Answered step by step

Verified Expert Solution

Question

1 Approved Answer

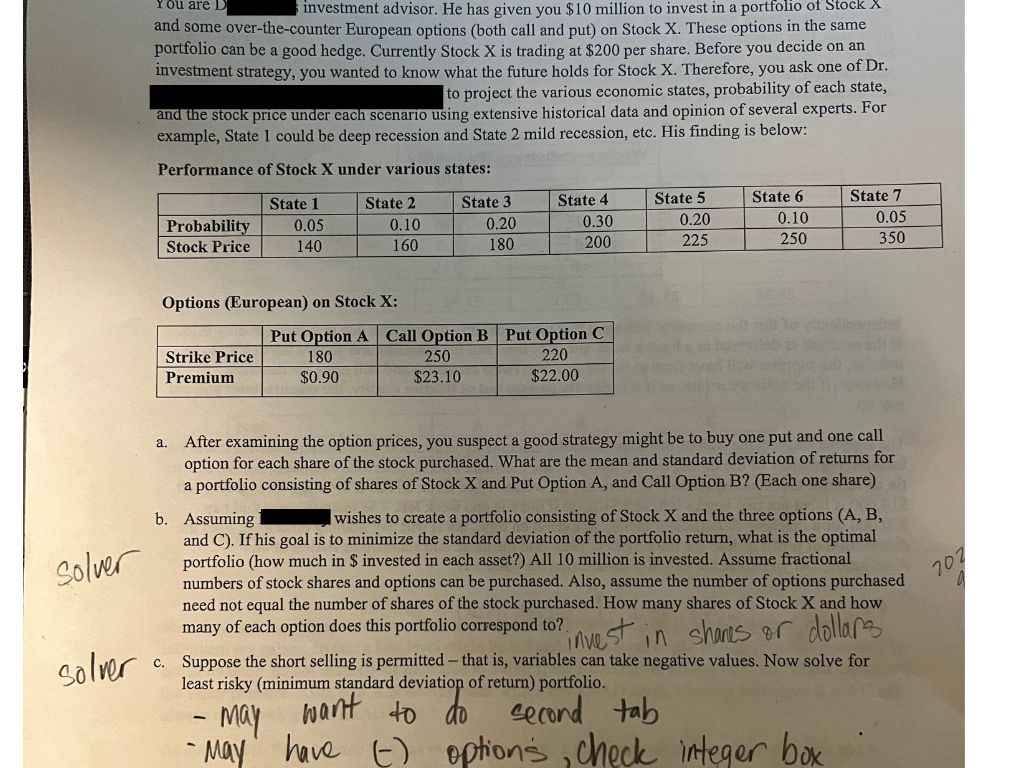

Please assist with questions B& C , using Solver in Excel. Please list the constraints you input in Solver. You are an investment advisor. He

Please assist with questions B& C using Solver in Excel. Please list the constraints you input in Solver.

You are an investment advisor. He has given you $ million to invest in a portfolio of Stock

and some overthecounter European options both call and put on Stock X These options in the same

portfolio can be a good hedge. Currently Stock is trading at $ per share. Before you decide on an

investment strategy, you wanted to know what the future holds for Stock X Therefore, you ask one of Dr

to project the various economic states, probability of each state,

and the stock price under each scenario using extensive historical data and opinion of several experts. For

example, State could be deep recession and State mild recession, etc. His finding is below:

Performance of Stock under various states:

Options European on Stock X:

b Assuming

wishes to create a portfolio consisting of Stock X and the three options A B

and C If his goal is to minimize the standard deviation of the portfolio return, what is the optimal

portfolio how much in $ invested in each asset? All million is invested. Assume fractional

numbers of stock shares and options can be purchased. Also, assume the number of options purchased

need not equal the number of shares of the stock purchased. How many shares of Stock X and how

many of each option does this portfolio correspond to

in shanes or dollars

c Suppose the short selling is permitted that is variables can take negative values. Now solve for

least risky minimum standard deviation of return portfolio.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started