Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please be descriptive and show all work step-by-step. Fresno Fiber Optics, Inc. manufactures fiber optic cables for the computer and telecommunications industries. At the request

Please be descriptive and show all work step-by-step.

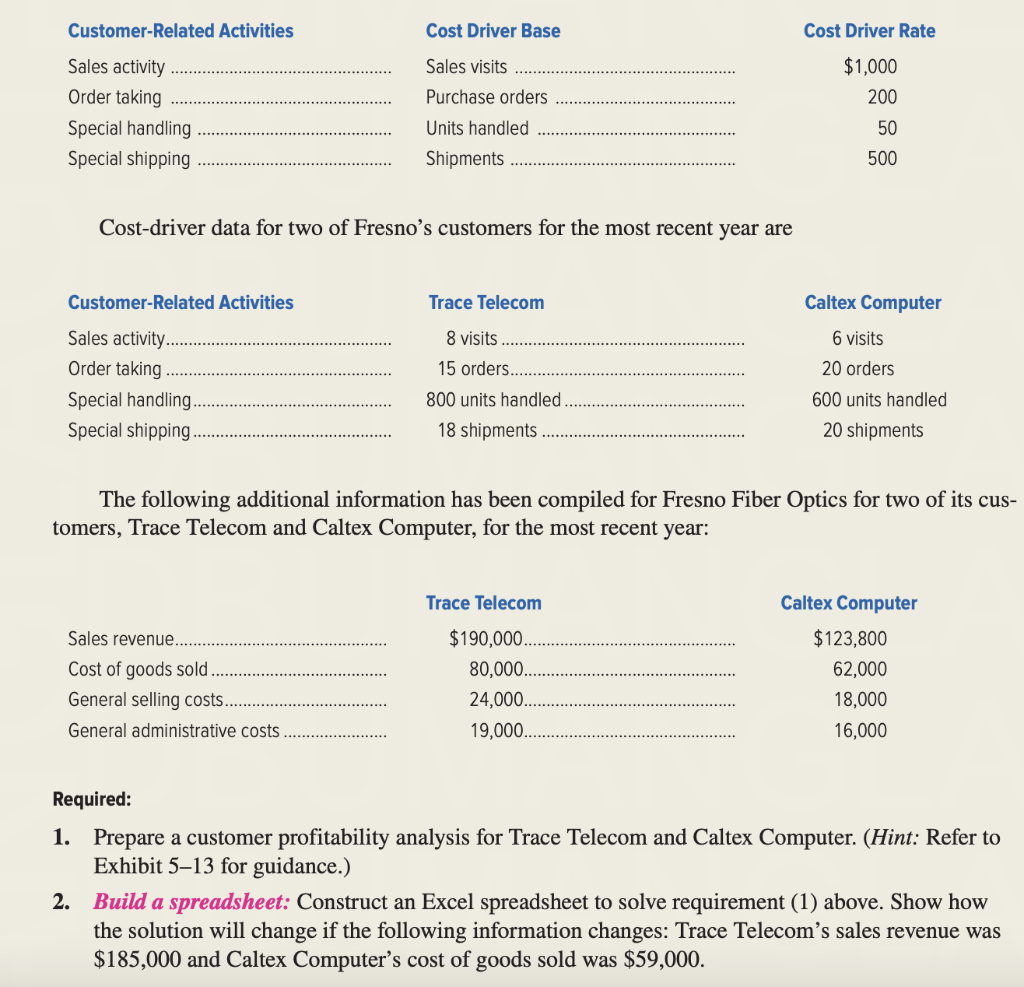

Fresno Fiber Optics, Inc. manufactures fiber optic cables for the computer and telecommunications industries. At the request of the company vice president of marketing, the cost management staff has recently completed a customer-profitability study. The following activity-based costing information was the basis for the analysis. Customer Related Activities Cost Driver Base Cost Driver Rate $1,000 200 Sales activity Order taking Special handling Special shipping Sales visits Purchase orders Units handled Shipments 50 500 Cost-driver data for two of Fresno's customers for the most recent year are Customer Related Activities Trace Telecom Caltex Computer 6 visits Sales activity.. Order taking Special handling Special shipping 8 visits 15 orders.... 800 units handled 18 shipments 20 orders 600 units handled 20 shipments The following additional information has been compiled for Fresno Fiber Optics for two of its cus- tomers, Trace Telecom and Caltex Computer, for the most recent year: Trace Telecom Sales revenue Cost of goods sold. General selling costs. General administrative costs $190,000 80,000. 24,000.. 19,000.. Caltex Computer $123,800 62,000 18,000 16,000 Required: 1. Prepare a customer profitability analysis for Trace Telecom and Caltex Computer. (Hint: Refer to Exhibit 513 for guidance.) 2. Build a spreadsheet: Construct an Excel spreadsheet to solve requirement (1) above. Show how the solution will change if the following information changes: Trace Telecom's sales revenue was $185,000 and Caltex Computer's cost of goods sold was $59,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started