please assist with incorrect one

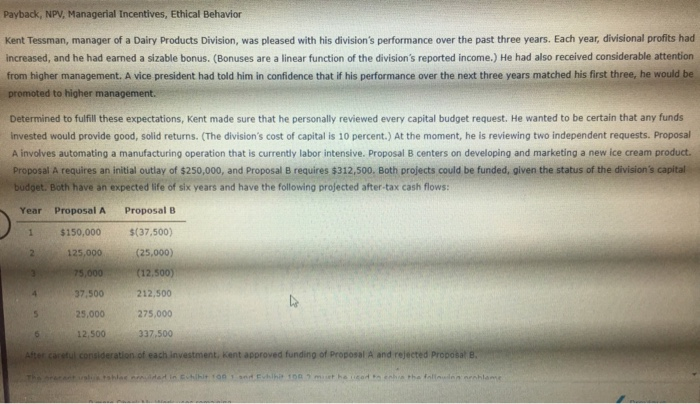

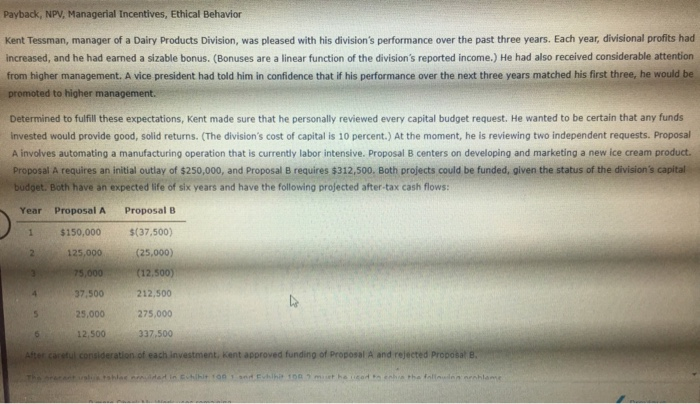

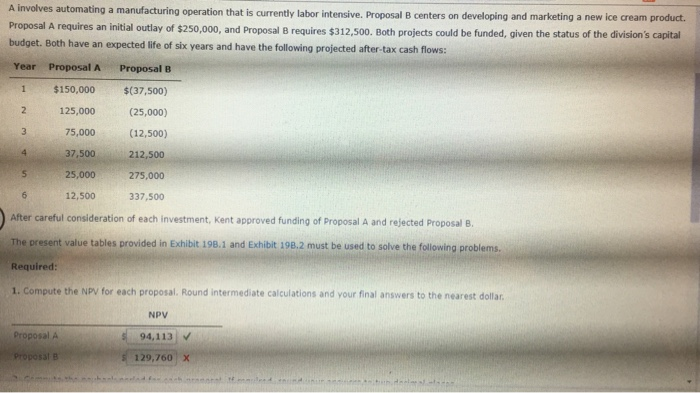

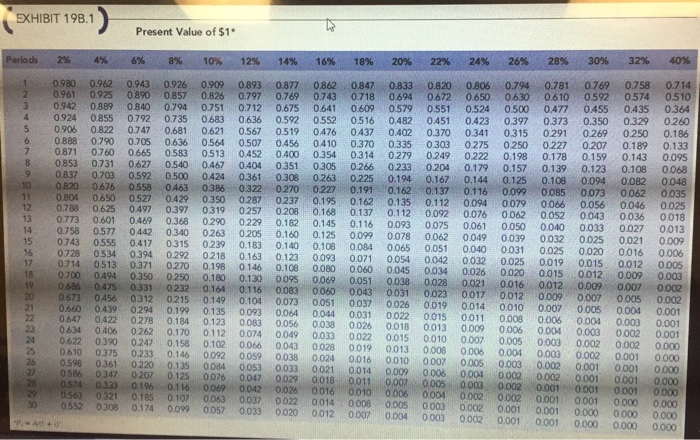

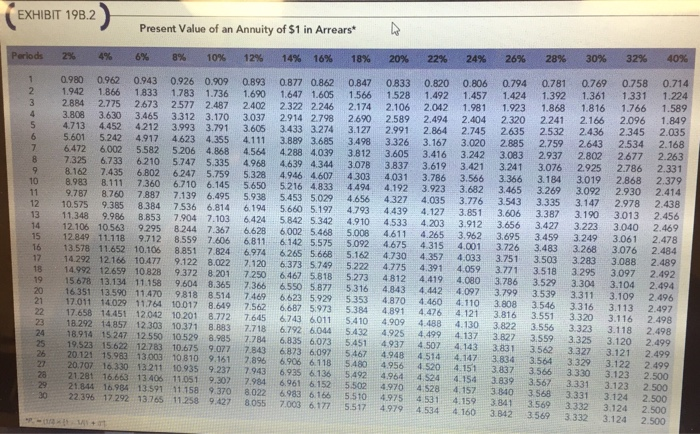

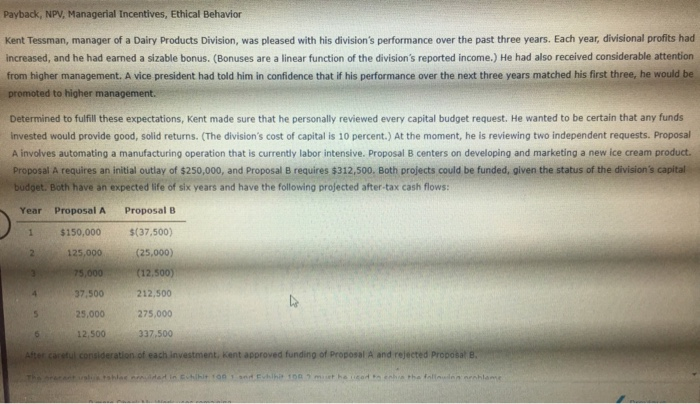

Payback, NPV, Managerial Incentives, Ethical Behavior Kent Tessman, manager of a Dairy Products Division, was pleased with his division's performance over the past three years. Each year, divisional profits had hed a sizable bonus. (Bonuses are a linear function of the division's reported income.) He had also received considerable attention increased, and he had earne from higher management. A vice president had told him in confidence that if his performance over the next three years matched his first three, he would be promoted to higher management. Determined to fulfill these expectations, Kent made sure that he personally reviewed every capital budget request. He wanted to be certain that any funds Invested would provide good, solid returns. (The division's cost of capital is 10 percent.) At the moment, he is reviewing two independent requests. Proposal A involves automating a manufacturing operation that is currently labor intensive. Proposal B centers on developing and marketing a new ice cream product. Proposal B requires $312,500. Both projects could be funded, given the status of the division's capital Proposal A requires an initial outlay of $250,000, and budget. Both have an expected life of six years and have the following projected after-tax cash flows: Year Proposal A Proposal B $150,000 1 $(37,500) 125,000 (25,000) (12,500) 75,000 37,500 212.500 275,000 25,000 12.500 337,500 After caretul consideration of each investment, Kent approved funding of Proposal A and rejected Proposal B. The oreransl tohler oreuidad in Evhihit 10n 1 snd Evhibit 100 enhia the fnlinulnn nenhlame mset he icod A involves automating a manufacturing operation that is currently labor intensive, Proposal B centers on developing and marketing a new ice cream product. Proposal A requires an initial outlay of $250,000, and Proposal B requires $312,500. Both projects could be funded, given the status of the division's capital budget. Both have an expected life of six years and have the following projected after-tax