Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please be detailed and help me with this provlem ABC Company makes one product and it provided the following information to help prepare the master

please be detailed and help me with this provlem

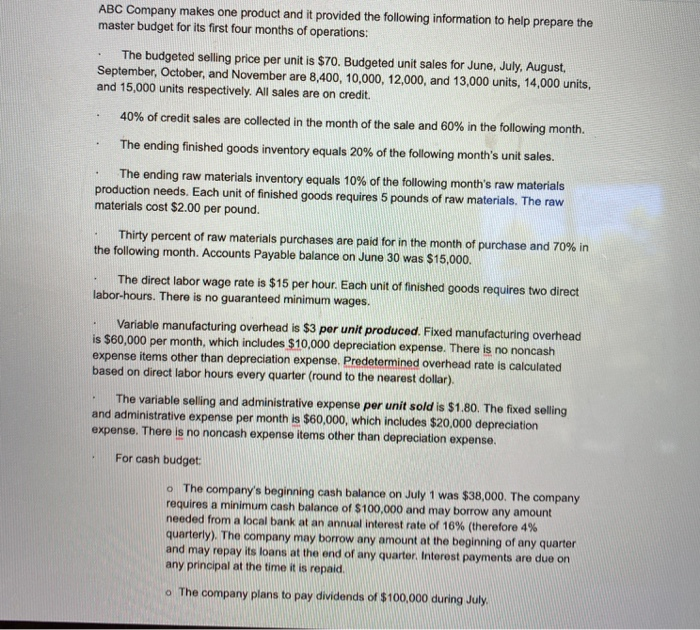

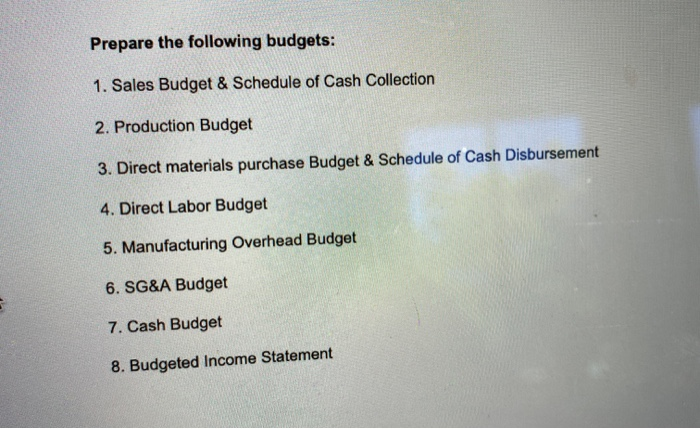

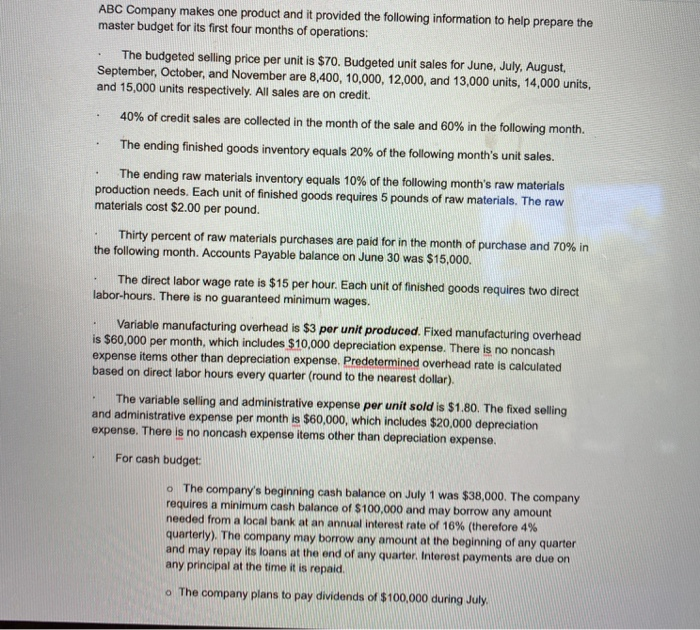

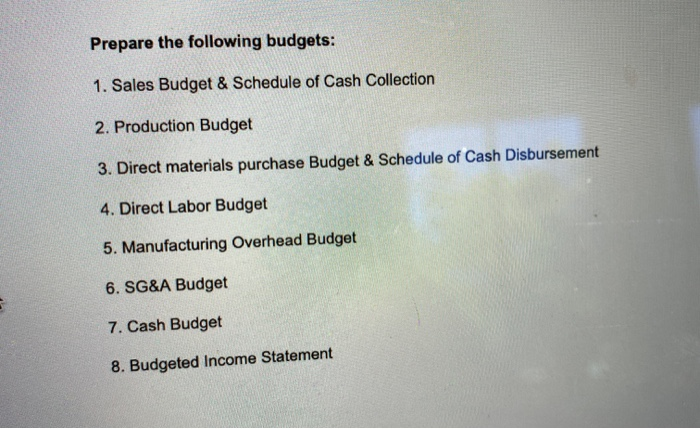

ABC Company makes one product and it provided the following information to help prepare the master budget for its first four months of operations: The budgeted selling price per unit is $70. Budgeted unit sales for June, July, August, September, October, and November are 8,400, 10,000, 12,000, and 13,000 units, 14,000 units, and 15,000 units respectively. All sales are on credit. 40% of credit sales are collected in the month of the sale and 60% in the following month. The ending finished goods inventory equals 20% of the following month's unit sales. The ending raw materials inventory equals 10% of the following month's raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. The raw materials cost $2.00 per pound. Thirty percent of raw materials purchases are paid for in the month of purchase and 70% in the following month. Accounts Payable balance on June 30 was $15,000. The direct labor wage rate is $15 per hour. Each unit of finished goods requires two direct labor-hours. There is no guaranteed minimum wages. Variable manufacturing overhead is $3 per unit produced. Fixed manufacturing overhead is $60,000 per month, which includes $10,000 depreciation expense. There is no noncash expense items other than depreciation expense. Predetermined overhead rate is calculated based on direct labor hours every quarter (round to the nearest dollar). The variable selling and administrative expense per unit sold is $1.80. The fixed selling and administrative expense per month is $60,000, which includes $20,000 depreciation expense. There is no noncash expense items other than depreciation expense. . For cash budget The company's beginning cash balance on July 1 was $38,000. The company requires a minimum cash balance of $100,000 and may borrow any amount needed from a local bank at an annual interest rate of 16% (therefore 4% quarterly). The company may borrow any amount at the beginning of any quarter and may repay its loans at the end of any quarter. Interest payments are due on any principal at the time it is repaid o The company plans to pay dividends of $100,000 during July Prepare the following budgets: 1. Sales Budget & Schedule of Cash Collection 2. Production Budget 3. Direct materials purchase Budget & Schedule of Cash Disbursement 4. Direct Labor Budget 5. Manufacturing Overhead Budget 6. SG&A Budget 7. Cash Budget 8. Budgeted Income Statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started