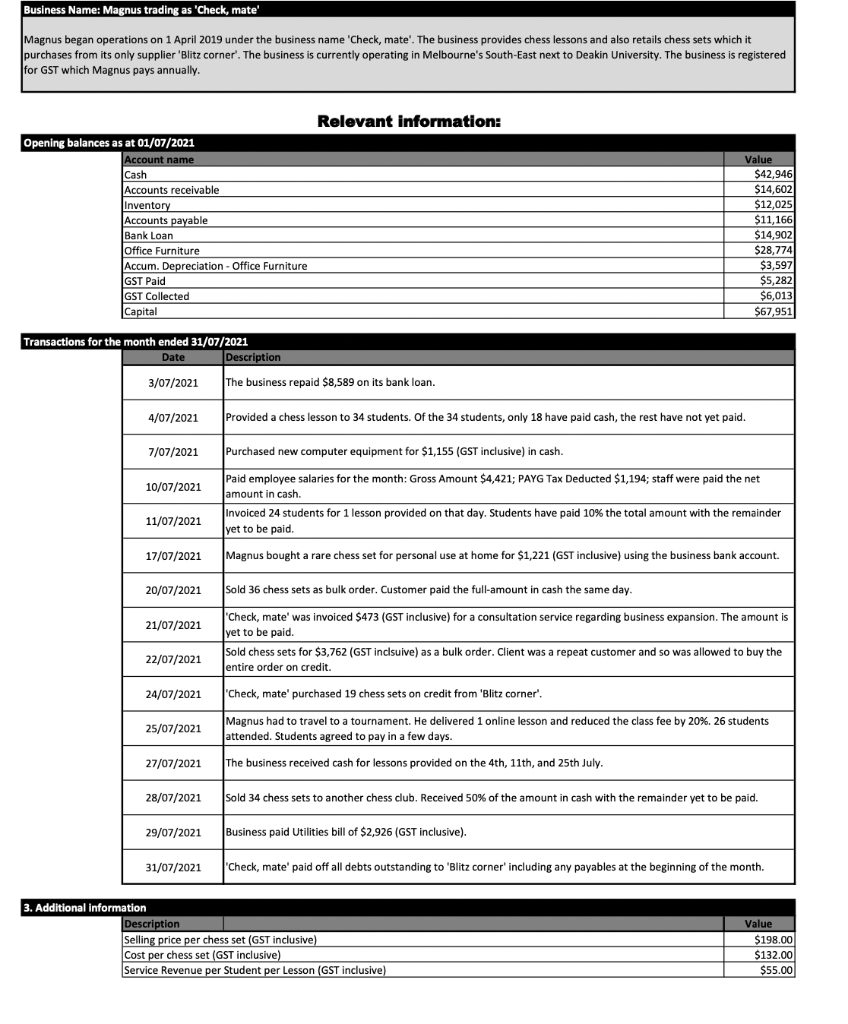

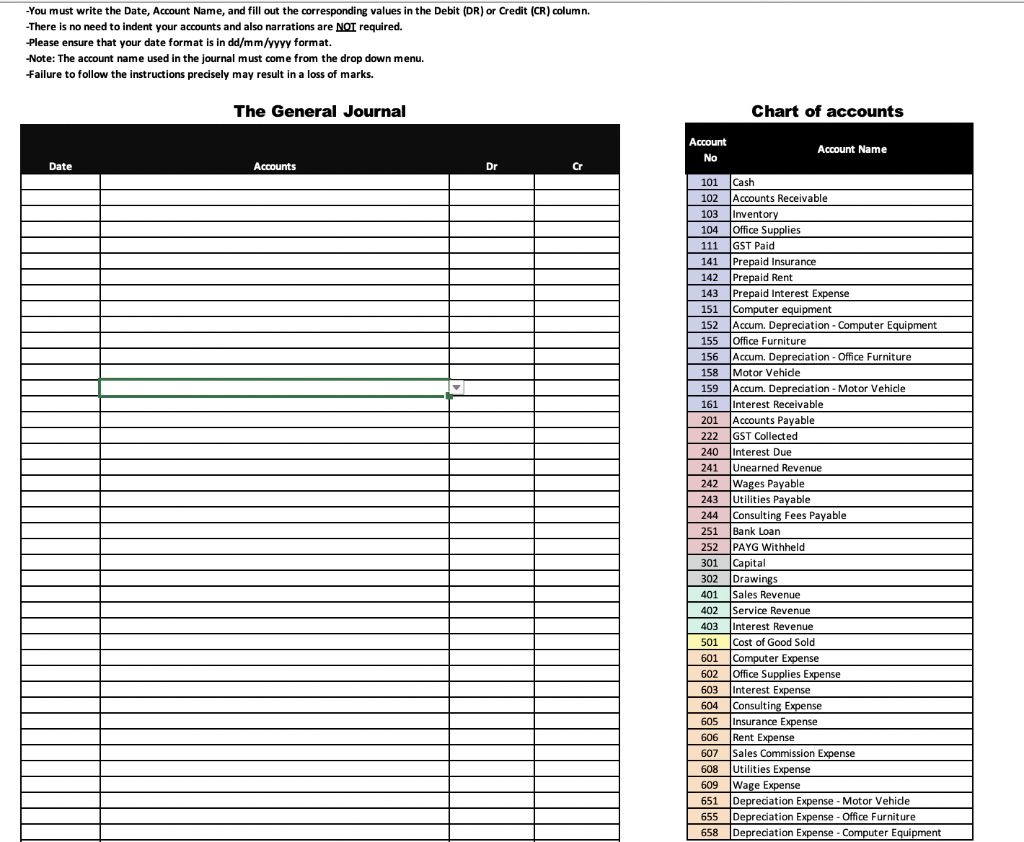

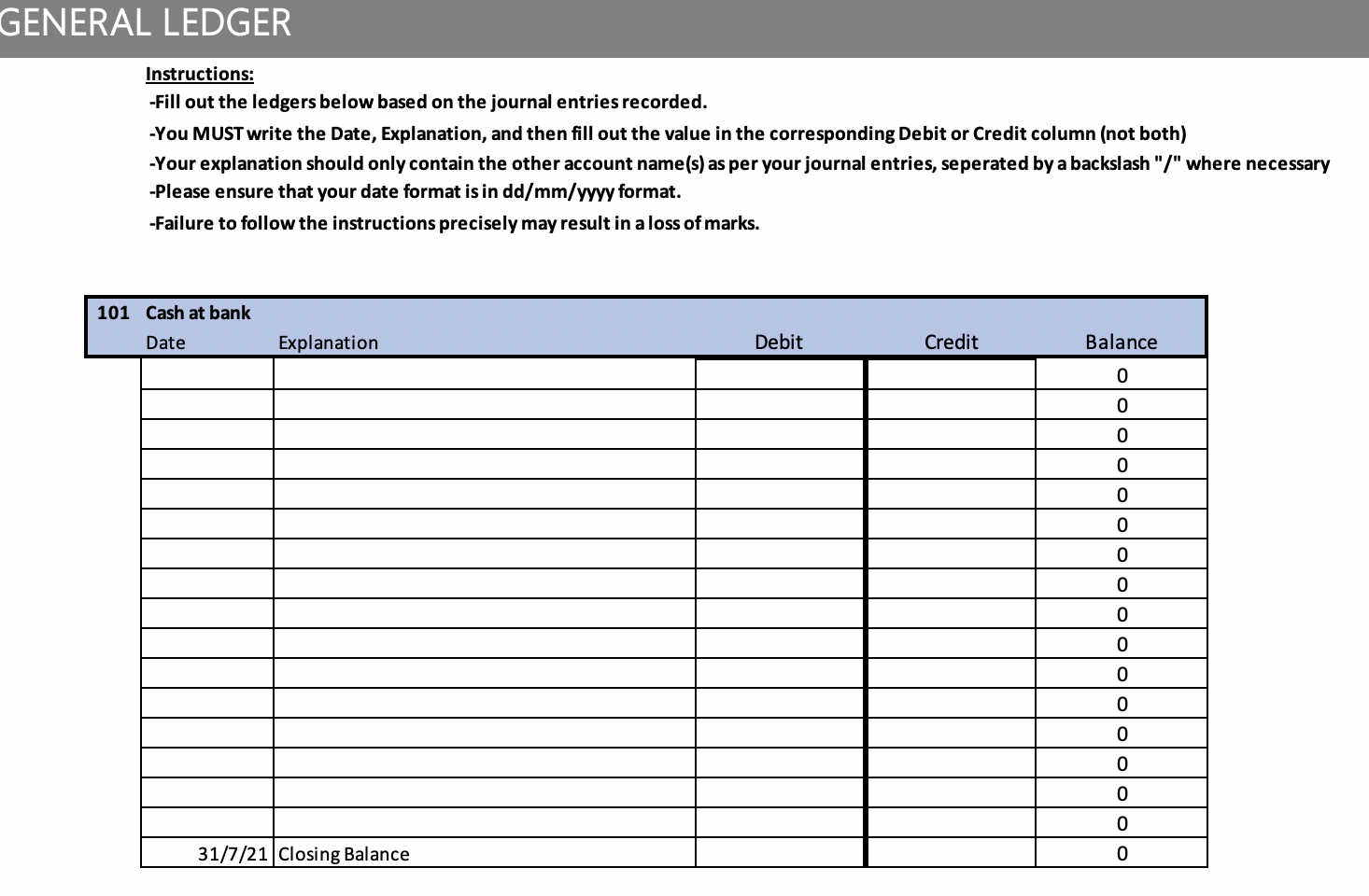

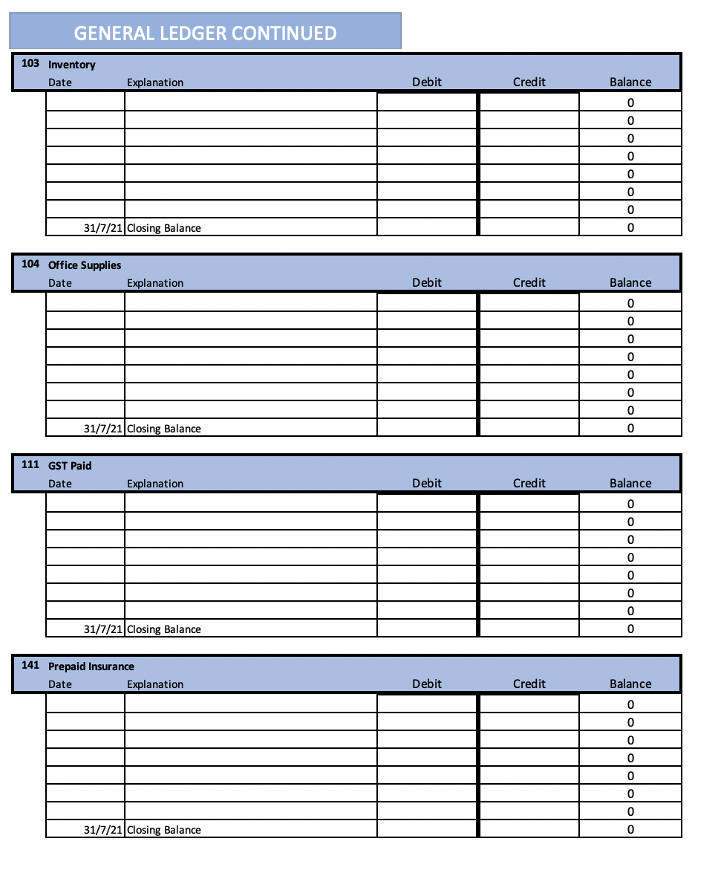

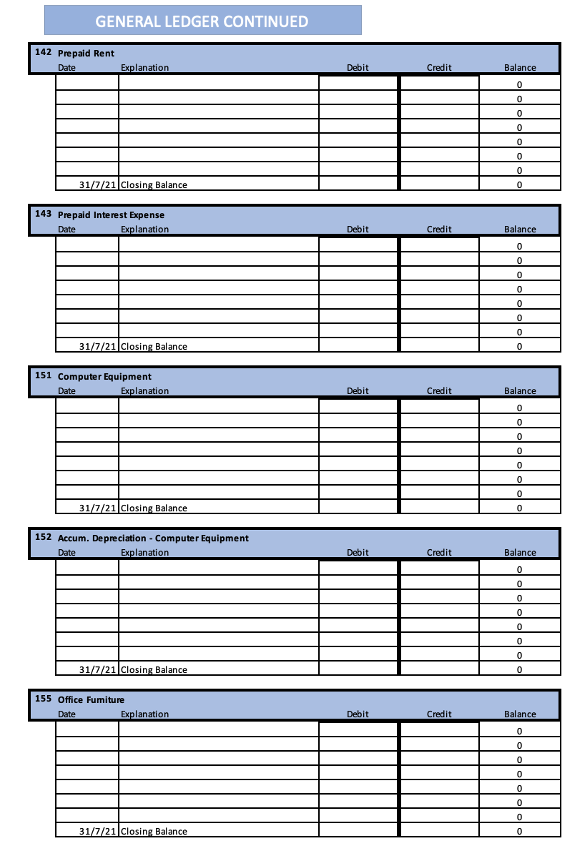

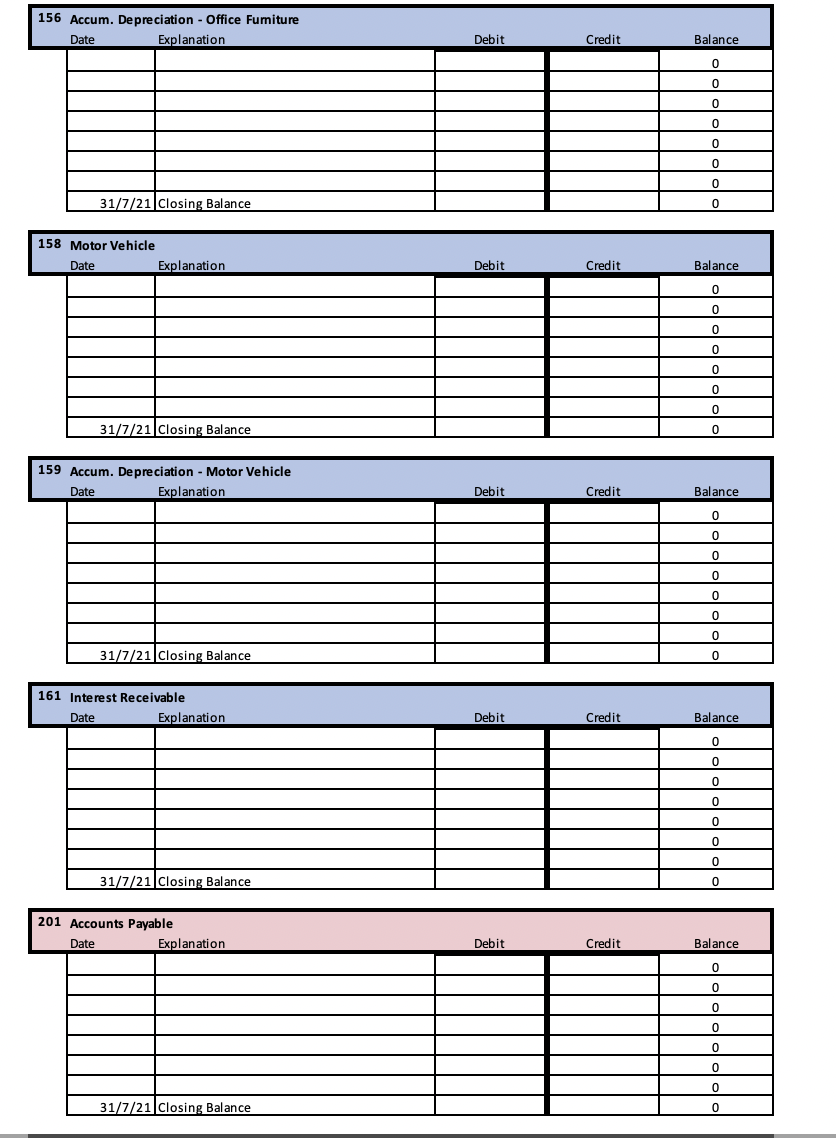

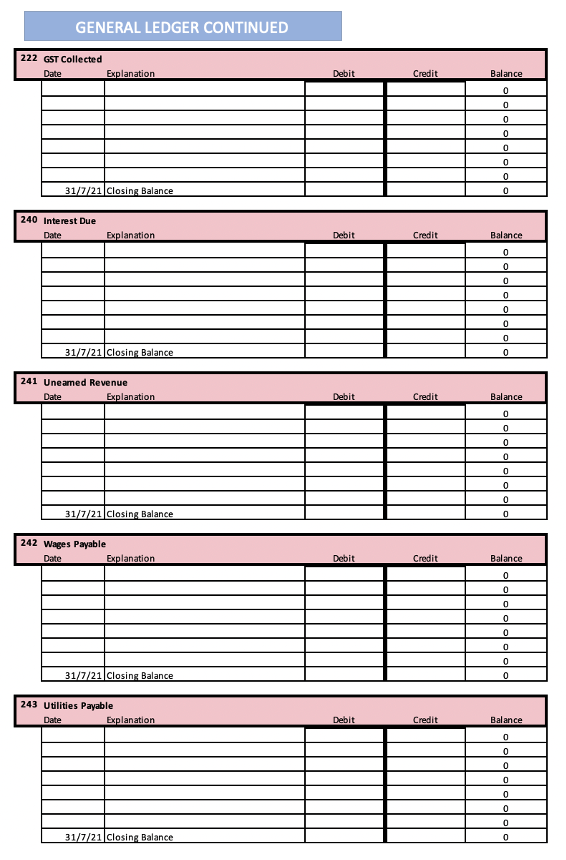

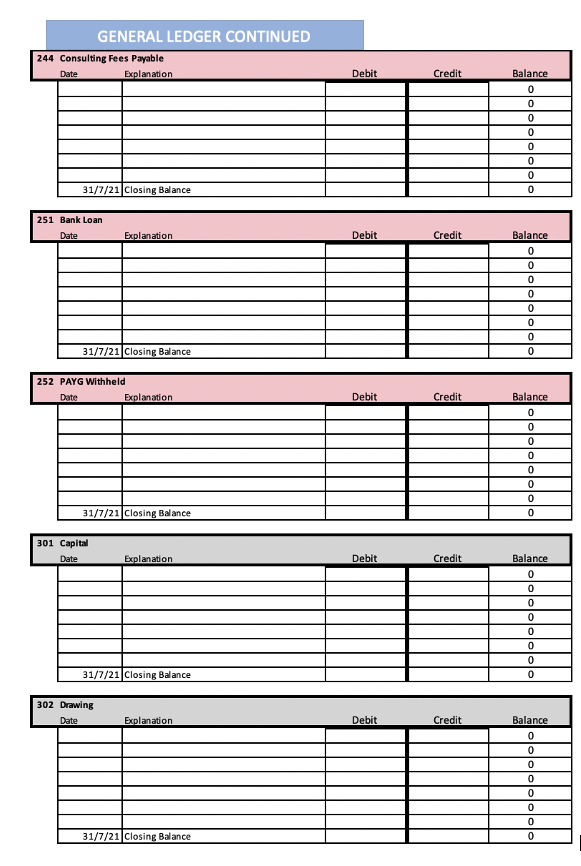

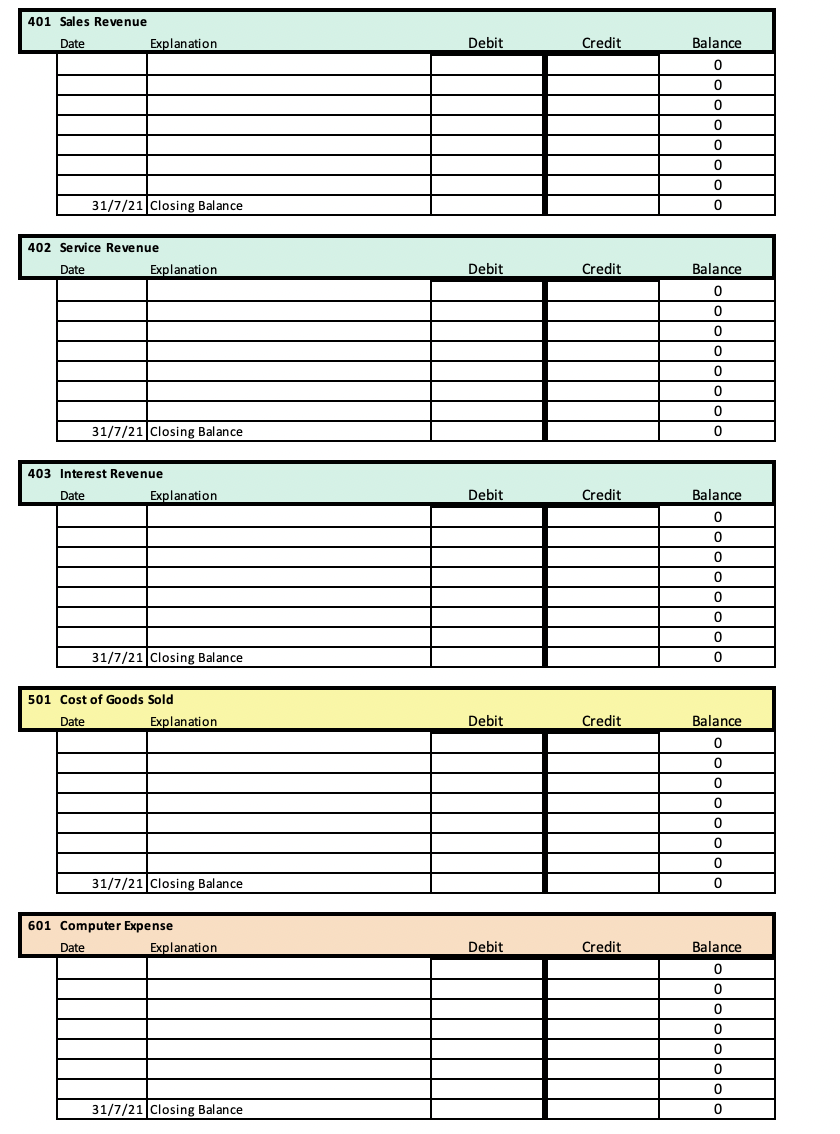

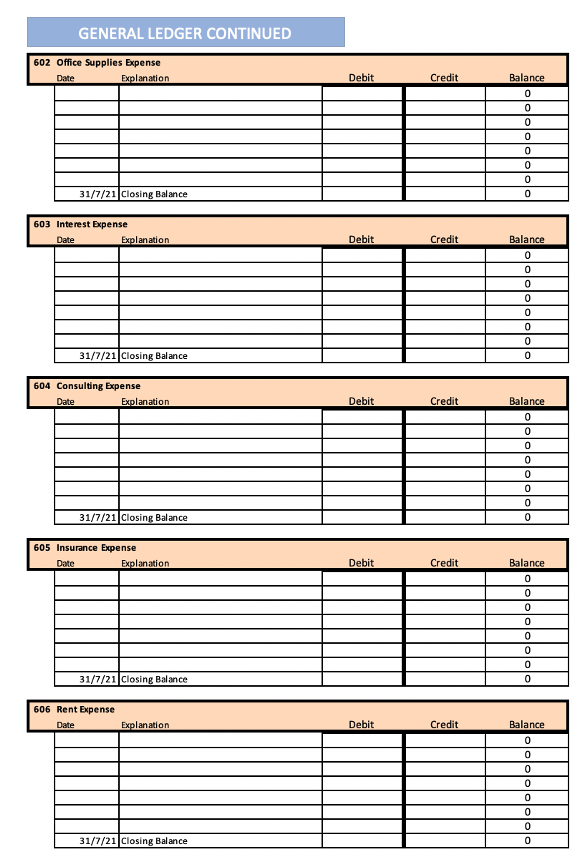

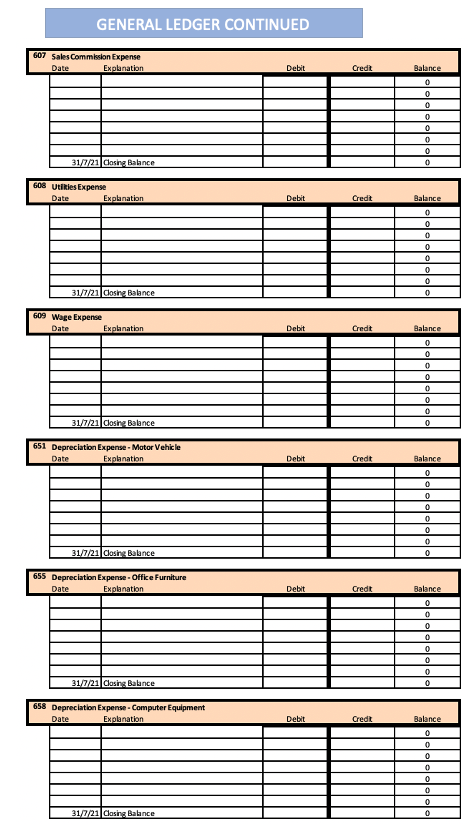

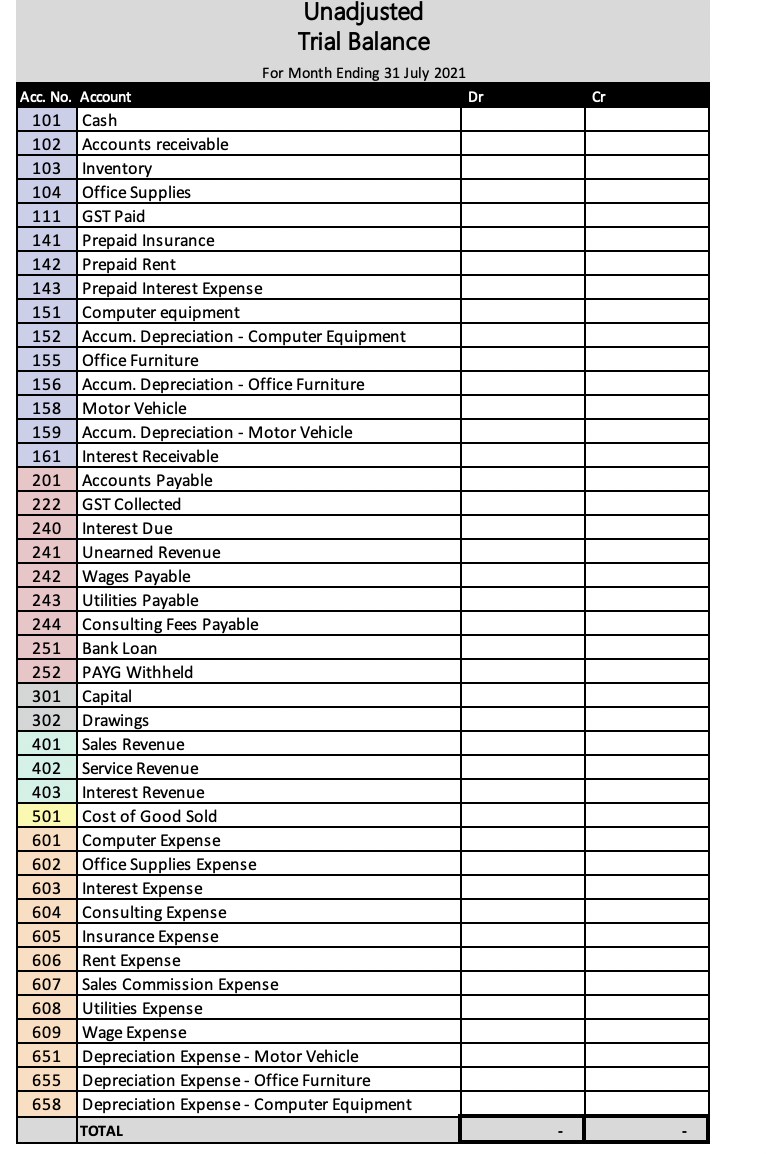

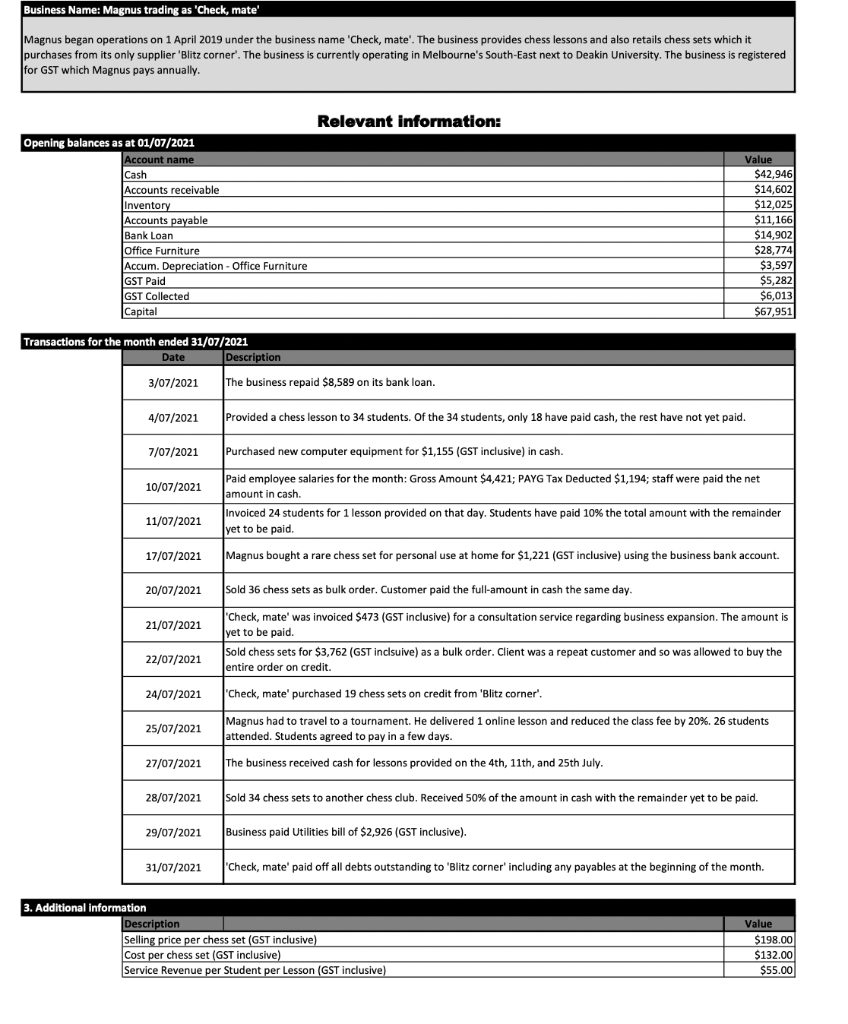

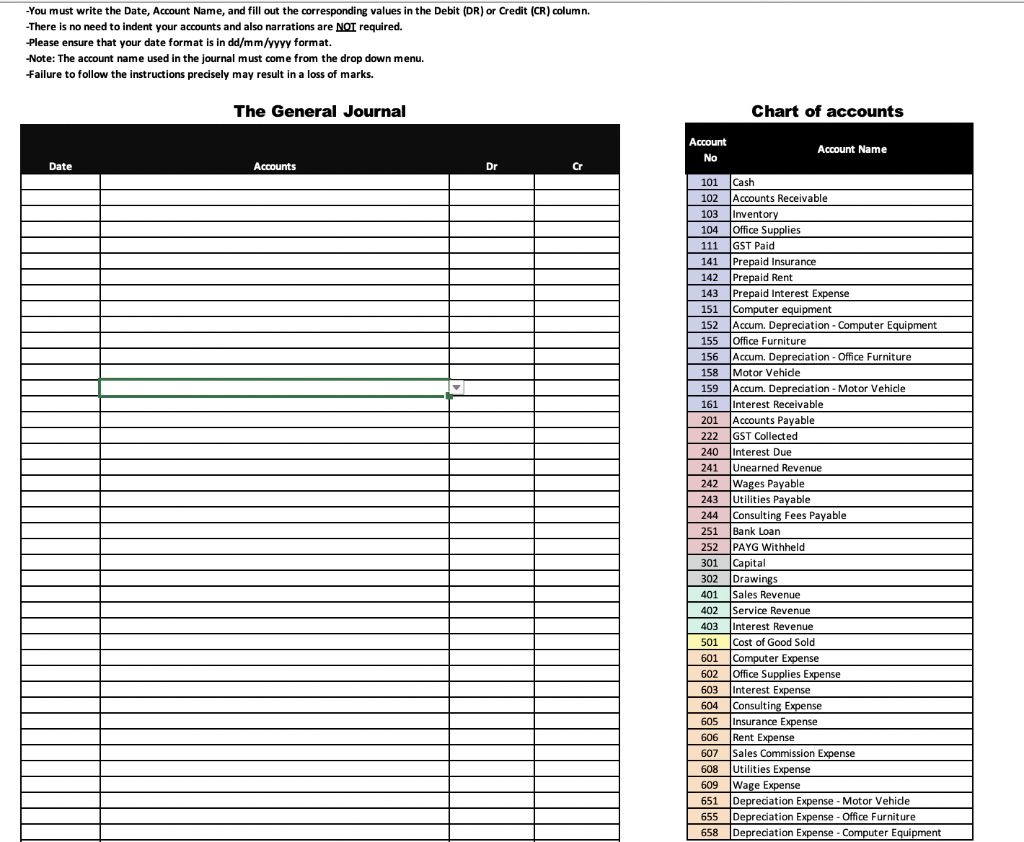

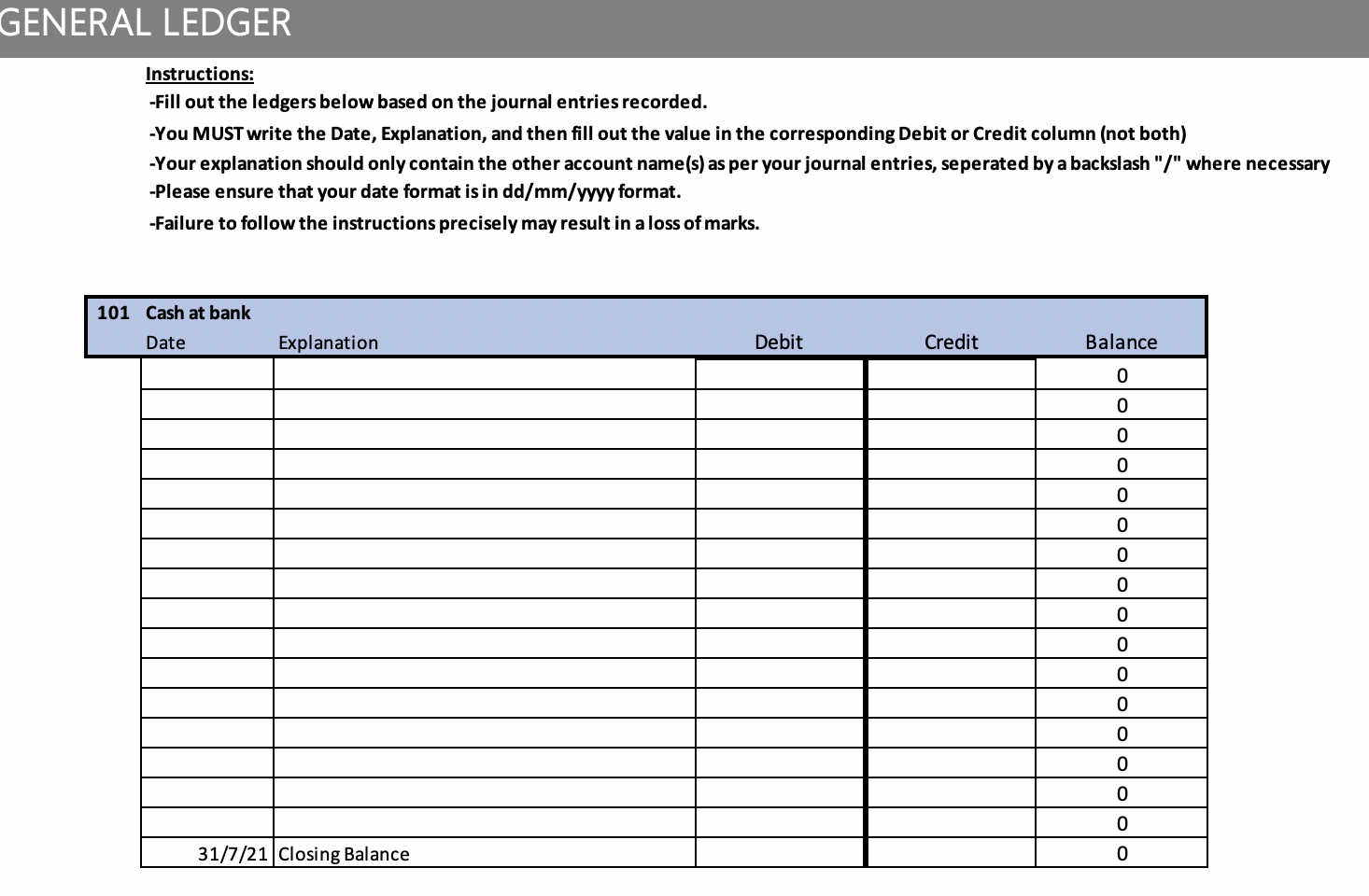

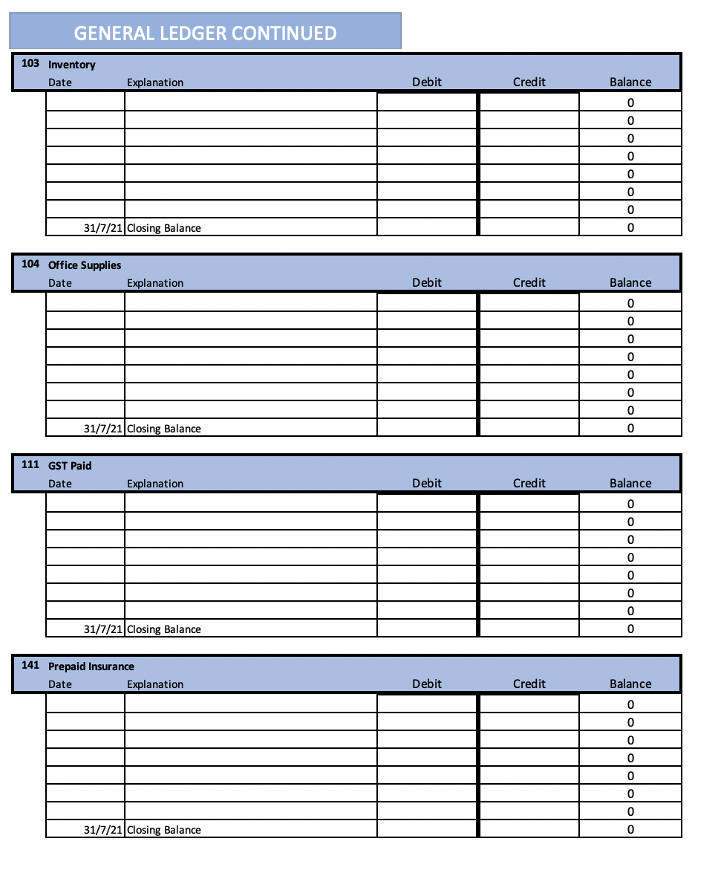

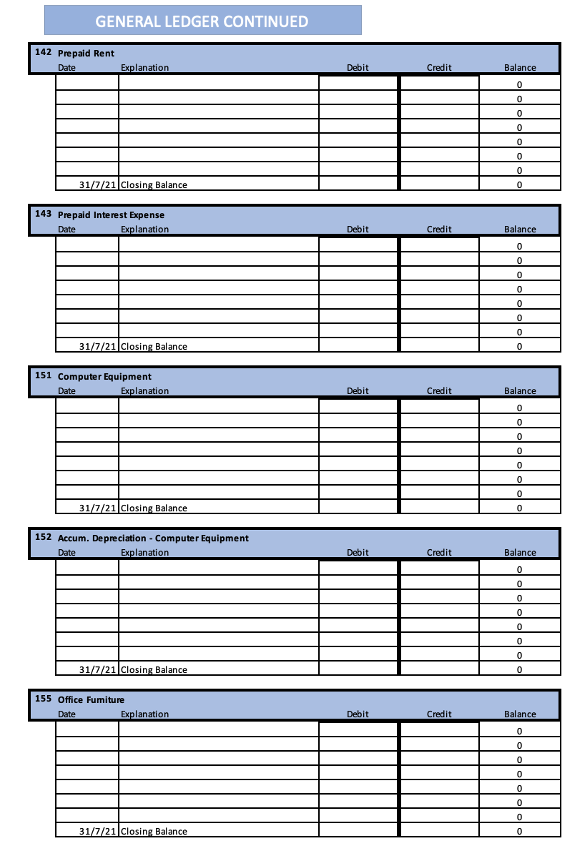

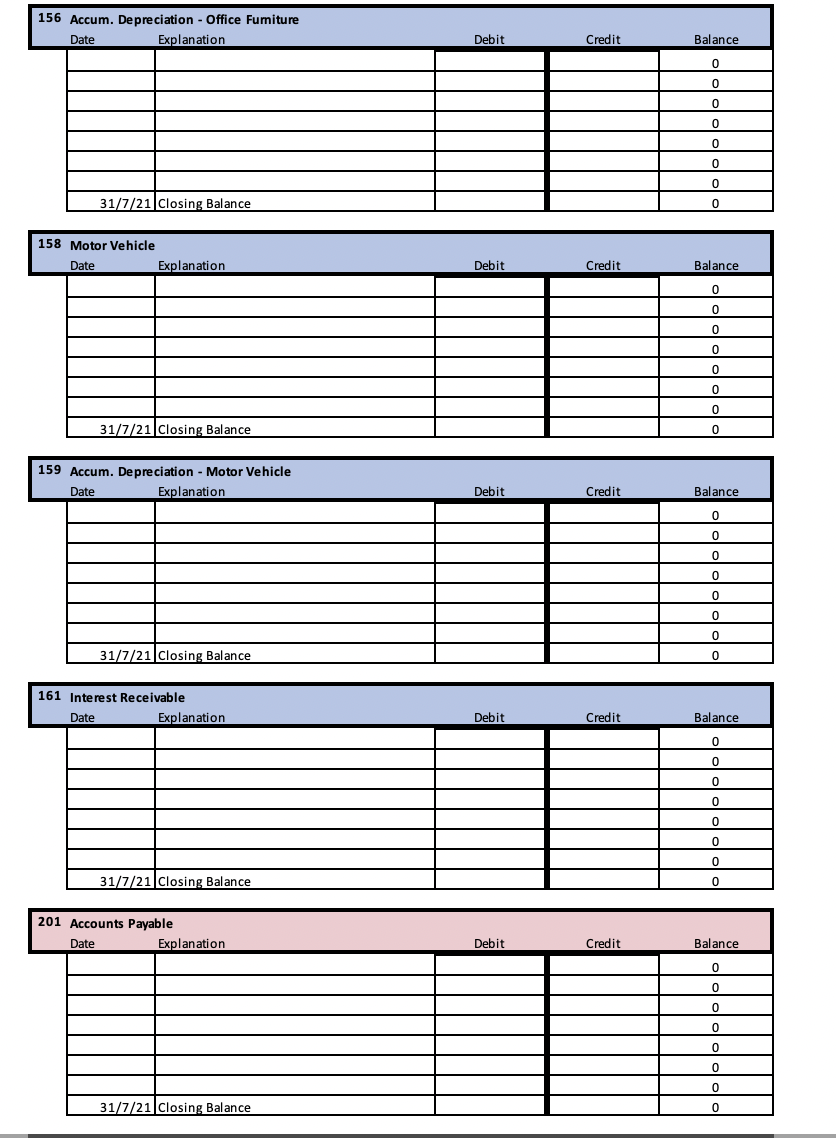

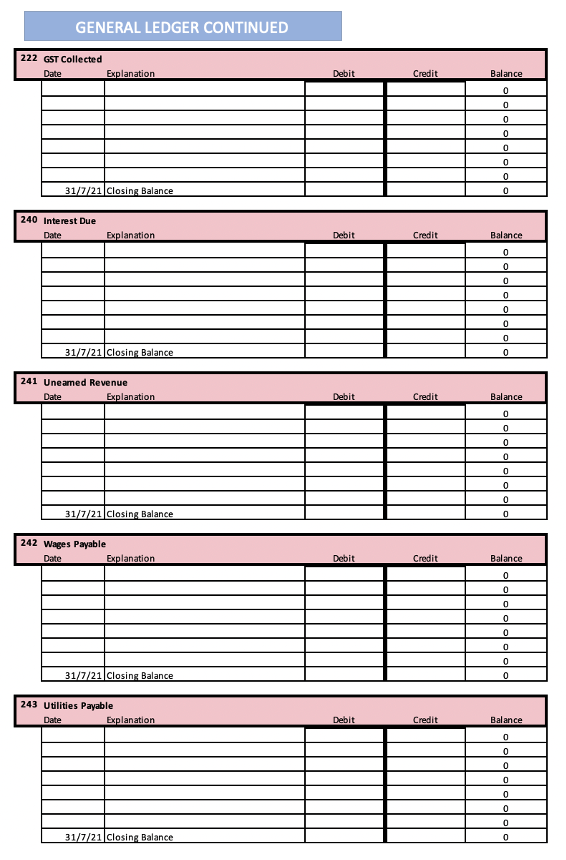

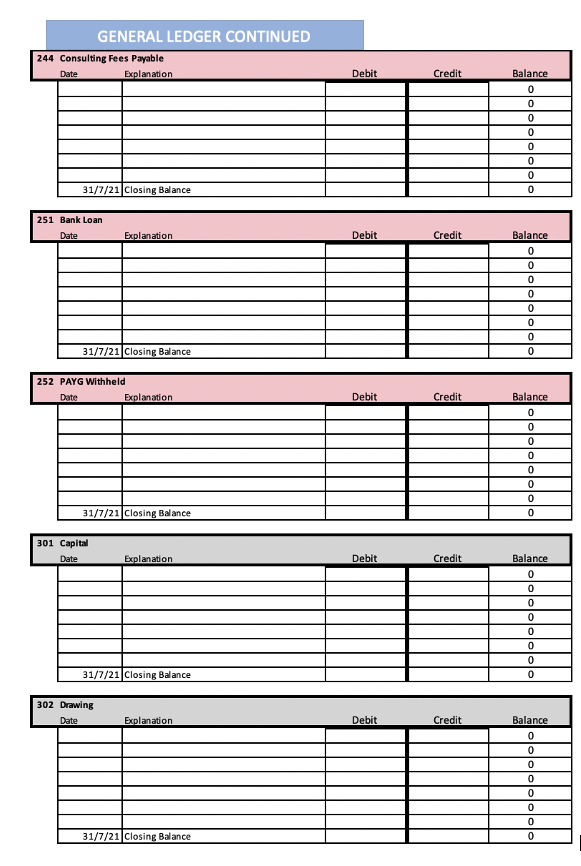

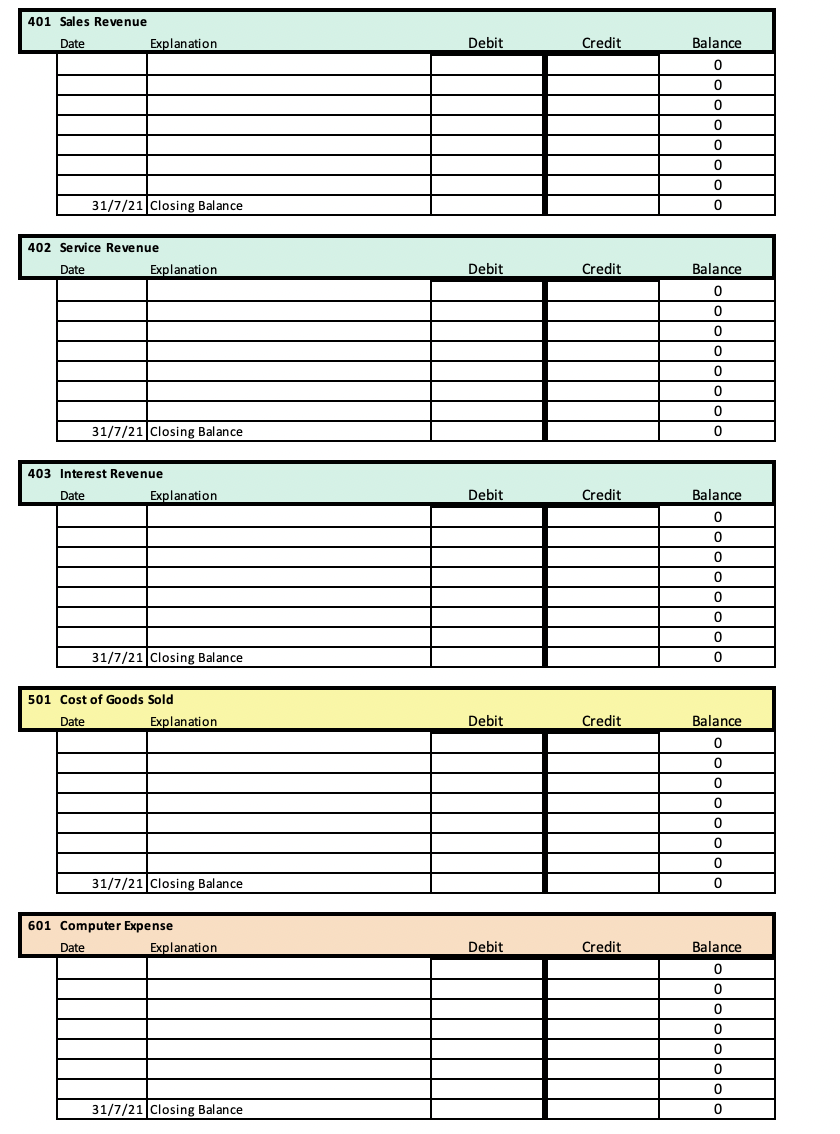

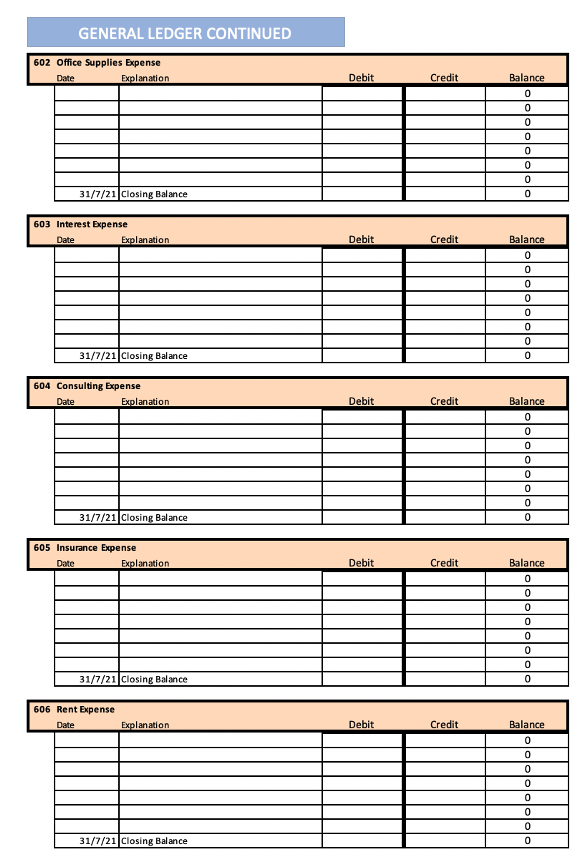

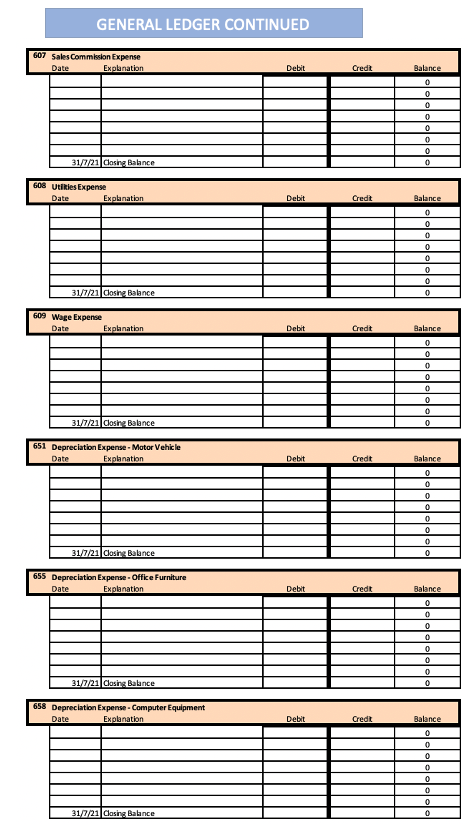

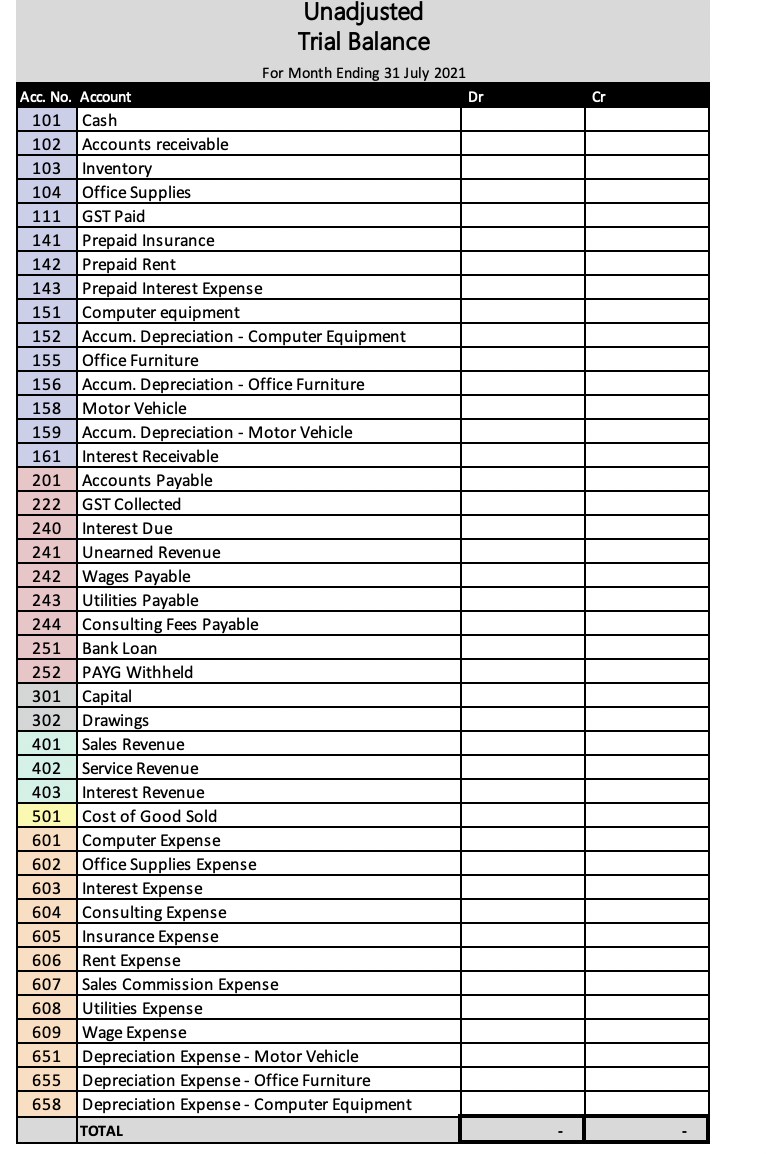

Business Name: Magnus trading as 'Check, mate' Magnus began operations on 1 April 2019 under the business name 'Check, mate'. The business provides chess lessons and also retails chess sets which it purchases from its only supplier 'Blitz corner'. The business is currently operating in Melbourne's South-East next to Deakin University. The business is registered for GST which Magnus