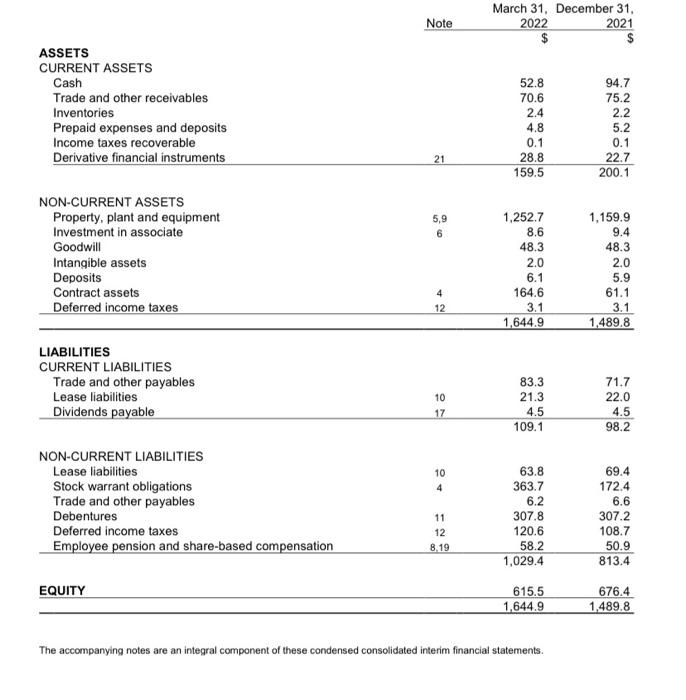

Please calculate the solvency ratio for 2022

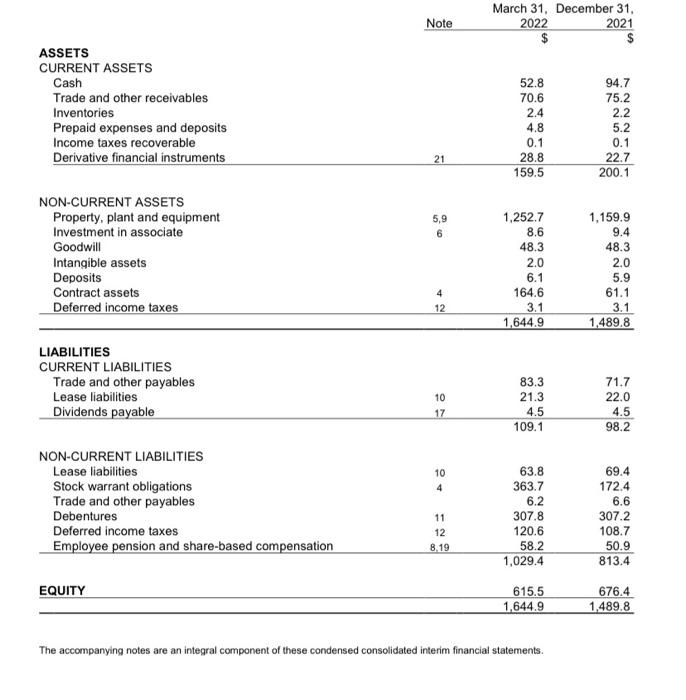

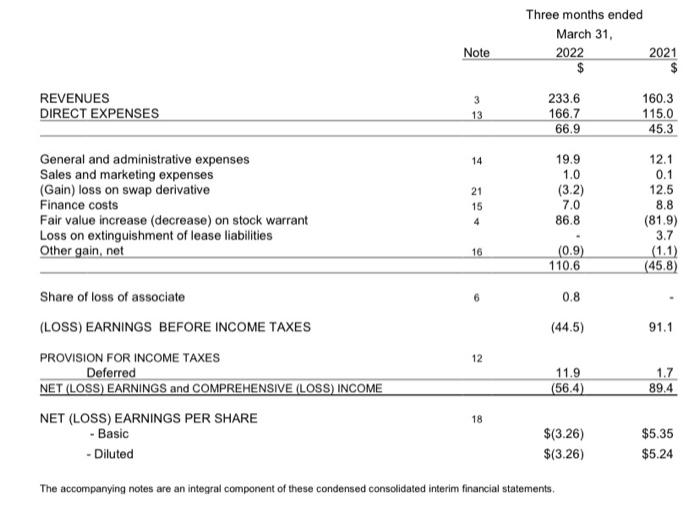

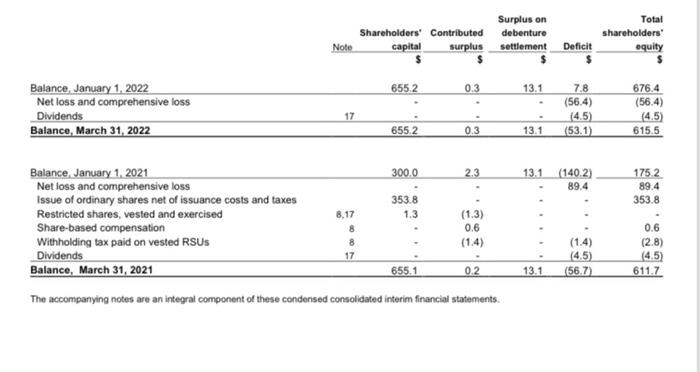

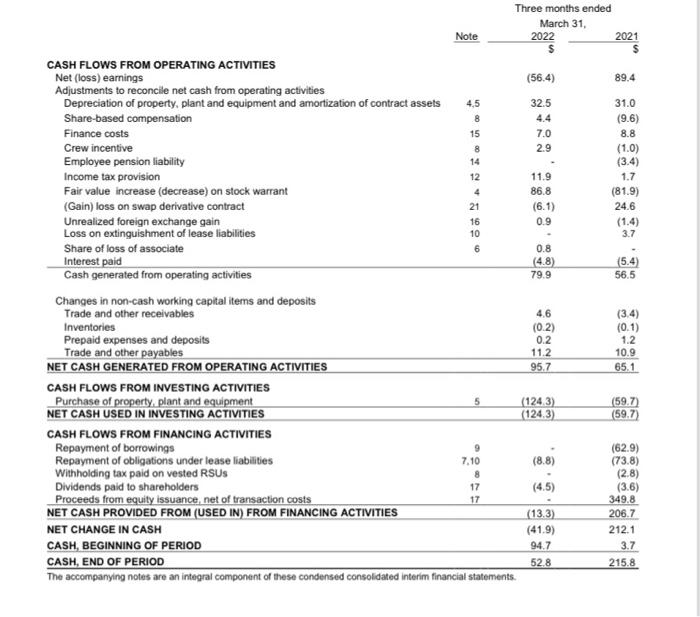

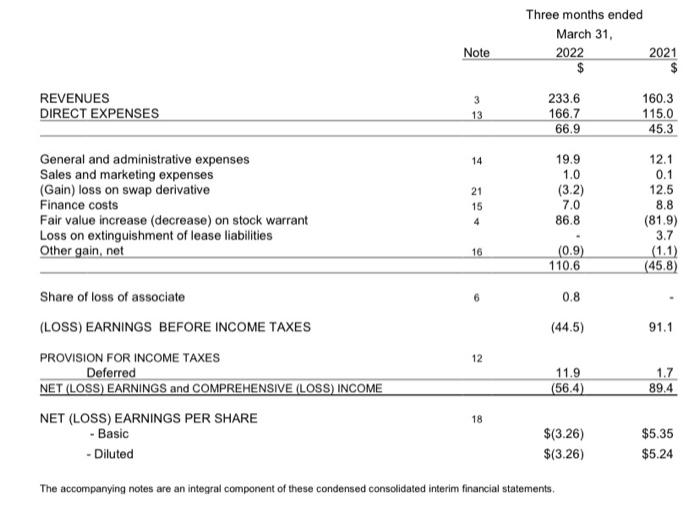

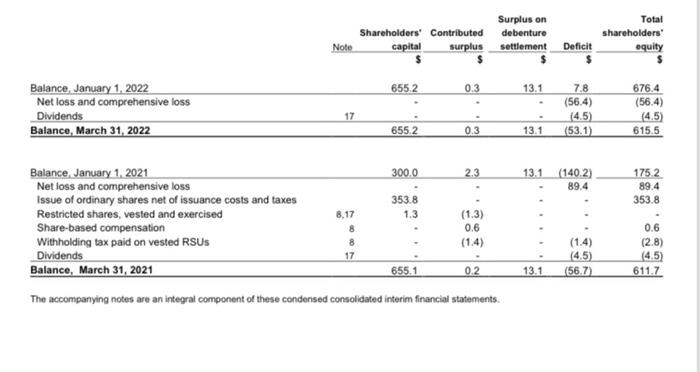

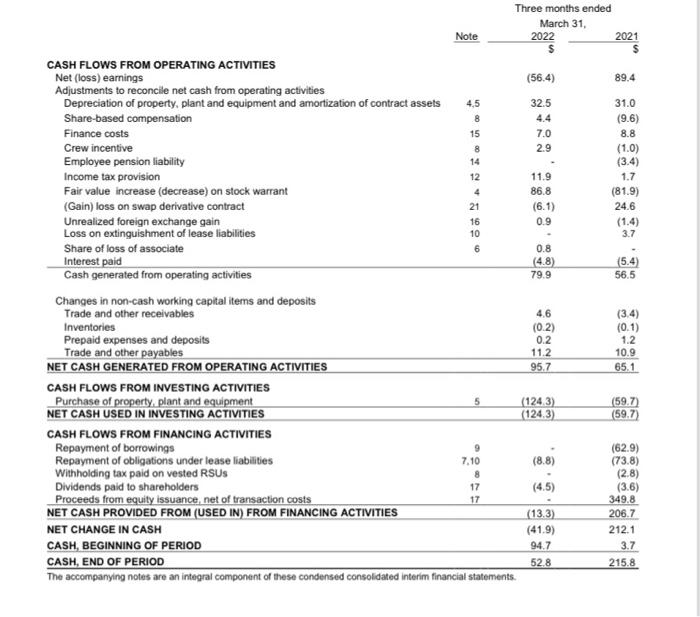

Note 21 5,9 6 March 31, December 31, 2022 2021 $ 94.7 75.2 2.2 5.2 0.1 22.7 200.1 1,159.9 9.4 48.3 2.0 5.9 61.1 3.1 1,489.8 71.7 22.0 4.5 98.2 69.4 172.4 6.6 307.2 108.7 50.9 813.4 676.4 1,489.8 ASSETS CURRENT ASSETS Cash Trade and other receivables Inventories Prepaid expenses and deposits Income taxes recoverable Derivative financial instruments NON-CURRENT ASSETS Property, plant and equipment Investment in associate Goodwill Intangible assets Deposits Contract assets 4 Deferred income taxes 12 LIABILITIES CURRENT LIABILITIES Trade and other payables Lease liabilities 10 Dividends payable 17 109.1 NON-CURRENT LIABILITIES Lease liabilities 10 63.8 4 363.7 Stock warrant obligations Trade and other payables Debentures 6.2 11 307.8 Deferred income taxes 12 120.6 Employee pension and share-based compensation 8,19 58.2 1,029.4 EQUITY 615.5 1,644.9 The accompanying notes are an integral component of these condensed consolidated interim financial statements. 