Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please attempt the question if you can solve all the questions, please do not attempt if you are going to solve only 1 part. i

Please attempt the question if you can solve all the questions, please do not attempt if you are going to solve only 1 part. i WILL DOWNVOTE AND REPORT IF 1 ANSWERED.

Calculate the present value of annuity received in 2 years of $750 at an interest rate of 5% compounded semi-annually?

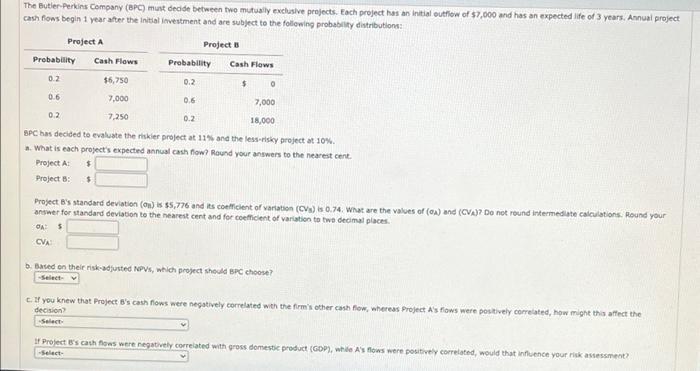

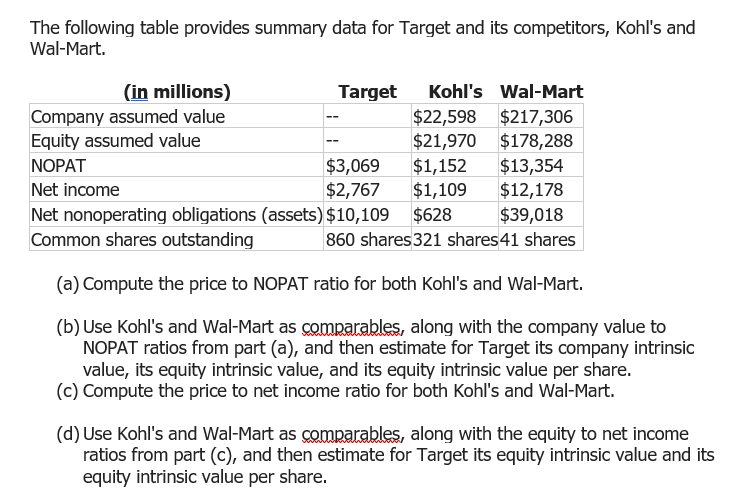

canin fows begin 1 year atter the initial investment and are subject to the follewing probabity distributions: 8PC has decided to evaluste the riskier project at 11% and the less-risky project at 10%. a. What is each project's expected annual cash fow? Reund your answers to the nearest cent. answer for standard deviation to the nearest cent and for coefticent of variation to twe decimal places. A=5 CVA2 b. Baved en their riskadjusted Nervs, which project should BPC choose? c. If you knew that Project 8's cash fiows nere negatively correlated with the firm's other cash fow, whereas Project A's fiows were postively coerelated, how might this affect the decision? If Prolect B"s cath fows were noastiveid monlated with gross domestic product (CDP), while A's flows were positively correlated, would that influence your risk assessment? The following table provides summary data for Target and its competitors, Kohl's and Wal-Mart. (a) Compute the price to NOPAT ratio for both Kohl's and Wal-Mart. (b) Use Kohl's and Wal-Mart as comparables, along with the company value to NOPAT ratios from part (a), and then estimate for Target its company intrinsic value, its equity intrinsic value, and its equity intrinsic value per share. (c) Compute the price to net income ratio for both Kohl's and Wal-Mart. (d) Use Kohl's and Wal-Mart as comparables, along with the equity to net income ratios from part (c), and then estimate for Target its equity intrinsic value and its equity intrinsic value per shareStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started