Answered step by step

Verified Expert Solution

Question

1 Approved Answer

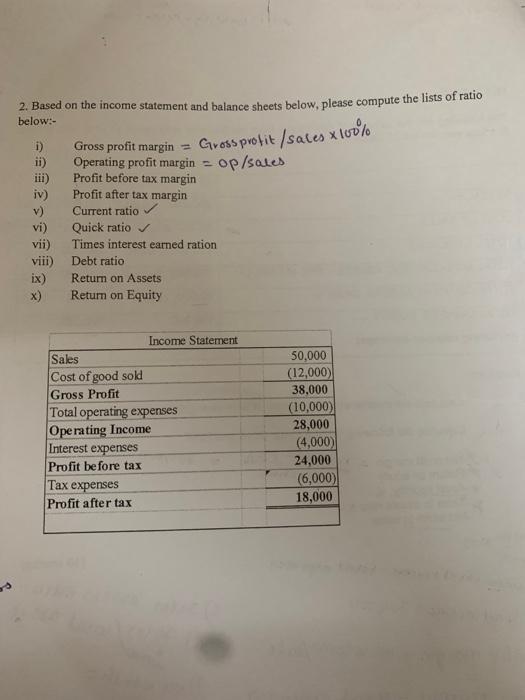

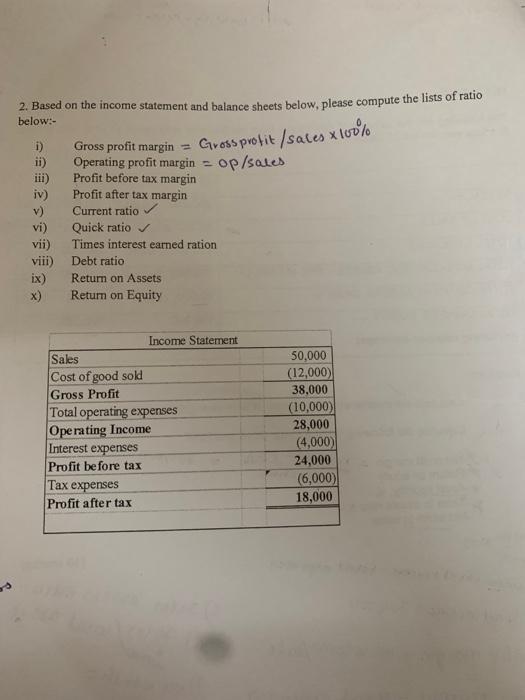

please be more detial 2. Based on the income statement and balance sheets below, please compute the lists of ratio below:- i) Gross profit margin

please be more detial

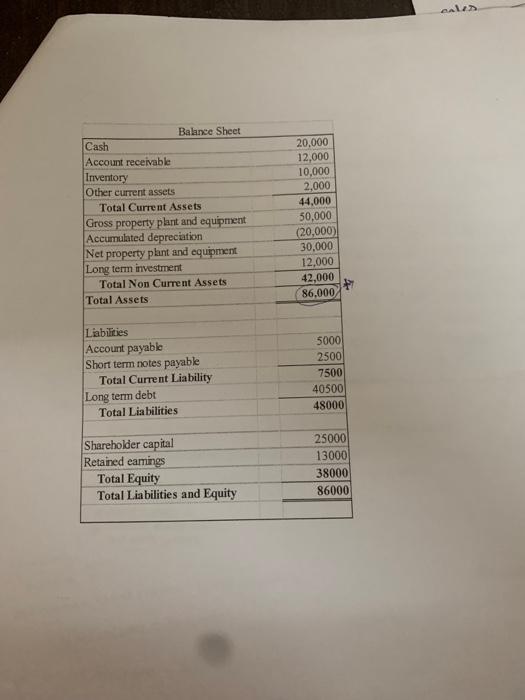

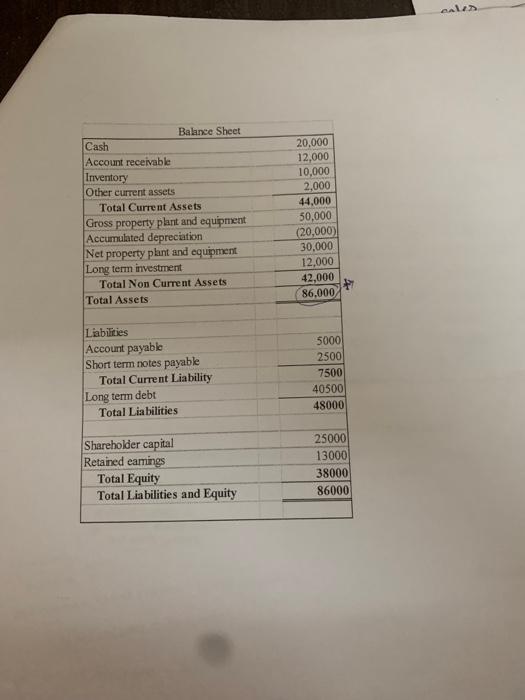

2. Based on the income statement and balance sheets below, please compute the lists of ratio below:- i) Gross profit margin = Gross protit/sales 100% ii) Operating profit margin =0p/ sales iii) Profit before tax margin iv) Profit after tax margin v) Current ratio vi) Quick ratio vii) Times interest earned ration viii) Debt ratio ix) Return on Assets x) Return on Equity Balance Sheet \begin{tabular}{|lr|} \hline Cash & 20,000 \\ \hline Account receivable & 12,000 \\ \hline Inventory & 10,000 \\ \hline Other current assets & 2,000 \\ \hline Total Current Assets & 44,000 \\ \hline Gross property plant and equipment & 50,000 \\ \hline Accumulated depreciation & (20,000) \\ \hline Net property plant and equipment & 30,000 \\ \hline Long term investment & 12,000 \\ \hline Total Non Current Assets & 42,000 \\ \hline Total Assets & 86,000 \\ \hline & \\ \hline Labirties & \\ \hline Account payable & 5000 \\ \hline Short term notes payable & 2500 \\ \hline Total Current Liability & 7500 \\ \hline Long term debt & 40500 \\ \hline Total Liabilities & 48000 \\ \hline & \\ \hline Shareholder capital & 25000 \\ \hline Retained eamings & 13000 \\ \hline Total Equity & 38000 \\ \hline Total Liabilities and Equity & 86000 \\ \hline & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started