Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please attempt all partsfor definite thumbs up I shall be very thankful to you. 16. When using a single cost driver to allocate overhead costs,

please attempt all partsfor definite thumbs up I shall be very thankful to you.

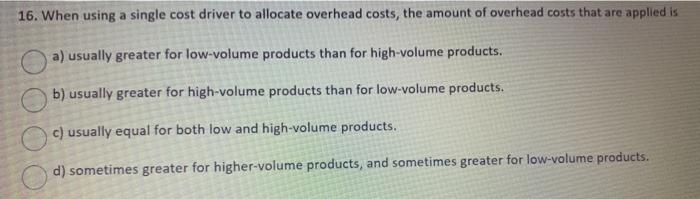

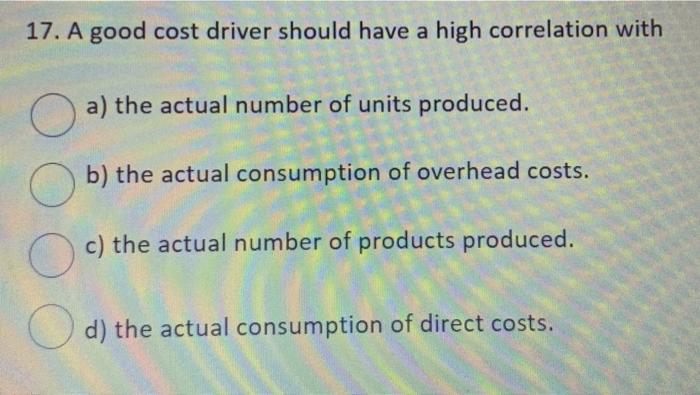

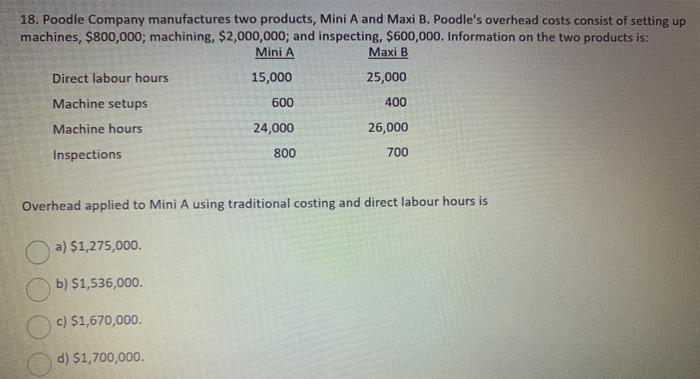

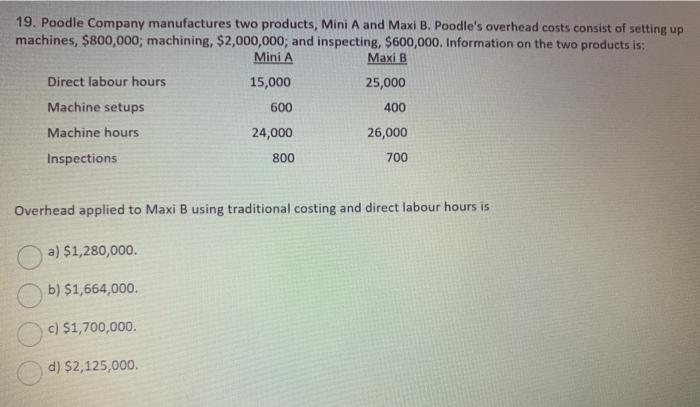

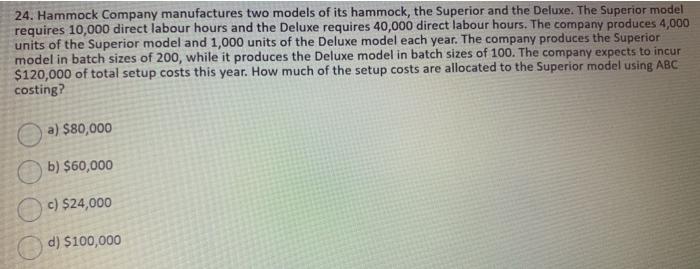

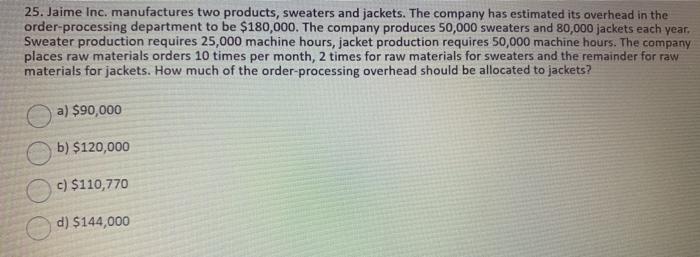

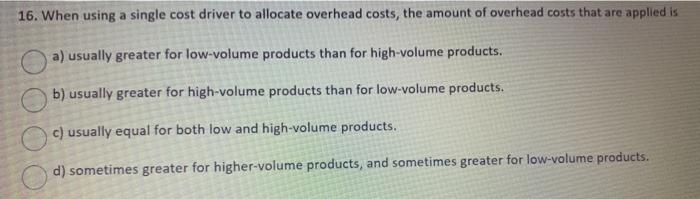

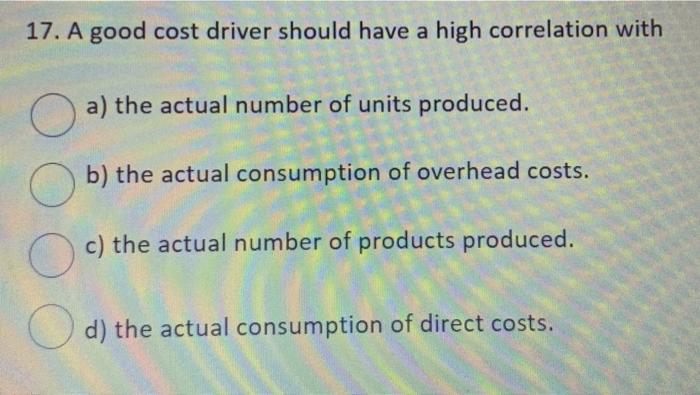

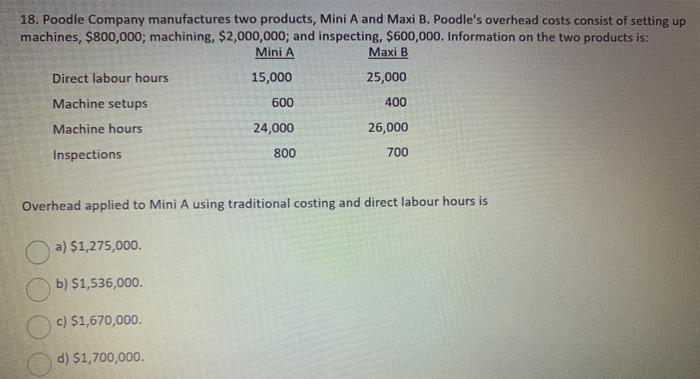

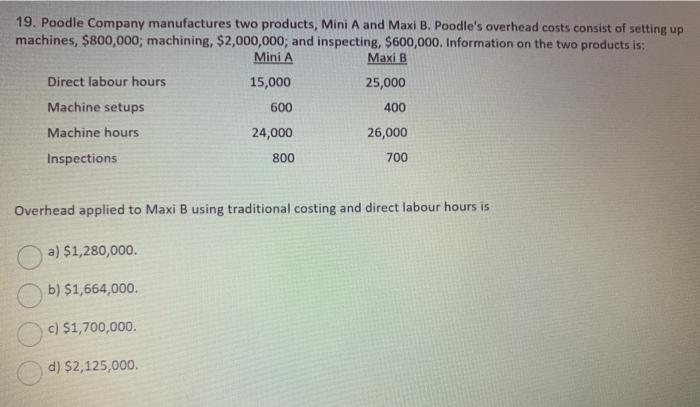

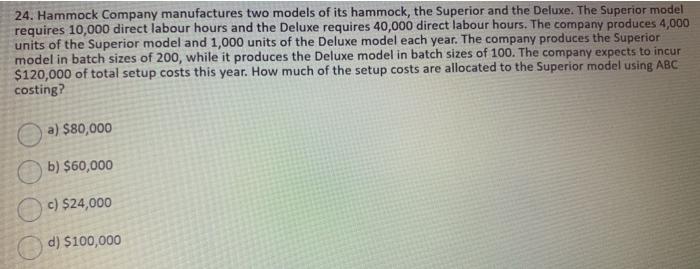

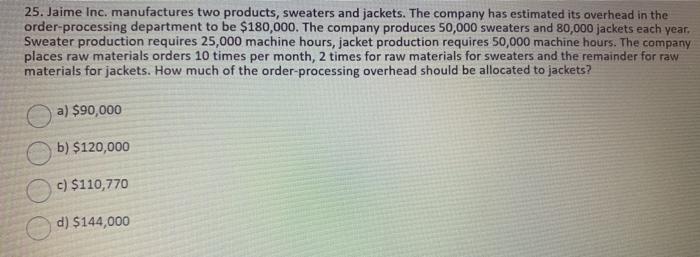

16. When using a single cost driver to allocate overhead costs, the amount of overhead costs that are applied is a) usually greater for low-volume products than for high-volume products. b) usually greater for high-volume products than for low-volume products. c) usually equal for both low and high-volume products. d) sometimes greater for higher-volume products, and sometimes greater for low-volume products. 17. A good cost driver should have a high correlation with a) the actual number of units produced. b) the actual consumption of overhead costs. O c) the actual number of products produced. d) the actual consumption of direct costs. 