cash flows: Year Proposal A Proposal B 1 $150,000 $(37,500) 2 125,000 (25,000) 3 75,000 (12,500) 4 37,500 212,500 5 25,000 275,000 6 12,500 337,500 After careful consideration of each investment, Kent approved funding of Proposal A and rejected Proposal B. The present value tables provided in Exhibit 19B.1 and Exhibit 19B.2 must be used to solve the following problems. Required: 1. Compute the NPV for each proposal. Round intermediate calculations and your final answers to the nearest dollar NPV Proposal A 94,113 Proposal B 129.760 X EXHIBIT 19B,1 Present Value of $1 Periods 2% 4% 6% 8% 10% 12% 14% 18% 26% 28% 30% 32% 40% 16% 20% 22% 24% 1 0.980 0.961 0.942 0.962 0.943 0.925 0890 0.857 0.840 0.792 0.735 0.747 0926 0.909 0.826 0.751 0.683 0.621 0.893 0.797 0.712 0.877 0.769 0.675 0.592 0.862 0.743 0.641 0.552 0476 0.769 0.592 0.758 0.574 0.435 0.329 0.250 0.714 0.510 0.364 0.260 0847 0718 0.833 0.694 0.579 0.820 0672 0.806 0.650 0.794 0630 0.781 0.610 2 0.889 0.855 0.794 0.609 0.551) 0.451 0.370 0.303 0.249 0.524 0.423 0.500 0.397 0.315 0.250 0.198 0.157 0.125 0.099 0079 0.062 0.052 0.477 0.373 0.455 4 0.924 0.636 0.516 0437 0.370 0.482 0.402 0.335 0.279 0233 0.194 0.162 0.137 0.135 0.112 0.093 0.078 0065 0.054 0045 0.038 0031 0,026 0.022 0018 0015 0013 0.010 0.009 0.007 0005 0003 0,006 0.350 5 0.906 0.888 0.871 0.822 0.681 0.567 0.507 0.452 0.519 0.341 0275 0.222 0.179 0.291 0.227 0.178 0.139 0.108 0.085 0.066 0.056 0.269 0.186 0.133 0.095 0.790 0.760 0.731 0.703 0.705 0.636 0.583 0.564 0.456 0.410 0.207 0.159 0.123 0.094 0.189 0.143 7 0.665 0.513 0.400 0.351 0.354 0.314 0.305 0.266 0.263 8 0.853 0.627 0.540 0.467 0.424 0386 0.350 0319 0.404 0.204 0.108 0.068 0048 0.035 0.025 0018 0.013 0.837 0.592 0.500 0361 0.322 0270 0.287 0257 0229 0.308 0.225 0.167 0.144 0.082 0062 0.046 0036 0.027 0.021 0.009 0016 0.006 0.012 0.009 0,007 0005 0.004 0.003 0.002 0.002 0.001 0,001 0001 0,001 0.000 0.000 0.000 10 0.820 0.804 0.650 0.625 0.788 0.773 0.601 0.676 0558 0.527 0.497 0463 0227 0.191 0.195 0.168 0.145 0.116 0.094 0.076 0061 0073 11 0.429 0.397 0.237 0.162 0.137 0.112 12 13 0.208 0.092 0.043 0.033 0025 0.469 0.368 0.290 0.182 0.116 0.125 0.099 0.108 0.084 0075 0.050 0.040 0.032 0.025 0019 0.015 0012 0009 0.007 14 0.758 0.577 442 0.417 0.394 0.371 0.340 0263 0.239 0.218 0.198 