Please calculate the statement of cash flow using the Indirect Method.

Please calculate the statement of cash flow using the Indirect Method.

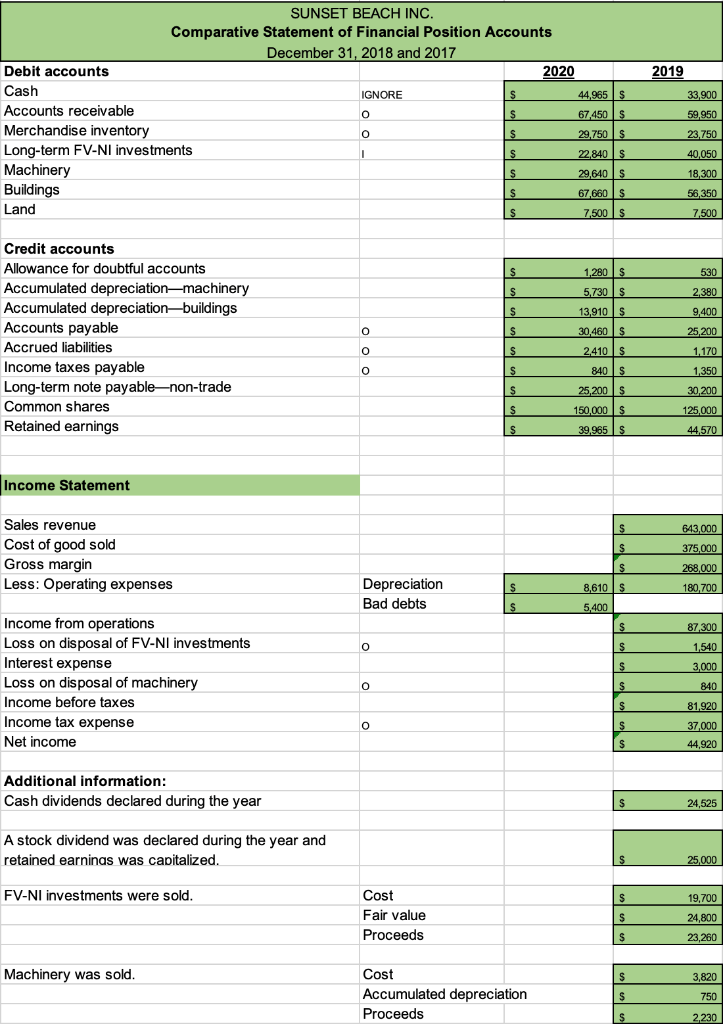

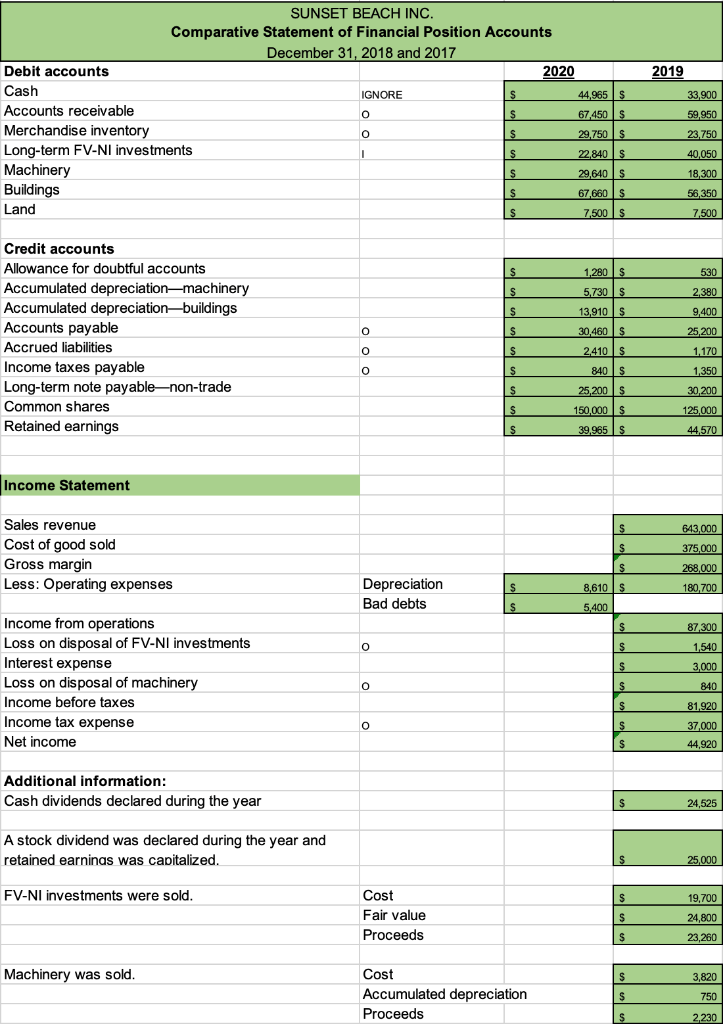

2019 33,900 SUNSET BEACH INC. Comparative Statement of Financial Position Accounts December 31, 2018 and 2017 Debit accounts 2020 Cash IGNORE S 44,965 $ Accounts receivable o S 67,450 $ Merchandise inventory O $ 29,750 $ Long-term FV-NI investments 1 $ 22.840 Machinery $ 29,640 $ Buildings s 67,660 $ Land S 7,500 $ 59,950 23,750 40,050 18,300 56,350 7,500 1,280S 530 S $ 2.380 $ 5,730 13,910 $ 30,460 $ 9,400 o s Credit accounts Allowance for doubtful accounts Accumulated depreciation-machinery Accumulated depreciation buildings Accounts payable Accrued liabilities Income taxes payable Long-term note payable-non-trade Common shares Retained earnings 25,200 1,170 o S S o 2.410 840 $ 25,200 $ 1,350 $ 30,200 S 150,000 $ 125,000 S 39,965 $ 44,570 Income Statement $ 643,000 $ Sales revenue Cost of good sold Gross margin Less: Operating expenses 375,000 268,000 $ $ Depreciation Bad debts 180,700 8,610S 5,400 $ $ 87,300 o S 1,540 3,000 $ Income from operations Loss on disposal of FV-NI investments Interest expense Loss on disposal of machinery Income before taxes Income tax expense Net income o $ $ 840 81,920 37,000 44,920 o S S Additional information: Cash dividends declared during the year $ 24,525 A stock dividend was declared during the year and retained earnings was capitalized. S 25,000 FV-NI investments were sold. s 19,700 Cost Fair value Proceeds S 24,800 $ $ 23,260 Machinery was sold. $ Cost Accumulated