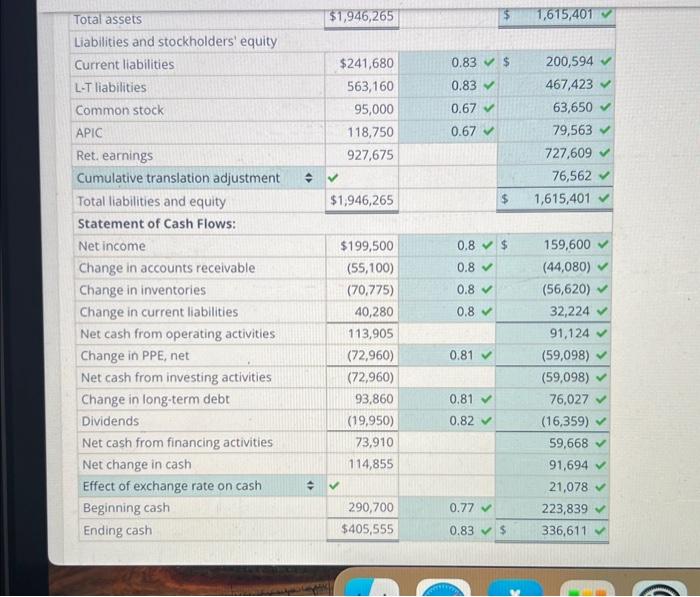

please calculate the bottom part B by red X. thank you

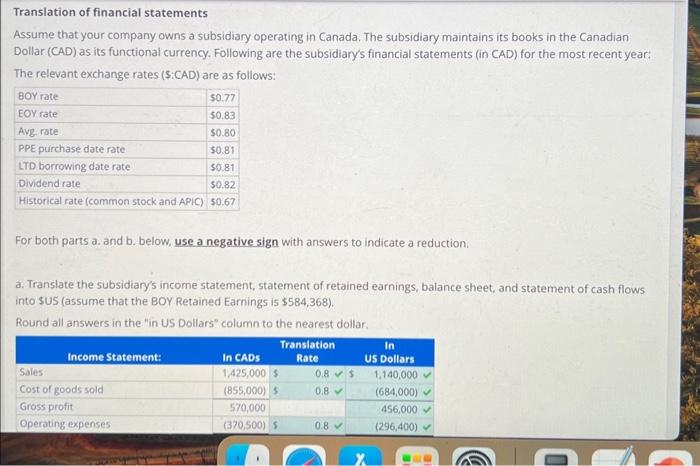

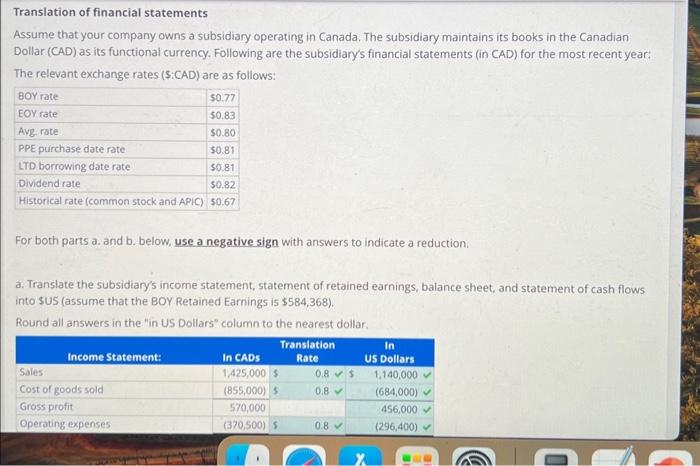

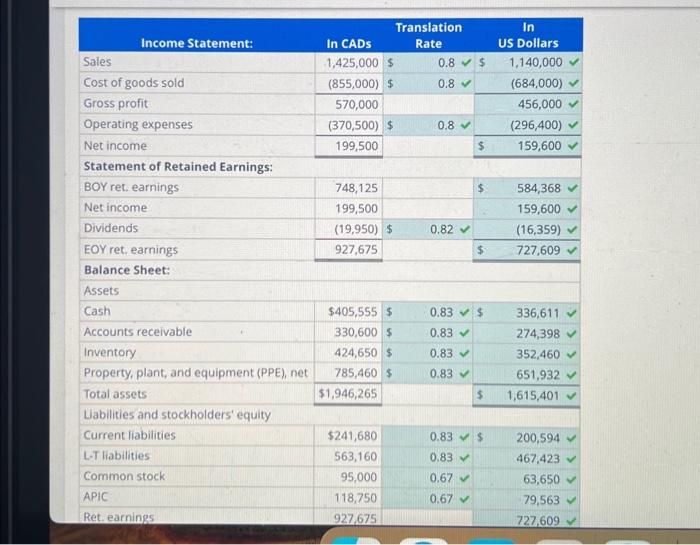

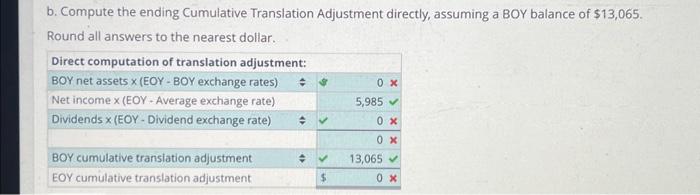

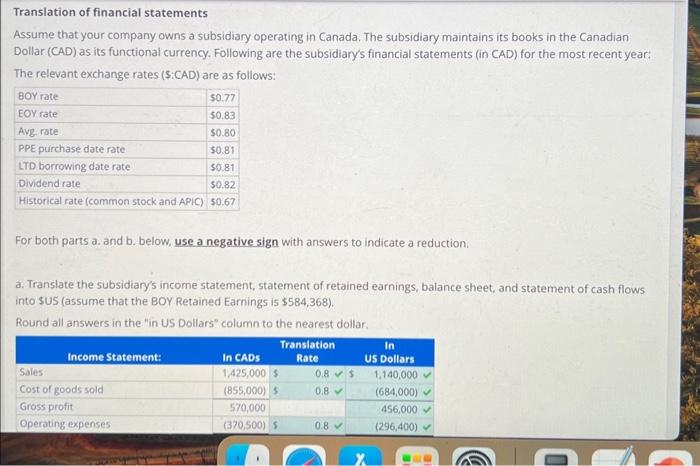

Translation of financial statements Assume that your company owns a subsidiary operating in Canada. The subsidiary maintains its books in the Canadian Dollar (CAD) as its functional currency. Following are the subsidiary's financial statements (in CAD) for the most recent year: The relevant exchange rates (S:CAD) are as follows: For both parts a. and b. below, use a negative sign with answers to indicate a reduction: a. Translate the subsidiary's income statement, statement of retained earnings, balance sheet, and statement of cash flows into suS (assume that the BOY Retained Earnings is $584,368 ). Round all answers in the "in US Dollars" column to the nearest dollar. \begin{tabular}{|c|c|c|c|c|c|} \hline Total assets & & $1,946,265 & & 5 & 1,615,401 \\ \hline \multicolumn{6}{|l|}{ Liabilities and stockholders' equity } \\ \hline Current liabilities & & $241,680 & 0.83 & $ & 200,594 \\ \hline L-T liabilities & & 563,160 & 0.83 & & 467,423 \\ \hline Common stock & & 95,000 & 0.67 & & 63,650 \\ \hline APIC & & 118,750 & 0.67 & & 79,563 \\ \hline Ret. earnings & & 927,675 & & & 727,609 \\ \hline Cumulative translation adjustment & ^ & & & & 76,562 \\ \hline Total liabilities and equity & & $1,946,265 & & $ & 1,615,401 \\ \hline \multicolumn{6}{|l|}{ Statement of Cash Flows: } \\ \hline Net income & & $199,500 & 0.8 & $ & 159,600 \\ \hline Change in accounts receivable & & (55,100) & 0.8 & & (44,080) \\ \hline Change in inventories & & (70,775) & 0.8 & & (56,620) \\ \hline Change in current liabilities & & 40,280 & 0.8 & & 32,224 \\ \hline Net cash from operating activities & & 113,905 & & & 91,124 \\ \hline Change in PPE, net & & (72,960) & 0.81 & & (59,098) \\ \hline Net cash from investing activities & & (72,960) & & & (59,098) \\ \hline Change in long-term debt & & 93.860 & 0.81 & & 76,027 \\ \hline Dividends & & (19,950) & 0.82 & & (16,359) \\ \hline Net cash from financing activities & & 73,910 & & & 59,668 \\ \hline Net change in cash & & 114,855 & & & 91,694 \\ \hline Effect of exchange rate on cash & & & & & 21,078 \\ \hline Beginning cash & & 290,700 & 0.77 & & 223,839 \\ \hline Ending cash & & $405,555 & 0.83 & $ & 336,611 \\ \hline \end{tabular} b. Compute the ending Cumulative Translation Adjustment directly, assuming a BOY balance of $13,065. Round all answers to the nearest dollar. Translation of financial statements Assume that your company owns a subsidiary operating in Canada. The subsidiary maintains its books in the Canadian Dollar (CAD) as its functional currency. Following are the subsidiary's financial statements (in CAD) for the most recent year: The relevant exchange rates (S:CAD) are as follows: For both parts a. and b. below, use a negative sign with answers to indicate a reduction: a. Translate the subsidiary's income statement, statement of retained earnings, balance sheet, and statement of cash flows into suS (assume that the BOY Retained Earnings is $584,368 ). Round all answers in the "in US Dollars" column to the nearest