PLEASE ATTEMPT ALL THREE PARTS FOR THUMBS UP. Minimum 300 words each for each part

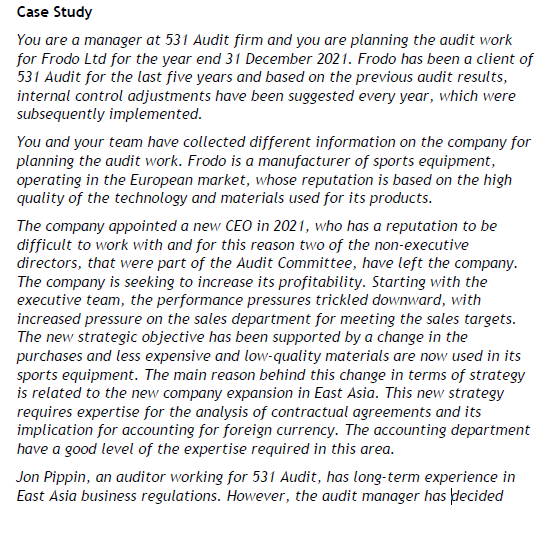

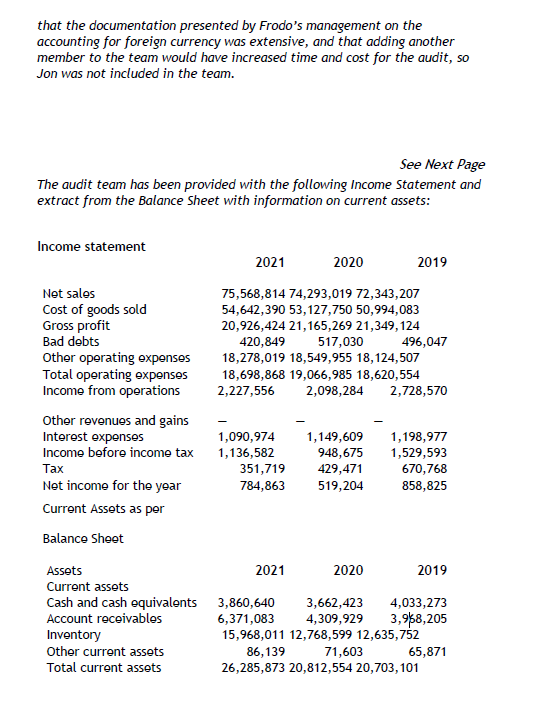

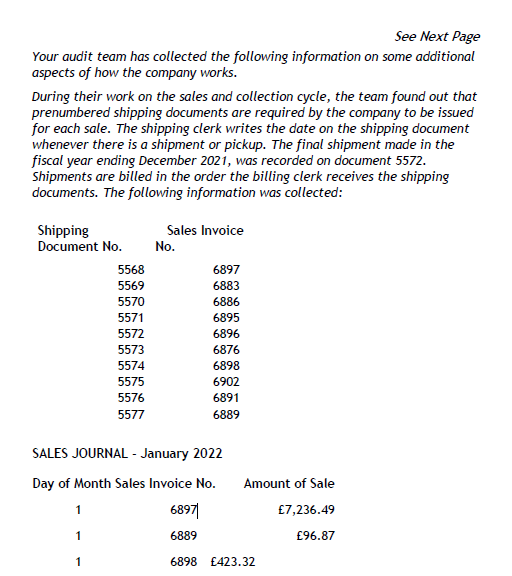

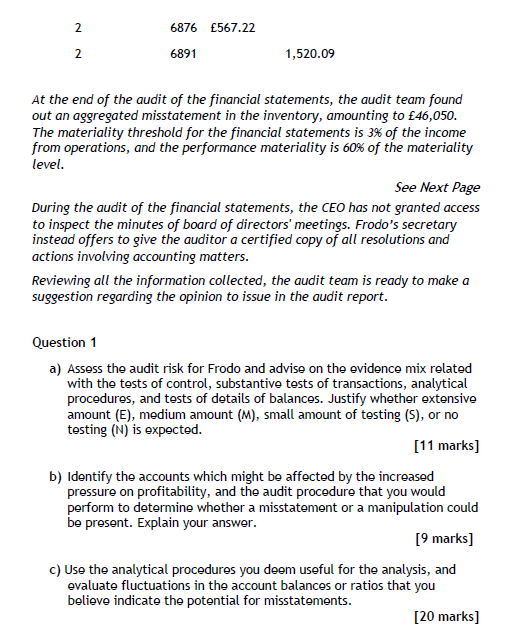

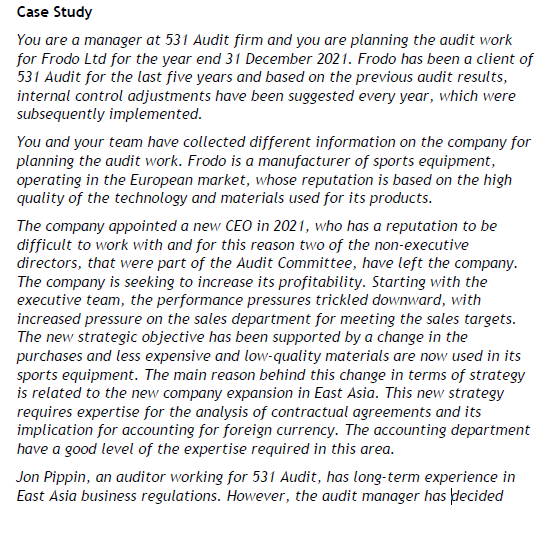

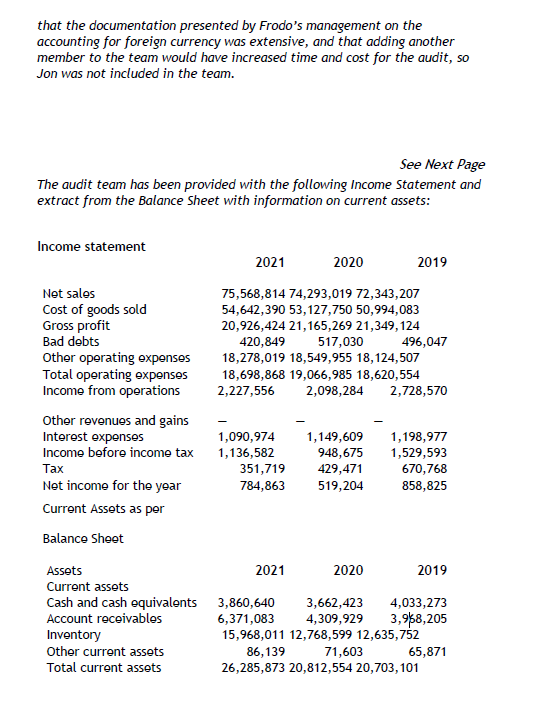

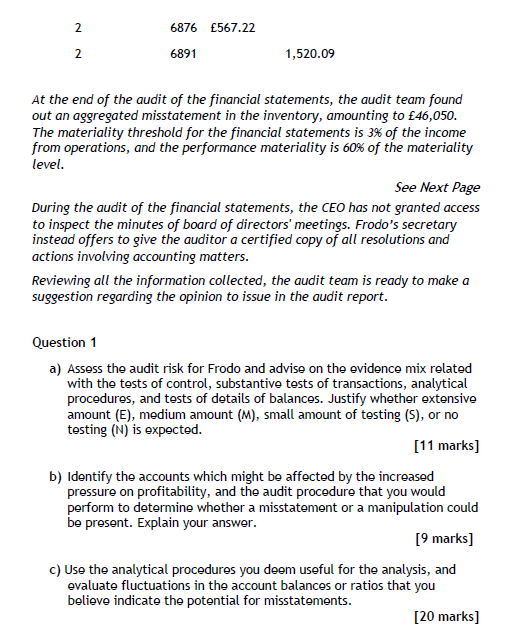

Case Study You are a manager at 531 Audit firm and you are planning the audit work for Frodo Ltd for the year end 31 December 2021. Frodo has been a client of 531 Audit for the last five years and based on the previous audit results, internal control adjustments have been suggested every year, which were subsequently implemented. You and your team have collected different information on the company for planning the audit work. Frodo is a manufacturer of sports equipment, operating in the European market, whose reputation is based on the high quality of the technology and materials used for its products. The company appointed a new CEO in 2021, who has a reputation to be difficult to work with and for this reason two of the non-executive directors, that were part of the Audit Committee, have left the company. The company is seeking to increase its profitability. Starting with the executive team, the performance pressures trickled downward, with increased pressure on the sales department for meeting the sales targets. The new strategic objective has been supported by a change in the purchases and less expensive and low-quality materials are now used in its sports equipment. The main reason behind this change in terms of strategy is related to the new company expansion in East Asia. This new strategy requires expertise for the analysis of contractual agreements and its implication for accounting for foreign currency. The accounting department have a good level of the expertise required in this area. Jon Pippin, an auditor working for 531 Audit, has long-term experience in East Asia business regulations. However, the audit manager has plecided that the documentation presented by Frodo's management on the accounting for foreign currency was extensive, and that adding another member to the team would have increased time and cost for the audit, so Jon was not included in the team. See Next Page The audit team has been provided with the following Income Statement and extract from the Balance sheet with information on current assets: Income statement 2021 2020 2019 75,568,814 74,293,019 72,343,207 54,642,390 53,127,750 50,994,083 20,926,424 21,165,269 21,349,124 420,849 517,030 496,047 18,278,019 18,549,955 18,124,507 18,698,868 19,066,985 18,620,554 2,227,556 2,098,284 2,728,570 Net sales Cost of goods sold Gross profit Bad debts Other operating expenses