52.8 70.6 2.4 4.8 0.1 28.8 159.5 1,252.7 8.6 48.3 2.0 6.1 164.6 3.1 1,644.9 83.3 21.3 4.5 Three months ended March 31, 2022 233.6 166.7 66.9 19.9 1.0 (3.2) 7.0 86.8 (0.9) Note REVENUES 3 DIRECT EXPENSES 13 General and administrative expenses 14 Sales and marketing expenses 21 (Gain) loss on swap derivative Finance costs 15 4 Fair value increase (decrease) on stock warrant Loss on extinguishment of lease liabilities Other gain, net 16 110.6 Share of loss of associate 0.8 (LOSS) EARNINGS BEFORE INCOME TAXES (44.5) PROVISION FOR INCOME TAXES 12 Deferred 11.9 NET (LOSS) EARNINGS and COMPREHENSIVE (LOSS) INCOME (56.4) NET (LOSS) EARNINGS PER SHARE 18 - Basic $(3.26) - Diluted $(3.26) The accompanying notes are an integral component of these condensed consolidated interim financial statements. $ 2021 160.3 115.0 45.3 12.1 0.1 12.5 8.8 (81.9) 3.7 (1.1) (45.8) 91.1 1.7 89.4 $5.35 $5.24 Surplus on debenture Shareholders Contributed Note capital surplus settlement Deficit $ Balance, January 1, 2022 655.2 0.3 13.1 7.8 (56.4) Net loss and comprehensive loss Dividends 17 (4.5) Balance, March 31, 2022 655.2 0.3 13.1 (53.1) Balance, January 1, 2021 300.0 2.3 13.1 (140.2) Net loss and comprehensive loss 89.4 Issue of ordinary shares net of issuance costs and taxes 353.8 Restricted shares, vested and exercised 8,17 1.3 (1.3) Share-based compensation 8 0.6 Withholding tax paid on vested RSUS 8 (1.4) . Dividends 17 Balance, March 31, 2021 655.1 0.2 13.1 The accompanying notes are an integral component of these condensed consolidated interim financial statements. (1.4) (4.5) (56.7) Total shareholders equity 676.4 (56.4) (4.5) 615.5 175.2 89.4 353.8 0.6 (2.8) (4.5) 611.7 Three months ended March 31, Note 2022 $ CASH FLOWS FROM OPERATING ACTIVITIES Net (loss) earnings (56.4) Adjustments to reconcile net cash from operating activities Depreciation of property, plant and equipment and amortization of contract assets 4,5 32.5 Share-based compensation 8 Finance costs 15 7.0 Crew incentive 2.9 Employee pension liability Income tax provision 11.9 Fair value increase (decrease) on stock warrant 86.8 (Gain) loss on swap derivative contract (6.1) Unrealized foreign exchange gain 0.9 Loss on extinguishment