Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please be careful to answer using 3 journal entry as it asked Selected transactions follow for Hiroole Sports Ltd. during the company's first month of

please be careful to answer using 3 journal entry as it asked

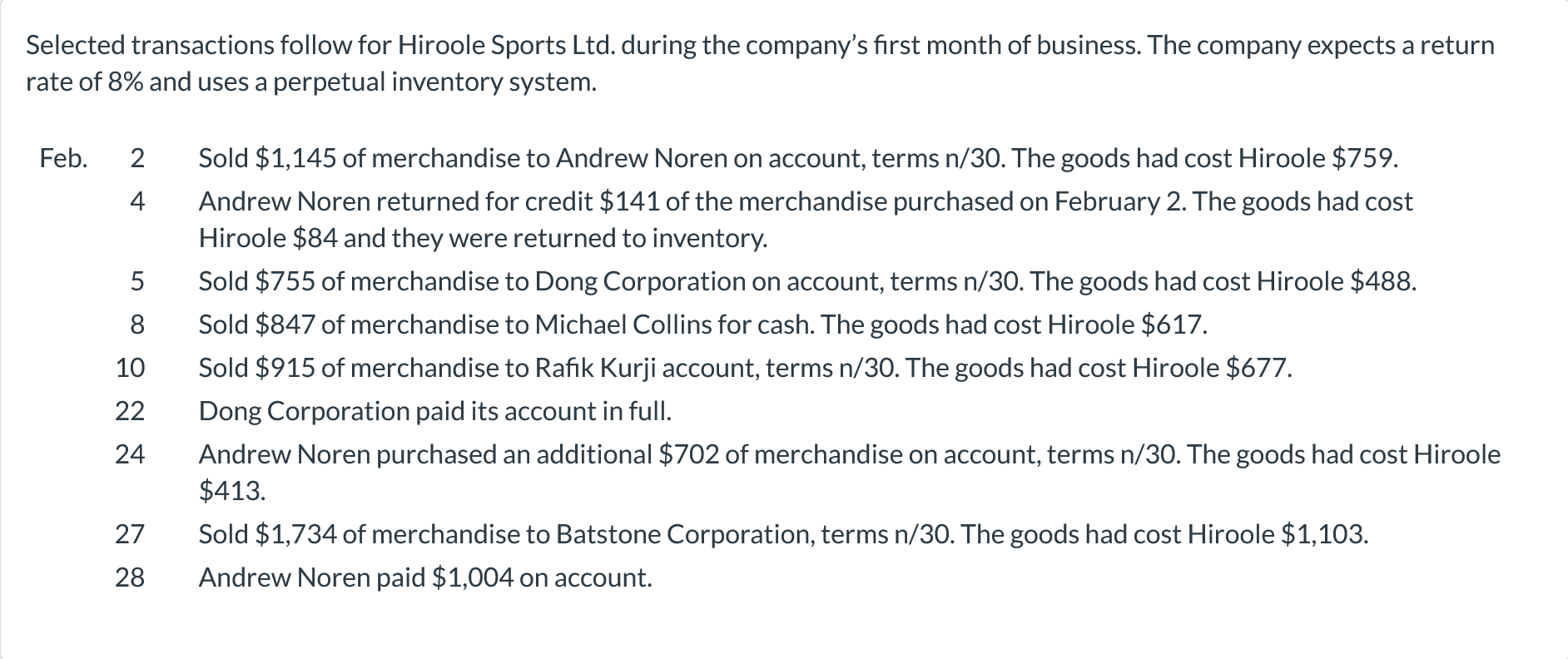

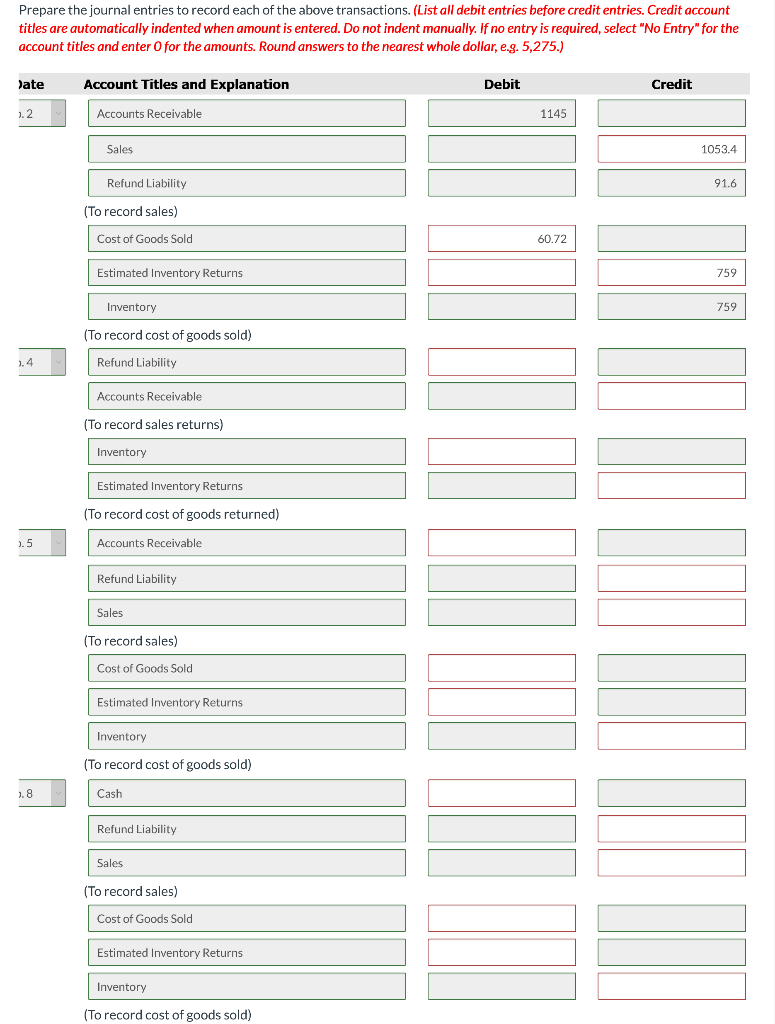

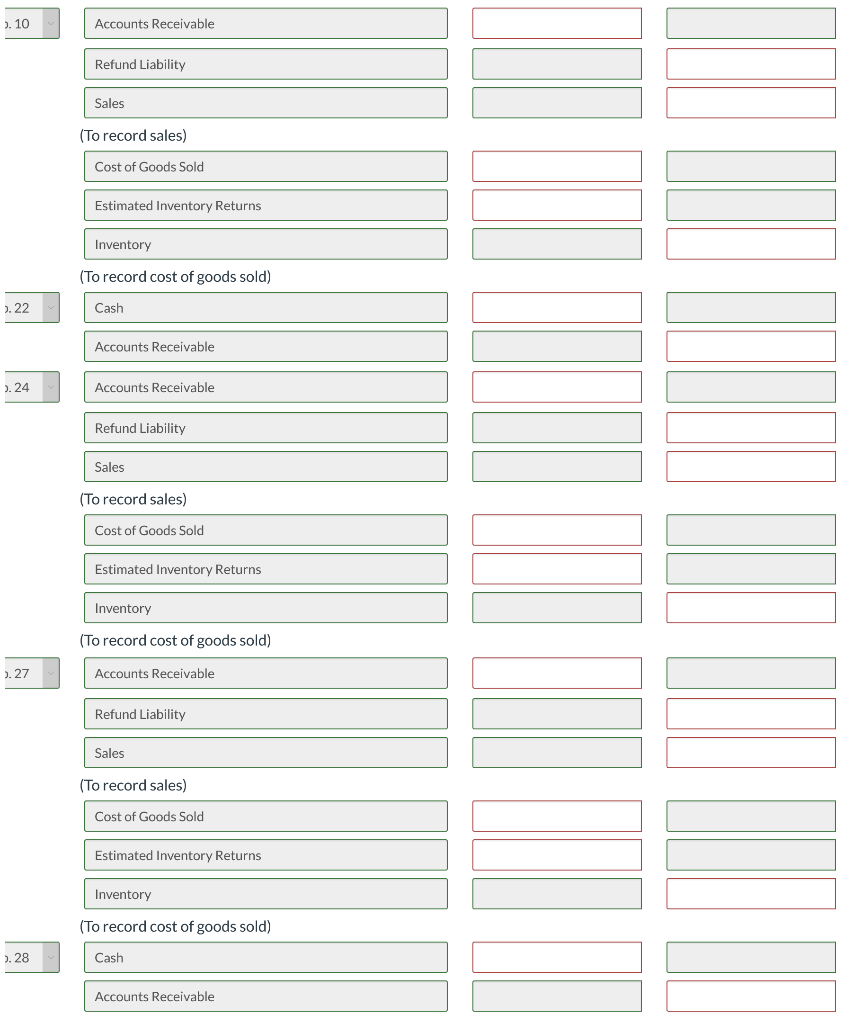

Selected transactions follow for Hiroole Sports Ltd. during the company's first month of business. The company expects a return rate of 8% and uses a perpetual inventory system. Feb. 2 4 5 8 10 Sold $1,145 of merchandise to Andrew Noren on account, terms n/30. The goods had cost Hiroole $759. Andrew Noren returned for credit $141 of the merchandise purchased on February 2. The goods had cost Hiroole $84 and they were returned to inventory. Sold $755 of merchandise to Dong Corporation on account, terms n/30. The goods had cost Hiroole $488. Sold $847 of merchandise to Michael Collins for cash. The goods had cost Hiroole $617. Sold $915 of merchandise to Rafik Kurji account, terms n/30. The goods had cost Hiroole $677. Dong Corporation paid its account in full. Andrew Noren purchased an additional $702 of merchandise on account, terms n/30. The goods had cost Hiroole $413 Sold $1,734 of merchandise to Batstone Corporation, terms n/30. The goods had cost Hiroole $1,103. Andrew Noren paid $1,004 on account. 