Total operating expenses Income from operations Other revenues and gains Interest expenses Income before income tax Tax Net income for the year Current Assets as per 1,090,974 1,136,582 351,719 784,863 1,149,609 948,675 429,471 519,204 1,198,977 1,529,593 670,768 858,825 Balance Sheet Assets 2021 2020 2019 Current assets Cash and cash equivalents 3,860,640 3,662,423 4,033,273 Account receivables 6,371,083 4,309,929 3,958,205 Inventory 15,968,011 12,768,599 12,635,752 Other current assets 86,139 71,603 65,871 Total current assets 26,285,873 20,812,554 20,703, 101 See Next Page Your audit team has collected the following information on some additional aspects of how the company works. During their work on the sales and collection cycle, the team found out that prenumbered shipping documents are required by the company to be issued for each sale. The shipping clerk writes the date on the shipping document whenever there is a shipment or pickup. The final shipment made in the fiscal year ending December 2021, was recorded on document 5572. Shipments are billed in the order the billing clerk receives the shipping documents. The following information was collected: 6883 Shipping Sales Invoice Document No. No. 5568 6897 5569 5570 6886 5571 6895 5572 5573 6876 5574 6898 5575 6902 5576 6891 5577 6889 6896 SALES JOURNAL - January 2022 Day of Month Sales Invoice No. 1 68971 Amount of Sale 7,236.49 1 6889 96.87 1 6898 423.32 N 6876 567.22 6891 2 1,520.09 At the end of the audit of the financial statements, the audit team found out an aggregated misstatement in the inventory, amounting to 46,050. The materiality threshold for the financial statements is 3% of the income from operations, and the performance materiality is 60% of the materiality level. See Next Page During the audit of the financial statements, the CEO has not granted access to inspect the minutes of board of directors' meetings. Frodo's secretary instead offers to give the auditor a certified copy of all resolutions and actions involving accounting matters. Reviewing all the information collected, the audit team is ready to make a suggestion regarding the opinion to issue in the audit report. Question 1 a) Assess the audit risk for Frodo and advise on the evidence mix related with the tests of control, substantive tests of transactions, analytical procedures, and tests of details of balances. Justify whether extensive amount (E), medium amount (M), small amount of testing (s), or no testing (N) is expected. [11 marks] b) Identify the accounts which might be affected by the increased pressure on profitability, and the audit procedure that you would perform to determine whether a misstatement or a manipulation could be present. Explain your answer. [9 marks] C) Use