Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please be clear on the answer. you can underline or bold the answers. please letme know if this is clear enough. Finances Plant Improvements Total

please be clear on the answer. you can underline or bold the answers.

please letme know if this is clear enough.

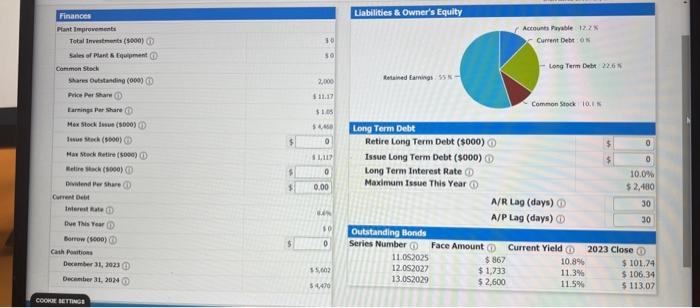

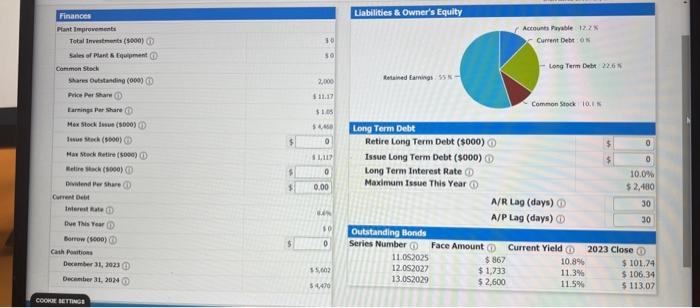

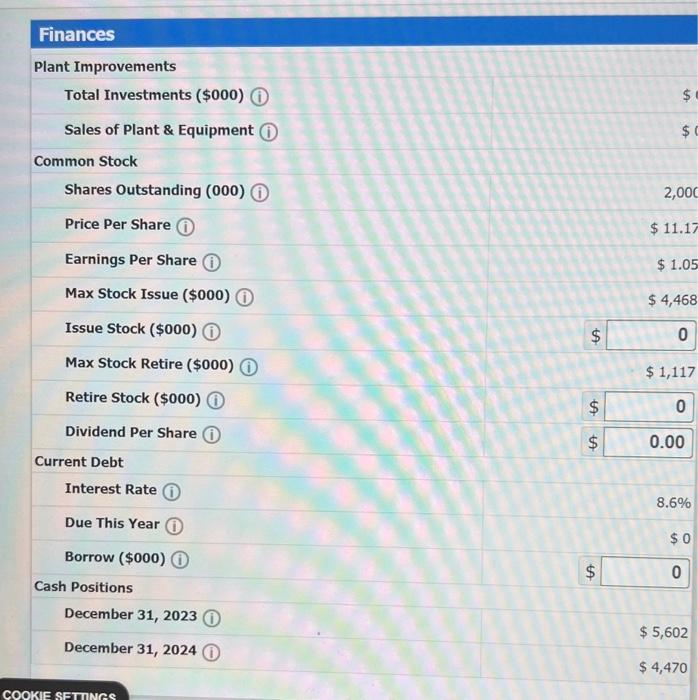

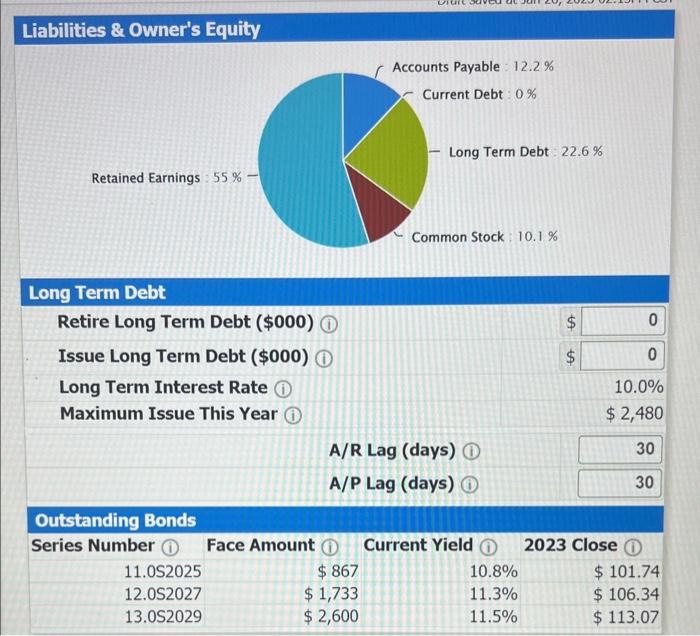

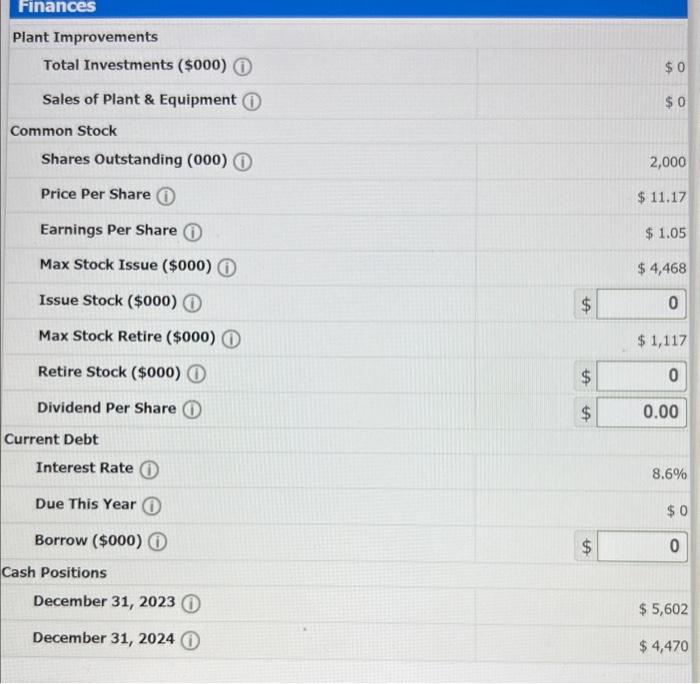

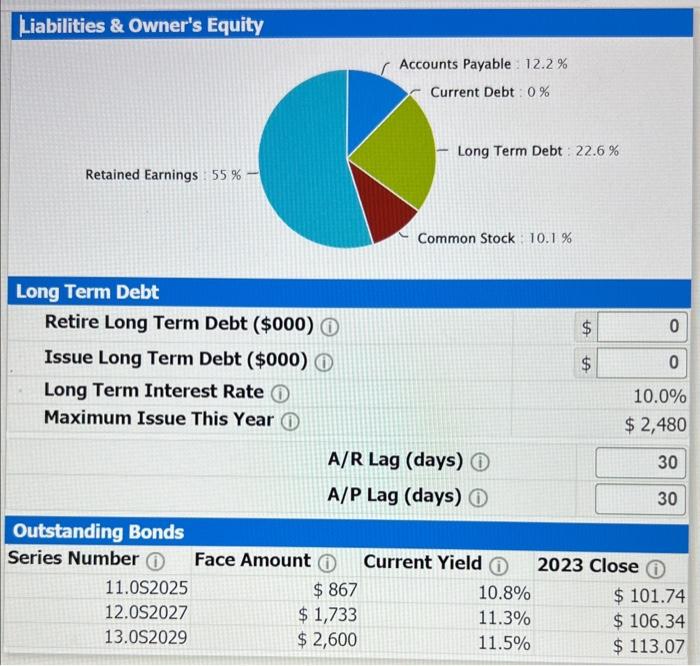

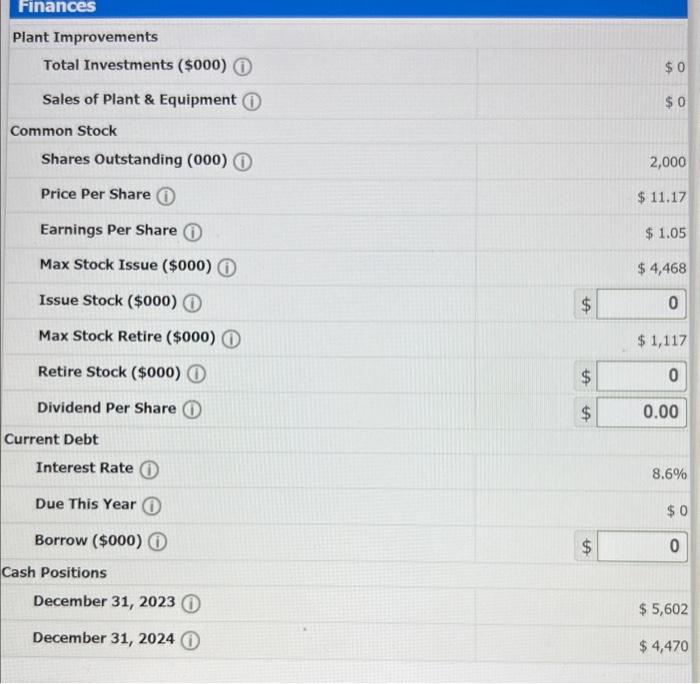

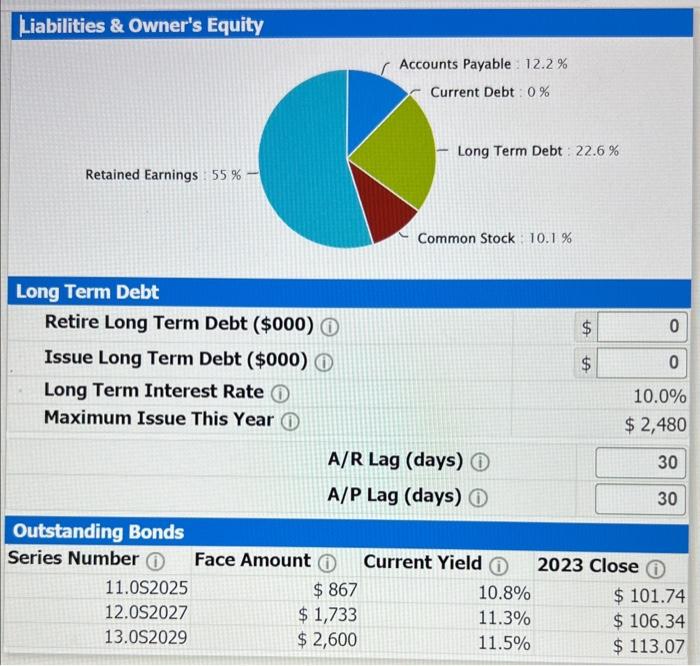

Finances Plant Improvements Total Investments (\$000) (i) Sales of Plant \& Equipment (i) Common Stock Shares Outstanding (000) Price Per Share Earnings Per Share Max Stock Issue (\$000) Issue Stock (\$000) (i) Max Stock Retire ( $000) (i) Retire Stock ( $000) Dividend Per Share (i) Current Debt Interest Rate Due This Year Borrow ( $000) Cash Positions December 31, 2023 December 31, 2024 $5,602 $4,470 Liabilities \& Owner's Equity Long Term Debt Retire Long Term Debt (\$000) Issue Long Term Debt (\$000) Long Term Interest Rate (i) Maximum Issue This Year (1) \begin{tabular}{|r|r|} \hline$ & 0 \\ \hline$ & 0 \\ \hline 10.0% \\ \hline 2,480 \\ \hline 30 \\ \hline 30 \\ \hline \end{tabular} A/R Lag (days) A/P Lag (days) (1) \begin{tabular}{|rrrr|} \hline Series Number (1) & Face Amount (1) & Current Yield (1) & 2023 Close (1) \\ \hline 11.0S2025 & $867 & 10.8% & $101.74 \\ 12.0e2027 & $1,733 & 11.3% & $106.34 \\ \hline 13.0S2029 & $2,600 & 11.5% & $113.07 \end{tabular} Plant Improvements Total Investments $000) $0 Sales of Plant \& Equipment (1) $0 Common Stock Shares Outstanding (000) Price Per Share (i) Earnings Per Share (i) Max Stock Issue (\$000) Issue Stock (\$000) Max Stock Retire (\$000) 2,000 Retire Stock ($000) Dividend Per Share Current Debt Interest Rate (i) $11.17 Due This Year (i) $1.05 Borrow ( $000) (i) Cash Positions December 31, 2023 $5,602 December 31,2024 $4,470 Liabilities \& Owner's Equity Finances Plant Improvements Total Investments (\$000) (i) Sales of Plant \& Equipment (i) Common Stock Shares Outstanding (000) Price Per Share Earnings Per Share Max Stock Issue (\$000) Issue Stock (\$000) (i) Max Stock Retire ( $000) (i) Retire Stock ( $000) Dividend Per Share (i) Current Debt