Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please bold final answer and put answer in the boxses provided. thank you Cascade Containers is organized into two divisions - Manufacturing and Distribution. Manufacturing

please bold final answer and put answer in the boxses provided. thank you

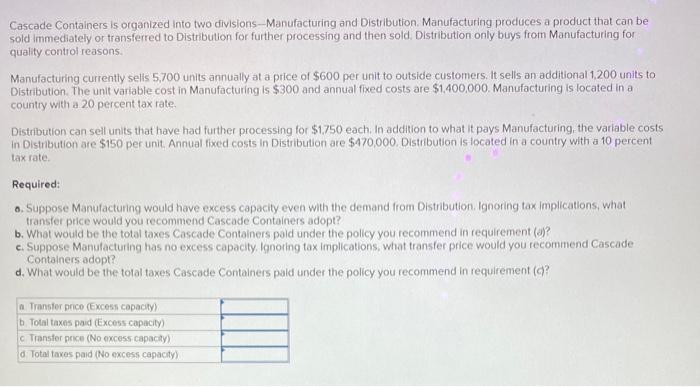

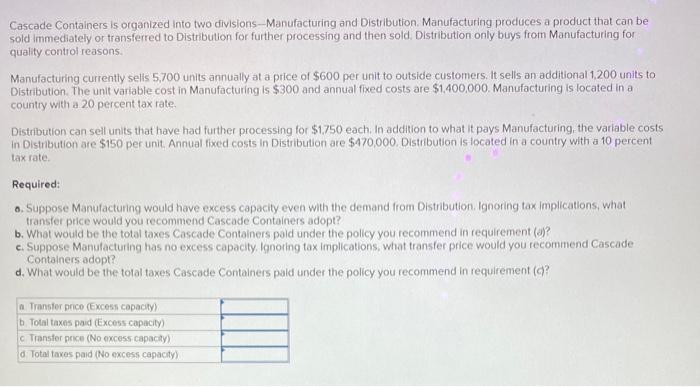

Cascade Containers is organized into two divisions - Manufacturing and Distribution. Manufacturing produces a product that can be sold immediately or transferred to Distribution for further processing and then sold. Distribution only buys from Manufacturing for quality control reasons. Manufacturing currently selts 5,700 units annually at a price of $600 per unit to outside customers, it sells an additional 1,200 units to Distribution. The unit variable cost in Manufacturing is $300 and annual fixed costs are $1.400,000. Manufacturing is located in a country with a 20 percent tax rate. Distribution can sell units that have had further processing for $1.750 each. In addition to what it pays Manufacturing, the variable costs in Distribution are $150 per unit. Annual fixed costs in Distribution are $470,000. Distribution is located in a country with a 10 percent tax rate. Required: 0. Suppose Manufacturing would have excess capacity even with the demand from Distribution. Ignoring tax implications, what transfer price would you recommend Cascade Containers adopt? b. What would be the total taxes Cascade Containers paid under the policy you recommend in requirement (a)? c. Suppose Manufacturing has no excess capacity. lgnoring tax implications, what transfer price would you recommend Cascade Containers adopt? d. What would be the total taxes Cascade Containers pald under the policy you recommend in requirement (a)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started