Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please calculate these working capital requirements from 2005 through 2010 The tables and figures are posted in the order in which they appear in the

Please calculate these working capital requirements from 2005 through 2010

Please calculate these working capital requirements from 2005 through 2010

The tables and figures are posted in the order in which they appear in the initial question.

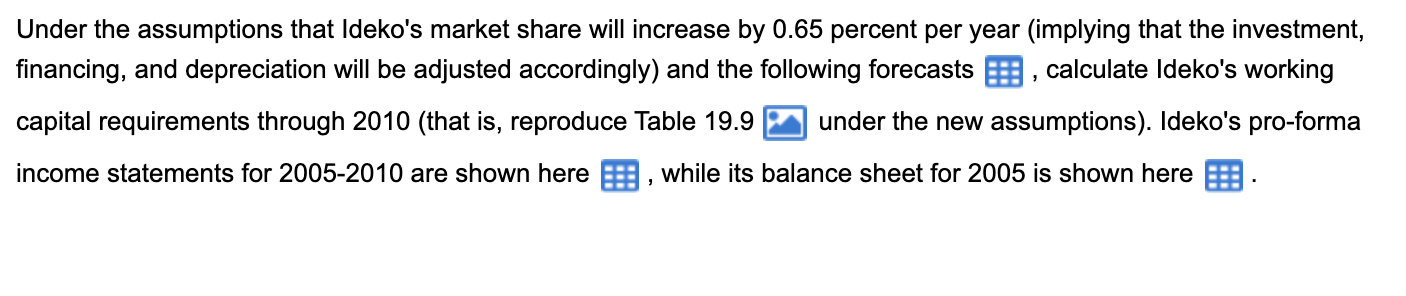

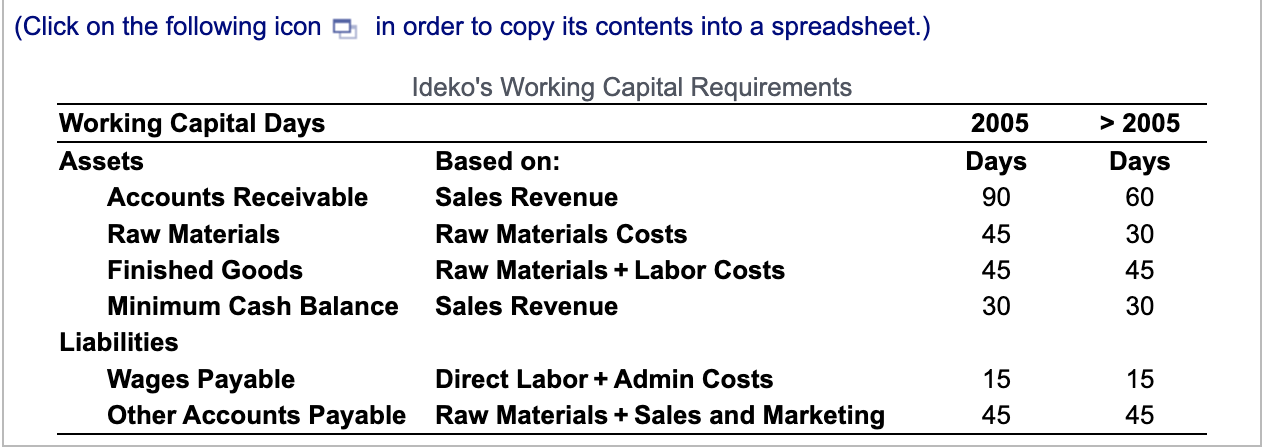

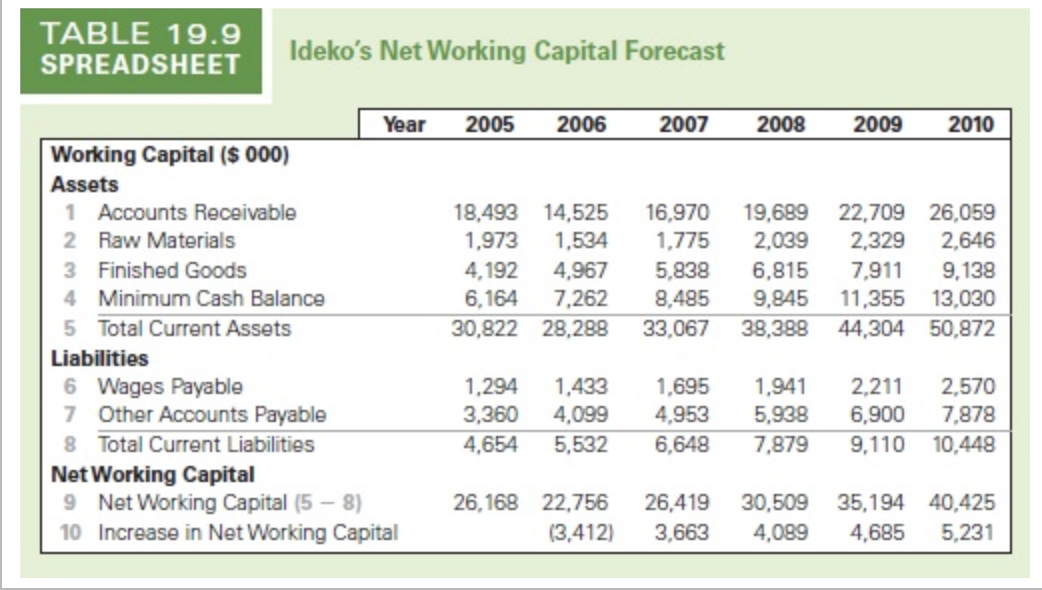

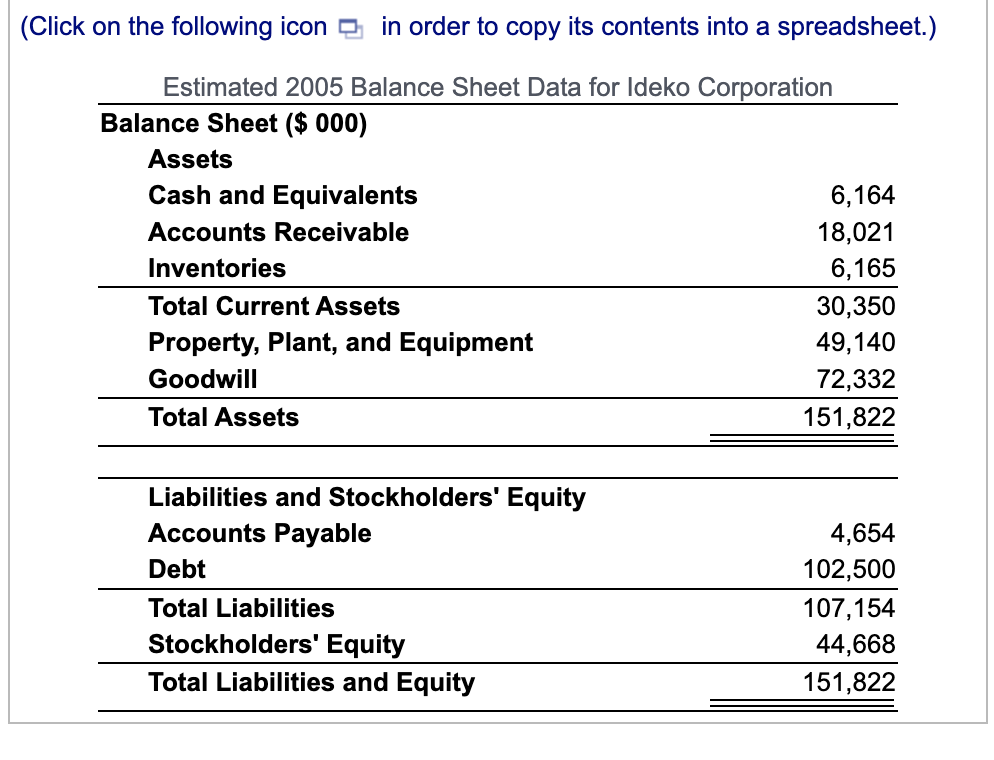

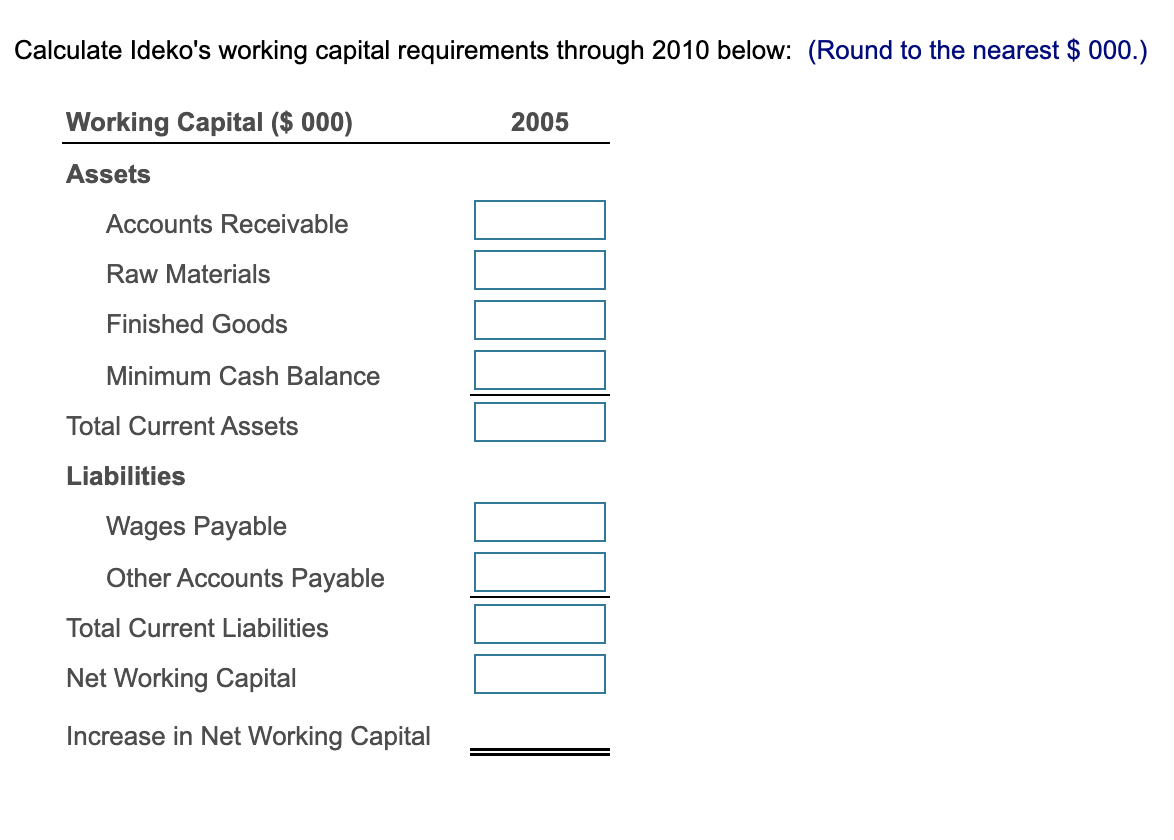

Under the assumptions that Ideko's market share will increase by 0.65 percent per year (implying that the investment, financing, and depreciation will be adjusted accordingly) and the following forecasts , calculate Ideko's working capital requirements through 2010 (that is, reproduce Table 19.9 under the new assumptions). Ideko's pro-forma income statements for 2005-2010 are shown here_, while its balance sheet for 2005 is shown here (Click on the following icon in