Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please assist with these questions Answer the questions from the information provided. 2.1 Use the information provided below to calculate the number of units of

please assist with these questions

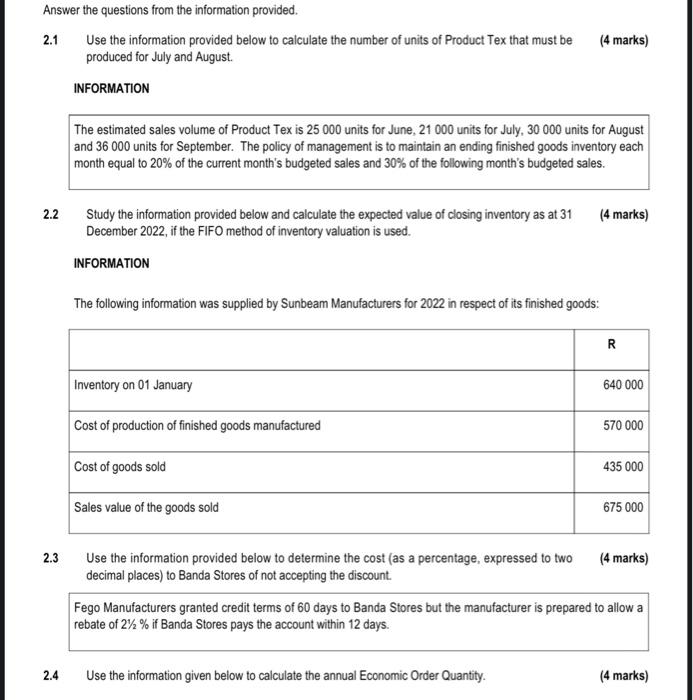

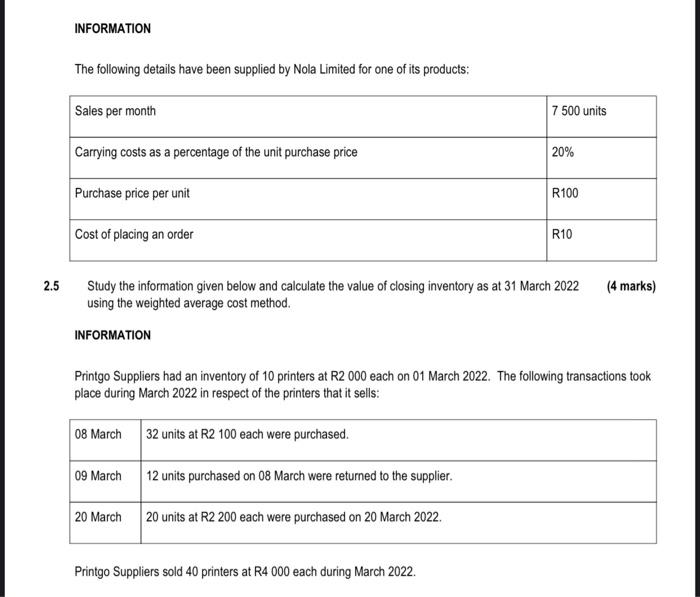

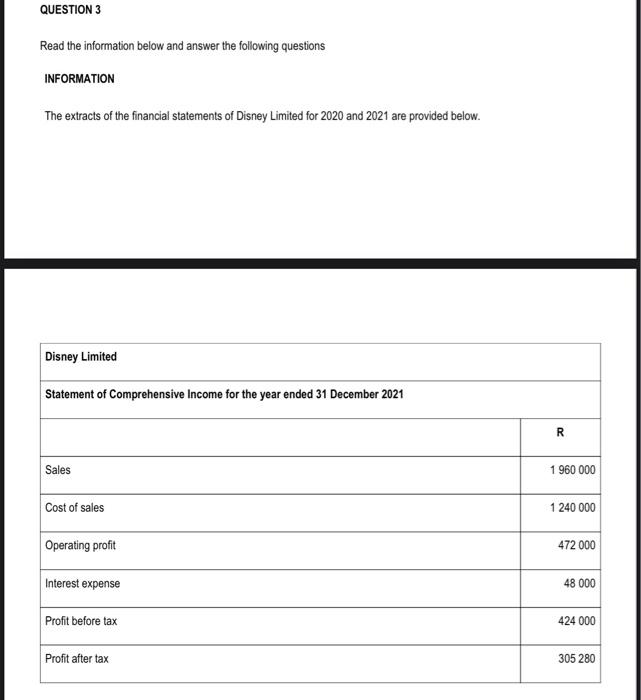

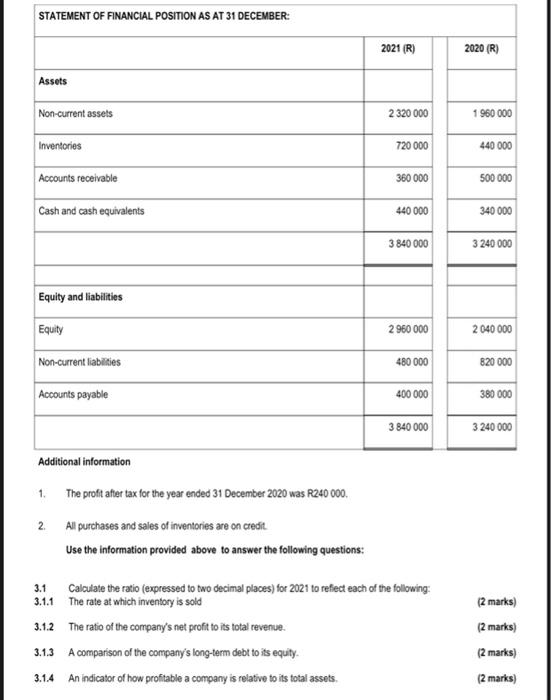

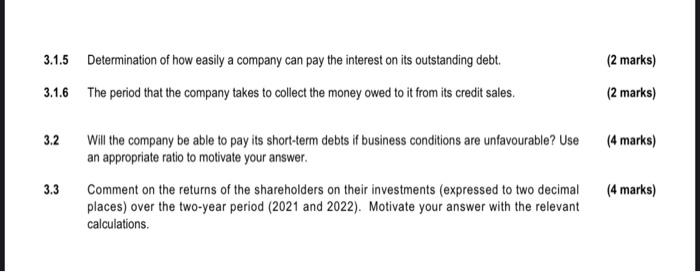

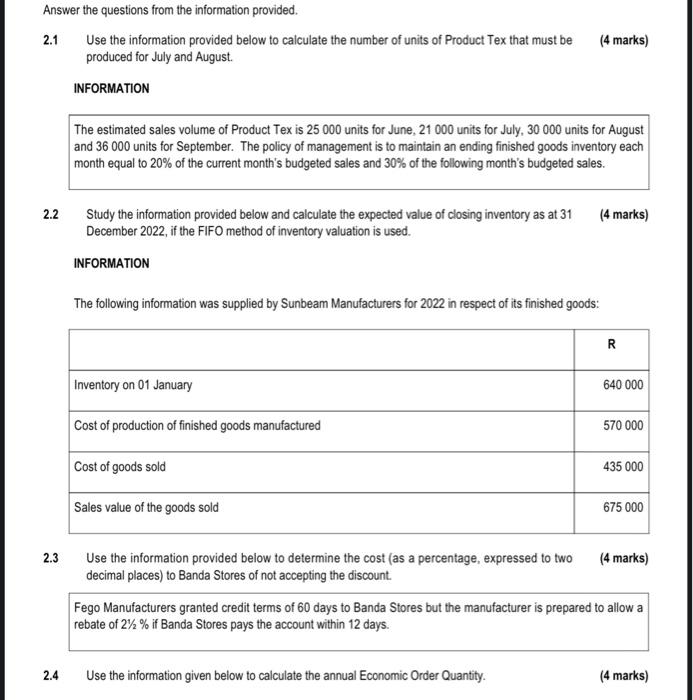

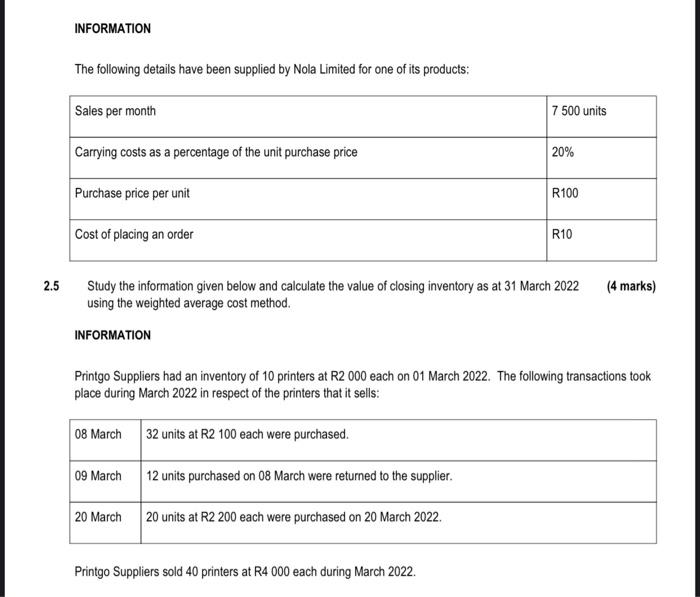

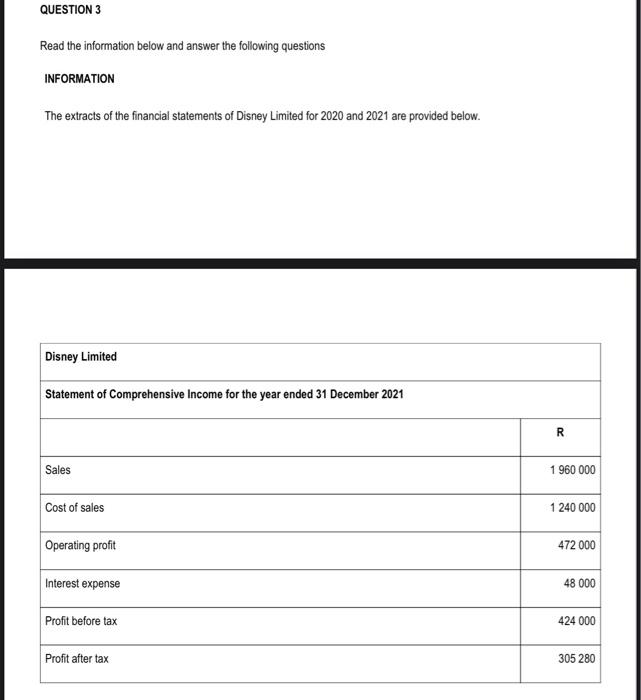

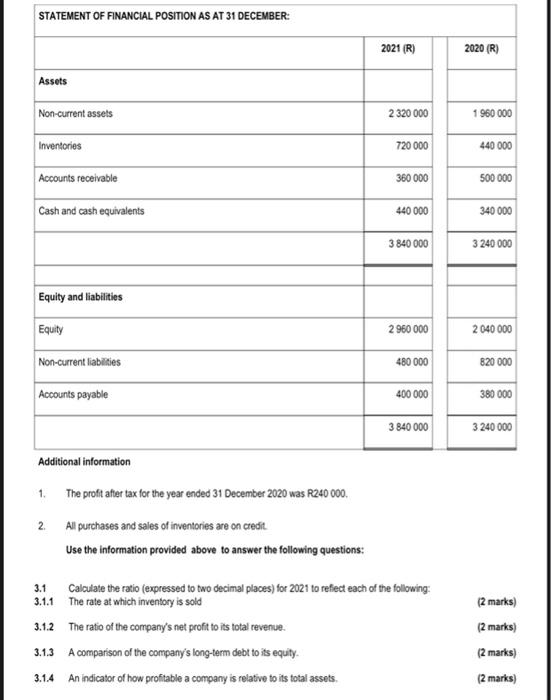

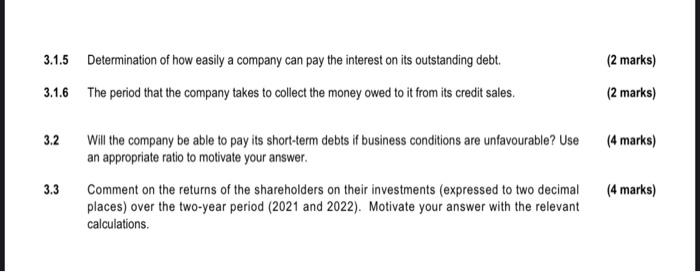

Answer the questions from the information provided. 2.1 Use the information provided below to calculate the number of units of Product Tex that must be produced for July and August. INFORMATION 2.2 2.3 2.4 The estimated sales volume of Product Tex is 25 000 units for June, 21 000 units for July, 30 000 units for August and 36 000 units for September. The policy of management is to maintain an ending finished goods inventory each month equal to 20% of the current month's budgeted sales and 30% of the following month's budgeted sales. Study the information provided below