0.205 0.160 0.140 0.123 0.108 0095 0062 0049 0.039 15 0743 0.728 0714 0513 0700 0494 0686 0475 0673 0456 0.660 0.439 0.647 0.422 0.634 0406 0622 0390 0.610 0.598 0.555 0315 0.292 0.183 0.051 0.040 0.031 16 0.020 0.534 0.163 0093 0.071 0.042 0034 0,028 0023 0.019 0015 0013 0.010 0006 0.007 0.006 0.032 0025 0026 0.020 0021 0016 0017 0012 0.014 0010 0.008 0.006 0.005 0.004 0.003 0015 0.012 17 0.005 0.003 0.002 0.002 0.001 0.001 0.001 0.000 0.000 0.270 0.250 0232 0146 0.180 0.130 0080 0.060 0.069 0.051 0060 0043 0051 0037 18 0350 19 0.009 0.331 0.164 0.116 0083 0.149 0.135 20 0312 0.104 0073 0.064 0.056 0.049 0.215 21 22 0,007 0.005 0.199 0.184 0.170 0.158 0.146 0.220 0.135 0.207 0125 0076 0.294 0.093 0.044 0031 0.011 0.278 0262 0.247 0.233 0.006 0.004 0.123 0.083 0.112 0074 0.102 0038 0026 0.009 0.007 0.006 0.005 0004 23 0.004 0.003 0.033 0.022 24 25 0.003 0.002 0066 0.092 0059 0084 0.043 0038 0.053 0033 0.047 0029 0.028 0.019 0.375 0.003 0.002 0024 0016 26 0.361 0586 0347 0574 0333 0563 0321 0552 0308 0.002 0.001 0021 0014 0.000 0.000 0.000 0,000 27 28 0002 0.002 0.001 0.001 0001 0.001 0001 0.001 0.000 0001 0018 0011 0.196 0116 0069 0042 0026 0.002 0.002 0016 0010 0014 0008 0.012 0.007 0004 0.002 0003 0.003 29 0.185 0.107 0.174 0099 0063 0.057 0.037 0.033 0022 0,020 30 0.005 o,.004 0.002 0.002 0.001 0.001 000 A+ 0.000 0.000 EXHIBIT 19B.2 Present Value of an Annuity of $1 in Arrears Periods 2% 4% 6% 8% 40% 10% 12% 14% 16% 32% 18% 20% 22% 24% 26% 28% 30% 0980 0.962 1.866 2.775 3.630 4.452 0.943 0.926 0.909 0.893 1.690 2.402 3.037 3.605 4.111 0.877 0.862 1.647 1.605 2.322 2.246 2.914 2.798 3.433 3274 3.889 3.685 4288 4.039 4.639 4.344 4.946 4.607 5.216 4.833 0.847 1.566 0.833 1.528 2.106 2.589 2.991 3.326 3.605 0.820 1.492 2.042 2.494 2.864 3.167 3.416 3.619 3.786 3.923 4.035 0.806 0.794 0.769 0.758 0.714 0.781 1.392 1.868 2.241 1.942 1.783 1.736 2.577 2.487 3312 3.170 3.993 3.791 4.623 1833 1.457 1.424 1.361 1.816 2.166 2.436 2.643 2.802 2.925 3.019 3.092 3.147 1.331 1,766 2.096 2345 2.534 2677 2.786 2.868 2.930 2.978 3.013 3.040 3.061 3.076 3.088 3.097 3.104 3.109 3.113 3.116 3.118 3.120 1.224 1.589 3 2.884 2.673 2.174 1.981 1.923 2.320 2.635 2.885 3.083 3.241 3.366 3.465 4 3.808 3.465 4.212 2.690 3.127 2.404 2.745 3.020 3.242 3.421 3.566 3.682 3.776 1.849 5 4.713 2,532 2.035 