dollar. \begin{tabular}{|c|c|c|c|c|c|} \hline Total assets & & $1,946,265 & & 5 & 1,615,401 \\ \hline \multicolumn{6}{|l|}{ Liabilities and stockholders' equity } \\ \hline Current liabilities & & $241,680 & 0.83 & $ & 200,594 \\ \hline L-T liabilities & & 563,160 & 0.83 & & 467,423 \\ \hline Common stock & & 95,000 & 0.67 & & 63,650 \\ \hline APIC & & 118,750 & 0.67 & & 79,563 \\ \hline Ret. earnings & & 927,675 & & & 727,609 \\ \hline Cumulative translation adjustment & ^ & & & & 76,562 \\ \hline Total liabilities and equity & & $1,946,265 & & $ & 1,615,401 \\ \hline \multicolumn{6}{|l|}{ Statement of Cash Flows: } \\ \hline Net income & & $199,500 & 0.8 & $ & 159,600 \\ \hline Change in accounts receivable & & (55,100) & 0.8 & & (44,080) \\ \hline Change in inventories & & (70,775) & 0.8 & & (56,620) \\ \hline Change in current liabilities & & 40,280 & 0.8 & & 32,224 \\ \hline Net cash from operating activities & & 113,905 & & & 91,124 \\ \hline Change in PPE, net & & (72,960) & 0.81 & & (59,098) \\ \hline Net cash from investing activities & & (72,960) & & & (59,098) \\ \hline Change in long-term debt & & 93.860 & 0.81 & & 76,027 \\ \hline Dividends & & (19,950) & 0.82 & & (16,359) \\ \hline Net cash from financing activities & & 73,910 & & & 59,668 \\ \hline Net change in cash & & 114,855 & & & 91,694 \\ \hline Effect of exchange rate on cash & & & & & 21,078 \\ \hline Beginning cash & & 290,700 & 0.77 & & 223,839 \\ \hline Ending cash & & $405,555 & 0.83 & $ & 336,611 \\ \hline \end{tabular} b. Compute the ending Cumulative Translation Adjustment directly, assuming a BOY balance of $13,065. Round all answers to the nearest dollar