please be as clear and as simple as possible. I am trying to understand it. show me the steps, not only the answers. thank you in advance.

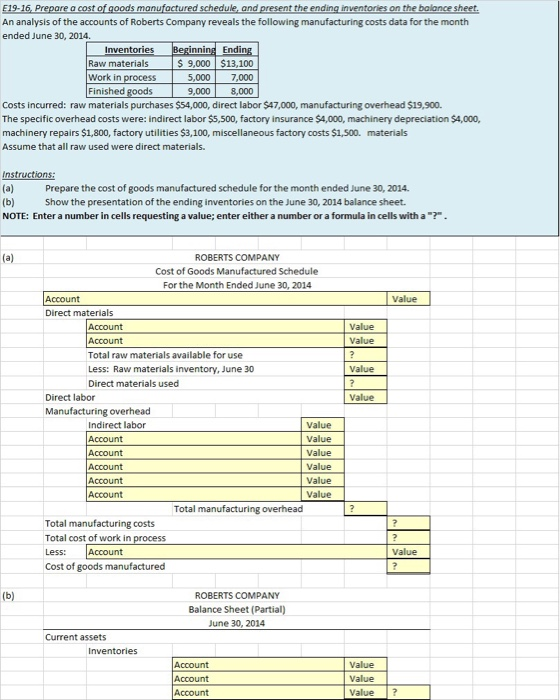

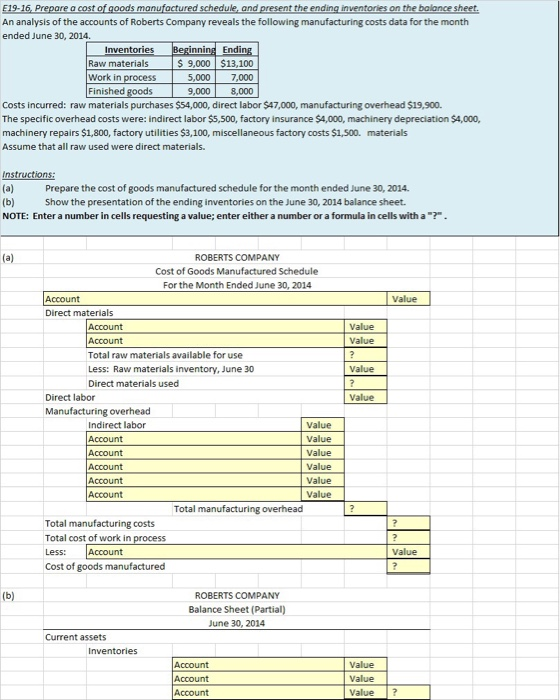

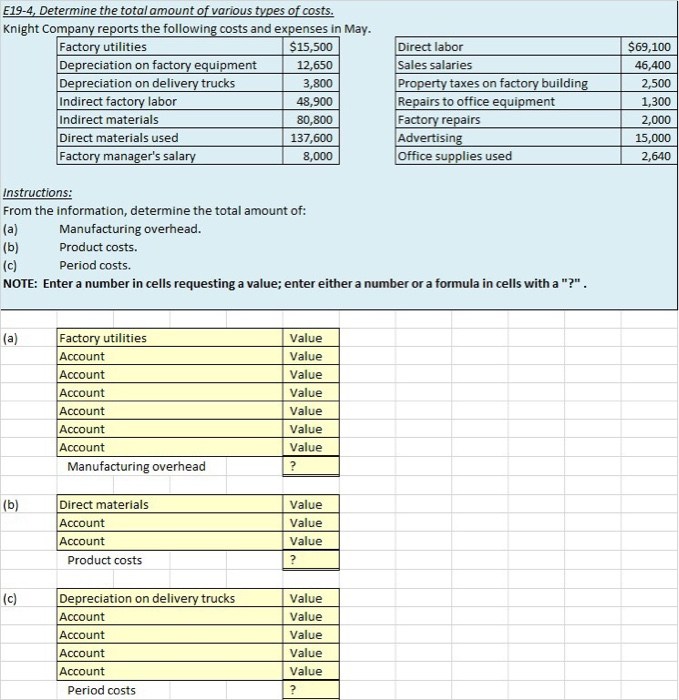

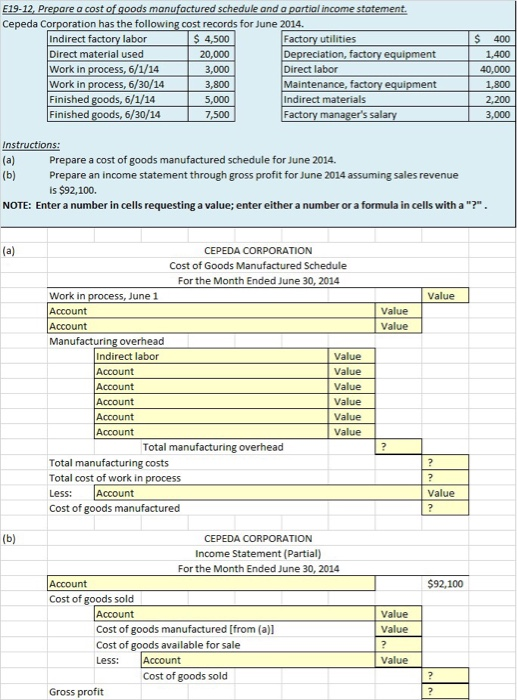

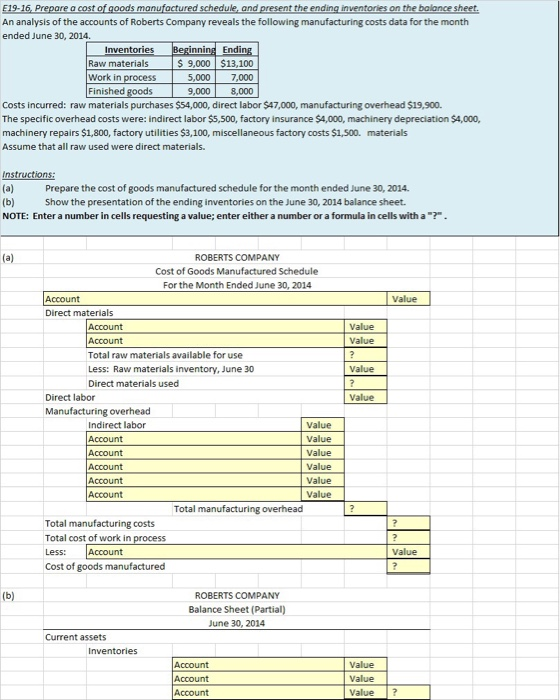

519-16. Prepare a cost of goods manufactured schedule, and present the ending inventories on the balance sheet An analysis of the accounts of Roberts Company reveals the following manufacturing costs data for the month ended June 30, 2014 Inventories Beginning Ending Raw materials $ 9,000 $13,100 Work in process 5,000 7,000 Finished goods 9,000 8,000 Costs incurred: raw materials purchases $54,000, direct labor $47,000, manufacturing overhead $19,900 The specific overhead costs were: indirect labor $5,500, factory insurance $4,000, machinery depreciation $4,000, machinery repairs $1,800, factory utilities $3,100, miscellaneous factory costs $1,500. materials Assume that all raw used were direct materials. Instructions: (a) Prepare the cost of goods manufactured schedule for the month ended June 30, 2014 (b) Show the presentation of the ending inventories on the June 30, 2014 balance sheet. NOTE: Enter a number in cells requesting a value; enter either a number or a formula in cells with a "?". Value Value value Value ROBERTS COMPANY Cost of Goods Manufactured Schedule For the Month Ended June 30, 2014 Account Direct materials Account Account Total raw materials available for use Less: Raw materials inventory, June 30 Direct materials used Direct labor Manufacturing overhead Indirect labor Value Account Value Account Value Account Value Account Value Account Value Total manufacturing overhead Total manufacturing costs Total cost of work in process Less: Account Cost of goods manufactured (b) ROBERTS COMPANY Balance Sheet (Partial) June 30, 2014 Current assets Inventories Value Account Account Account Value E19-4, Determine the total amount of various types of costs. Knight Company reports the following costs and expenses in May. Factory utilities $15,500 Depreciation on factory equipment 12,650 Depreciation on delivery trucks 3,800 Indirect factory labor 48,900 Indirect