18. Poodle Company manufactures two products, Mini A and Maxi B. Poodle's overhead costs consist of setting up machines, $800,000; machining, $2,000,000; and inspecting, $600,000. Information on the two products is: Mini A Maxi B Direct labour hours 15,000 25,000 Machine setups 600 400 Machine hours 24,000 26,000 Inspections 800 700 Overhead applied to Mini A using traditional costing and direct labour hours is a) $1,275,000. b) $1,536,000. c) $1,670,000. d) $1,700,000 19. Poodle Company manufactures two products, Mini A and Maxi B. Poodle's overhead costs consist of setting up machines, $800,000; machining, $2,000,000; and inspecting, $600,000. Information on the two products is: Mini A Maxi B 15,000 25,000 600 400 Direct labour hours Machine setups Machine hours Inspections 24,000 26,000 800 700 Overhead applied to Maxi B using traditional costing and direct labour hours is a) $1,280,000 b) $1,664,000. c) $1,700,000 d) $2,125,000 25. Jaime Inc. manufactures two products, sweaters and jackets. The company has estimated its overhead in the order-processing department to be $180,000. The company produces 50,000 sweaters and 80,000 jackets each year, Sweater production requires 25,000 machine hours, jacket production requires 50,000 machine hours. The company places raw materials orders 10 times per month, 2 times for raw materials for sweaters and the remainder for raw materials for jackets. How much of the order processing overhead should be allocated to jackets? a) $90,000 b) $120,000 c) $110,770 d) $144,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started