Answered step by step

Verified Expert Solution

Question

1 Approved Answer

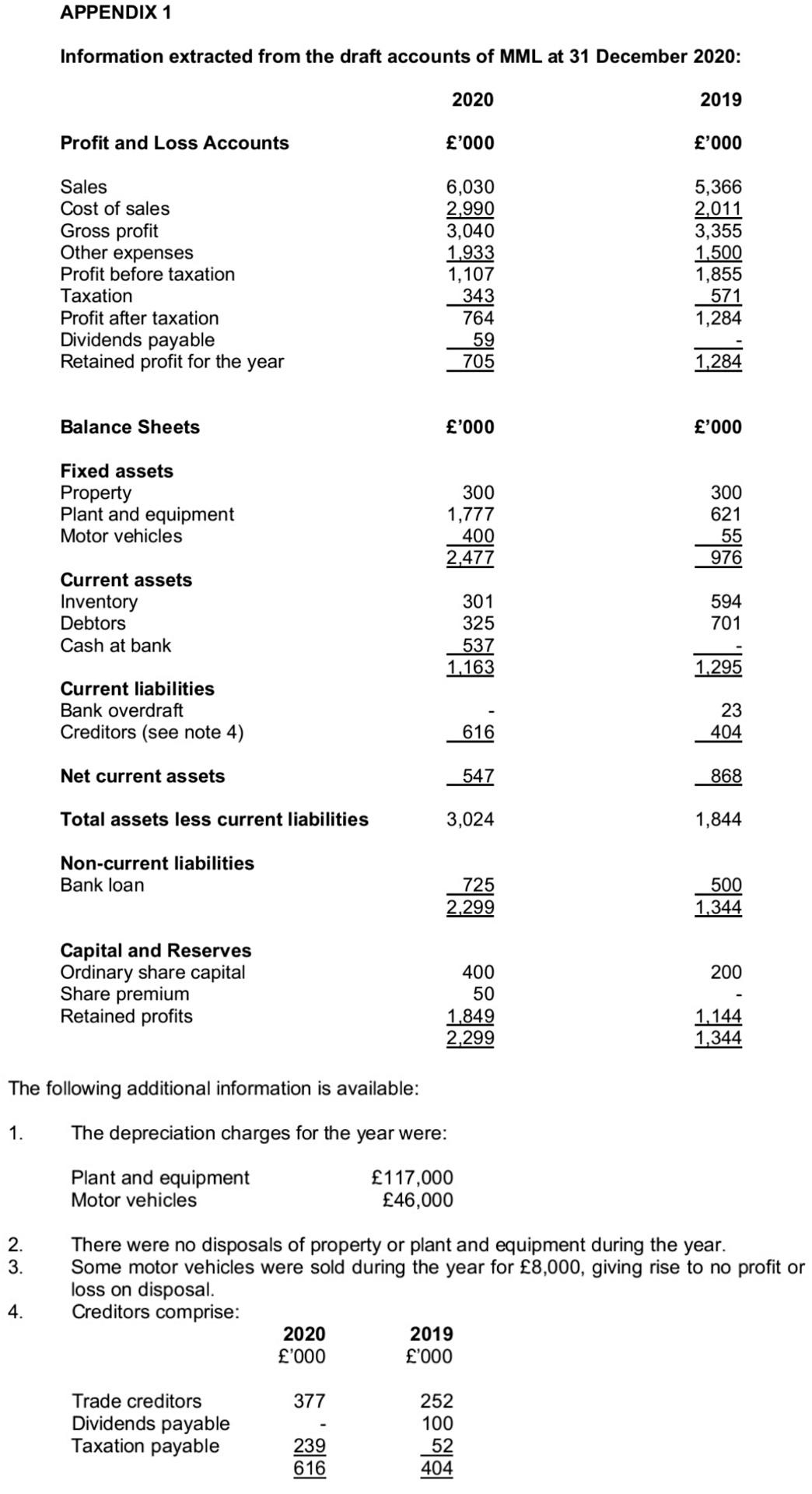

please calculate : 1.gross margin 2. profit margin 3. return on capital employed based on the following information. APPENDIX 1 Information extracted from the draft

please calculate :

1.gross margin 2. profit margin 3. return on capital employed

based on the following information.

APPENDIX 1 Information extracted from the draft accounts of MML at 31 December 2020: 2020 2019 Profit and Loss Accounts '000 '000 Sales Cost of sales Gross profit Other expenses Profit before taxation Taxation Profit after taxation Dividends payable Retained profit for the year 6,030 2,990 3,040 1.933 1,107 343 764 59 705 5,366 2,011 3,355 1,500 1,855 571 1,284 1,284 Balance Sheets '000 '000 Fixed assets Property Plant and equipment Motor vehicles 300 1,777 400 2,477 300 621 55 976 Current assets Inventory Debtors Cash at bank 594 701 301 325 537 1,163 1.295 Current liabilities Bank overdraft Creditors (see note 4) 23 404 616 Net current assets 547 868 Total assets less current liabilities 3,024 1,844 Non-current liabilities Bank loan 725 2.299 500 1.344 200 Capital and Reserves Ordinary share capital Share premium Retained profits 400 50 1.849 2,299 1.144 1,344 The following additional information is available: 1. The depreciation charges for the year were: Plant and equipment Motor vehicles 117,000 46,000 2. 3. There were no disposals of property or plant and equipment during the year. Some motor vehicles were sold during the year for 8,000, giving rise to no profit or loss on disposal. Creditors comprise: 2020 2019 '000 '000 4. 377 Trade creditors Dividends payable Taxation payable 252 100 52 404 239 616

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started