Question

Please Attempt the Following Questions based on the CASE below. (1) Calculate (i) returns on equity, (ii) the existing shareholders ownership, (iii) debt/equity ratio, and

Please Attempt the Following Questions based on the CASE below. (1) Calculate (i) returns on equity, (ii) the existing shareholders ownership, (iii) debt/equity ratio, and (iv) cash surplus/deficit for each financing option. [7 points] (2) States four factors that suggest business risk is low and four factors that suggest business risk is high. [4 points] (3) Suppose demand weakens and cash flows drop significantly. As a result, the firm is unable to service its debts and the stock price falls to $0.05/share. If the companys only chance of survival is to swap 80% of its debt for equity, calculate the proportion of shares that debt-holders should receive in this SWAP. (Assume no new financing is in place before the SWAP). [4 points] (4) Will you agree to a deal that gives debt-holders 70% of the shares in an initial swap? Explain. [2 points] Rocky Mountain High (RMH) The Ski Resort Industry: RMH is examining two alternatives for financing a $20 million expansion project for its ski resort. The industry is characterized by rapid technological advancement making snowmaking and snow-grooming easier. In addition, the introduction of high speed four-passenger chair lifts has increased the capacity of resorts to handle more skiers and has provided skiers with more actual skiing time for their money. The capital required for these technologies and the destination resort demanded by the graying skier population calls for continuous capital upgrades of the resorts to remain competitive. Small resorts that cant raise the needed capital are being squeezed out. RMH is a well-capitalized resort and was ranked third two years in a row in North American. RMH believes that the current expansion project is key to maintaining its premier ski facility as a destination resort. About 50% of RMHs customers are from outside Canada. While the Canadian economy has been resilient to the recent economic crisis, there is still significant risk that the economy can be adversely affected by recessions in other parts of the world. Financing Options: Option 1: RMH can borrow the money from its current banker. The bank loan will be for $20m at a fixed 8% interest per year for 10 years. The loan agreement requires $2m in principal payment at the end of each year plus the interest due. The loan will be secured by undeveloped property of RMH and all other assets not already pledged.

Option 2: While the financial crisis depressed the financial markets including the Toronto Stock Exchange (TSX), the markets have by and large bounced back, but there is significant risk that the momentum will not continue. The underwriting fee will be 6% of the gross proceeds, and based on current market conditions the shares will be underwritten at the current stock price of $12 per share. The offer will be for 1.8 million shares to ensure there is sufficient fund for the project and the underwriting fees. For simplicity, RMH can sell the shares immediately and, hence, bridge financing is not necessary if it decides to sell shares.

