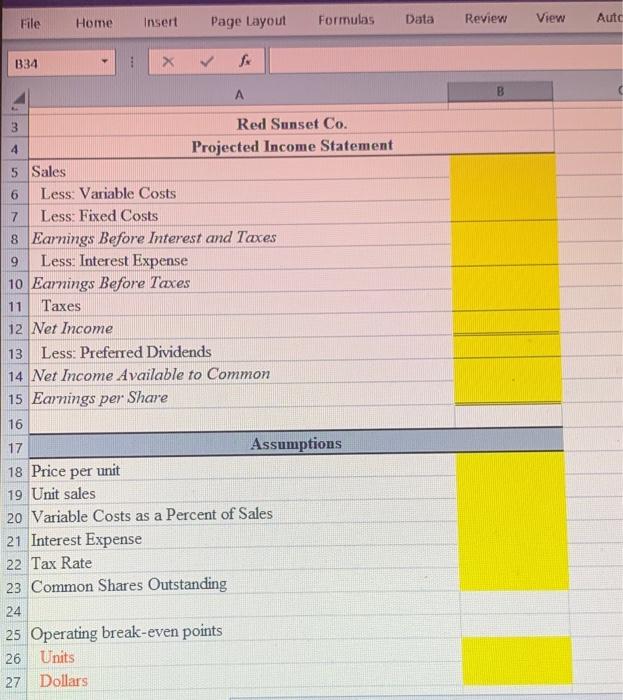

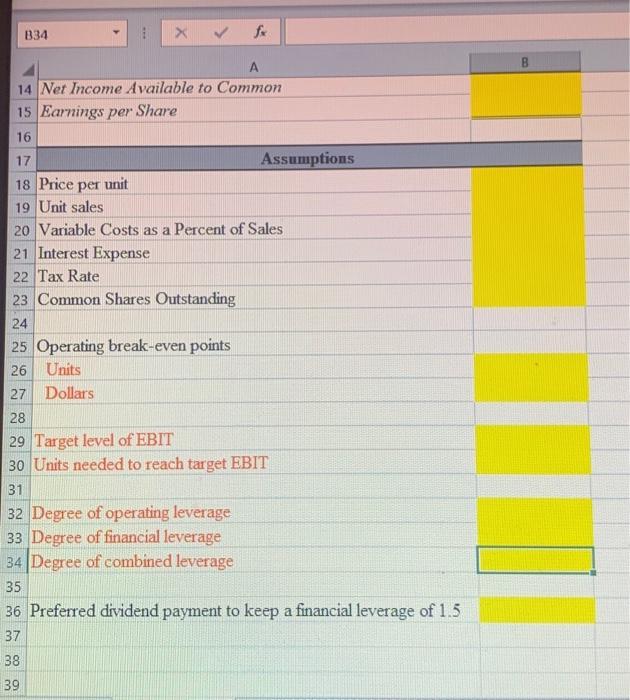

Please be so kind of showing the excel formulas I would really appreciate if i was able to see what the process of the cell fomulas are not only the answers thank you.

