Answered step by step

Verified Expert Solution

Question

1 Approved Answer

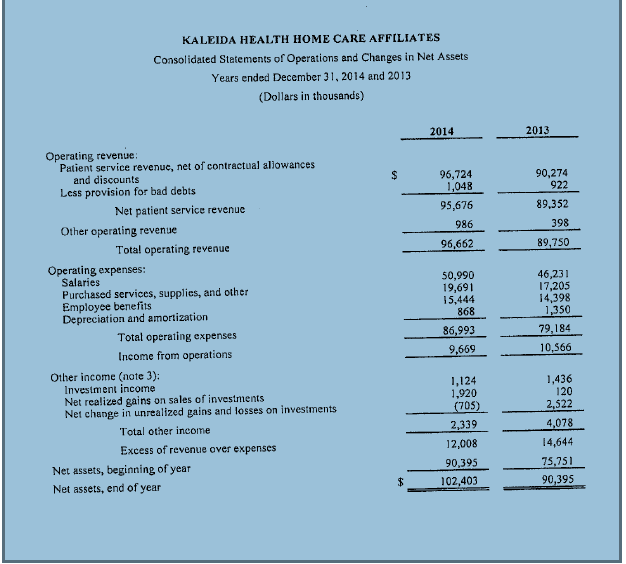

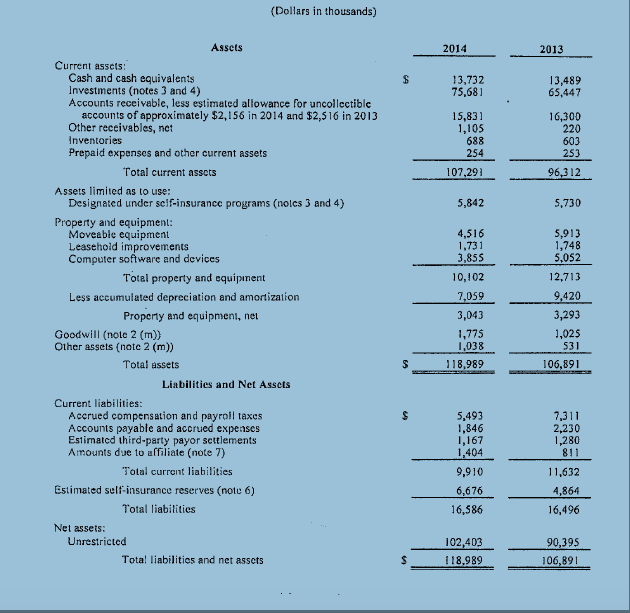

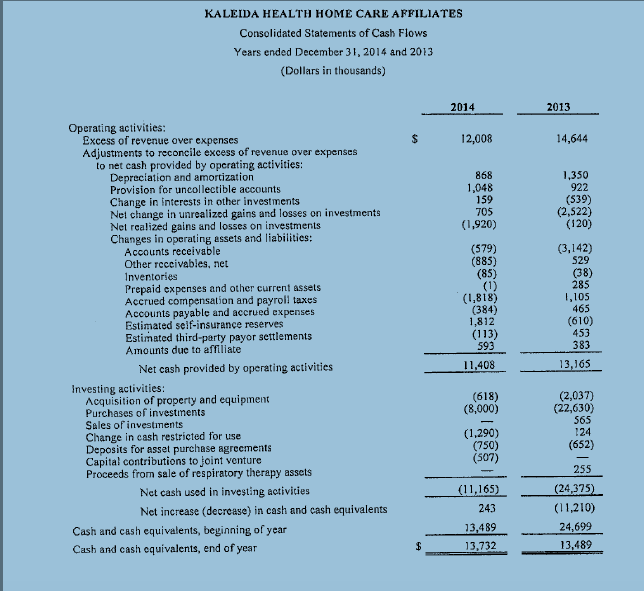

Please calculate the following ratios and discuss their importance for the year ended 12.31.14. (a) Current Ratio (b) Days of Cash (c) Days of A/R

Please calculate the following ratios and discuss their importance for the year ended 12.31.14. (a) Current Ratio (b) Days of Cash (c) Days of A/R (d) Debt to Assets (e) Debt to Equity (f) Return on Assets (g) Return on Equity (h) Average Payment Period (i) Net Margin (j) Working Capital (k) Average Age of Plant (l) Quick Ratio

KALEIDA HEALTH HOME CARE AFFILIATES Consolidated Statements of Operations and Changes in Net Assets Years ended December 31, 2014 and 2013 (Dollars in thousands) 2014 2013 Operating revenue Patient service revenue, net of contractual allowances and discounts Less provision for bad debts 96,724 ,048 95,676 90,274 922 Net patient service revenue 89,352 398 89,750 Other operating revenue 986 96,662 Total operating revenue Operating expenses Salaries Purchased services, supplics, and other Employee benefits Depreciation and amortization 50,990 19,691 5,444 868 46,231 7,205 4,398 1,350 79,184 Total operating expenses Income from operations 86,993 9,669 Other income (note 3): Investment income Net realized gains on sales of investments Net change in unrealized gains and losses on investments 1,124 1,920 705 1,436 120 522 Total other income 2,339 12,008 4,078 Excess of revenue over expenses 4,644 75,751 Net assets, beginning of year Net assets, end of year 102,403 90,395Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started