Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please assist with question 3 Question 3 [30 MARKS] Calculate the hourly cost of a concrete mixer, throughout its expected life, based on the following

Please assist with question 3

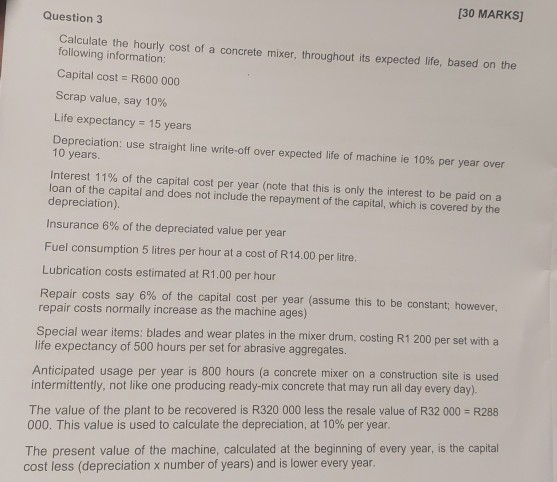

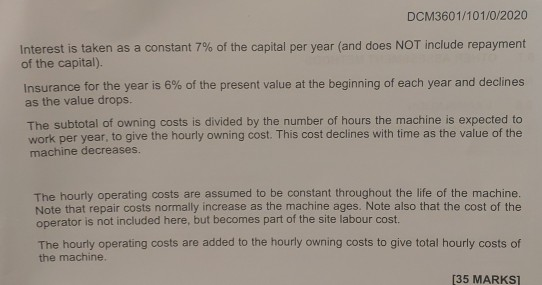

Question 3 [30 MARKS] Calculate the hourly cost of a concrete mixer, throughout its expected life, based on the following information: Capital cost = R600 000 Scrap value, say 10% Life expectancy = 15 years Depreciation: use straight line write-off over expected life of machine ie 10% per year over 10 years Interest 11% of the capital cost per year (note that this is only the interest to be paid on a loan of the capital and does not include the repayment of the capital, which is covered by the depreciation). Insurance 6% of the depreciated value per year Fuel consumption 5 litres per hour at a cost of R14.00 per litre. Lubrication costs estimated at R1.00 per hour Repair costs say 6% of the capital cost per year (assume this to be constant; however, repair costs normally increase as the machine ages) Special wear items: blades and wear plates in the mixer drum, costing R1 200 per set with a life expectancy of 500 hours per set for abrasive aggregates. Anticipated usage per year is 800 hours (a concrete mixer on a construction site is used intermittently, not like one producing ready-mix concrete that may run all day every day). The value of the plant to be recovered is R320 000 less the resale value of R32 000 = R288 000. This value is used to calculate the depreciation, at 10% per year. The present value of the machine, calculated at the beginning of every year, is the capital cost less (depreciation x number of years) and is lower every year. DCM3601/101/0/2020 Interest is taken as a constant 7% of the capital per year (and does NOT include repayment of the capital). Insurance for the year is 6% of the present value at the beginning of each year and declines as the value drops The subtotal of owning costs is divided by the number of hours the machine is expected to work per year, to give the hourly owning cost. This cost declines with time as the value of the machine decreases. The hourly operating costs are assumed to be constant throughout the life of the machine. Note that repair costs normally increase as the machine ages. Note also that the cost of the operator is not included here, but becomes part of the site labour cost. The hourly operating costs are added to the hourly owning costs to give total hourly costs of the machine [35 MARKS] Question 3 [30 MARKS] Calculate the hourly cost of a concrete mixer, throughout its expected life, based on the following information: Capital cost = R600 000 Scrap value, say 10% Life expectancy = 15 years Depreciation: use straight line write-off over expected life of machine ie 10% per year over 10 years Interest 11% of the capital cost per year (note that this is only the interest to be paid on a loan of the capital and does not include the repayment of the capital, which is covered by the depreciation). Insurance 6% of the depreciated value per year Fuel consumption 5 litres per hour at a cost of R14.00 per litre. Lubrication costs estimated at R1.00 per hour Repair costs say 6% of the capital cost per year (assume this to be constant; however, repair costs normally increase as the machine ages) Special wear items: blades and wear plates in the mixer drum, costing R1 200 per set with a life expectancy of 500 hours per set for abrasive aggregates. Anticipated usage per year is 800 hours (a concrete mixer on a construction site is used intermittently, not like one producing ready-mix concrete that may run all day every day). The value of the plant to be recovered is R320 000 less the resale value of R32 000 = R288 000. This value is used to calculate the depreciation, at 10% per year. The present value of the machine, calculated at the beginning of every year, is the capital cost less (depreciation x number of years) and is lower every year. DCM3601/101/0/2020 Interest is taken as a constant 7% of the capital per year (and does NOT include repayment of the capital). Insurance for the year is 6% of the present value at the beginning of each year and declines as the value drops The subtotal of owning costs is divided by the number of hours the machine is expected to work per year, to give the hourly owning cost. This cost declines with time as the value of the machine decreases. The hourly operating costs are assumed to be constant throughout the life of the machine. Note that repair costs normally increase as the machine ages. Note also that the cost of the operator is not included here, but becomes part of the site labour cost. The hourly operating costs are added to the hourly owning costs to give total hourly costs of the machine [35 MARKS]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started