pays annually. Relevant information: Opening balances as at 01/07/2021 Account name Cash Accounts receivable Inventory Accounts payable Bank Loan Office Furniture Accum. Depreciation - Office Furniture GST Paid GST Collected Capital Value $42.946 $14,602 $12,025 $11,166 $14,902 $28,774 $3,597 $5,282 $6,013 $67,951 Transactions for the month ended 31/07/2021 Date Description 3/07/2021 The business repaid $8,589 on its bank loan. . 4/07/2021 Provided a chess lesson to 34 students. Of the 34 students, only 18 have paid cash, the rest have not yet paid. 7/07/2021 Purchased new computer equipment for $1,155 (GST inclusive) in cash. 10/07/2021 Paid employee salaries for the month: Gross Amount $4,421; PAYG Tax Deducted $1,194; staff were paid the net Jamount in cash 11/07/2021 Invoiced 24 students for 1 lesson provided on that day. Students have paid 10% the total amount with the remainder yet to be paid. 17/07/2021 Magnus bought a rare chess set for personal use at home for $1,221 (GST inclusive) using the business bank account 20/07/2021 Sold 36 chess sets as bulk order. Customer paid the full amount in cash the same day 21/07/2021 'Check, mate' was invoiced $473 (GST inclusive) for a consultation service regarding business expansion. The amount is yet to be paid. . Sold chess sets for $3,762 (GST inclsuive) as a bulk order. Client was a repeat customer and so was allowed to buy the entire order on credit. 