Please calculate 4-5 based on the infromation above.

Please calculate 4-5 based on the infromation above.

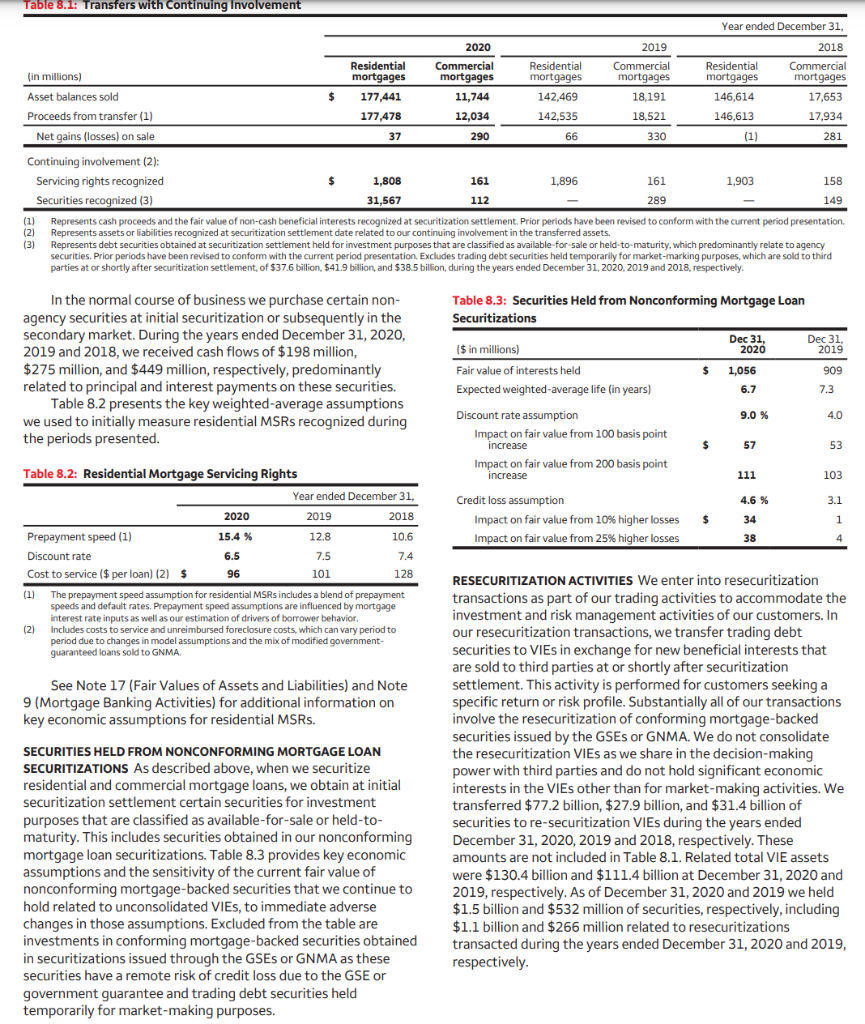

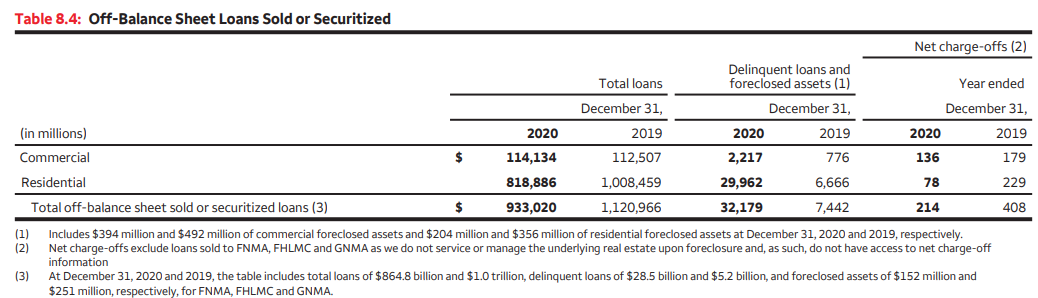

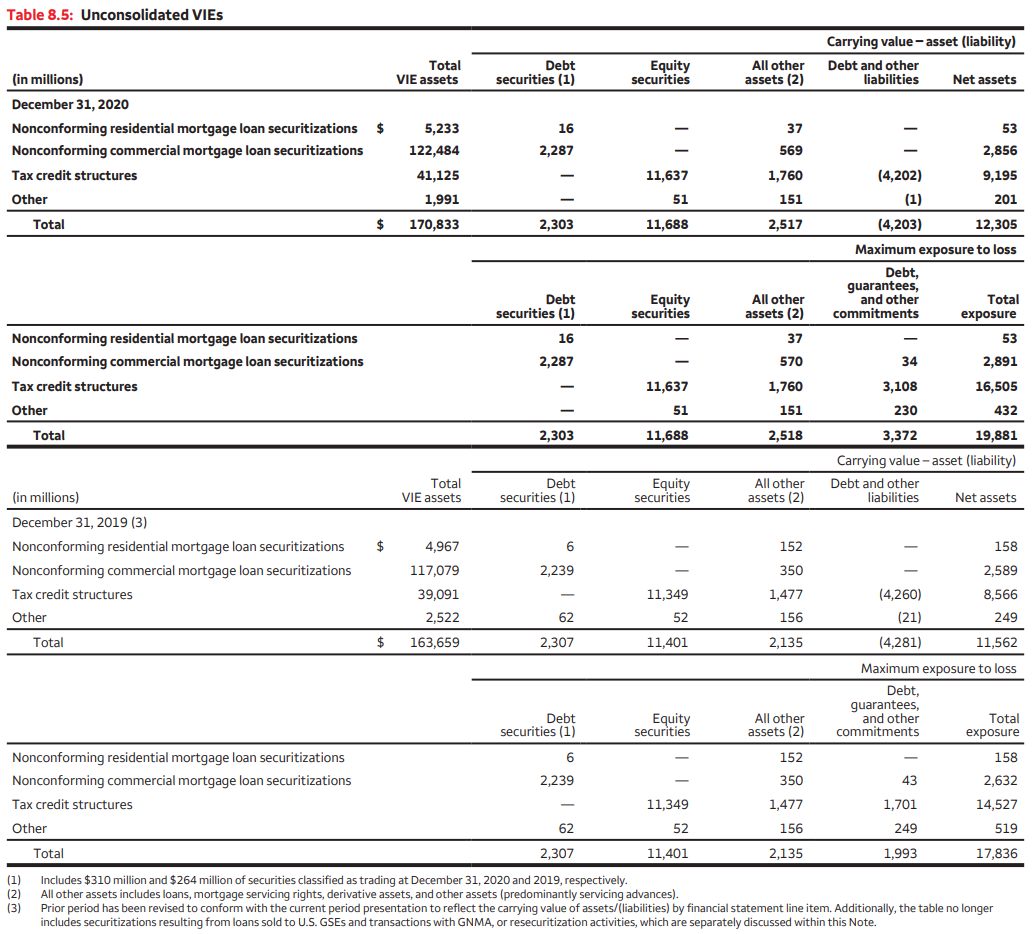

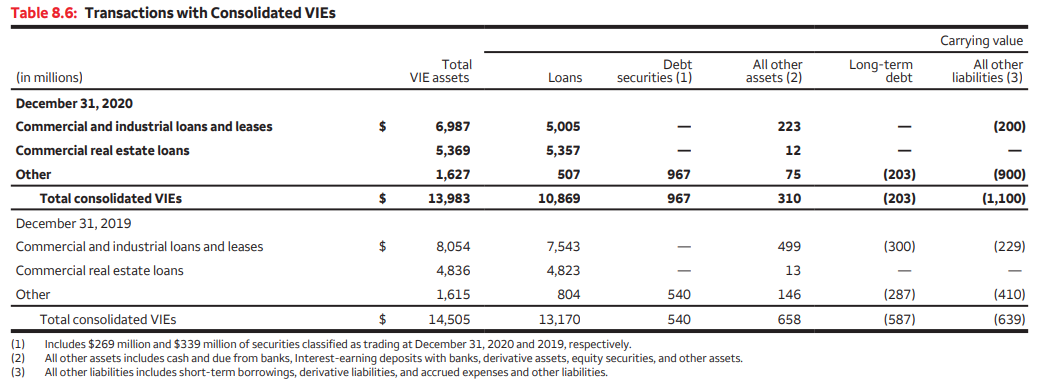

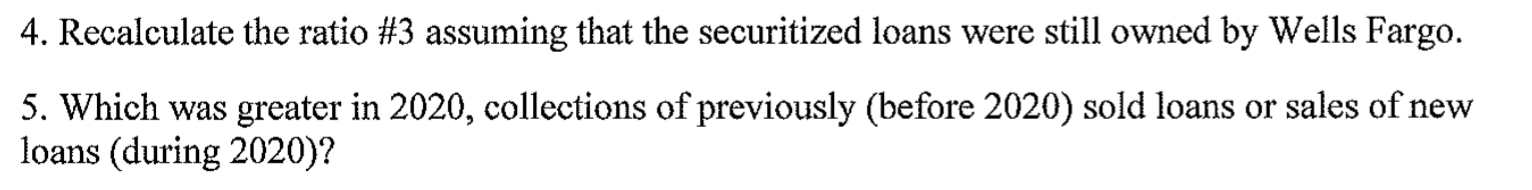

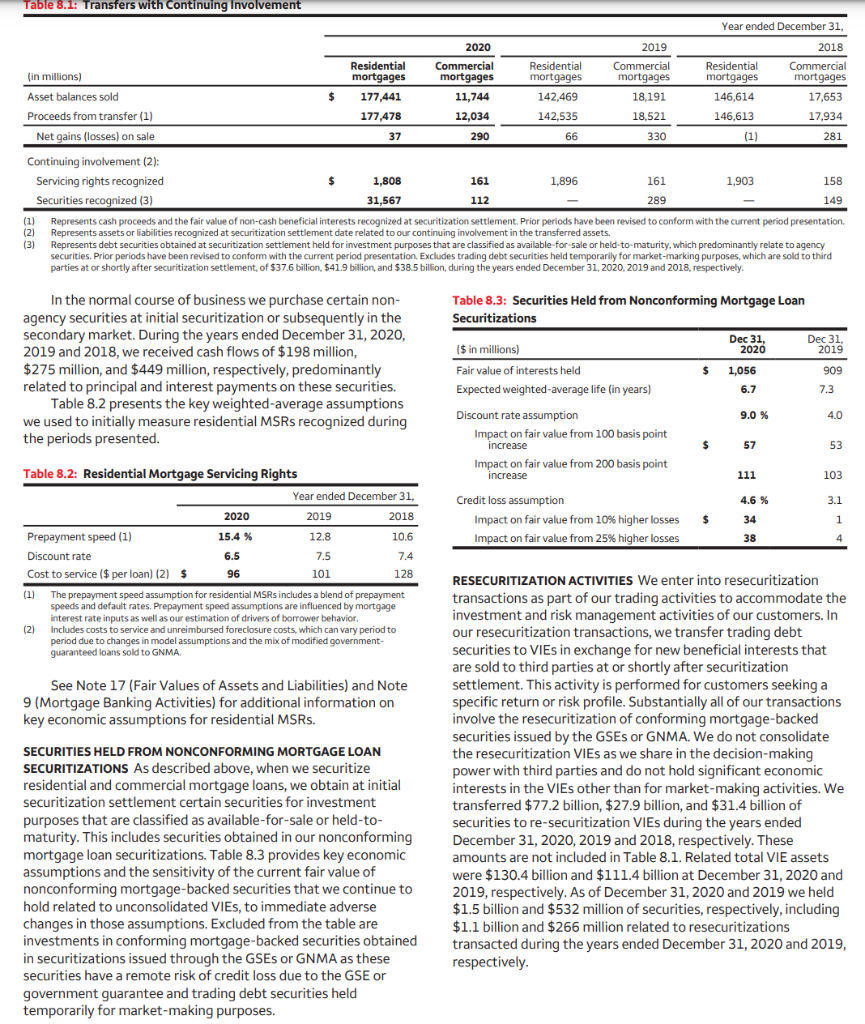

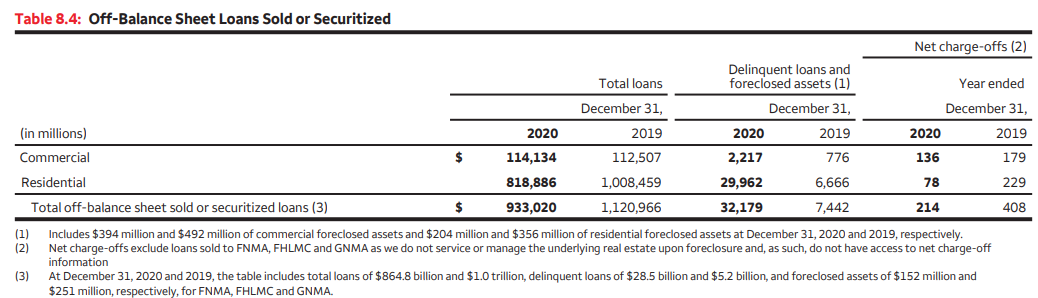

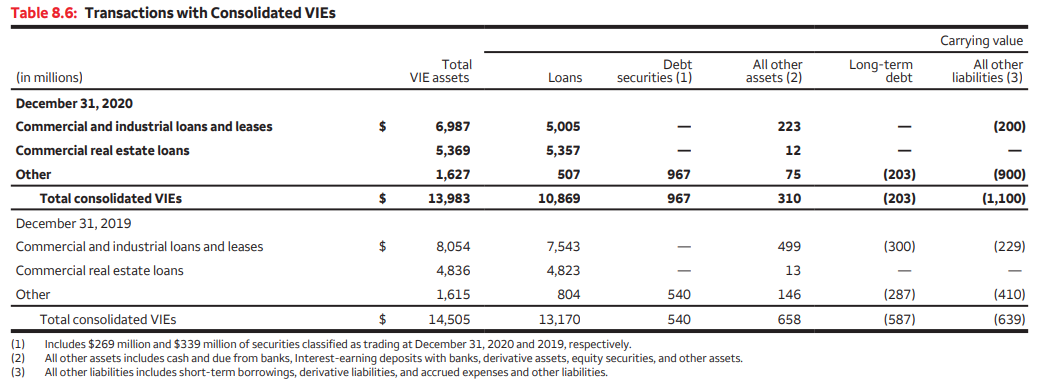

Table 8.1: Transfers with Continuing Involvement Year ended December 31 2020 2019 2018 Residential Commercial Residential Commercial Residential Commercial (in millions) mortgages mortgages mortgages mortgages mortgages mortgages Asset balances sold $ 177,441 11,744 142,469 18,191 146,614 17,653 Proceeds from transfer (1) 177,478 12,034 142,535 18.521 146,613 17,934 Net gains (losses) on sale 37 290 66 330 (1) 281 Continuing involvement (2): Servicing rights recognized $ 1,808 161 1,896 161 1,903 158 Securities recognized (3) 31,567 289 149 (1) Represents cash proceeds and the fair value of non-cash beneficial interests recognized at securitization settlement. Prior periods have been revised to conform with the current period presentation (2) Represents assets or liabilities recognized at securitization settlement date related to our continuing involvement in the transferred assets. (3) Represents debt securities obtained at securitization settlement held for investment purposes that are classified as available for sale or held-to-maturity, which predominantly relate to agency securities. Prior periods have been revised to conform with the current period presentation. Excludes trading debt securities held temporarily for market-marking purposes, which are sold to third parties at or shortly after securitization settlement of $37.6 billion, $41.9 billion, and $38.5 billion, during the years ended December 31, 2020, 2019 and 2018, respectively 112 In the normal course of business we purchase certain non- agency securities at initial securitization or subsequently in the secondary market. During the years ended December 31, 2020, 2019 and 2018, we received cash flows of $198 million, $275 million, and $449 million, respectively, predominantly related to principal and interest payments on these securities. Table 8.2 presents the key weighted average assumptions we used to initially measure residential MSRs recognized during the periods presented. Table 8.3: Securities Held from Nonconforming Mortgage Loan Securitizations Dec 31, Dec 31 ($ in millions) ( 2020 2019 Fair value of interests held $ 1,056 909 Expected weighted average life (in years) 6.7 7.3 9.0 % 4.0 