Answered step by step

Verified Expert Solution

Question

1 Approved Answer

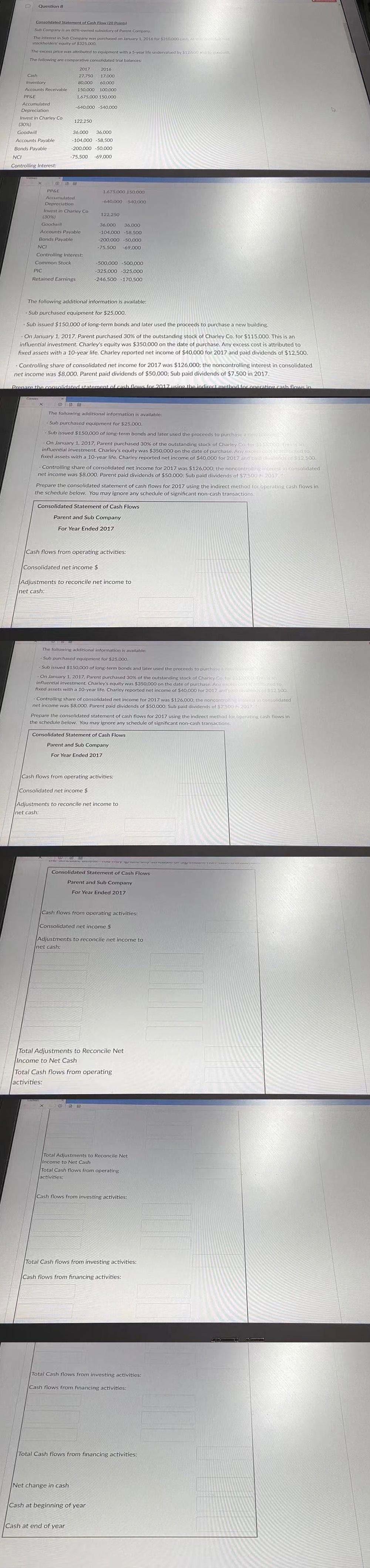

Please be fast! Thanks!!! Question 8 Consolidated Statement of Cash Flow (20 Points) Sub Company is an 80%-owned subsidiary of Parent Company The interest in

Please be fast! Thanks!!!

Question 8 Consolidated Statement of Cash Flow (20 Points) Sub Company is an 80%-owned subsidiary of Parent Company The interest in Sub Company was purchased on January 1, 2016 for $310.000 cash At Sabine stockholders' equity of $325,000 The excess price was attributed to equipment with a 5-year life undervalued by $12.500 and The following are comparative consolidated trial balances: 2017 2016 Cash 27,750 17,000 Inventory 80.000 60.000 Accounts Receivable 150.000 100.000 PPSE 1,675.000 150,000 Accumulated -640,000 -540,000 Depreciation Invest in Charley Co (30%) 122.250 Goodwill 36,000 36.000 -104,000 -58,500 Accounts Payable Bonds Payable - 200,000 -50,000 NCI -75,500 -69,000 Controlling Interest: 13 PPSE 1.675.000 150.000 640,000 540,000 Accumulated Depreciation Invest in Charley Co (30%) 122.250 Goodwill 36,000 36.000 Accounts Payable -104.000-58.500 Bonds Payable -200,000 -50,000 NCI - 75,500 -69,000 Controlling Interest: Common Stock -500.000 500.000 PIC -325,000 325,000 Retained Earnings -246,500 170,500 The following additional information is available: Sub purchased equipment for $25,000. Sub issued $150,000 of long-term bonds and later used the proceeds to purchase a new building. On January 1, 2017 Parent purchased 30% of the outstanding stock of Charley Co. for $115,000. This is an influential investment. Charley's equity was $350,000 on the date of purchase. Any excess cost is attributed to fixed assets with a 10-year life. Charley reported net income of $40,000 for 2017 and paid dividends of $12,500. Controlling share of consolidated net income for 2017 was $126,000; the noncontrolling interest in consolidated net income was $8,000. Parent paid dividends of $50,000; Sub paid dividends of $7.500 in 2017. Drenare the consolidated statement of cash flows for 2017 msing the indirect method fornecting cash flows.in The following additional information is available: Sub purchased equipment for $25.000 Sub issued $150,000 of long-term bonds and later used the proceeds to purchase and On January 1, 2017 Parent purchased 30% of the outstanding stock of Charley Crotone influential investment. Charley's equity was $350,000 on the date of purchase. Any dito fixed assets with a 10-year life. Charley reported net income of $40,000 for 2017 and Panda 2500. Controlling share of consolidated net income for 2017 was $126,000: the noncontrolling interest in consolidated net income was $8,000. Parent paid dividends of $50.000: Sub paid dividends of $7.50. 2017 Prepare the consolidated statement of cash flows for 2017 using the indirect method for operating cash flows in the schedule below. You may ignore any schedule of significant non-cash transactions. Consolidated Statement of Cash Flows Parent and Sub Company For Year Ended 2017 Cash flows from operating activities: Consolidated net income $ Adjustments to reconcile net income to net cash: The following additional information is available: Sub purchased equipment for $25.000 Sub issued $150,000 of long-term bonds and later used the proceeds to purchase and On January 1, 2017. Parent purchased 30% of the outstanding stock of Charley Coloran influential investment. Charley's equity was $350,000 on the date of purchase. Any exceed to fixed assets with a 10-year life. Charley reported net income of $40,000 for 2017 and paid dunes 12 500. Controlling share of consolidated net income for 2017 was $126,000; the noncontro inginkan.comHolidated net income was $8,000. Parent paid dividends of $50,000: Sub paid dividends of $7:50 In 2012 Prepare the consolidated statement of cash flows for 2017 using the indirect method for operating cash flows in the schedule below. You may ignore any schedule of significant non-cash transactions Consolidated Statement of Cash Flows Parent and Sub Company For Year Ended 2017 Cash flows from operating activities: Consolidated net income $ Adjustments to reconcile net income to net cash: HOTEL Consolidated Statement of Cash Flows Parent and Sub Company For Year Ended 2017 Cash flows from operating activities: Consolidated net income $ Adjustments to reconcile net income to net cash: Total Adjustments to Reconcile Net Income to Net Cash Total Cash flows from operating activities: Total Adjustments to Reconcile Net Income to Net Cash Total Cash flows from operating activities. Cash flows from investing activities: Total Cash flows from investing activities: Cash flows from financing activities: Total Cash flows from investing activities: Cash flows from financing activities: Total Cash flows from financing activities: Net change in cash Cash at beginning of year Cash at end of yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started