Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please attempt all parts for definite thumbs up. i really need help. I shall be very thankful to you. 30. A company incurs $1,200,000 of

please attempt all parts for definite thumbs up. i really need help. I shall be very thankful to you.

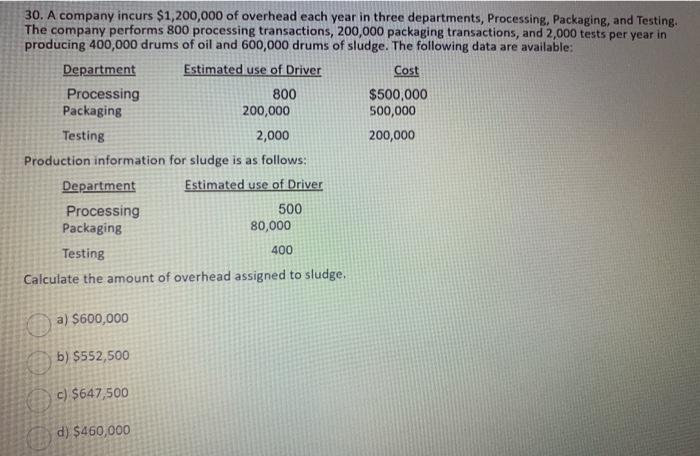

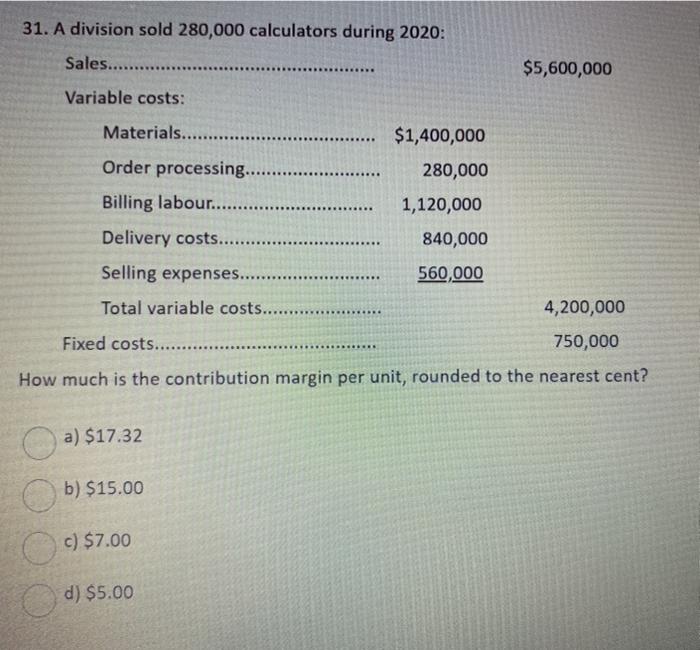

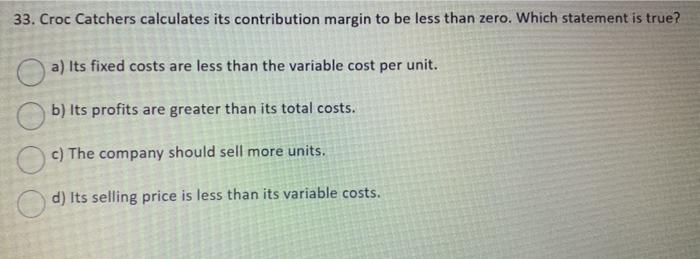

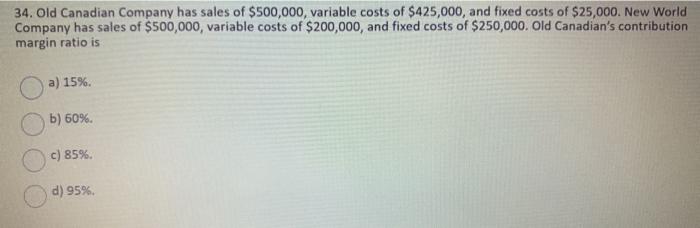

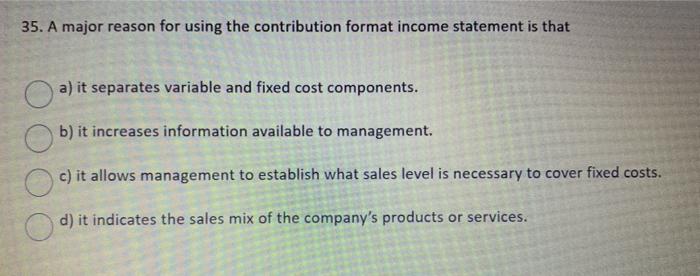

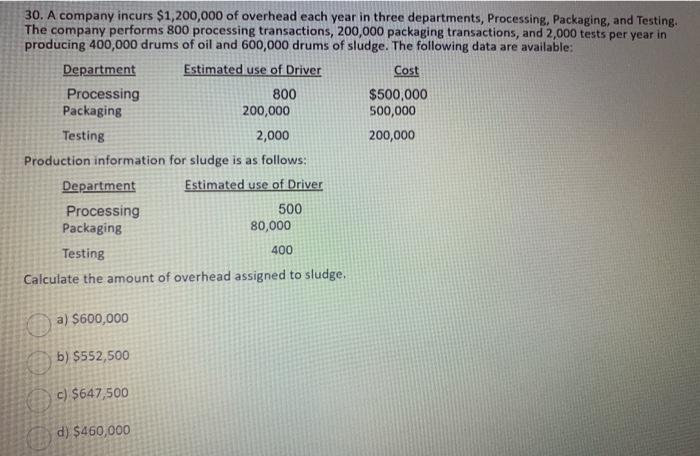

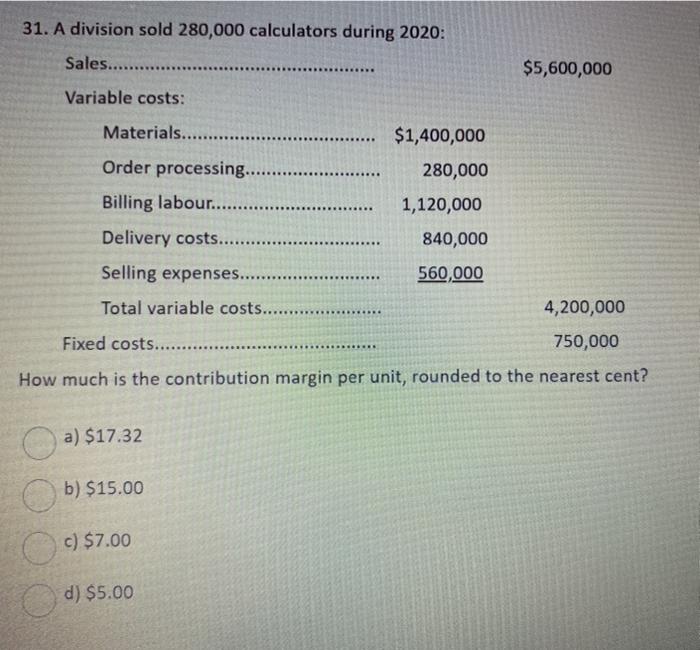

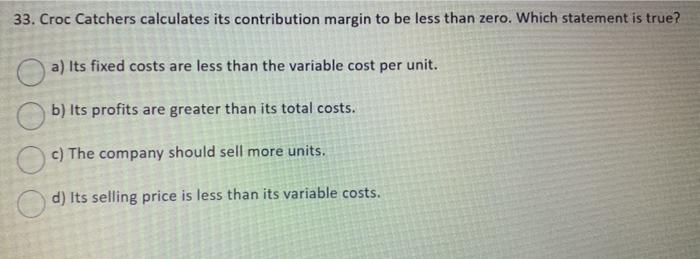

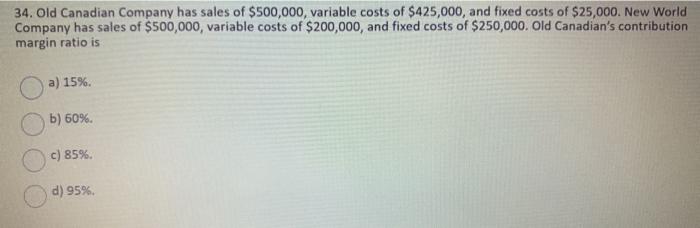

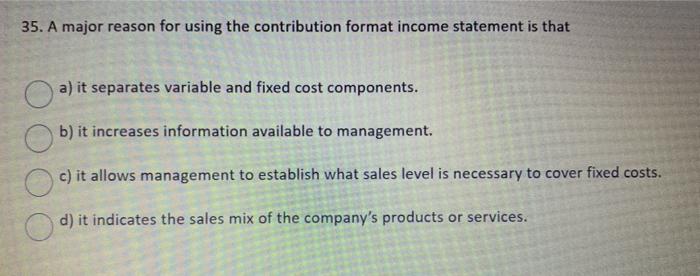

30. A company incurs $1,200,000 of overhead each year in three departments, Processing, Packaging, and Testing. The company performs 800 processing transactions, 200,000 packaging transactions, and 2,000 tests per year in producing 400,000 drums of oil and 600,000 drums of sludge. The following data are available: Department Estimated use of Driver Cost Processing 800 $500,000 Packaging 200,000 500,000 Testing 2,000 200,000 Production information for sludge is as follows: Department Estimated use of Driver Processing 500 Packaging 80,000 Testing 400 Calculate the amount of overhead assigned to sludge. a) $600,000 b) $552,500 c) $647,500 d) $460,000 31. A division sold 280,000 calculators during 2020: Sales............ $5,600,000 Variable costs: Materials........... $1,400,000 Order processing........... 280,000 Billing labour.... 1,120,000 Delivery costs.......... 840,000 Selling expenses......... 560,000 Total variable costs...... 4,200,000 Fixed costs................ 750,000 How much is the contribution margin per unit, rounded to the nearest cent? a) $17.32 b) $15.00 b c) $7.00 d) $5.00 33. Croc Catchers calculates its contribution margin to be less than zero. Which statement is true? a) Its fixed costs are less than the variable cost per unit. b) Its profits are greater than its total costs. c) The company should sell more units. d) Its selling price is less than its variable costs. 34. Old Canadian Company has sales of $500,000, variable costs of $425,000, and fixed costs of $25,000. New World Company has sales of $500,000, variable costs of $200,000, and fixed costs of $250,000. Old Canadian's contribution margin ratio is a) 15%. b) 60%. c) 85%. d) 95% 35. A major reason for using the contribution format income statement is that a) it separates variable and fixed cost components. b) it increases information available to management. c) it allows management to establish what sales level is necessary to cover fixed costs. d) it indicates the sales mix of the company's products or services

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started