Discount rate assumption Impact on fair value from 100 basis point increase Impact on fair value from 200 basis point increase $ 57 53 111 103 3.1 Credit loss assumption Impact on fair value from 10% higher losses $ Impact on fair value from 25% higher losses 4.6 % 34 38 1 4 7.4 Table 8.2: Residential Mortgage Servicing Rights Year ended December 31, , 2020 2019 2018 Prepayment speed (1) 1 15.4 % 12.8 10.6 Discount rate 6.5 7.5 Cost to service ($ per loan) (2) $ 96 101 128 (1) The prepayment speed assumption for residential MSRs includes a blend of prepayment speeds and default rates. Prepayment speed assumptions are influenced by mortgage interest rate inputs as well as our estimation of drivers of borrower behavior, (2) Includes costs to service and unreimbursed foreclosure costs, which can vary period to period due to changes in model assumptions and the mix of modified government- guaranteed loans sold to GNMA. See Note 17 (Fair Values of Assets and Liabilities) and Note 9 (Mortgage Banking Activities) for additional information on key economic assumptions for residential MSRs. SECURITIES HELD FROM NONCONFORMING MORTGAGE LOAN SECURITIZATIONS As described above, when we securitize residential and commercial mortgage loans, we obtain at initial securitization settlement certain securities for investment purposes that are classified as available-for-sale or held-to- maturity. This includes securities obtained in our nonconforming mortgage loan securitizations. Table 8.3 provides key economic assumptions and the sensitivity of the current fair value of nonconforming mortgage-backed securities that we continue to hold related to unconsolidated VIEs, to immediate adverse changes in those assumptions. Excluded from the table are investments in conforming mortgage-backed securities obtained in securitizations issued through the GSEs or GNMA as these securities have a remote risk of credit loss due to the GSE or government guarantee and trading debt securities held temporarily for market-making purposes. RESECURITIZATION ACTIVITIES We enter into resecuritization transactions as part of our trading activities to accommodate the investment and risk management activities of our customers. In our resecuritization transactions, we transfer trading debt securities to VIEs in exchange for new beneficial interests that are sold to third parties at or shortly after securitization settlement. This activity is performed for customers seeking a specific return or risk profile. Substantially all of our transactions involve the resecuritization of conforming mortgage-backed securities issued by the GSEs or GNMA. We do