Interest Rate Due This Year Borrow ( $000) Cash Positions December 31, 2023 December 31, 2024 $5,602 $4,470 Liabilities \& Owner's Equity Long Term Debt Retire Long Term Debt (\$000) Issue Long Term Debt (\$000) Long Term Interest Rate (i) Maximum Issue This Year (1) \begin{tabular}{|r|r|} \hline$ & 0 \\ \hline$ & 0 \\ \hline 10.0% \\ \hline 2,480 \\ \hline 30 \\ \hline 30 \\ \hline \end{tabular} A/R Lag (days) A/P Lag (days) (1) \begin{tabular}{|rrrr|} \hline Series Number (1) & Face Amount (1) & Current Yield (1) & 2023 Close (1) \\ \hline 11.0S2025 & $867 & 10.8% & $101.74 \\ 12.0e2027 & $1,733 & 11.3% & $106.34 \\ \hline 13.0S2029 & $2,600 & 11.5% & $113.07 \end{tabular} Plant Improvements Total Investments $000) $0 Sales of Plant \& Equipment (1) $0 Common Stock Shares Outstanding (000) Price Per Share (i) Earnings Per Share (i) Max Stock Issue (\$000) Issue Stock (\$000) Max Stock Retire (\$000) 2,000 Retire Stock ($000) Dividend Per Share Current Debt Interest Rate (i) $11.17 Due This Year (i) $1.05 Borrow ( $000) (i) Cash Positions December 31, 2023 $5,602 December 31,2024 $4,470 Liabilities \& Owner's Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started