the analytical procedures you deem useful for the analysis, and evaluate fluctuations in the account balances or ratios that you believe indicate the potential for misstatements. [20 marks) Case Study You are a manager at 531 Audit firm and you are planning the audit work for Frodo Ltd for the year end 31 December 2021. Frodo has been a client of 531 Audit for the last five years and based on the previous audit results, internal control adjustments have been suggested every year, which were subsequently implemented. You and your team have collected different information on the company for planning the audit work. Frodo is a manufacturer of sports equipment, operating in the European market, whose reputation is based on the high quality of the technology and materials used for its products. The company appointed a new CEO in 2021, who has a reputation to be difficult to work with and for this reason two of the non-executive directors, that were part of the Audit Committee, have left the company. The company is seeking to increase its profitability. Starting with the executive team, the performance pressures trickled downward, with increased pressure on the sales department for meeting the sales targets. The new strategic objective has been supported by a change in the purchases and less expensive and low-quality materials are now used in its sports equipment. The main reason behind this change in terms of strategy is related to the new company expansion in East Asia. This new strategy requires expertise for the analysis of contractual agreements and its implication for accounting for foreign currency. The accounting department have a good level of the expertise required in this area. Jon Pippin, an auditor working for 531 Audit, has long-term experience in East Asia business regulations. However, the audit manager has plecided that the documentation presented by Frodo's management on the accounting for foreign currency was extensive, and that adding another member to the team would have increased time and cost for the audit, so Jon was not included in the team. See Next Page The audit team has been provided with the following Income Statement and extract from the Balance sheet with information on current assets: Income statement 2021 2020 2019 75,568,814 74,293,019 72,343,207 54,642,390 53,127,750 50,994,083 20,926,424 21,165,269 21,349,124 420,849 517,030 496,047 18,278,019 18,549,955 18,124,507 18,698,868 19,066,985 18,620,554 2,227,556 2,098,284 2,728,570 Net sales Cost of goods sold Gross profit Bad debts Other operating expenses Total operating expenses Income from operations Other revenues and gains Interest expenses Income before income tax Tax Net income for the year Current Assets as per 1,090,974 1,136,582 