22/07/2021 24/07/2021 Check, mate' purchased 19 chess sets on credit from 'Blitz corner'. 25/07/2021 Magnus had to travel to a tournament. He delivered 1 online lesson and reduced the class fee by 20%. 26 students attended. Students agreed to pay in a few days. 27/07/2021 The business received cash for lessons provided on the 4th, 11th, and 25th July. 28/07/2021 sold 34 chess sets to another chess club. Received 50% of the amount in cash with the remainder yet to be paid. 29/07/2021 Business paid Utilities bill of $2,926 (GST inclusive) 31/07/2021 'Check, mate' paid off all debts outstanding to 'Blitz corner' including any payables at the beginning of the month. 3. Additional information Description Selling price per chess set (GST inclusive) Cost per chess set (GST inclusive) Service Revenue per Student per Lesson (GST inclusive) Value $198.00 $132.00 $55.00 -You must write the Date, Account Name, and fill out the corresponding values in the Debit (DR) or Credit (CR) column. -There is no need to indent your accounts and also narrations are NOT required. Please ensure that your date format is in dd/mm/yyyy format. Note: The account name used in the journal must come from the drop down menu. Failure to follow the instructions precisely may result in a loss of marks. The General Journal Chart of accounts Account Account Name No Date Accounts Dr