Answered step by step

Verified Expert Solution

Question

1 Approved Answer

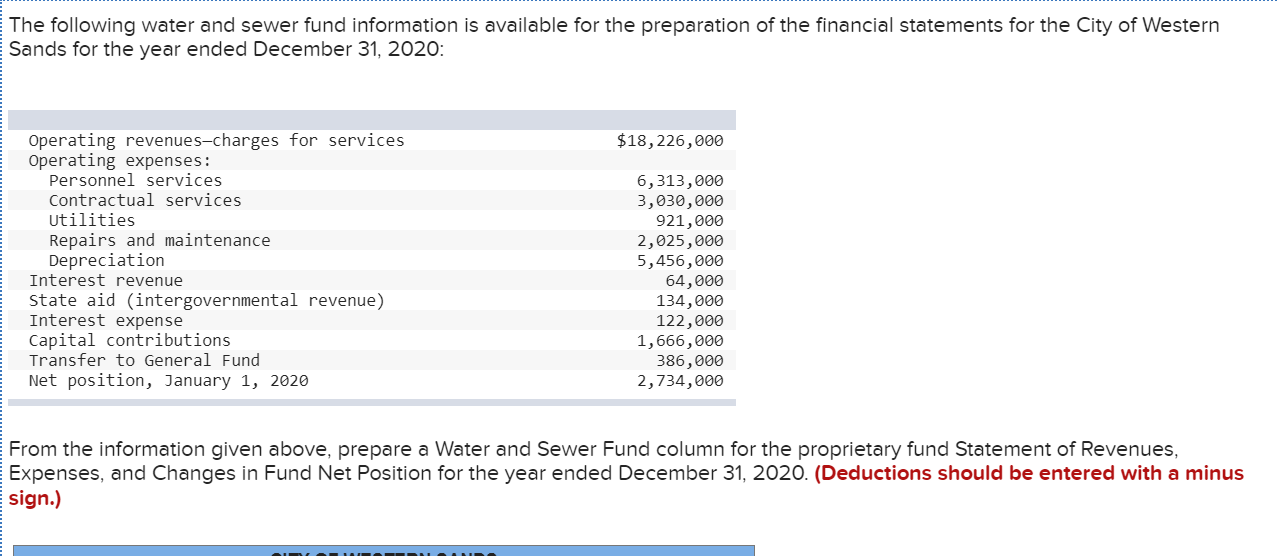

Please bold or highlight answer in explanation. The following water and sewer fund information is available for the preparation of the financial statements for the

Please bold or highlight answer in explanation.

