Answered step by step

Verified Expert Solution

Question

1 Approved Answer

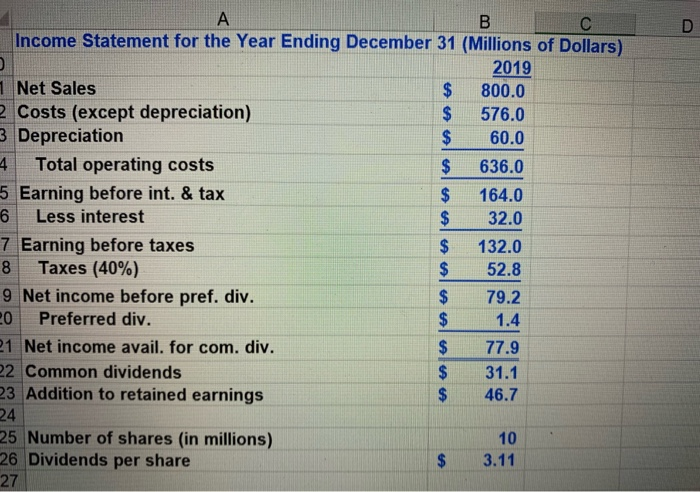

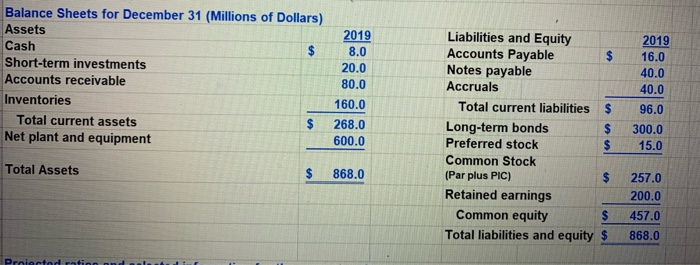

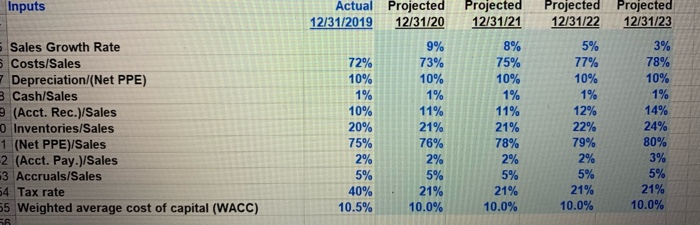

Please calculate FCF for each projected year. Also calcuate the growth rates of free cash flow each year to ensure there is consistent growth by

Please calculate FCF for each projected year. Also calcuate the growth rates of free cash flow each year to ensure there is consistent growth by the end of the forecast period. Please use excel and try to show formula.

