Answered step by step

Verified Expert Solution

Question

1 Approved Answer

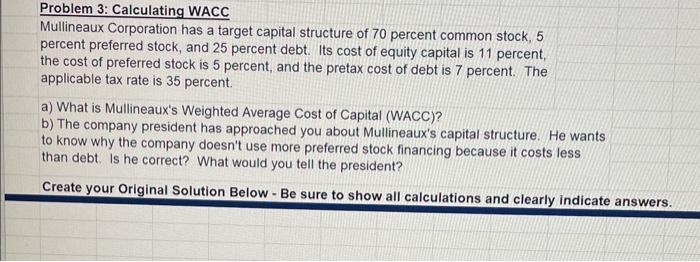

Please be clear about your work so I can understand how to do these questions. Thank you! Problem 3: Calculating WACC Mullineaux Corporation has a

Please be clear about your work so I can understand how to do these questions. Thank you!

Problem 3: Calculating WACC Mullineaux Corporation has a target capital structure of 70 percent common stock, 5 percent preferred stock, and 25 percent debt. Its cost of equity capital is 11 percent, the cost of preferred stock is 5 percent, and the pretax cost of debt is 7 percent. The applicable tax rate is 35 percent. a) What is Mullineaux's Weighted Average Cost of Capital (WACC)? b) The company president has approached you about Mullineaux's capital structure. He wants to know why the company doesn't use more preferred stock financing because it costs less than debt. Is he correct? What would you tell the president? Create your Original Solution Below - Be sure to show all calculations and clearly indicate ans

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started