not consolidate the resecuritization VIEs as we share in the decision-making power with third parties and do not hold significant economic interests in the VIEs other than for market-making activities. We transferred $77.2 billion, $27.9 billion, and $31.4 billion of securities to re-securitization VIEs during the years ended December 31, 2020, 2019 and 2018, respectively. These amounts are not included in Table 8.1. Related total VIE assets were $130.4 billion and $111.4 billion at December 31, 2020 and 2019, respectively. As of December 31, 2020 and 2019 we held $1.5 billion and $532 million of securities, respectively, including $1.1 billion and $266 million related to resecuritizations transacted during the years ended December 31, 2020 and 2019, respectively Table 8.4: Off-Balance Sheet Loans Sold or Securitized Net charge-offs (2) Delinquent loans and Total loans foreclosed assets (1) Year ended December 31, December 31, December 31, (in millions) 2020 2019 2020 2019 2020 2019 Commercial $ 114,134 112,507 2,217 776 136 179 Residential 818,886 1,008,459 29,962 6,666 78 229 Total off-balance sheet sold or securitized loans (3) $ 933,020 1,120,966 32,179 7,442 214 408 (1) Includes $394 million and $492 million of commercial foreclosed assets and $204 million and $356 million of residential foreclosed assets at December 31, 2020 and 2019, respectively. (2 Net charge-offs exclude loans sold to FNMA, FHLMC and GNMA as we do not service or manage the underlying real estate upon foreclosure and, as such, do not have access to net charge-off information (3) 3 At December 31, 2020 and 2019, the table includes total loans of $864.8 billion and $1.0 trillion, delinquent loans of $28.5 billion and $5.2 billion, and foreclosed assets of $152 million and $251 million, respectively, for FNMA, FHLMC and GNMA. Table 8.5: Unconsolidated VIES Debt Total VIE assets Equity securities securities (1) Carrying value-asset (liability) Debt and other liabilities Net assets All other assets (2) (in millions) December 31, 2020 Nonconforming residential mortgage loan securitizations Nonconforming commercial mortgage loan securitizations Tax credit structures $ 5,233 122,484 16 2,287 37 569 53 2,856 41,125 1,991 11,637 51 1,760 151 Other (4,202) 9,195 (1) 201 (4,203) 12,305 Maximum exposure to loss Total $ 170,833 2,303 11,688 2,517 Debt, guarantees, Debt Equity All other and other Total securities (1) securities assets (2) commitments exposure Nonconforming residential mortgage loan securitizations 16 37 53 Nonconforming commercial mortgage loan securitizations 2,287 570 34 2,891 Tax credit structures 11,637 1,760 3,108 