and calculate the expected value of closing inventory as at 31 December 2022, if the FIFO method of inventory valuation is used. INFORMATION Inventory on 01 January Cost of production of finished goods manufactured The following information was supplied by Sunbeam Manufacturers for 2022 in respect of its finished goods: Cost of goods sold Sales value of the goods sold (4 marks) Use the information provided below to determine the cost (as a percentage, expressed to two decimal places) to Banda Stores of not accepting the discount. (4 marks) Use the information given below to calculate the annual Economic Order Quantity. R 640 000 570 000 435 000 675 000 (4 marks) Fego Manufacturers granted credit terms of 60 days to Banda Stores but the manufacturer is prepared to allow a rebate of 2% % if Banda Stores pays the account within 12 days. (4 marks) 2.5 INFORMATION The following details have been supplied by Nola Limited for one of its products: Sales per month Carrying costs as a percentage of the unit purchase price Purchase price per unit Cost of placing an order 08 March 09 March Study the information given below and calculate the value of closing inventory as at 31 March 2022 using the weighted average cost method. INFORMATION 20 March 32 units at R2 100 each were purchased. Printgo Suppliers had an inventory of 10 printers at R2 000 each on 01 March 2022. The following transactions took place during March 2022 in respect of the printers that it sells: 12 units purchased on 08 March were returned to the supplier. 7 500 units 20 units at R2 200 each were purchased on 20 March 2022. 20% Printgo Suppliers sold 40 printers at R4 000 each during March 2022. R100 R10 (4 marks) QUESTION 3 Read the information below and answer the following questions INFORMATION The extracts of the financial statements of Disney Limited for 2020 and 2021 are provided below. Disney Limited Statement of Comprehensive Income for the year ended 31 December 2021 Sales Cost of sales Operating profit Interest expense Profit before tax Profit after tax R 1 960 000 1 240 000 472 000 48 000 424 000 305 280 STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER: Assets Non-current assets Inventories Accounts receivable Cash and cash equivalents Equity and liabilities Equity Non-current liabilities Accounts payable Additional information 1. The profit after tax for the year ended 31 December 2020 was R240 000. 2. All purchases and sales of inventories are on credit. Use the information provided above to answer the following questions: 2021 (R) 2320 000 720 000 360 000 440 000 3840 000 2 960 000 480 000 400 000 3 840 000 3.1 Calculate the ratio (expressed to two decimal places) for 2021 to reflect each of the following: The rate at which inventory is sold 3.1.1 3.1.2 The ratio of the company's net profit to its total revenue. 3.1.3 A comparison of the company's long-term debt to its equity. 3.1.4 An indicator of how profitable a company is relative to its total assets. 2020 (R) 1 960 000 440 000 500 000 340 000 3 240 000 2 040 000 820 000 380 000 3 240 000 (2 marks) (2 marks) (2 marks) (2 marks) 3.1.5 3.1.6 3.2 3.3 Determination of how easily a company can pay the interest on its outstanding debt. The period that the company takes to collect the money owed to it from its credit sales. Will the company be able to pay its short-term debts if business conditions are unfavourable? Use an appropriate ratio to motivate your answer. Comment on the returns of the shareholders on their investments (expressed to two decimal places) over the two-year period (2021 and 2022). Motivate your answer with the relevant calculations. (2 marks) (2 marks) (4 marks) (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started