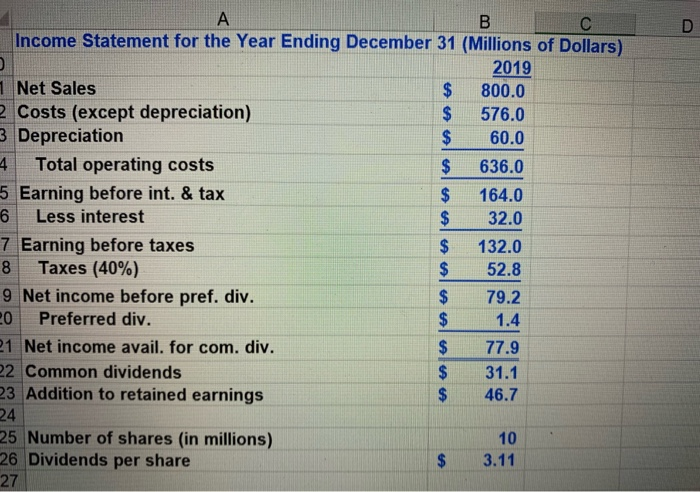

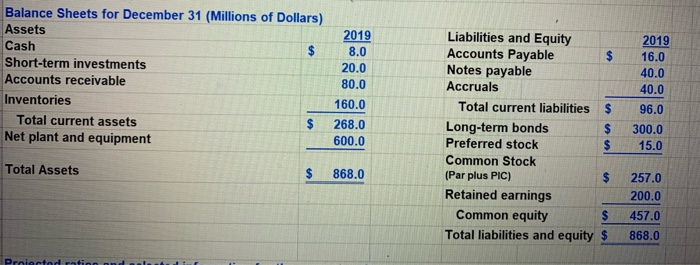

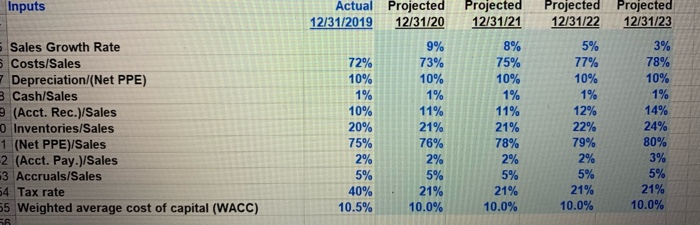

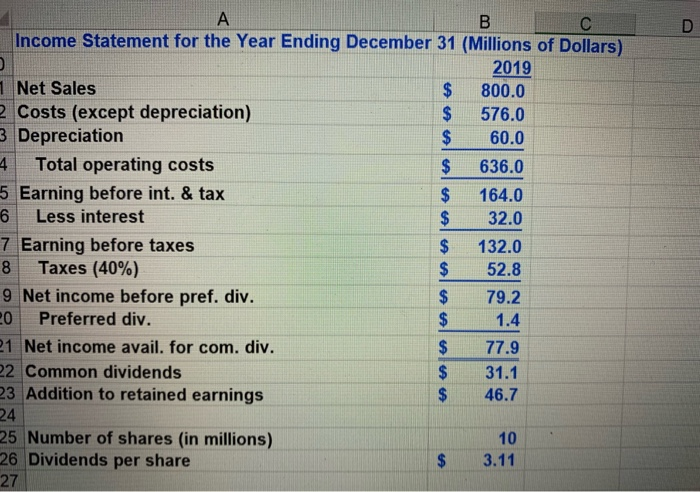

D U 4 6 A B C Income Statement for the Year Ending December 31 (Millions of Dollars) 2019 1 Net Sales $ 800.0 2 Costs (except depreciation) $ 576.0 3 Depreciation $ 60.0 Total operating costs $ 636.0 5 Earning before int. & tax $ 164.0 Less interest $ 32.0 7 Earning before taxes 132.0 8 Taxes (40%) $ 52.8 9 Net income before pref. div. $ 79.2 20 Preferred div. $ 1.4 21 Net income avail. for com. div. $ 77.9 22 Common dividends $ 31.1 23 Addition to retained earnings $ 46.7 24 25 Number of shares (in millions) 10 26 Dividends per share 3.11 27 $ $ Balance Sheets for December 31 (Millions of Dollars) Assets Cash Short-term investments Accounts receivable Inventories Total current assets $ Net plant and equipment 2019 8.0 20.0 80.0 2019 16.0 40.0 40.0 96.0 300.0 15.0 $ Liabilities and Equity Accounts Payable $ Notes payable Accruals Total current liabilities Long-term bonds $ Preferred stock $ Common Stock (Par plus PIC) $ Retained earnings Common equity $ Total liabilities and equity $ 160.0 268.0 600.0 Total Assets $ 868.0 257.0 200.0 457.0 868.0 Proiected ratinn anda Inputs Actual Projected 12/31/2019 12/31/20 Projected Projected 12/31/22 12/31/23 Sales Growth Rate Costs/Sales Depreciation/(Net PPE) 3 Cash/Sales (Acct. Rec.)/Sales O Inventories/Sales 1 (Net PPE)/Sales 2 (Acct. Pay.)/Sales 3 Accruals/Sales 54 Tax rate 55 Weighted average cost of capital (WACC) 72% 10% 1% 10% 20% 75% 2% 5% 40% 10.5% 9% 73% 10% 1% 11% 21% 76% 2% 5% 21% 10.0% Projected 12/31/21 8% 75% 10% 1% 11% 21% 78% 2% 5% 21% 10.0% 5% 77% 10% 1% 12% 22% 79% 2% 5% 21% 10.0% 3% 78% 10% 1% 14% 24% 80% 3% 5% 21% 10.0% 56

D U 4 6 A B C Income Statement for the Year Ending December 31 (Millions of Dollars) 2019 1 Net Sales $ 800.0 2 Costs (except depreciation) $ 576.0 3 Depreciation $ 60.0 Total operating costs $ 636.0 5 Earning before int. & tax $ 164.0 Less interest $ 32.0 7 Earning before taxes 132.0 8 Taxes (40%) $ 52.8 9 Net income before pref. div. $ 79.2 20 Preferred div. $ 1.4 21 Net income avail. for com. div. $ 77.9 22 Common dividends $ 31.1 23 Addition to retained earnings $ 46.7 24 25 Number of shares (in millions) 10 26 Dividends per share 3.11 27 $ $ Balance Sheets for December 31 (Millions of Dollars) Assets Cash Short-term investments Accounts receivable Inventories Total current assets $ Net plant and equipment 2019 8.0 20.0 80.0 2019 16.0 40.0 40.0 96.0 300.0 15.0 $ Liabilities and Equity Accounts Payable $ Notes payable Accruals Total current liabilities Long-term bonds $ Preferred stock $ Common Stock (Par plus PIC) $ Retained earnings Common equity $ Total liabilities and equity $ 160.0 268.0 600.0 Total Assets $ 868.0 257.0 200.0 457.0 868.0 Proiected ratinn anda Inputs Actual Projected 12/31/2019 12/31/20 Projected Projected 12/31/22 12/31/23 Sales Growth Rate Costs/Sales Depreciation/(Net PPE) 3 Cash/Sales (Acct. Rec.)/Sales O Inventories/Sales 1 (Net PPE)/Sales 2 (Acct. Pay.)/Sales 3 Accruals/Sales 54 Tax rate 55 Weighted average cost of capital (WACC) 72% 10% 1% 10% 20% 75% 2% 5% 40% 10.5% 9% 73% 10% 1% 11% 21% 76% 2% 5% 21% 10.0% Projected 12/31/21 8% 75% 10% 1% 11% 21% 78% 2% 5% 21% 10.0% 5% 77% 10% 1% 12% 22% 79% 2% 5% 21% 10.0% 3% 78% 10% 1% 14% 24% 80% 3% 5% 21% 10.0% 56

Please calculate FCF for each projected year. Also calcuate the growth rates of free cash flow each year to ensure there is consistent growth by the end of the forecast period. Please use excel and try to show formula.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started