22 24 27 28 Prepare the journal entries to record each of the above transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Round answers to the nearest whole dollar, e.g. 5,275.) Wate Account Titles and Explanation Debit Credit 1.2 Accounts Receivable 1145 Sales 1053.4 Refund Liability 91.6 (To record sales) Cost of Goods Sold 60.72 Estimated Inventory Returns 759 Inventory 759 (To record cost of goods sold) 1.4 Refund Liability Accounts Receivable (To record sales returns) Inventory Estimated Inventory Returns (To record cost of goods returned) Accounts Receivable 1.5 Refund Liability Sales (To record sales) Cost of Goods Sold Estimated Inventory Returns Inventory (To record cost of goods sold) 1.8 Cash Refund Liability Sales (To record sales) Cost of Goods Sold Estimated Inventory Returns Inventory (To record cost of goods sold) 5. 10 Accounts Receivable Refund Liability Sales (To record sales) Cost of Goods Sold Estimated Inventory Returns Inventory (To record cost of goods sold) 2.22 Cash Accounts Receivable 0.24 Accounts Receivable Refund Liability Sales (To record sales) Cost of Goods Sold Estimated Inventory Returns Inventory (To record cost of goods sold) 1.27 Accounts Receivable Refund Liability Sales (To record sales) Cost of Goods Sold Estimated Inventory Returns Inventory (To record cost of goods sold) .. 28 Cash Accounts ReceivableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started