16,505 Other 51 151 230 432 Total 2,303 11,688 2,518 3,372 19,881 Carrying value-asset (liability) Total Debt Equity All other Debt and other (in millions) VIE assets securities (1) securities assets (2) liabilities Net assets December 31, 2019 (3) Nonconforming residential mortgage loan securitizations $ 4,967 6 152 158 Nonconforming commercial mortgage loan securitizations 117.079 2,239 350 2,589 Tax credit structures 39,091 11,349 1,477 (4,260) 8.566 Other 2,522 62 52 156 (21) 249 Total $ 163,659 2,307 11,401 2,135 (4,281) 11,562 Maximum exposure to loss Debt. guarantees, Debt Equity All other and other Total securities (1) securities assets (2) commitments exposure Nonconforming residential mortgage loan securitizations 6 152 Nonconforming commercial mortgage loan securitizations 2,239 350 43 2,632 Tax credit structures 11,349 1,477 1,701 14,527 Other 62 52 249 519 Total 2,307 11,401 2,135 1,993 17,836 (1) Includes $310 million and $264 million of securities classified as trading at December 31, 2020 and 2019, respectively. (2) All other assets includes loans, mortgage servicing rights, derivative assets, and other assets (predominantly servicing advances). (3) Prior period has been revised to conform with the current period presentation to reflect the carrying value of assets/(liabilities) by financial statement line item. Additionally, the table no longer includes securitizations resulting from loans sold to U.S. GSEs and transactions with GNMA, or resecuritization activities, which are separately discussed within this Note. 158 156 Table 8.6: Transactions with Consolidated VIES Total Long-term debt Carrying value All other liabilities (3) (200) (203) (203) (900) (1,100) Debt All other (in millions) VIE assets Loans securities (1) assets (2) December 31, 2020 Commercial and industrial loans and leases $ 6,987 5,005 223 Commercial real estate loans 5,369 5,357 12 Other 1,627 507 967 75 Total consolidated VIES $ 13,983 10,869 967 310 December 31, 2019 Commercial and industrial loans and leases $ 8,054 7,543 499 Commercial real estate loans 4,836 4,823 13 Other 1,615 804 540 146 Total consolidated VIES $ 14,505 13,170 540 658 (1) Includes $269 million and $339 million of securities classified as trading at December 31, 2020 and 2019, respectively. (2) All other assets includes cash and due from banks, Interest-earning deposits with banks, derivative assets, equity securities, and other assets. (3) All other liabilities includes short-term borrowings, derivative liabilities, and accrued expenses and other liabilities. (300) (229) (287) (410) (587) (639) 4. Recalculate the ratio #3 assuming that the securitized loans were still owned by Wells Fargo. 