depreciation Proceeds 3,820 750 s S s 2230 2019 33,900 SUNSET BEACH INC. Comparative Statement of Financial Position Accounts December 31, 2018 and 2017 Debit accounts 2020 Cash IGNORE S 44,965 $ Accounts receivable o S 67,450 $ Merchandise inventory O $ 29,750 $ Long-term FV-NI investments 1 $ 22.840 Machinery $ 29,640 $ Buildings s 67,660 $ Land S 7,500 $ 59,950 23,750 40,050 18,300 56,350 7,500 1,280S 530 S $ 2.380 $ 5,730 13,910 $ 30,460 $ 9,400 o s Credit accounts Allowance for doubtful accounts Accumulated depreciation-machinery Accumulated depreciation buildings Accounts payable Accrued liabilities Income taxes payable Long-term note payable-non-trade Common shares Retained earnings 25,200 1,170 o S S o 2.410 840 $ 25,200 $ 1,350 $ 30,200 S 150,000 $ 125,000 S 39,965 $ 44,570 Income Statement $ 643,000 $ Sales revenue Cost of good sold Gross margin Less: Operating expenses 375,000 268,000 $ $ Depreciation Bad debts 180,700 8,610S 5,400 $ $ 87,300 o S 1,540 3,000 $ Income from operations Loss on disposal of FV-NI investments Interest expense Loss on disposal of machinery Income before taxes Income tax expense Net income o $ $ 840 81,920 37,000 44,920 o S S Additional information: Cash dividends declared during the year $ 24,525 A stock dividend was declared during the year and retained earnings was capitalized. S 25,000 FV-NI investments were sold. s 19,700 Cost Fair value Proceeds S 24,800 $ $ 23,260 Machinery was sold. $ Cost Accumulated depreciation Proceeds 3,820 750 s S s 2230

Please calculate the statement of cash flow using the Indirect Method.

Please calculate the statement of cash flow using the Indirect Method.