Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please calculate Jolenes net tax payable for 2019. Make sure to clearly show your work (use S3 format) and explain/support relevant amount (including items you

Please calculate Jolenes net tax payable for 2019. Make sure to clearly show your work (use S3 format) and explain/support relevant amount (including items you have excluded from the calculation).

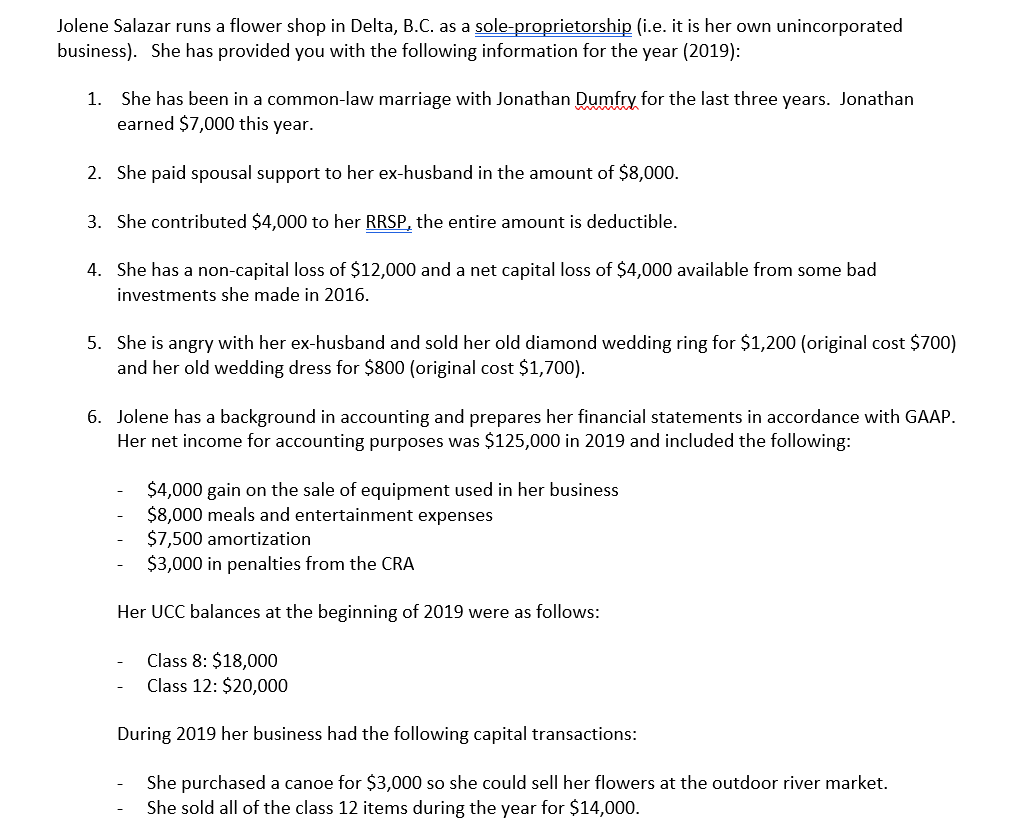

Jolene Salazar runs a flower shop in Delta, B.C. as a sole proprietorship (i.e. it is her own unincorporated business). She has provided you with the following information for the year (2019): 1. She has been in a common-law marriage with Jonathan Dumfry for the last three years. Jonathan earned $7,000 this year. 2. She paid spousal support to her ex-husband in the amount of $8,000. 3. She contributed $4,000 to her RRSP, the entire amount is deductible. 4. She has a non-capital loss of $12,000 and a net capital loss of $4,000 available from some bad investments she made in 2016. 5. She is angry with her ex-husband and sold her old diamond wedding ring for $1,200 (original cost $700) and her old wedding dress for $800 (original cost $1,700). 6. Jolene has a background in accounting and prepares her financial statements in accordance with GAAP. Her net income for accounting purposes was $125,000 in 2019 and included the following: $4,000 gain on the sale of equipment used in her business $8,000 meals and entertainment expenses $7,500 amortization $3,000 in penalties from the CRA Her UCC balances at the beginning of 2019 were as follows: Class 8: $18,000 Class 12: $20,000 During 2019 her business had the following capital transactions: She purchased a canoe for $3,000 so she could sell her flowers at the outdoor river market. She sold all of the class 12 items during the year for $14,000. Jolene Salazar runs a flower shop in Delta, B.C. as a sole proprietorship (i.e. it is her own unincorporated business). She has provided you with the following information for the year (2019): 1. She has been in a common-law marriage with Jonathan Dumfry for the last three years. Jonathan earned $7,000 this year. 2. She paid spousal support to her ex-husband in the amount of $8,000. 3. She contributed $4,000 to her RRSP, the entire amount is deductible. 4. She has a non-capital loss of $12,000 and a net capital loss of $4,000 available from some bad investments she made in 2016. 5. She is angry with her ex-husband and sold her old diamond wedding ring for $1,200 (original cost $700) and her old wedding dress for $800 (original cost $1,700). 6. Jolene has a background in accounting and prepares her financial statements in accordance with GAAP. Her net income for accounting purposes was $125,000 in 2019 and included the following: $4,000 gain on the sale of equipment used in her business $8,000 meals and entertainment expenses $7,500 amortization $3,000 in penalties from the CRA Her UCC balances at the beginning of 2019 were as follows: Class 8: $18,000 Class 12: $20,000 During 2019 her business had the following capital transactions: She purchased a canoe for $3,000 so she could sell her flowers at the outdoor river market. She sold all of the class 12 items during the year for $14,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started