5. Which was greater in 2020, collections of previously (before 2020) sold loans or sales of new loans (during 2020)? Table 8.1: Transfers with Continuing Involvement Year ended December 31 2020 2019 2018 Residential Commercial Residential Commercial Residential Commercial (in millions) mortgages mortgages mortgages mortgages mortgages mortgages Asset balances sold $ 177,441 11,744 142,469 18,191 146,614 17,653 Proceeds from transfer (1) 177,478 12,034 142,535 18.521 146,613 17,934 Net gains (losses) on sale 37 290 66 330 (1) 281 Continuing involvement (2): Servicing rights recognized $ 1,808 161 1,896 161 1,903 158 Securities recognized (3) 31,567 289 149 (1) Represents cash proceeds and the fair value of non-cash beneficial interests recognized at securitization settlement. Prior periods have been revised to conform with the current period presentation (2) Represents assets or liabilities recognized at securitization settlement date related to our continuing involvement in the transferred assets. (3) Represents debt securities obtained at securitization settlement held for investment purposes that are classified as available for sale or held-to-maturity, which predominantly relate to agency securities. Prior periods have been revised to conform with the current period presentation. Excludes trading debt securities held temporarily for market-marking purposes, which are sold to third parties at or shortly after securitization settlement of $37.6 billion, $41.9 billion, and $38.5 billion, during the years ended December 31, 2020, 2019 and 2018, respectively 112 In the normal course of business we purchase certain non- agency securities at initial securitization or subsequently in the secondary market. During the years ended December 31, 2020, 2019 and 2018, we received cash flows of $198 million, $275 million, and $449 million, respectively, predominantly related to principal and interest payments on these securities. Table 8.2 presents the key weighted average assumptions we used to initially measure residential MSRs recognized during the periods presented. Table 8.3: Securities Held from Nonconforming Mortgage Loan Securitizations Dec 31, Dec 31 ($ in millions) ( 2020 2019 Fair value of interests held $ 1,056 909 Expected weighted average life (in years) 6.7 7.3 9.0 % 4.0 Discount rate assumption Impact on fair value from 100 basis point increase Impact on fair value from 200 basis point increase $ 57 53 111 103 3.1 Credit loss assumption Impact on fair value from 10% higher losses $ Impact on fair value from 25% higher losses 4.6 % 34 38 1 4 7.4 