please calculate the adjusted entries

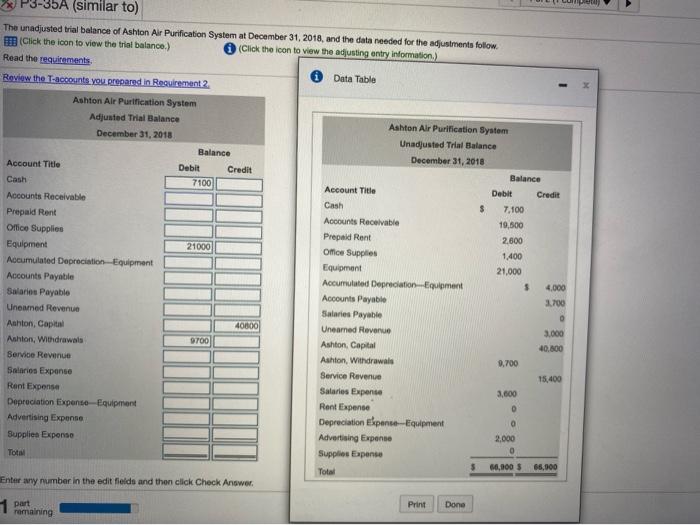

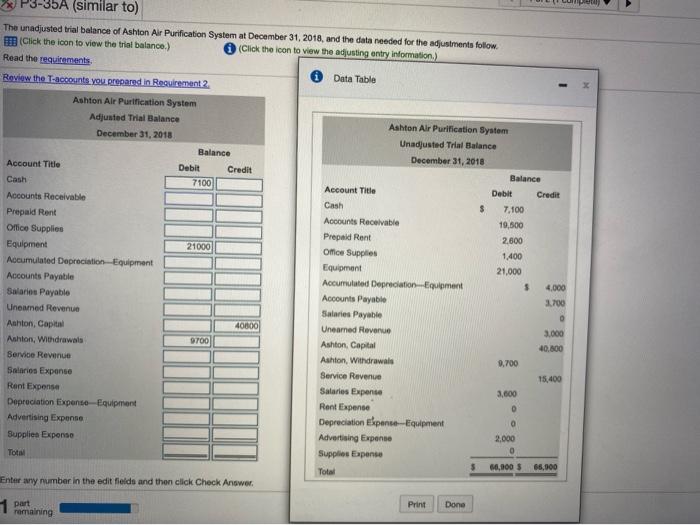

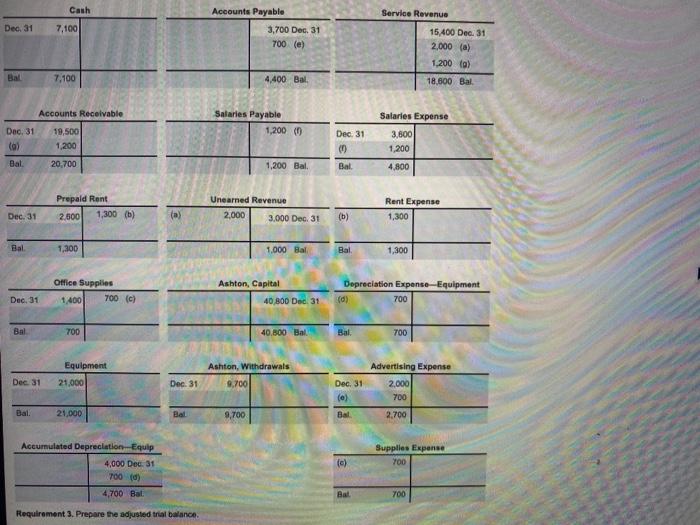

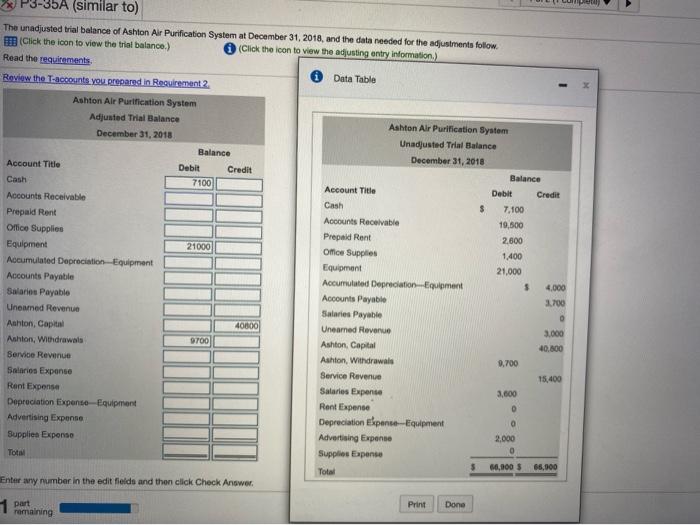

P3-35A (similar to) The unadjusted trial balance of Ashton Air Purification System at December 31, 2018, and the data needed for the adjustments follow (Click the icon to view the trial balance.) (Click the icon to view the adjusting entry information.) Read the requirements Review the T-accounts you prepared in Reovirement 2 Data Table Ashton Air Purification System Adjusted Trial Balance Ashton Air Purification System December 31, 2018 Unadjusted Trial Balance Balance December 31, 2018 Account Title Debit Credit Balance Cash 7100 Account Title Debit Credit Accounts Receivable Cash $ 7.100 Prepaid Rent Accounts Receivable 19,500 Office Supplies Prepaid Rent 2,600 Equipment 21000 Omce Supplies 1,400 Accumulated Depreciation Equipment Equipment 21,000 Accounts Payable Accumulated Depreciation Equipment $ 4,000 Salaries Payable Accounts Payable 3.700 Uneamed Revenue Salaries Payable Ashton, Capital 40000 Uneamed Revenue 3.000 Ashton, Withdrawals 9700 Ashton Capital 40.800 Service Revenue Ashton, Withdrawals 9.700 Salaries Expense Service Revenue 15,400 Rent Expense Salaries Expense 3,600 Depreciation Expense Equipment Rent Expense Advertising Expense Depreciation expans-Equipment 0 Supplies Exponse Advertising Expense 2,000 Tot Supplies Epense 60,000 $ 65,000 Total Enter any number in the edit fields and then click Check Answer Print Done remaining 1 part Cash Dec 31 7,100 Accounts Payable 3,700 Dec 31 700 (e) Service Revenus 15,400 Dec 31 2,000 (a) 1.200 al 18,600 Bal Bal 7.100 4,400 Bal. Salaries Expense Accounts Receivable Dec 31 19,500 () 1,200 Salaries Payable 1,200 Dec. 31 3,500 1,200 4.800 Bal 20,700 1,200 Bal Bal. Prepaid Rent 1,300 (6) Unearned Revenue 2,000 3.000 Dec 31 Rent Expense 1,300 Dec. 31 2.500 (a) (b) Bal 1,300 1,000 Bal Bal 1,300 Office Supplies 1/400 Ashton, Capital 40 800 Dec 31 700 (0) Dopreciation Expense-Equipment (d) 700 Dec. 31 Bal 700 40.800 Bal Bal. 700 Equipment 21.000 Ashton, Withdrawals 9,700 Dec 31 Dec 31 Dec. 31 (0) Advertising Expense 2,000 700 Bal. 21,000 Bal 9,700 Bal 2,700 Supplies Expanse 700 (c) Accumulated Depreciation Equip 4,000 Dec. 31 700 (d) 4,700 Bat Bat 700 Requirement 3. Prepare the adjusted trial balance