Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please calculate the following ratios using the attached financial statements for 2017. Current Ratio: Days Cash on Hand Debt Ratio Total Margin OU Hospital Consolidated

Please calculate the following ratios using the attached financial statements for 2017.

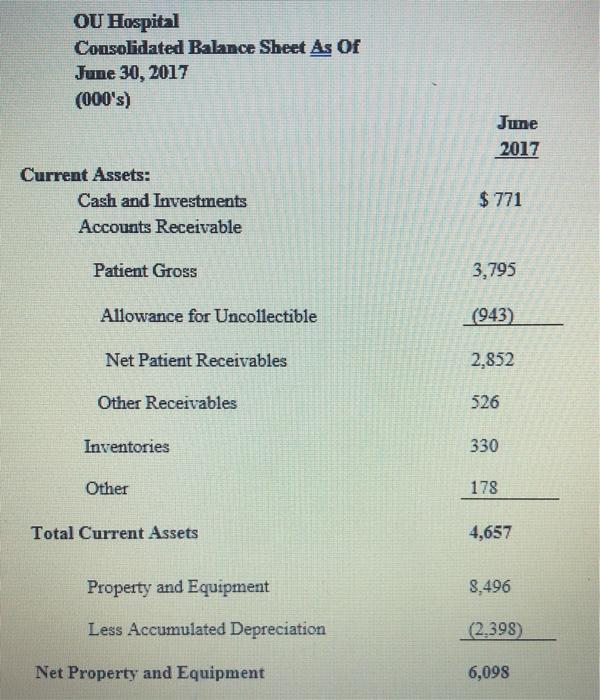

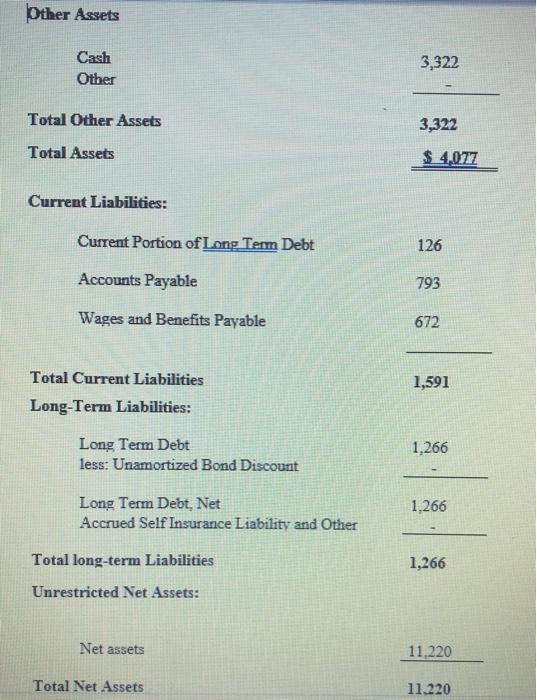

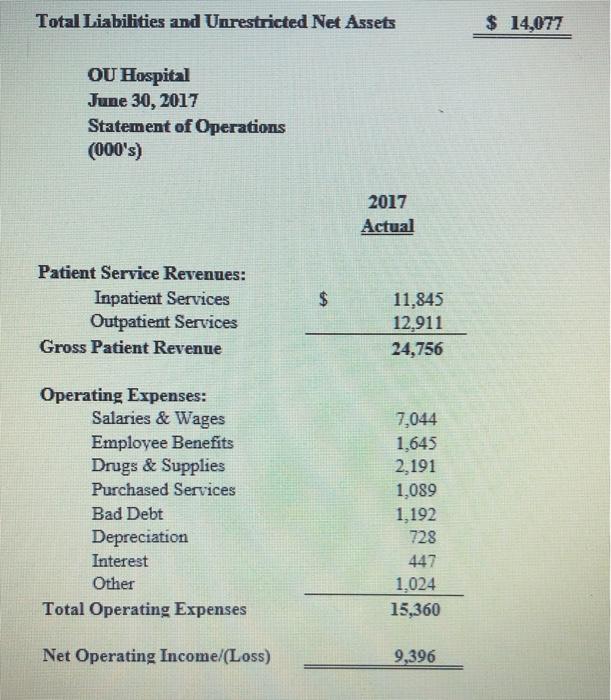

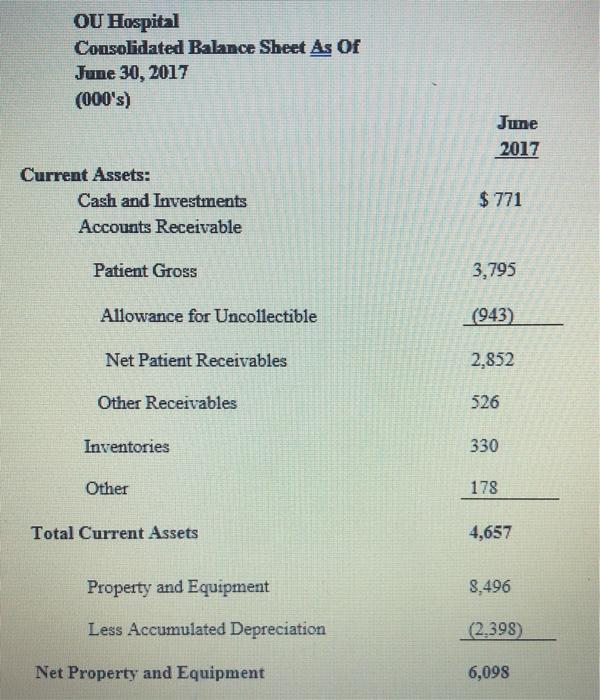

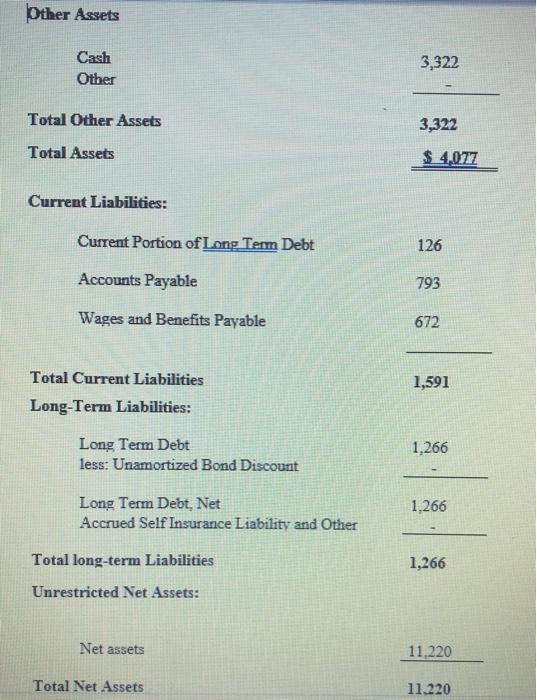

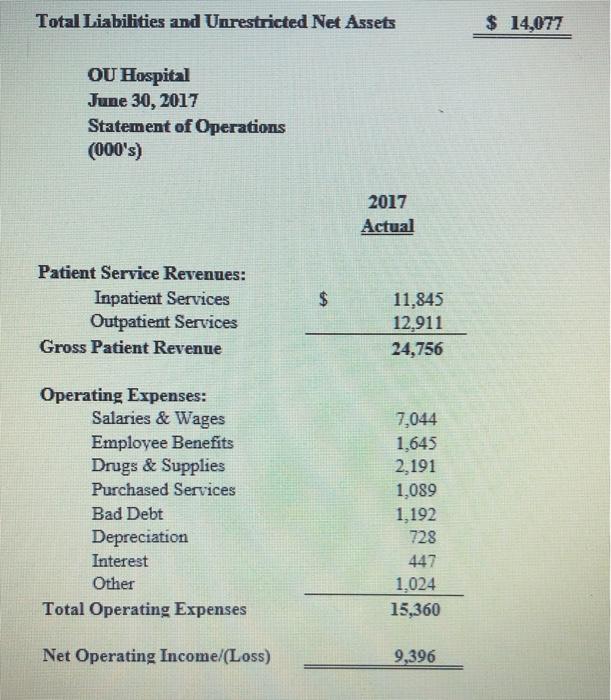

OU Hospital Consolidated Balance Sheet As Of June 30, 2017 (000's) June 2017 Current Assets: Cash and Investments Accounts Receivable $ 771 Patient Gross 3,795 Allowance for Uncollectible (943) Net Patient Receivables 2,852 Other Receivables 526 Inventories 330 Other 178 Total Current Assets 4,657 Property and Equipment 8,496 Less Accumulated Depreciation (2,398) Net Property and Equipment 6,098 Other Assets Cash Other 3,322 Total Other Assets 3,322 Total Assets $ 4,077 Current Liabilities: Current Portion of Long Term Debt 126 Accounts Payable 793 Wages and Benefits Payable 672 1,591 Total Current Liabilities Long-Term Liabilities: Long Term Debt less: Unamortized Bond Discount 1,266 Long Term Debt, Net Accrued Self Insurance Liability and Other 1.266 Total long-term Liabilities 1,266 Unrestricted Net Assets: Net assets 11,220 Total Net Assets 11.220 Total Liabilities and Unrestricted Net Assets $ 14,077 OU Hospital June 30, 2017 Statement of Operations (000's) 2017 Actual $ Patient Service Revenues: Inpatient Services Outpatient Services Gross Patient Revenue 11,845 12,911 24,756 Operating Expenses: Salaries & Wages Employee Benefits Drugs & Supplies Purchased Services Bad Debt Depreciation Interest Other Total Operating Expenses 7,044 1,645 2.191 1,089 1,192 728 447 1,024 15,360 Net Operating Income/(Loss) 9,396 Current Ratio:

Days Cash on Hand

Debt Ratio

Total Margin

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started