Table 8.2: Residential Mortgage Servicing Rights Year ended December 31, , 2020 2019 2018 Prepayment speed (1) 1 15.4 % 12.8 10.6 Discount rate 6.5 7.5 Cost to service ($ per loan) (2) $ 96 101 128 (1) The prepayment speed assumption for residential MSRs includes a blend of prepayment speeds and default rates. Prepayment speed assumptions are influenced by mortgage interest rate inputs as well as our estimation of drivers of borrower behavior, (2) Includes costs to service and unreimbursed foreclosure costs, which can vary period to period due to changes in model assumptions and the mix of modified government- guaranteed loans sold to GNMA. See Note 17 (Fair Values of Assets and Liabilities) and Note 9 (Mortgage Banking Activities) for additional information on key economic assumptions for residential MSRs. SECURITIES HELD FROM NONCONFORMING MORTGAGE LOAN SECURITIZATIONS As described above, when we securitize residential and commercial mortgage loans, we obtain at initial securitization settlement certain securities for investment purposes that are classified as available-for-sale or held-to- maturity. This includes securities obtained in our nonconforming mortgage loan securitizations. Table 8.3 provides key economic assumptions and the sensitivity of the current fair value of nonconforming mortgage-backed securities that we continue to hold related to unconsolidated VIEs, to immediate adverse changes in those assumptions. Excluded from the table are investments in conforming mortgage-backed securities obtained in securitizations issued through the GSEs or GNMA as these securities have a remote risk of credit loss due to the GSE or government guarantee and trading debt securities held temporarily for market-making purposes. RESECURITIZATION ACTIVITIES We enter into resecuritization transactions as part of our trading activities to accommodate the investment and risk management activities of our customers. In our resecuritization transactions, we transfer trading debt securities to VIEs in exchange for new beneficial interests that are sold to third parties at or shortly after securitization settlement. This activity is performed for customers seeking a specific return or risk profile. Substantially all of our transactions involve the resecuritization of conforming mortgage-backed securities issued by the GSEs or GNMA. We do not consolidate the resecuritization VIEs as we share in the decision-making power with third parties and do not hold significant economic interests in the VIEs other than for market-making activities. We transferred $77.2 billion, $27.9 billion, and $31.4 billion of securities