of lease liabilities Share of loss of associate 0.8 Interest paid (4.8) Cash generated from operating activities 79.9 Changes in non-cash working capital items and deposits Trade and other receivables 4.6 Inventories (0.2) Prepaid expenses and deposits 0.2 Trade and other payables 11.2 NET CASH GENERATED FROM OPERATING ACTIVITIES 95.7 CASH FLOWS FROM INVESTING ACTIVITIES (124.3) Purchase of property, plant and equipment NET CASH USED IN INVESTING ACTIVITIES (124.3) CASH FLOWS FROM FINANCING ACTIVITIES Repayment of borrowings 9 7.10 (8.8) Repayment of obligations under lease liabilities Withholding tax paid on vested RSUS 8 Dividends paid to shareholders 17 (4.5) Proceeds from equity issuance, net of transaction costs 17 (13.3) NET CASH PROVIDED FROM (USED IN) FROM FINANCING ACTIVITIES NET CHANGE IN CASH (41.9) CASH, BEGINNING OF PERIOD 94.7 CASH, END OF PERIOD 52.8 The accompanying notes are an integral component of these condensed consolidated interim financial statements. 8 14 12 4 21 16 10 6 5 2021 89.4 31.0 $ (9.6) 8.8 (1.0) (3.4) 1.7 (81.9) 24.6 (1.4) 3.7 (5.4) 56.5 (3.4) (0.1) 1.2 10.9 65.1 (59.7) (59.7) (62.9) (73.8) (2.8) (3.6) 349.8 206.7 212.1 3.7 215.8