Cr 101 Cash 102 Accounts Receivable 103 Inventory 104 Office Supplies 111 GST Paid 141 Prepaid Insurance B. 142 Prepaid Rent par 143 Prepaid Interest Expense ped interes 151 Computer equipment 152 Accum. Depreciation - Computer Equipment fo 155 Office Furniture 156 Accum. Depreciation - Office Furniture u 158 Motor Vehide 159 Accum. Depreciation - Motor Vehicle 161 Interest Receivable 201 Accounts Payable 222 GST Collected 240 Interest Due 241 27 Unearned Revenue 242 4* Wages Payable 243 Utilities Payable 244 Consulting Fees Payable 251 Bank Loan 22 un 252 PAYG Withheld 224 301 Capital w apical 302 Drawings we 401 Sales Revenue 402 Service Revenue e nevenue 403 Interest Revenue 501 Cost of Good Sold 601 Computer Expense Computer exper 602 Office Supplies Expense 603 Interest Expense 604 Consulting Expense 605 Insurance Expense 606 Rent Expense 607 Sales Commission Expense 608 Utilities Expense 609 Wage Expense 651 Depreciation Expense - Motor Vehicle 655 Depreciation Expense - Office Furniture 658 Depreciation Expense - Computer Equipment GENERAL LEDGER Instructions: -Fill out the ledgers below based on the journal entries recorded. -You MUST write the Date, Explanation, and then fill out the value in the corresponding Debit or Credit column (not both) -Your explanation should only contain the other account name(s) as per your journal entries, seperated by a backslash "/" where necessary -Please ensure that your date format is in dd/mm/yyyy format. -Failure to follow the instructions precisely may result in a loss of marks. 