to re-securitization VIEs during the years ended December 31, 2020, 2019 and 2018, respectively. These amounts are not included in Table 8.1. Related total VIE assets were $130.4 billion and $111.4 billion at December 31, 2020 and 2019, respectively. As of December 31, 2020 and 2019 we held $1.5 billion and $532 million of securities, respectively, including $1.1 billion and $266 million related to resecuritizations transacted during the years ended December 31, 2020 and 2019, respectively Table 8.4: Off-Balance Sheet Loans Sold or Securitized Net charge-offs (2) Delinquent loans and Total loans foreclosed assets (1) Year ended December 31, December 31, December 31, (in millions) 2020 2019 2020 2019 2020 2019 Commercial $ 114,134 112,507 2,217 776 136 179 Residential 818,886 1,008,459 29,962 6,666 78 229 Total off-balance sheet sold or securitized loans (3) $ 933,020 1,120,966 32,179 7,442 214 408 (1) Includes $394 million and $492 million of commercial foreclosed assets and $204 million and $356 million of residential foreclosed assets at December 31, 2020 and 2019, respectively. (2 Net charge-offs exclude loans sold to FNMA, FHLMC and GNMA as we do not service or manage the underlying real estate upon foreclosure and, as such, do not have access to net charge-off information (3) 3 At December 31, 2020 and 2019, the table includes total loans of $864.8 billion and $1.0 trillion, delinquent loans of $28.5 billion and $5.2 billion, and foreclosed assets of $152 million and $251 million, respectively, for FNMA, FHLMC and GNMA. Table 8.5: Unconsolidated VIES Debt Total VIE assets Equity securities securities (1) Carrying value-asset (liability) Debt and other liabilities Net assets All other assets (2) (in millions) December 31, 2020 Nonconforming residential mortgage loan securitizations Nonconforming commercial mortgage loan securitizations Tax credit structures $ 5,233 122,484 16 2,287 37 569 53 2,856 41,125 1,991 11,637 51 1,760 151 Other (4,202) 9,195 (1) 201 (4,203) 12,305 Maximum exposure to loss Total $ 170,833 2,303 11,688 2,517 Debt, guarantees, Debt Equity All other and other Total securities (1) securities assets (2) commitments exposure Nonconforming residential mortgage loan securitizations 16 37 53 Nonconforming commercial mortgage loan securitizations 2,287 570 34 2,891 Tax credit structures 11,637 1,760 3,108 16,505 Other 51 151 230 432 Total 2,303 11,688 2,518 3,372 19,881 Carrying value-asset (liability) Total Debt Equity All other Debt and other (in millions) VIE assets securities (1) securities assets (2) liabilities Net assets December 31, 2019 (3) Nonconforming residential