Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please calculate again , I think previous answer is incorrect Question: Firm valuation The firm ABC has a target debt-to-assets ratio of 50%; the pre-tax

Please calculate again , I think previous answer is incorrect

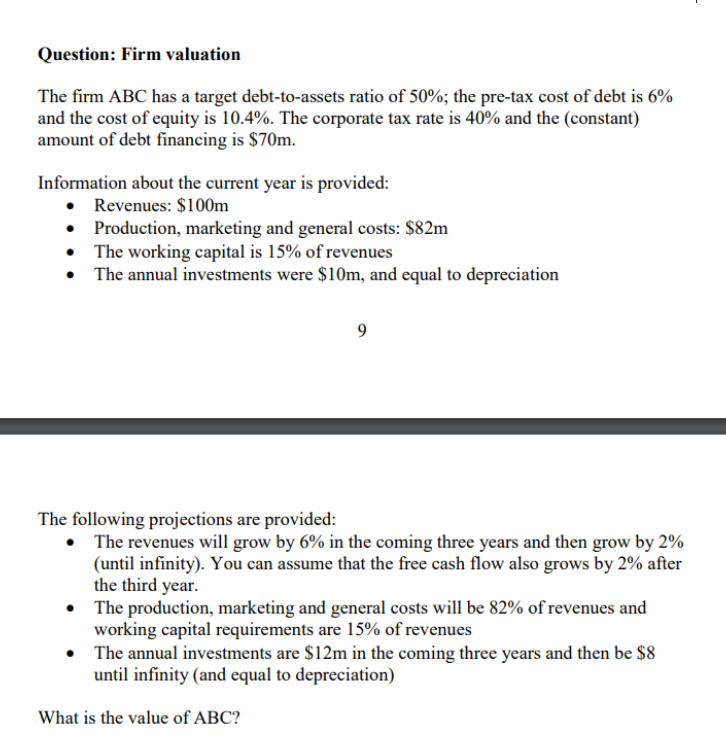

Question: Firm valuation The firm ABC has a target debt-to-assets ratio of 50%; the pre-tax cost of debt is 6% and the cost of equity is 10.4%. The corporate tax rate is 40% and the (constant) amount of debt financing is $70m. Information about the current year is provided: - Revenues: $100m - Production, marketing and general costs: $82m - The working capital is 15% of revenues - The annual investments were $10m, and equal to depreciation 9 The following projections are provided: - The revenues will grow by 6% in the coming three years and then grow by 2% (until infinity). You can assume that the free cash flow also grows by 2% after the third year. - The production, marketing and general costs will be 82% of revenues and working capital requirements are 15% of revenues - The annual investments are $12m in the coming three years and then be $8 until infinity (and equal to depreciation) What is the value of ABCStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started