Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please assume 1 year of construction and 10 years of manufacturing. Thank you! 1 year 6) You are working within the economic analysis and planning

Please assume 1 year of construction and 10 years of manufacturing. Thank you!

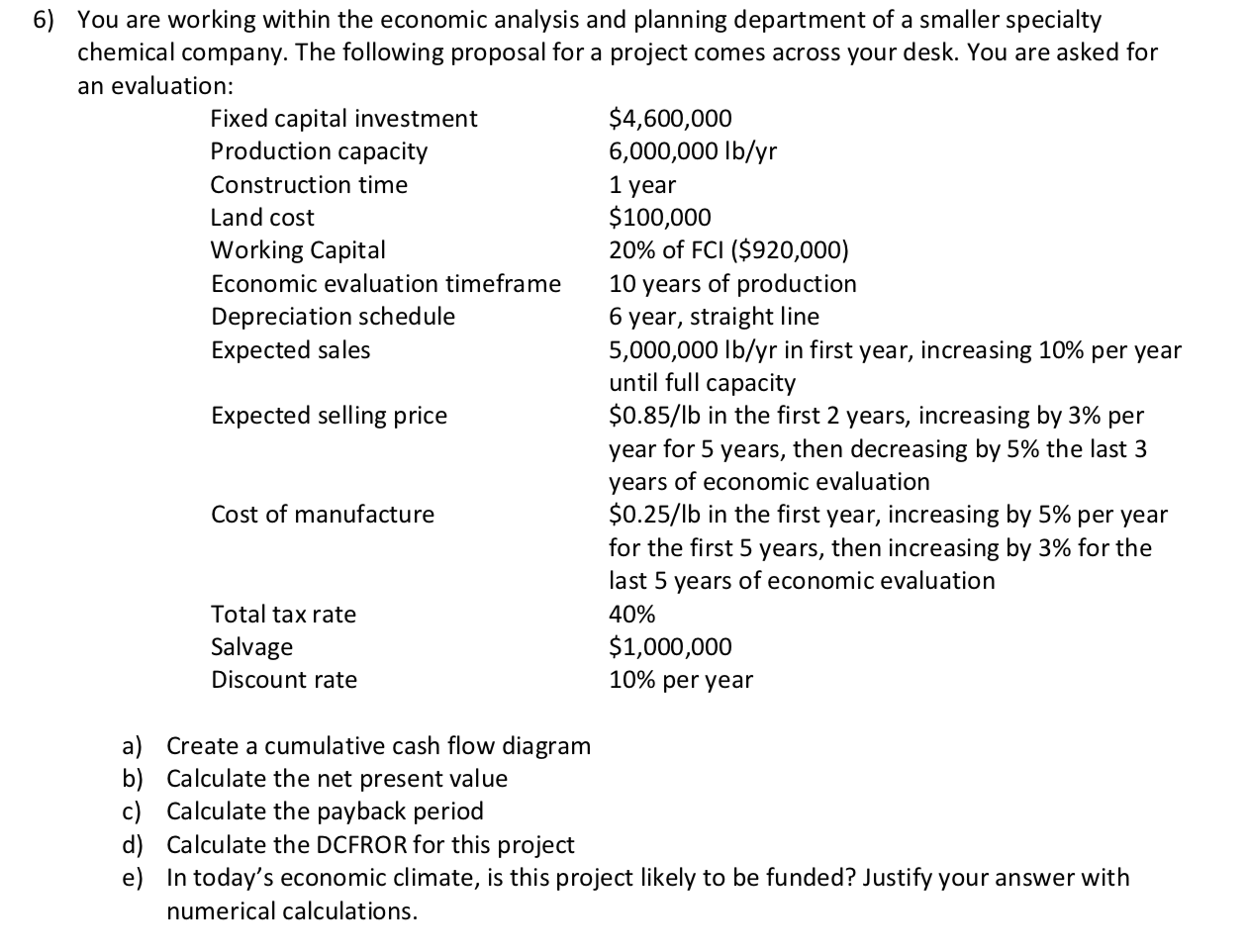

1 year 6) You are working within the economic analysis and planning department of a smaller specialty chemical company. The following proposal for a project comes across your desk. You are asked for an evaluation: Fixed capital investment $4,600,000 Production capacity 6,000,000 lb/yr Construction time Land cost $100,000 Working Capital 20% of FCI ($920,000) Economic evaluation timeframe 10 years of production Depreciation schedule 6 year, straight line Expected sales 5,000,000 lb/yr in first year, increasing 10% per year until full capacity Expected selling price $0.85/lb in the first 2 years, increasing by 3% per year for 5 years, then decreasing by 5% the last 3 years of economic evaluation Cost of manufacture $0.25/lb in the first year, increasing by 5% per year for the first 5 years, then increasing by 3% for the last 5 years of economic evaluation Total tax rate 40% Salvage $1,000,000 Discount rate 10% per year a) Create a cumulative cash flow diagram b) Calculate the net present value c) Calculate the payback period d) Calculate the DCFROR for this project e) In today's economic climate, is this project likely to be funded? Justify your answer with numerical calculations. 1 year 6) You are working within the economic analysis and planning department of a smaller specialty chemical company. The following proposal for a project comes across your desk. You are asked for an evaluation: Fixed capital investment $4,600,000 Production capacity 6,000,000 lb/yr Construction time Land cost $100,000 Working Capital 20% of FCI ($920,000) Economic evaluation timeframe 10 years of production Depreciation schedule 6 year, straight line Expected sales 5,000,000 lb/yr in first year, increasing 10% per year until full capacity Expected selling price $0.85/lb in the first 2 years, increasing by 3% per year for 5 years, then decreasing by 5% the last 3 years of economic evaluation Cost of manufacture $0.25/lb in the first year, increasing by 5% per year for the first 5 years, then increasing by 3% for the last 5 years of economic evaluation Total tax rate 40% Salvage $1,000,000 Discount rate 10% per year a) Create a cumulative cash flow diagram b) Calculate the net present value c) Calculate the payback period d) Calculate the DCFROR for this project e) In today's economic climate, is this project likely to be funded? Justify your answer with numerical calculationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started