Answered step by step

Verified Expert Solution

Question

1 Approved Answer

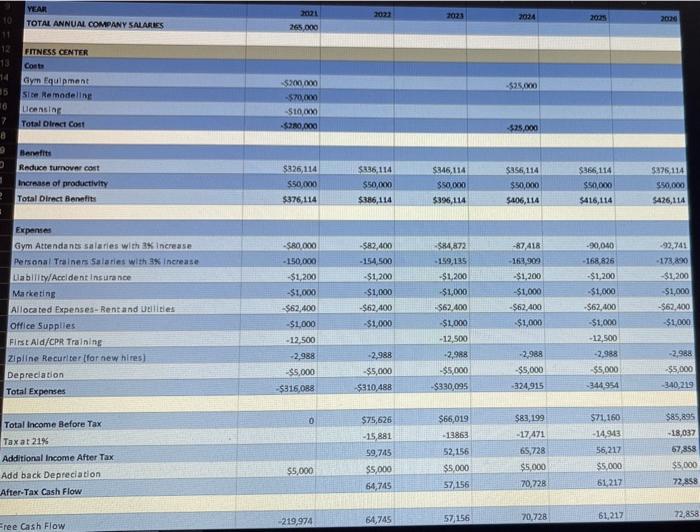

Please Calculate NPV, IRR, Discount rate and Benefit Cost Ratio for the following and show work. 2021 YEAR TOTAL ANNUAL COMPANY SALARIES 2023 10 2024

Please Calculate NPV, IRR, Discount rate and Benefit Cost Ratio for the following and show work.

2021 YEAR TOTAL ANNUAL COMPANY SALARIES 2023 10 2024 2018 2010 265.000 12 13 14 35 16 7 FITNESS CENTER Costa Gym Equipment Site Remodeling Lconsin Total Direct Cont $25.000 $200,000 -$70,00 -$100 $280.000 -$25.000 Herefits Reduce turnover cost Increase of productivity Total Direct Benefits $326,114 550.000 $376,114 $336,114 $50,000 $386,114 $346,114 $50,000 $396,114 $856,114 $50,000 5406,114 $366114 $50,000 $416,114 $376,114 $50,000 $426,114 $84,872 -159,185 -$1,200 Expenses Gym Attendants salaries with increase Personal Trainers Salaries with 3% increase Liability/Accident Insurance Marketing Allocated Expenses-Rent and wellites Office Supplies First Ald/CPR Training Zipline Recuriter (for new hires) Depreciation Total Expenses -$80,000 - 150,000 -$1,200 -$1,000 $62,400 $1,000 - 12.500 -2988 $5,000 -5316,088 582.400 - 154 500 $1,200 -$1,000 -$62,400 $1,000 -87418 163 909 -$1,200 $1,000 -$62,400 $1,000 -90,040 168,826 -$1,200 -$1.000 $62,400 -$1,000 -12,500 -2,988 $5,000 -344,954 -92,741 -173,890 $1,200 -$1,000 -$62,400 $1,000 $1,000 $62,400 $1,000 -12.500 -2.988 -$5,000 $330,095 -2,988 -$5,000 $310.48B -2,988 $5,000 324,915 -2,988 35,000 -340,219 0 $66,019 - 13863 Total Income Before Tax Taxat 21% Additional income After Tax Add back Depreciation After Tax Cash Flow $75,626 -15,881 59,745 $5,000 64,745 $83, 199 -17 471 65,728 $5,000 70,728 $71.160 14,943 56,217 $5,000 52, 156 $5,000 57,156 $85,895 -18,037 67,858 $5.000 72858 $5,000 61217 219,974 57,156 61,217 64,745 70,728 72.858 Free Cash Flow 2021 YEAR TOTAL ANNUAL COMPANY SALARIES 2023 10 2024 2018 2010 265.000 12 13 14 35 16 7 FITNESS CENTER Costa Gym Equipment Site Remodeling Lconsin Total Direct Cont $25.000 $200,000 -$70,00 -$100 $280.000 -$25.000 Herefits Reduce turnover cost Increase of productivity Total Direct Benefits $326,114 550.000 $376,114 $336,114 $50,000 $386,114 $346,114 $50,000 $396,114 $856,114 $50,000 5406,114 $366114 $50,000 $416,114 $376,114 $50,000 $426,114 $84,872 -159,185 -$1,200 Expenses Gym Attendants salaries with increase Personal Trainers Salaries with 3% increase Liability/Accident Insurance Marketing Allocated Expenses-Rent and wellites Office Supplies First Ald/CPR Training Zipline Recuriter (for new hires) Depreciation Total Expenses -$80,000 - 150,000 -$1,200 -$1,000 $62,400 $1,000 - 12.500 -2988 $5,000 -5316,088 582.400 - 154 500 $1,200 -$1,000 -$62,400 $1,000 -87418 163 909 -$1,200 $1,000 -$62,400 $1,000 -90,040 168,826 -$1,200 -$1.000 $62,400 -$1,000 -12,500 -2,988 $5,000 -344,954 -92,741 -173,890 $1,200 -$1,000 -$62,400 $1,000 $1,000 $62,400 $1,000 -12.500 -2.988 -$5,000 $330,095 -2,988 -$5,000 $310.48B -2,988 $5,000 324,915 -2,988 35,000 -340,219 0 $66,019 - 13863 Total Income Before Tax Taxat 21% Additional income After Tax Add back Depreciation After Tax Cash Flow $75,626 -15,881 59,745 $5,000 64,745 $83, 199 -17 471 65,728 $5,000 70,728 $71.160 14,943 56,217 $5,000 52, 156 $5,000 57,156 $85,895 -18,037 67,858 $5.000 72858 $5,000 61217 219,974 57,156 61,217 64,745 70,728 72.858 Free Cash Flow Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started