mortgage loan securitizations $ 4,967 6 152 158 Nonconforming commercial mortgage loan securitizations 117.079 2,239 350 2,589 Tax credit structures 39,091 11,349 1,477 (4,260) 8.566 Other 2,522 62 52 156 (21) 249 Total $ 163,659 2,307 11,401 2,135 (4,281) 11,562 Maximum exposure to loss Debt. guarantees, Debt Equity All other and other Total securities (1) securities assets (2) commitments exposure Nonconforming residential mortgage loan securitizations 6 152 Nonconforming commercial mortgage loan securitizations 2,239 350 43 2,632 Tax credit structures 11,349 1,477 1,701 14,527 Other 62 52 249 519 Total 2,307 11,401 2,135 1,993 17,836 (1) Includes $310 million and $264 million of securities classified as trading at December 31, 2020 and 2019, respectively. (2) All other assets includes loans, mortgage servicing rights, derivative assets, and other assets (predominantly servicing advances). (3) Prior period has been revised to conform with the current period presentation to reflect the carrying value of assets/(liabilities) by financial statement line item. Additionally, the table no longer includes securitizations resulting from loans sold to U.S. GSEs and transactions with GNMA, or resecuritization activities, which are separately discussed within this Note. 158 156 Table 8.6: Transactions with Consolidated VIES Total Long-term debt Carrying value All other liabilities (3) (200) (203) (203) (900) (1,100) Debt All other (in millions) VIE assets Loans securities (1) assets (2) December 31, 2020 Commercial and industrial loans and leases $ 6,987 5,005 223 Commercial real estate loans 5,369 5,357 12 Other 1,627 507 967 75 Total consolidated VIES $ 13,983 10,869 967 310 December 31, 2019 Commercial and industrial loans and leases $ 8,054 7,543 499 Commercial real estate loans 4,836 4,823 13 Other 1,615 804 540 146 Total consolidated VIES $ 14,505 13,170 540 658 (1) Includes $269 million and $339 million of securities classified as trading at December 31, 2020 and 2019, respectively. (2) All other assets includes cash and due from banks, Interest-earning deposits with banks, derivative assets, equity securities, and other assets. (3) All other liabilities includes short-term borrowings, derivative liabilities, and accrued expenses and other liabilities. (300) (229) (287) (410) (587) (639) 4. Recalculate the ratio #3 assuming that the securitized loans were still owned by Wells Fargo. 5. Which was greater in 2020, collections of previously (before 2020) sold loans or sales of new loans (during 2020)

Please calculate 4-5 based on the infromation above.

Please calculate 4-5 based on the infromation above.