please assist with this

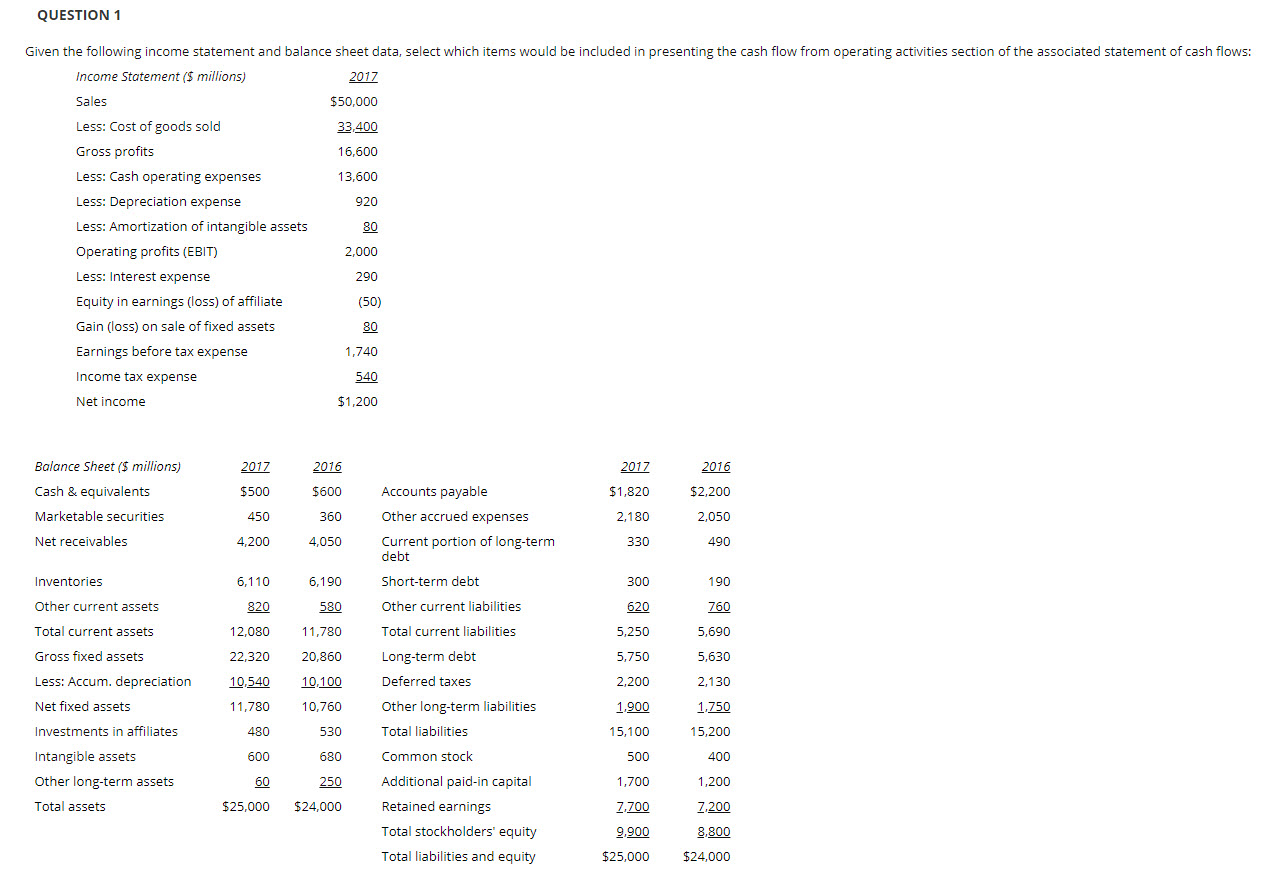

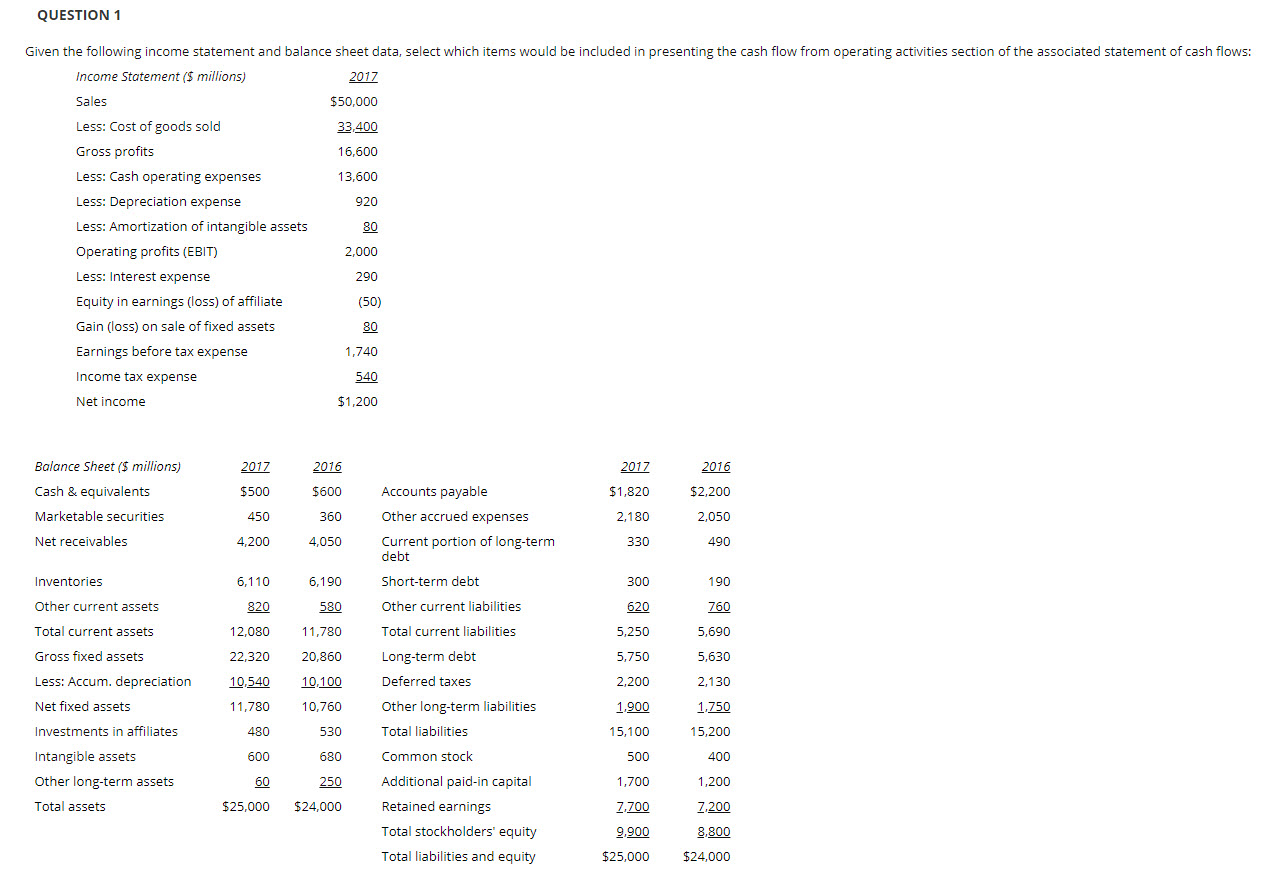

QUESTION 1 Given the following income statement and balance sheet data, select which items would be included in presenting the cash flow from operating activities section of the associated statement of cash flows: Income Statement ($ millions) 2017 Sales $50,000 Less: Cost of goods sold 33.400 Gross profits 16,600 Less: Cash operating expenses 13,600 Less: Depreciation expense 920 Less: Amortization of intangible assets Operating profits (EBIT) 2,000 Less: Interest expense 290 Equity in earnings (loss) of affiliate (50) Gain (loss) on sale of fixed assets 80 Earnings before tax expense 1,740 Income tax expense 540 Net income $1,200 80 Balance Sheet($ millions) Cash & equivalents Marketable securities Net receivables 2017 $500 450 2016 $600 360 2017 $1,820 2,180 2016 $2,200 2,050 4,200 4,050 330 490 Inventories 300 Other current assets Total current assets Gross fixed assets Less: Accum. depreciation Net fixed assets Investments in affiliates 6,110 820 12,080 22,320 10.540 11,780 480 600 60 $25,000 6,190 580 11,780 20,860 10.100 10,760 530 620 5,250 5.750 Accounts payable Other accrued expenses Current portion of long-term debt Short-term debt Other current liabilities Total current liabilities Long-term debt Deferred taxes Other long-term liabilities Total liabilities 2,200 1,900 15,100 500 190 760 5,690 5,630 2,130 1.750 15,200 400 1,200 7,200 8,800 $24,000 Intangible assets 680 Common stock Additional paid-in capital 1,700 Other long-term assets Total assets 250 $24,000 Retained earnings Total stockholders' equity Total liabilities and equity 7.700 9.900 $25,000 Add-back depreciation expense of $920 subtract depreciation expense of $920 add-back amortization of intangible assets of $80 subtract amortization of intangible assets of $80 subtract earnings recognized on investments in affiliates (equity in earnings of affiliate) of $50 add earnings recognized on investments in affiliates (equity in earnings of affiliate) of $50 add change in receivables of $150 subtract change in receivables of $150 add change in inventories of $80 subtract change in inventories of $80 add change in other current assets of $240 subtract change in other current assets of $240 add change in other noncurrent assets of $190 subtract change in other noncurrent assets of $190 add change in accounts payable of $380 subtract change in accounts payable of $380 add change in accrued expenses of $130 subtract change in accrued expenses of $130 add change in other current liabilities of $140 subtract change in other current liabilities of $140 add change in deferred taxes of $70 subtract change in deferred taxes of $70 add change in other noncurrent liabilities of $150 subtract change in other noncurrent liabilities of $150 add-back interest expense of $290 add gain on sale of fixed assets of $80 subtract gain on sale of fixed assets of $80