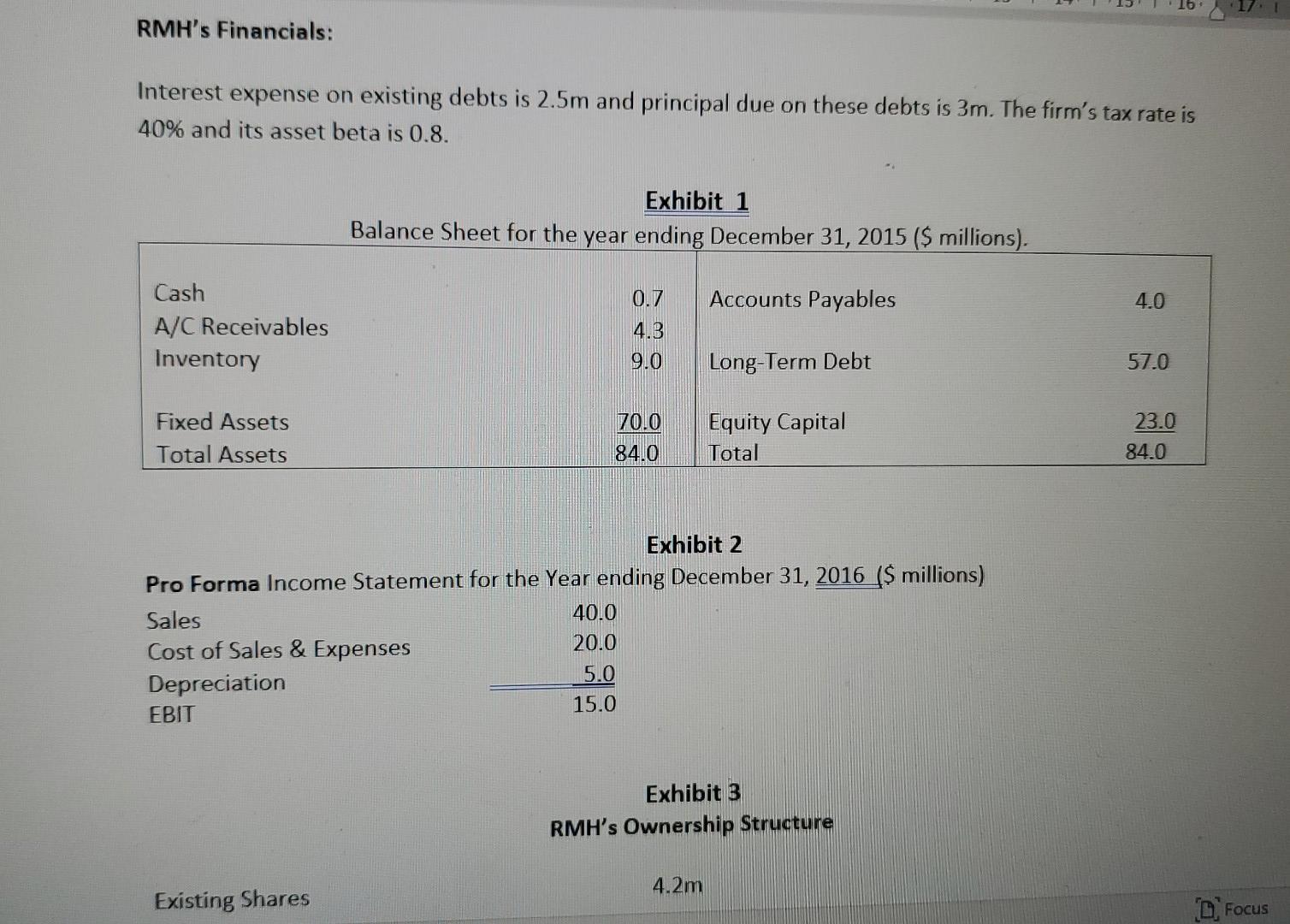

RMH's Financials: Interest expense on existing debts is 2.5m and principal due on these debts is 3m. The firm's tax rate is 40% and its asset beta is 0.8. Exhibit 1 Balance Sheet for the year ending December 31, 2015 ($ millions). Accounts Payables 4.0 Cash A/C Receivables Inventory 0.7 4.3 9.0 Long-Term Debt 57.0 Fixed Assets Total Assets 70.0 84.0 Equity Capital Total 23.0 84.0 Exhibit 2 Pro Forma Income Statement for the Year ending December 31, 2016 ($ millions) Sales 40.0 Cost of Sales & Expenses 20.0 Depreciation 5.0 EBIT 15.0 Exhibit 3 RMH's Ownership Structure 4.2m Existing Shares D Focus RMH's Financials: Interest expense on existing debts is 2.5m and principal due on these debts is 3m. The firm's tax rate is 40% and its asset beta is 0.8. Exhibit 1 Balance Sheet for the year ending December 31, 2015 ($ millions). Accounts Payables 4.0 Cash A/C Receivables Inventory 0.7 4.3 9.0 Long-Term Debt 57.0 Fixed Assets Total Assets 70.0 84.0 Equity Capital Total 23.0 84.0 Exhibit 2 Pro Forma Income Statement for the Year ending December 31, 2016 ($ millions) Sales 40.0 Cost of Sales & Expenses 20.0 Depreciation 5.0 EBIT 15.0 Exhibit 3 RMH's Ownership Structure 4.2m Existing Shares D FocusStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started