101 Cash at bank Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 31/7/21 Closing Balance 0 GENERAL LEDGER CONTINUED 103 Inventory Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 31/7/21 Closing Balance 0 104 Office Supplies Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 0 31/7/21 Closing Balance 111 GST Paid Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 0 31/7/21 Closing Balance 141 Prepaid Insurance Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 31/7/21 Closing Balance 0 GENERAL LEDGER CONTINUED 142 Prepaid Rent Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 0 31/7/21 Closing Balance 143 Prepaid Interest Expense Date Explanation Debit Credit Balance 0 0 0 0 0 0 31/7/21 Closing Balance 0 0 151 Computer Equipment Date Explanation Debit Credit Balance 0 0 0 0 0 0 31/7/21 Closing Balance 0 0 152 Accum. Depreciation - Computer Equipment Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 31/7/21 Closing Balance 0 155 Office Furniture Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 31/7/21 Closing Balance 0 156 Accum. Depreciation - Office Furniture Date Explanation Debit Credit Balance 0 0 0 TE 0 0 0 0 31/7/21 Closing Balance 0 158 Motor Vehicle Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 31/7/21 Closing Balance 0 159 Accum. Depreciation - Motor Vehicle Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 31/7/21 Closing Balance 0 161 Interest Receivable Date Explanation - Debit Credit Balance 0 0 0 0 0 0 0 0 0 31/7/21 Closing Balance 0 201 Accounts Payable Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 0 0 0 31/7/21 Closing Balance 0 GENERAL LEDGER CONTINUED 222 GST Collected Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 31/7/21 Closing Balance 0 240 Interest Due Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 0 31/7/21 Closing Balance 241 Uneamed Revenue Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 31/7/21 Closing Balance 0 242 Wages Payable Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 31/7/21 Closing Balance 0 243 Utilities Payable Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 31/7/21 Closing Balance 0 GENERAL LEDGER CONTINUED 244 Consulting Fees Payable Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 0 31/7/21 Closing Balance 251 Bank Loan Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 0 31/7/21 Closing Balance 252 PAYG Withheld Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 0 31/7/21 Closing Balance 301 Capital Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 0 31/7/21 Closing Balance 302 Drawing Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 31/7/21 Closing Balance 0 401 