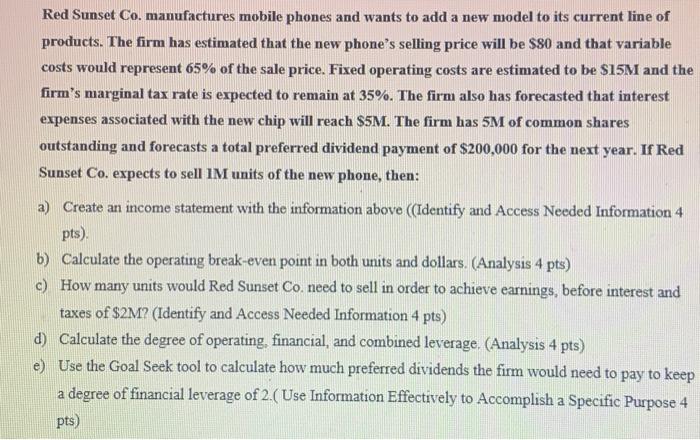

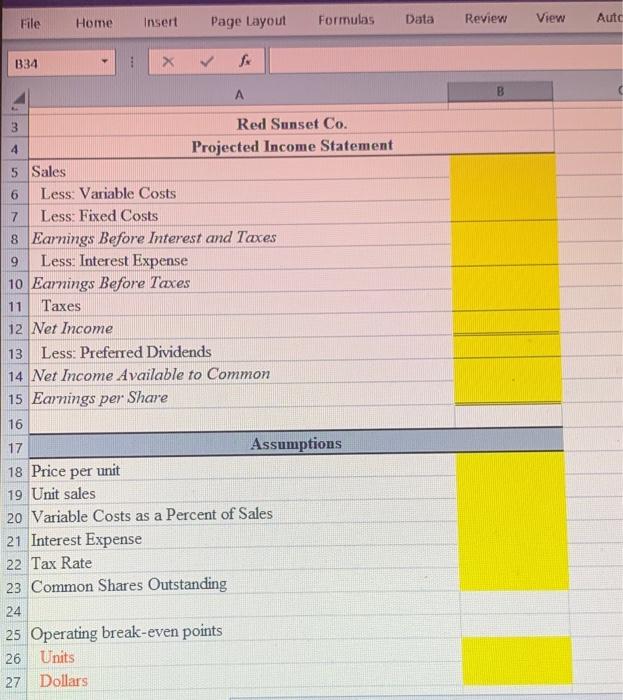

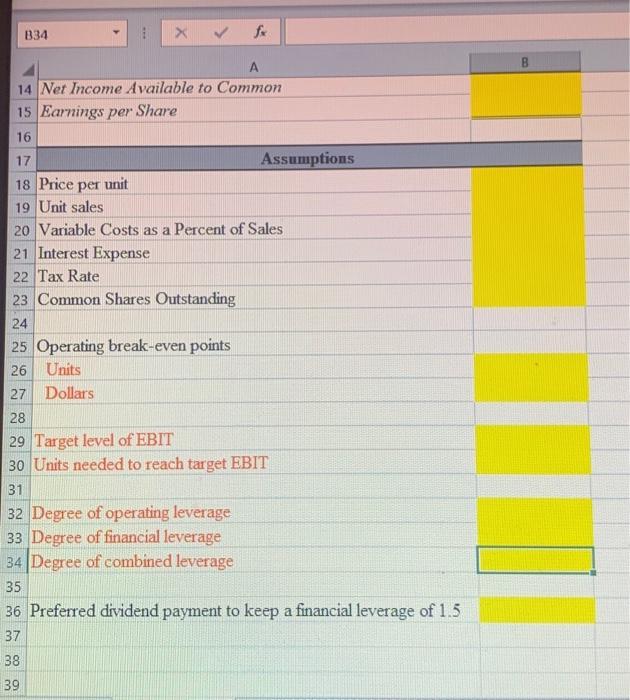

Red Sunset Co. manufactures mobile phones and wants to add a new model to its current line of products. The firm has estimated that the new phone's selling price will be $S0 and that variable costs would represent 65% of the sale price. Fixed operating costs are estimated to be $15M and the firm's marginal tax rate is expected to remain at 35%. The firm also has forecasted that interest expenses associated with the new chip will reach $5M. The firm has 5M of common shares outstanding and forecasts a total preferred dividend payment of $200,000 for the next year. If Red Sunset Co. expects to sell IM units of the new phone, then: a) Create an income statement with the information above ((Identify and Access Needed Information 4 pts). b) Calculate the operating break-even point in both units and dollars. (Analysis 4pts ) c) How many units would Red Sunset Co. need to sell in order to achieve earnings, before interest and taxes of \$2M? (Identify and Access Needed Information 4 pts) d) Calculate the degree of operating, financial, and combined leverage. (Analysis 4pts ) e) Use the Goal Seek tool to calculate how much preferred dividends the firm would need to pay to keep a degree of financial leverage of 2. Use Information Effectively to Accomplish a Specific Purpose 4 pts) \begin{tabular}{|l|l|} \hline 14 & Net Income Available to Common \\ \hline 15 & Earnings per Share \\ \hline 16 & \\ \hline 17 & \\ \hline 18 & Price per unit \\ \hline 19 & Unit sales \\ \hline 20 & Variable Costs as a Percent of Sales \\ \hline 21 & Interest Expense \\ \hline 22 & Tax Rate \\ \hline 23 & Common Shares Outstanding \\ \hline 24 & \\ \hline 25 & Operating break-even points \\ \hline 26 & Units \\ \hline 27 & Dollars \\ \hline 28 & \\ \hline 29 & Target level of EBIT \\ \hline 30 & Units needed to reach target EBIT \\ \hline 31 & \\ \hline 32 & Degree of operating leverage \\ \hline 33 & Degree of financial leverage \\ \hline 34 & Degree of combined leverage \\ \hline & \\ \hline \end{tabular} Preferred dividend payment to keep a financial leverage of 1.5 Red Sunset Co. manufactures mobile phones and wants to add a new model to its current line of products. The firm has estimated that the new phone's selling price will be $S0 and that variable costs would represent 65% of the sale price. Fixed operating costs are estimated to be $15M and the firm's marginal tax rate is expected to remain at 35%. The firm also has forecasted that interest expenses associated with the new chip will reach $5M. The firm has 5M of common shares outstanding and forecasts a total preferred dividend payment of $200,000 for the next year. If Red Sunset Co. expects to sell IM units of the new phone, then: a) Create an income statement with the information above ((Identify and Access Needed Information 4 pts). b) Calculate the operating break-even point in both units and dollars. (Analysis 4pts ) c) How many units would Red Sunset Co. need to sell in order to achieve earnings, before interest and taxes of \$2M? (Identify and Access Needed Information 4 pts) d) Calculate the degree of operating, financial, and combined leverage. (Analysis 4pts ) e) Use the Goal Seek tool to calculate how much preferred dividends the firm would need to pay to keep a degree of financial leverage of 2. Use Information Effectively to Accomplish a Specific Purpose 4 pts) \begin{tabular}{|l|l|} \hline 14 & Net Income Available to Common \\ \hline 15 & Earnings per Share \\ \hline 16 & \\ \hline 17 & \\ \hline 18 & Price per unit \\ \hline 19 & Unit sales \\ \hline 20 & Variable Costs as a Percent of Sales \\ \hline 21 & Interest Expense \\ \hline 22 & Tax Rate \\ \hline 23 & Common Shares Outstanding \\ \hline 24 & \\ \hline 25 & Operating break-even points \\ \hline 26 & Units \\ \hline 27 & Dollars \\ \hline 28 & \\ \hline 29 & Target level of EBIT \\ \hline 30 & Units needed to reach target EBIT \\ \hline 31 & \\ \hline 32 & Degree of operating leverage \\ \hline 33 & Degree of financial leverage \\ \hline 34 & Degree of combined leverage \\ \hline & \\ \hline \end{tabular} Preferred dividend payment to keep a financial leverage of 1.5