materials 80,800 Direct materials used 137,600 Factory manager's salary 8,000 Direct labor Sales salaries Property taxes on factory building Repairs to office equipment Factory repairs Advertising Office supplies used $69,100 46,400 2,500 1,300 2,000 15,000 2,640 Instructions: From the information, determine the total amount of: (a) Manufacturing overhead. (b) Product costs. (c) Period costs. NOTE: Enter a number in cells requesting a value; enter either a number or a formula in cells with a "?". Factory utilities Account Account Account Account Account Account Manufacturing overhead Value Value Value Value Value Value Value (b) Direct materials Account Account Product costs Value Value Value 2 Depreciation on delivery trucks Account Account Account Account Period costs Value Value Value Value Value ? S 400 E19.12. Prepare a cost of goods manufactured schedule and a partial income statement Cepeda Corporation has the following cost records for June 2014 Indirect factory labor $ 4,500 Factory utilities Direct material used 20,000 Depreciation, factory equipment Work in process, 6/1/14 3,000 Direct labor Work in process, 6/30/14 3,800 Maintenance, factory equipment Finished goods, 6/1/14 5,000 Indirect materials Finished goods, 6/30/14 7,500 Factory manager's salary 1.400 40,000 1.800 2,200 3,000 Instructions: (a) Prepare a cost of goods manufactured schedule for June 2014. (b) Prepare an income statement through gross profit for June 2014 assuming sales revenue is $92,100. NOTE: Enter a number in cells requesting a value; enter either a number or a formula in cells with a "?". (a) Value Value Value CEPEDA CORPORATION Cost of Goods Manufactured Schedule For the Month Ended June 30, 2014 Work in process, June 1 Account Account Manufacturing overhead Indirect labor Value Account Value Account Value Account Value Account I Value Account Value Total manufacturing overhead Total manufacturing costs Total cost of work in process Less: Account Cost of goods manufactured Value $92,100 CEPEDA CORPORATION Income Statement (Partial) For the Month Ended June 30, 2014 Account Cost of goods sold Account Cost of goods manufactured [from(a)] Cost of goods available for sale Less: Account Cost of goods sold Gross profit Value Value Value