Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please be as detail and the answer to be written down so I can plug it in properly. The Mathura Company provides you with the

Please be as detail and the answer to be written down so I can plug it in properly.

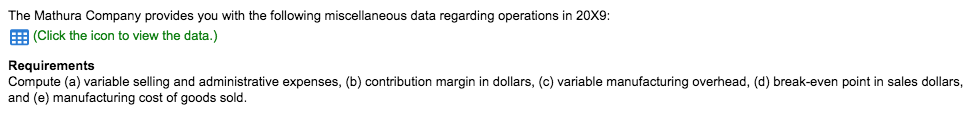

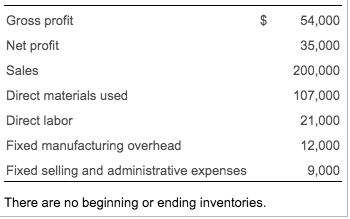

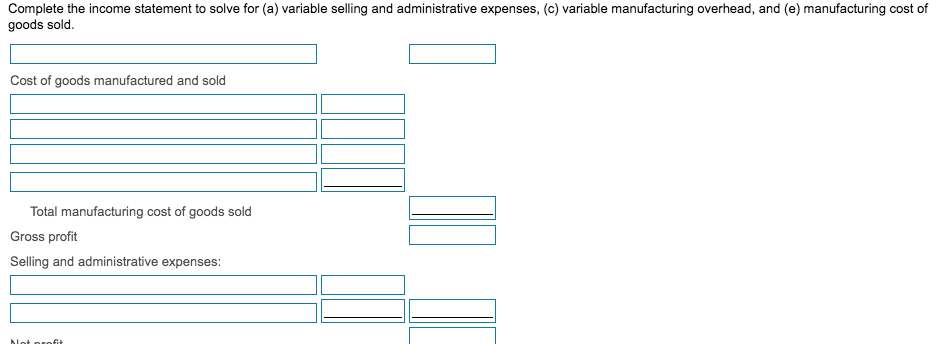

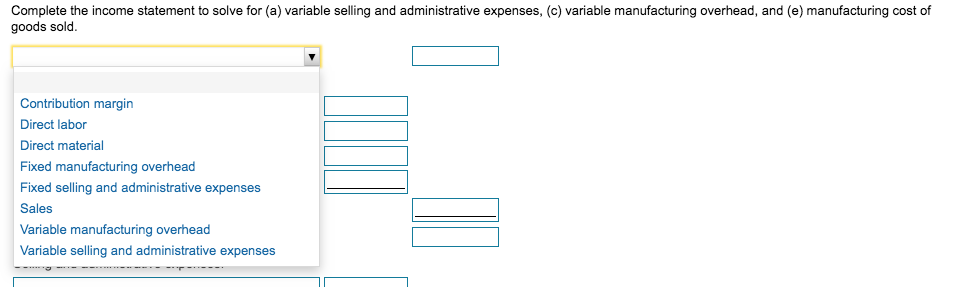

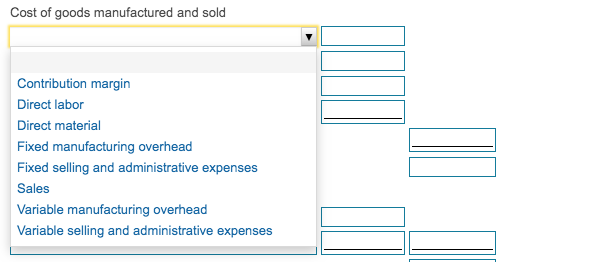

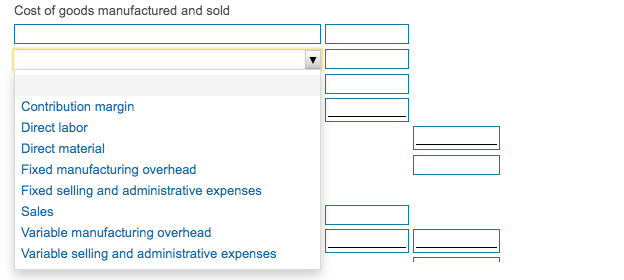

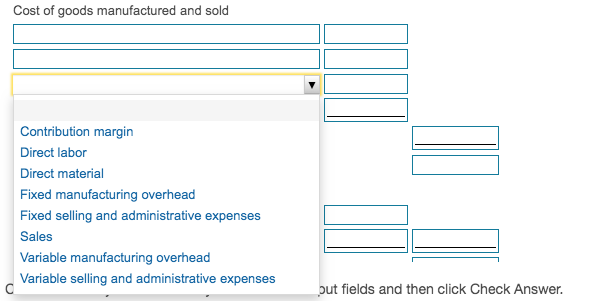

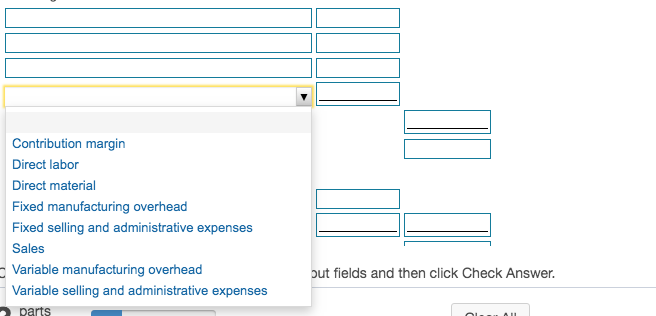

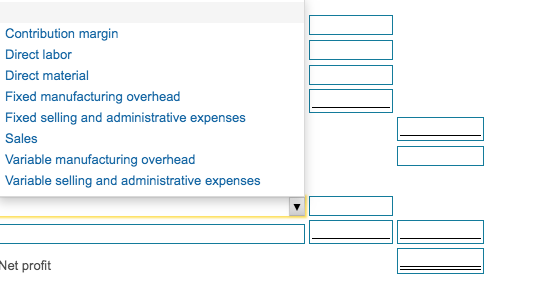

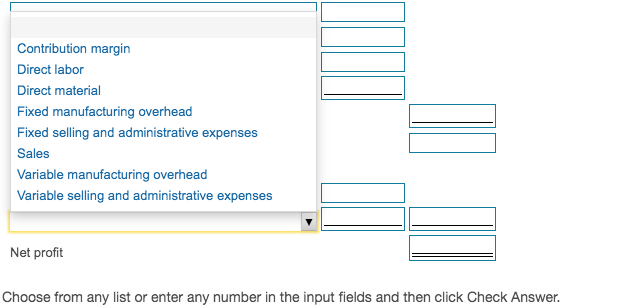

The Mathura Company provides you with the following miscellaneous data regarding operations in 20X9: 2 (Click the icon to view the data.) Requirements Compute (a) variable selling and administrative expenses, (b) contribution margin in dollars, (c) variable manufacturing overhead, (d) break-even point in sales dollars, and (e) manufacturing cost of goods sold. $ Gross profit Net profit Sales Direct materials used Direct labor Fixed manufacturing overhead Fixed selling and administrative expenses 54,000 35,000 200,000 107,000 21,000 12,000 9,000 There are no beginning or ending inventories. Complete the income statement to solve for (a) variable selling and administrative expenses, (c) variable manufacturing overhead, and (e) manufacturing cost of goods sold. Cost of goods manufactured and sold Total manufacturing cost of goods sold Gross profit Selling and administrative expenses: HIT Alat rafit Net profit Choose from any list or enter any number in the input fields and then click Check Answer. Complete the income statement to solve for (a) variable selling and administrative expenses, (c) variable manufacturing overhead, and (e) manufacturing cost of goods sold. Contribution margin Direct labor Direct material Fixed manufacturing overhead Fixed selling and administrative expenses Sales Variable manufacturing overhead Variable selling and administrative expenses Cost of goods manufactured and sold Contribution margin Direct labor Direct material Fixed manufacturing overhead Fixed selling and administrative expenses Sales Variable manufacturing overhead Variable selling and administrative expenses Cost of goods manufactured and sold Contribution margin Direct labor Direct material Fixed manufacturing overhead Fixed selling and administrative expenses Sales Variable manufacturing overhead Variable selling and administrative expenses Cost of goods manufactured and sold Contribution margin Direct labor Direct material Fixed manufacturing overhead Fixed selling and administrative expenses Sales Variable manufacturing overhead Variable selling and administrative expenses C put fields and then click Check Answer. Contribution margin Direct labor Direct material Fixed manufacturing overhead Fixed selling and administrative expenses Sales Variable manufacturing overhead Variable selling and administrative expenses out fields and then click Check Answer. parts Contribution margin Direct labor Direct material Fixed manufacturing overhead Fixed selling and administrative expenses Sales Variable manufacturing overhead Variable selling and administrative expenses Net profit Contribution margin Direct labor Direct material Fixed manufacturing overhead Fixed selling and administrative expenses Sales Variable manufacturing overhead Variable selling and administrative expenses Net profit Choose from any list or enter any number in the input fields and then click CheckStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started