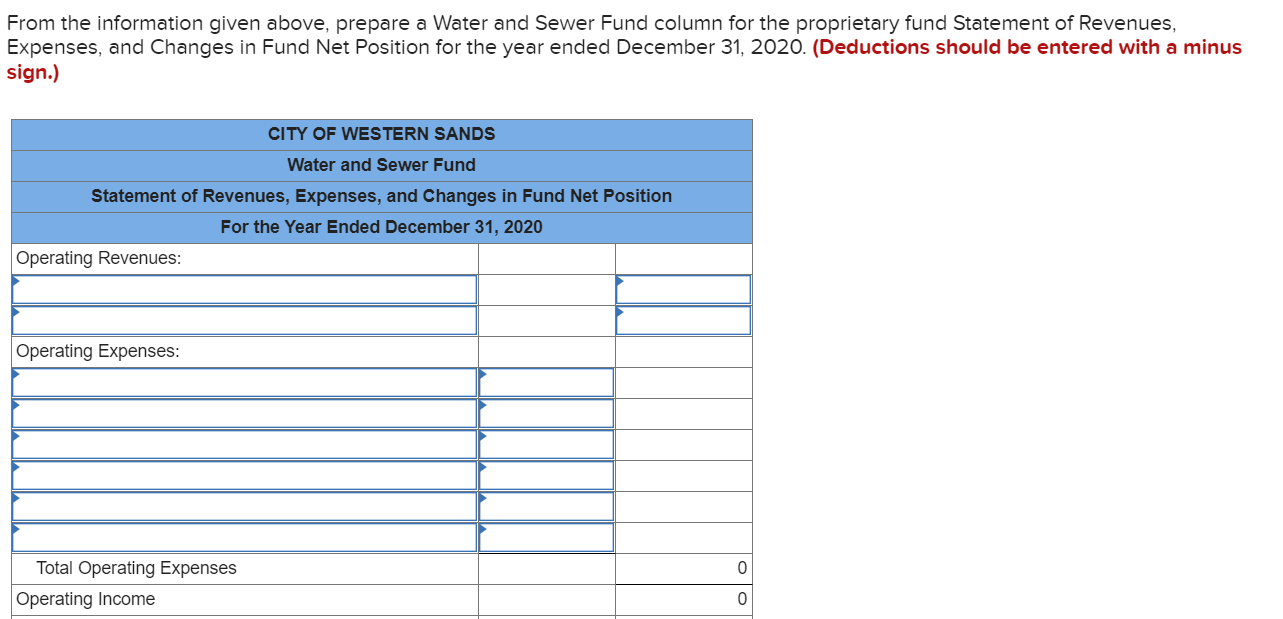

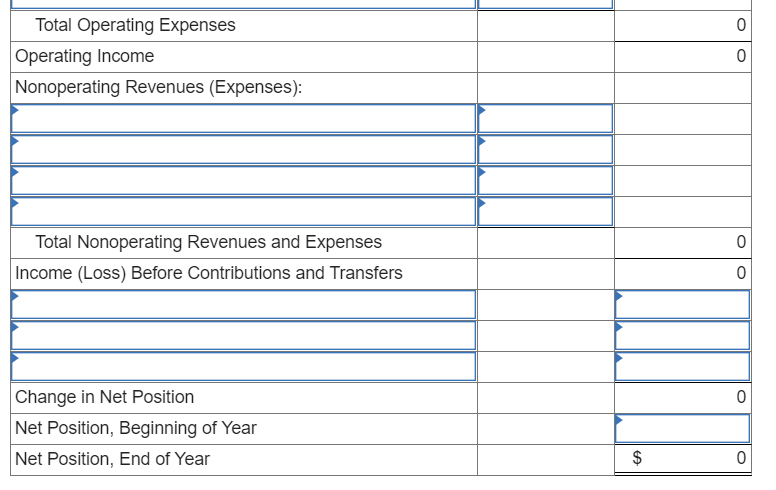

The following water and sewer fund information is available for the preparation of the financial statements for the City of Western Sands for the year ended December 31, 2020: $18, 226,000 Operating revenues-charges for services Operating expenses: Personnel services Contractual services Utilities Repairs and maintenance Depreciation Interest revenue State aid (intergovernmental revenue) Interest expense Capital contributions Transfer to General Fund Net position, January 1, 2020 6,313,000 3,030,000 921,000 2,025,000 5,456,000 64,000 134,000 122,000 1,666,000 386,000 2,734,000 From the information given above, prepare a Water and Sewer Fund column for the proprietary fund Statement of Revenues, Expenses, and Changes in Fund Net Position for the year ended December 31, 2020. (Deductions should be entered with a minus sign.) From the information given above, prepare a Water and Sewer Fund column for the proprietary fund Statement of Revenues, Expenses, and Changes in Fund Net Position for the year ended December 31, 2020. (Deductions should be entered with a minus sign.) CITY OF WESTERN SANDS Water and Sewer Fund Statement of Revenues, Expenses, and Changes in Fund Net Position For the Year Ended December 31, 2020 Operating Revenues: Operating Expenses: 0 Total Operating Expenses Operating Income 0 0 Total Operating Expenses Operating Income Nonoperating Revenues (Expenses): 0 0 Total Nonoperating Revenues and Expenses Income (Loss) Before Contributions and Transfers 0 0 Change in Net Position Net Position, Beginning of Year Net Position, End of Year $ 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started