351,719 784,863 1,149,609 948,675 429,471 519,204 1,198,977 1,529,593 670,768 858,825 Balance Sheet Assets 2021 2020 2019 Current assets Cash and cash equivalents 3,860,640 3,662,423 4,033,273 Account receivables 6,371,083 4,309,929 3,958,205 Inventory 15,968,011 12,768,599 12,635,752 Other current assets 86,139 71,603 65,871 Total current assets 26,285,873 20,812,554 20,703, 101 See Next Page Your audit team has collected the following information on some additional aspects of how the company works. During their work on the sales and collection cycle, the team found out that prenumbered shipping documents are required by the company to be issued for each sale. The shipping clerk writes the date on the shipping document whenever there is a shipment or pickup. The final shipment made in the fiscal year ending December 2021, was recorded on document 5572. Shipments are billed in the order the billing clerk receives the shipping documents. The following information was collected: 6883 Shipping Sales Invoice Document No. No. 5568 6897 5569 5570 6886 5571 6895 5572 5573 6876 5574 6898 5575 6902 5576 6891 5577 6889 6896 SALES JOURNAL - January 2022 Day of Month Sales Invoice No. 1 68971 Amount of Sale 7,236.49 1 6889 96.87 1 6898 423.32 N 6876 567.22 6891 2 1,520.09 At the end of the audit of the financial statements, the audit team found out an aggregated misstatement in the inventory, amounting to 46,050. The materiality threshold for the financial statements is 3% of the income from operations, and the performance materiality is 60% of the materiality level. See Next Page During the audit of the financial statements, the CEO has not granted access to inspect the minutes of board of directors' meetings. Frodo's secretary instead offers to give the auditor a certified copy of all resolutions and actions involving accounting matters. Reviewing all the information collected, the audit team is ready to make a suggestion regarding the opinion to issue in the audit report. Question 1 a) Assess the audit risk for Frodo and advise on the evidence mix related with the tests of control, substantive tests of transactions, analytical procedures, and tests of details of balances. Justify whether extensive amount (E), medium amount (M), small amount of testing (s), or no testing (N) is expected. [11 marks] b) Identify the accounts which might be affected by the increased pressure on profitability, and the audit procedure that you would perform to determine whether a misstatement or a manipulation could be present. Explain your answer. [9 marks] C) Use the analytical procedures you deem useful for the analysis, and evaluate fluctuations in the account balances or ratios that you believe indicate the potential for misstatements. [20 marks)