order to copy its contents into a spreadsheet.) Ideko's Net Working Capital Forecast \begin{tabular}{lrrrrrr} Income Statement ($000) & 2005 & 2006 & 2007 & 2008 & 2009 & 2010 \\ \hline Sales & 73,085 & 83,457 & 94,938 & 107,635 & 121,663 & 137,148 \end{tabular} Cost of Goods Sold \begin{tabular}{lrrrrrr} Raw Materials & (15,940) & (18,007) & (20,263) & (22,725) & (25,410) & (28,336) \\ Direct Labor Costs & (17,444) & (20,310) & (23,556) & (27,229) & (31,380) & (36,067) \\ \cline { 2 - 7 } Gross Profit & 39,701 & 45,140 & 51,119 & 57,681 & 64,873 & 72,745 \\ Sales and Marketing & (10,875) & (13,629) & (16,880) & (20,698) & (23,943) & (26,991) \\ Administrative & (13,163) & (12,527) & (14,250) & (15,080) & (15,828) & (17,843) \\ EBITDA & 15,663 & 18,984 & 19,989 & 21,903 & 25,102 & 27,911 \\ Depreciation & (5,460) & (5,419) & (5,382) & (5,349) & (5,319) & (6,852) \\ EBIT & 10,203 & 13,565 & 14,607 & 16,554 & 19,783 & 21,059 \\ Interest Expense (net) & (75) & (6,888) & (6,888) & (6,888) & (6,888) & (6,888) \\ Pretax Income & 10,128 & 6,677 & 7,719 & 9,666 & 12,895 & 14,171 \\ Income Tax & (3,545) & (2,337) & (2,702) & (3,383) & (4,513) & (4,960) \\ \hline Net Income & 6,583 & 4,340 & 5,017 & 6,283 & 8,382 & 9,211 \\ \hline \hline \end{tabular} (Click on the following icon in order to copy its contents into a spreadsheet.) Calculate Ideko's working capital requirements through 2010 below: (Round to the nearest $000.) Under the assumptions that Ideko's market share will increase by 0.65 percent per year (implying that the investment, financing, and depreciation will be adjusted accordingly) and the following forecasts , calculate Ideko's working capital requirements through 2010 (that is, reproduce Table 19.9 under the new assumptions). Ideko's pro-forma income statements for 2005-2010 are shown here_, while its balance sheet for 2005 is shown here (Click on the following icon in order to copy its contents into a spreadsheet.) Ideko's Net Working Capital Forecast \begin{tabular}{lrrrrrr} Income Statement ($000) & 2005 & 2006 & 2007 & 2008 & 2009 & 2010 \\ \hline Sales & 73,085 & 83,457 & 94,938 & 107,635 & 121,663 & 137,148 \end{tabular} Cost of Goods Sold \begin{tabular}{lrrrrrr} Raw Materials & (15,940) & (18,007) & (20,263) & (22,725) & (25,410) & (28,336) \\ Direct Labor Costs & (17,444) & (20,310) & (23,556) & (27,229) & (31,380) & (36,067) \\ \cline { 2 - 7 } Gross Profit & 39,701 & 45,140 & 51,119 & 57,681 & 64,873 & 72,745 \\ Sales and Marketing & (10,875) & (13,629) & (16,880) & (20,698) & (23,943) & (26,991) \\ Administrative & (13,163) & (12,527) & (14,250) & (15,080) & (15,828) & (17,843) \\ EBITDA & 15,663 & 18,984 & 19,989 & 21,903 & 25,102 & 27,911 \\ Depreciation & (5,460) & (5,419) & (5,382) & (5,349) & (5,319) & (6,852) \\ EBIT & 10,203 & 13,565 & 14,607 & 16,554 & 19,783 & 21,059 \\ Interest Expense (net) & (75) & (6,888) & (6,888) & (6,888) & (6,888) & (6,888) \\ Pretax Income & 10,128 & 6,677 & 7,719 & 9,666 & 12,895 & 14,171 \\ Income Tax & (3,545) & (2,337) & (2,702) & (3,383) & (4,513) & (4,960) \\ \hline Net Income & 6,583 & 4,340 & 5,017 & 6,283 & 8,382 & 9,211 \\ \hline \hline \end{tabular} (Click on the following icon in order to copy its contents into a spreadsheet.) Calculate Ideko's working capital requirements through 2010 below: (Round to the nearest $000.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started