Answered step by step

Verified Expert Solution

Question

1 Approved Answer

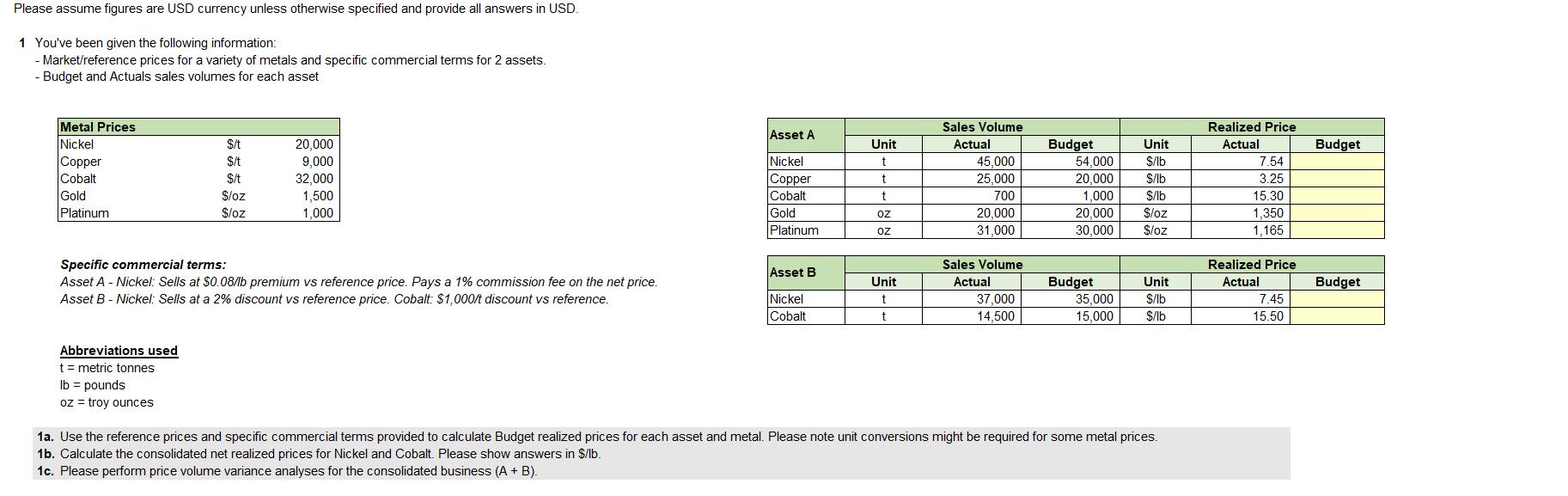

Please assume figures are USD currency unless otherwise specified and provide all answers in USD. 1 You've been given the following information: - Market/reference

Please assume figures are USD currency unless otherwise specified and provide all answers in USD. 1 You've been given the following information: - Market/reference prices for a variety of metals and specific commercial terms for 2 assets. - Budget and Actuals sales volumes for each asset Metal Prices Nickel Copper Cobalt Gold Platinum Sales Volume Realized Price Asset A $/t 20,000 S/t 9,000 $/t 32,000 $/oz $/oz 1,500 1,000 Unit Actual Budget Unit Actual Budget Nickel t 45,000 54,000 $/lb 7.54 Copper t 25,000 20,000 $/lb 3.25 Cobalt t 700 1,000 $/lb 15.30 Gold OZ 20,000 20,000 $/oz 1,350 Platinum OZ 31,000 30,000 $/oz 1,165 Specific commercial terms: Asset B Asset A - Nickel: Sells at $0.08/lb premium vs reference price. Pays a 1% commission fee on the net price. Asset B - Nickel: Sells at a 2% discount vs reference price. Cobalt: $1,000/t discount vs reference. Unit Sales Volume Actual Realized Price Nickel Cobalt t t 37,000 14,500 Budget 35,000 Unit $/lb Actual Budget 7.45 15,000 $/lb 15.50 Abbreviations used t = metric tonnes lb = pounds oz = troy ounces 1a. Use the reference prices and specific commercial terms provided to calculate Budget realized prices for each asset and metal. Please note unit conversions might be required for some metal prices. 1b. Calculate the consolidated net realized prices for Nickel and Cobalt. Please show answers in $/lb. 1c. Please perform price volume variance analyses for the consolidated business (A + B).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started