Please be specific!

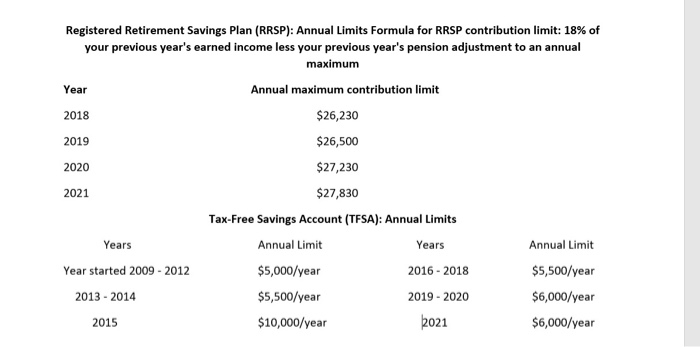

Rose wants to make an offer for a condo. She was waiting for the bank to get back to her as she just submitted her application for a mortgage. Her gross annual income is $120,000 and has been the same for the last 3 years due to salary freeze at her company. The property that she is looking to purchase would result in monthly heating costs of $290, condo fees of $1,825 per year, while her annual property taxes would be $4,000. Her only debt is a car loan of $1,250 per month. a) Calculate Rose's monthly mortgage payment if her Total Debt Service (TDS) is 39% b) Rose is looking to put maximum down payment on the condo as she wants a conventional mortgage. of the bank accepts her ratio, and approves her for a mortgage, she is looking to make an offer of $225,000 on the condo. Calculate her down payment c) Rose made a Registered Retirement Savings Plan (RRSP) contribution in January 2020 to claim as a deduction on her 2019 personal income tax return. She knew how much to contribute based on her Canada Revenue Agency (CRA) Notice of Assessment, which shows her the RRSP deduction limitie. how much she can contribute), Rose does not have any RRSP carryfroward amount as she always maximizes her annual contribution. Rather than rely on her Notice of Agreement from the government, she would like to know how to calculate the contribution amount and has asked you for your help. Show Rose how you would calculate her 2019 RRSP contribution. Also, show her how you calculate her expected refund from making this RRSP contribution based on her marginal tax rate. She is very excited t to know this information as she just filed her tax returns before revised deadline and is expecting a refund shortly. (Ignore Non-Refundable Tax Credits) d) Rose just turned 23 years old on October 1, 2020. She has never made any Tax-Free Savings Account (TESA) contriutions to date. If the bank does not approve her mortgage, she will maximize her TESA contributions by using funds that she had earmarked for the down payment. What is the maximum amount that she could put in her TFSA including carry forward amounts)? 2019 Combined Federal and Quebec Personal Income Tax Brackets and Tax Rates 2019 Taxable income 2019 Tax Rates 2019 Taxable income 2019 Tax Rates first $43,790 27.53% over $95,259 up to $106,555 45.71% over $43,790 up to $47,630 32.53% over $106,555 up to $147,667 47.46% over $47,630 up to 587,575 37.12% over $147,667 up to $210,371 49.97% over $87,575 up to $95,259 41.12% over $210,371 53.31% Registered Retirement Savings Plan (RRSP): Annual Limits Formula for RRSP contribution limit: 18% of your previous year's earned income less your previous year's pension adjustment to an annual maximum Year Annual maximum contribution limit 2018 $26,230 2019 $26,500 2020 $27,230 $27,830 Tax-Free Savings Account (TFSA): Annual Limits Years Annual Limit Years Annual Limit Year started 2009 - 2012 $5,000/year 2016 - 2018 $5,500/year 2013 - 2014 $5,500/year 2019 - 2020 $6,000/year 2015 $10,000/year 2021 $6,000/year 2021 Rose wants to make an offer for a condo. She was waiting for the bank to get back to her as she just submitted her application for a mortgage. Her gross annual income is $120,000 and has been the same for the last 3 years due to salary freeze at her company. The property that she is looking to purchase would result in monthly heating costs of $290, condo fees of $1,825 per year, while her annual property taxes would be $4,000. Her only debt is a car loan of $1,250 per month. a) Calculate Rose's monthly mortgage payment if her Total Debt Service (TDS) is 39% b) Rose is looking to put maximum down payment on the condo as she wants a conventional mortgage. of the bank accepts her ratio, and approves her for a mortgage, she is looking to make an offer of $225,000 on the condo. Calculate her down payment c) Rose made a Registered Retirement Savings Plan (RRSP) contribution in January 2020 to claim as a deduction on her 2019 personal income tax return. She knew how much to contribute based on her Canada Revenue Agency (CRA) Notice of Assessment, which shows her the RRSP deduction limitie. how much she can contribute), Rose does not have any RRSP carryfroward amount as she always maximizes her annual contribution. Rather than rely on her Notice of Agreement from the government, she would like to know how to calculate the contribution amount and has asked you for your help. Show Rose how you would calculate her 2019 RRSP contribution. Also, show her how you calculate her expected refund from making this RRSP contribution based on her marginal tax rate. She is very excited t to know this information as she just filed her tax returns before revised deadline and is expecting a refund shortly. (Ignore Non-Refundable Tax Credits) d) Rose just turned 23 years old on October 1, 2020. She has never made any Tax-Free Savings Account (TESA) contriutions to date. If the bank does not approve her mortgage, she will maximize her TESA contributions by using funds that she had earmarked for the down payment. What is the maximum amount that she could put in her TFSA including carry forward amounts)? 2019 Combined Federal and Quebec Personal Income Tax Brackets and Tax Rates 2019 Taxable income 2019 Tax Rates 2019 Taxable income 2019 Tax Rates first $43,790 27.53% over $95,259 up to $106,555 45.71% over $43,790 up to $47,630 32.53% over $106,555 up to $147,667 47.46% over $47,630 up to 587,575 37.12% over $147,667 up to $210,371 49.97% over $87,575 up to $95,259 41.12% over $210,371 53.31% Registered Retirement Savings Plan (RRSP): Annual Limits Formula for RRSP contribution limit: 18% of your previous year's earned income less your previous year's pension adjustment to an annual maximum Year Annual maximum contribution limit 2018 $26,230 2019 $26,500 2020 $27,230 $27,830 Tax-Free Savings Account (TFSA): Annual Limits Years Annual Limit Years Annual Limit Year started 2009 - 2012 $5,000/year 2016 - 2018 $5,500/year 2013 - 2014 $5,500/year 2019 - 2020 $6,000/year 2015 $10,000/year 2021 $6,000/year 2021