2.168 2.263 2.331 2.379 2.414 2.438 5.601 6 5.242 4.917 4.355 5.206 4.868 5.747 5.335 6.247 5.759 6.710 6.145 7.139 6.495 7.536 6.814 7.904 7.103 8244 7.367 8.559 3.498 3.812 3.078 2.759 2.937 3.076 3.184 3.269 3.335 3.387 7 6.472 6.002 6.733 5.582 4.564 8 7.325 8.162 8.983 9.787 10.575 6.210 4.968 3.837 7.435 6.802 5.328 4303 4.031 10 11 8.111 7.360 5.650 4.494 4.192 4.327 8.760 7.887 5.938 6.194 5.453 5.029 5.660 5.197 5.842 5.342 4.656 3.543 12 9.385 9.986 12.106 10.563 12.849 11.118 8.384 8.853 9.295 9.712 4.793 4.910 5.008 5.092 4.439 4.127 3.851 3.606 13 3.190 11.348 2.456 6.424 4.533 4.203 3.912 3.656 3.962 3.695 4.001 14 3.427 3.223 2.469 6628 002 5468 4.611 4.265 15 3.459 3.483 3.249 7.606 8.851 7.824 8.022 2,478 6.811 6.974 7.120 6142 5.575 6.265 5668 4.675 4.315 3.726 16 13.578 11.652 10.106 14.292 12166 10477 14.992 12.659 10.828 15.678 13.134 11 158 16 351 13.590 11470 9818 17.011 14029 11.764 10.017 17.658 14451 12.042 10 201 18.292 14.857 12.303 10.371 8.883 3.268 3.283 3.295 3.304 3.311 3.316 3.320 3.323 3.325 3.327 3.329 2,484 5.162 4.730 4.357 17 4.033 3.751 3.503 9.122 2.489 2.492 2.494 2.496 2.497 2.498 6.373 5749 5.222 5.273 5316 4.775 4812 4.391 4.419 4.059 18 3.771 3.518 9.372 8.201 7.250 6467 5.818 6.550 5.877 6623 5929 6.687 5.973 6743 6011 6.792 6044 6.835 6073 6.873 6.097 6 906 6118 6.935 6.136 6961 6152 6983 6166 7.003 6177 19 4.080 3.786 3.529 3.799 3.539 3.808 3.816 9.604 8.365 7.366 7.469 7.562 4.843 20 21 22 23 24 4.442 4.097 8.514 8.649 5.353 4.870 4.891 4.460 4.476 4.110 4.121 4.130 3.546 3.551 3.556 3.559 5.384 4.909 5.410 S.432 4.925 8.772 7.645 4.488 4.499 3.822 7.718 2.498 18.914 15247 19.523 15.622 12.783 10.675 9.077 20 121 15.983 13003 10 810 20.707 16.330 13 211 10.935 9.237 7943 21.28t 16.663 13406 11.051 9.307 7.984 21.844 16.984 13.591 11.158 9.370 22.396 17292 13.765 11.258 12.550 10529 8.985 4137 3.827 3831 3.834 3.837 3.839 3840 3841 3.842 7.784 7 843 7.896 25 26 27 5.451 2,499 4.937 4.948 4.956 4.964 4.507 4.143 3.562 3.121 5.467 2.499 4.514 4.147 4.151 4.154 4.157 9.161 3.564 5.480 5.492 3.122 3.123 2.499 2.500 4.520 3.566 3.567 3 568 3.569 3332 3569 3.330 28 29 4.524 3.331 5.502 5510 3.123 4.970 2.500 2.500 2.500 2.500 4 528 4 531 8.022 8055 3.331 3.124 30 4.975 4.159 9.427 5517 3.124 3.124 4.979 4.534 4.160 3 332 NRRNR&RR