Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please attempt the question if you can solve all the questions, please do not attempt if you are going to solve only 1 part. i

Please attempt the question if you can solve all the questions, please do not attempt if you are going to solve only 1 part. i WILL DOWNVOTE AND REPORT IF 1 ANSWERED.

Find the stock price:

D0 = $1.2 Growth rate forever = 7% Return = 10%

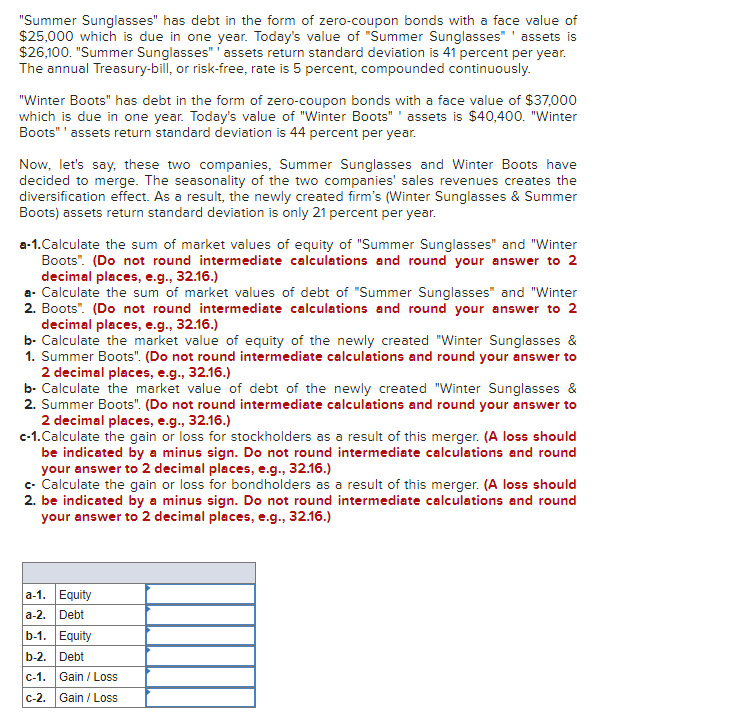

"Summer Sunglasses" has debt in the form of zero-coupon bonds with a face value of $25,000 which is due in one year. Today's value of "Summer Sunglasses"' ' assets is $26,100. "Summer Sunglasses" ' assets return standard deviation is 41 percent per year. The annual Treasury-bill, or risk-free, rate is 5 percent, compounded continuously. "Winter Boots" has debt in the form of zero-coupon bonds with a face value of $37,000 which is due in one year. Today's value of "Winter Boots" ' assets is $40,400. "Winter Boots" ' assets return standard deviation is 44 percent per year. Now, let's say, these two companies, Summer Sunglasses and Winter Boots have decided to merge. The seasonality of the two companies' sales revenues creates the diversification effect. As a result, the newly created firm's (Winter Sunglasses \& Summer Boots) assets return standard deviation is only 21 percent per year. a-1.Calculate the sum of market values of equity of "Summer Sunglasses" and "Winter Boots". (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Calculate the sum of market values of debt of "Summer Sunglasses" and "Winter 2. Boots". (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. Calculate the market value of equity of the newly created "Winter Sunglasses \& 1. Summer Boots". (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. Calculate the market value of debt of the newly created "Winter Sunglasses \& 2. Summer Boots". (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c-1. Calculate the gain or loss for stockholders as a result of this merger. (A loss should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c- Calculate the gain or loss for bondholders as a result of this merger. (A loss should 2. be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started