Sales Revenue Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 31/7/21 Closing Balance 0 402 Service Revenue Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 0 0 0 31/7/21 Closing Balance 0 403 Interest Revenue Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 0 31/7/21 Closing Balance 0 501 Cost of Goods Sold Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 0 31/7/21 Closing Balance 0 601 Computer Expense Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 31/7/21 Closing Balance 0 GENERAL LEDGER CONTINUED 602 Office Supplies Expense Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 0 31/7/21 Closing Balance 603 Interest Expense Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 0 31/7/21 Closing Balance 604 Consulting Expense Date Explanation Debit Credit Balance 0 0 0 0 0 lololo 31/7/21 Closing Balance 605 Insurance Expense Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 0 31/7/21 Closing Balance 606 Rent Expense Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 0 31/7/21 Closing Balance GENERAL LEDGER CONTINUED 607 Sales Commission Expense Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 0 31/7/21 clasing Balance 608 Utikies Expense Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 0 31/7/21 Closing Balance 609 Wage Expense Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 31/7/21 Closing Balance 0 651 Depreciation Expense - Motor Vehicle Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 31/7/21 Closing Balance 0 655 Depreciation Expense - Office Furniture Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 31/7/21 Closing Balance 0 658 Depreciation Expense - Computer Equipment Date Explanation Debit Credit Balance 0 0 0 0 0 0 0 O 31/7/21 Closing Balance Cr 101 102 104 141 142 156 159 161 Unadjusted Trial Balance For Month Ending 31 July 2021 Acc. No. Account Dr Cash Accounts receivable 103 Inventory Office Supplies 111 GST Paid Prepaid Insurance Prepaid Rent 143 Prepaid Interest Expense 151 Computer equipment 152 Accum. Depreciation - Computer Equipment 155 Office Furniture Accum. Depreciation - Office Furniture 158 Motor Vehicle Accum. Depreciation - Motor Vehicle Interest Receivable 201 Accounts Payable 222 GST Collected 240 Interest Due 241 Unearned Revenue 242 Wages Payable 243 Utilities Payable 244 Consulting Fees Payable 251 Bank Loan 252 PAYG Withheld 301 Capital 302 Drawings 401 Sales Revenue 402 Service Revenue 403 Interest Revenue 501 Cost of Good Sold 601 Computer Expense 602 Office Supplies Expense Interest Expense Consulting Expense Insurance Expense Rent Expense Sales Commission Expense 608 Utilities Expense Wage Expense 651 Depreciation Expense - Motor Vehicle 655 Depreciation Expense - Office Furniture 658 Depreciation Expense - Computer Equipment TOTAL 603 604 605 606 607 609