Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please can do general journal, closing entries, general ledger and trial balance please thank you During the second half of December 20-1, Tis Specialty Shop

please can do general journal, closing entries, general ledger and trial balance please

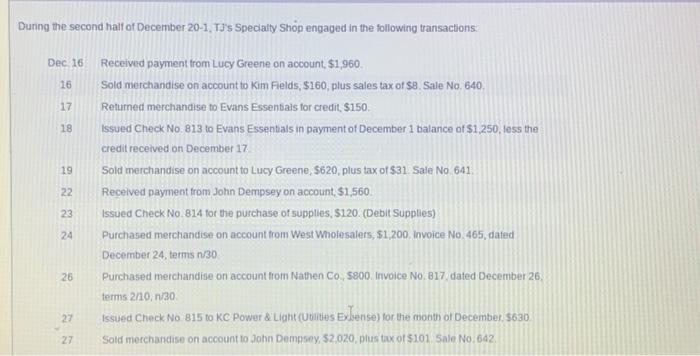

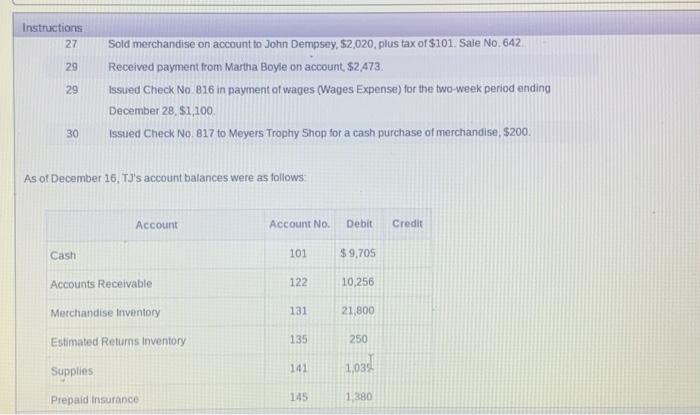

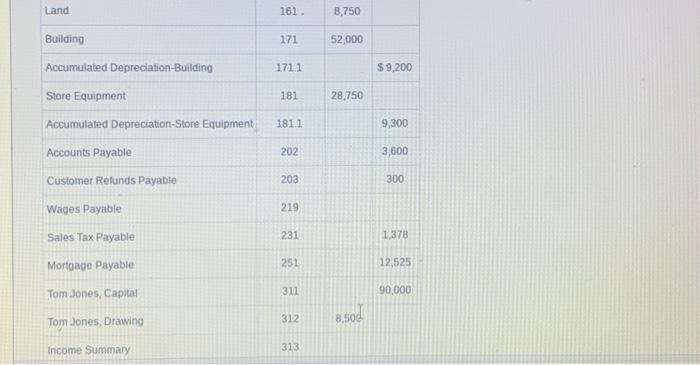

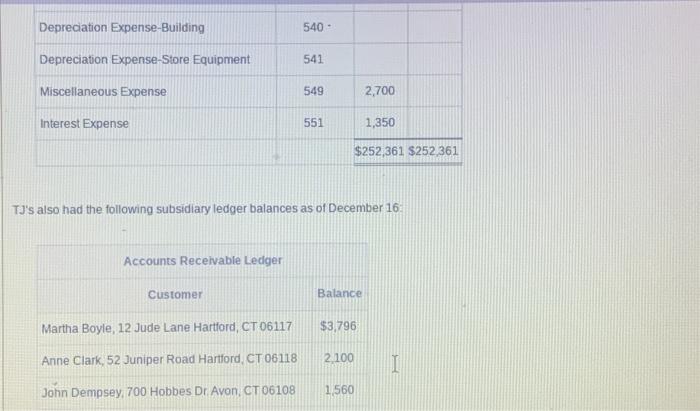

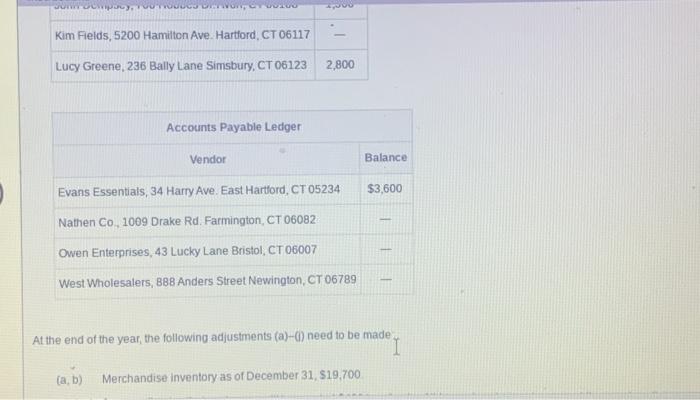

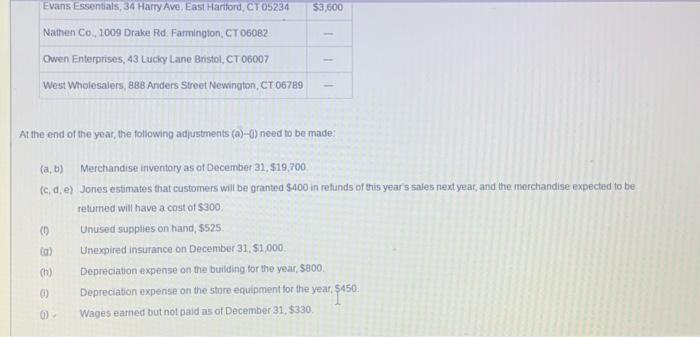

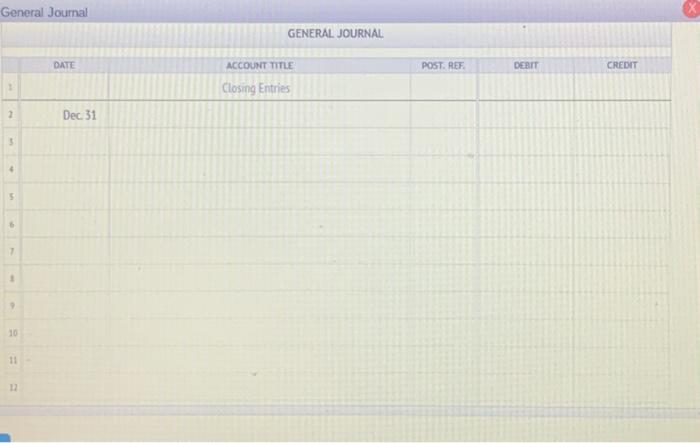

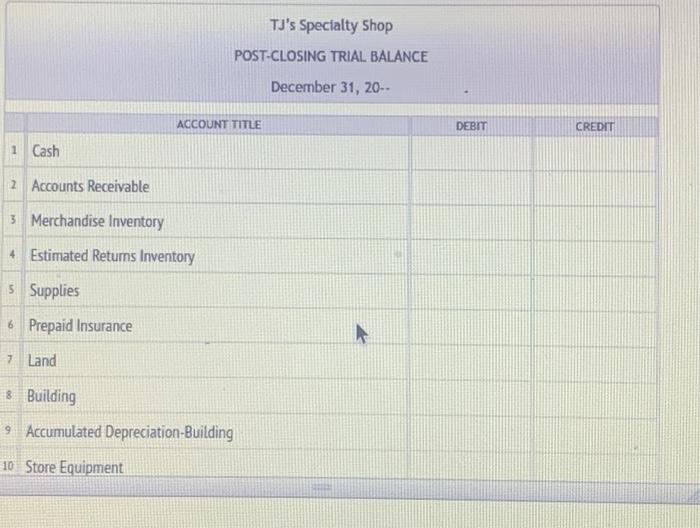

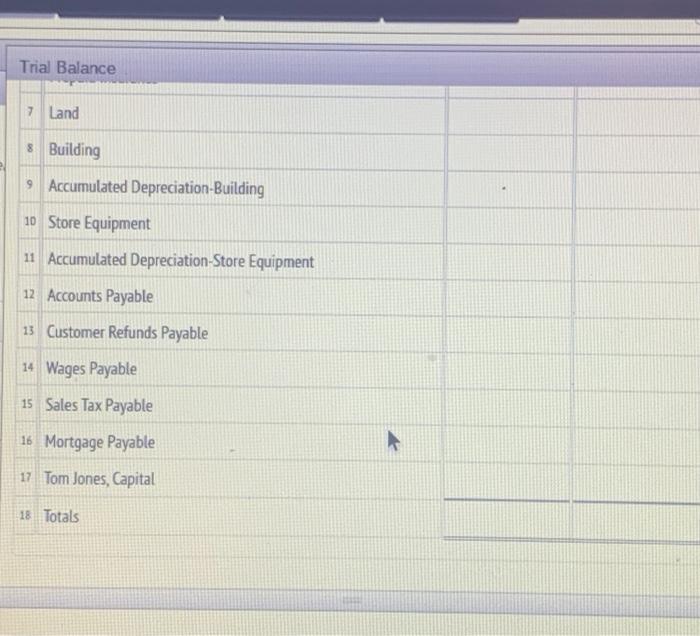

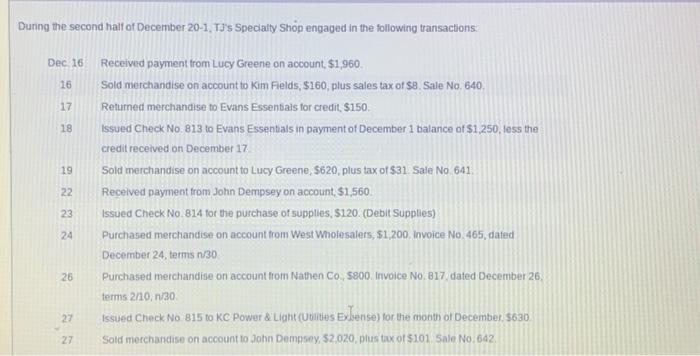

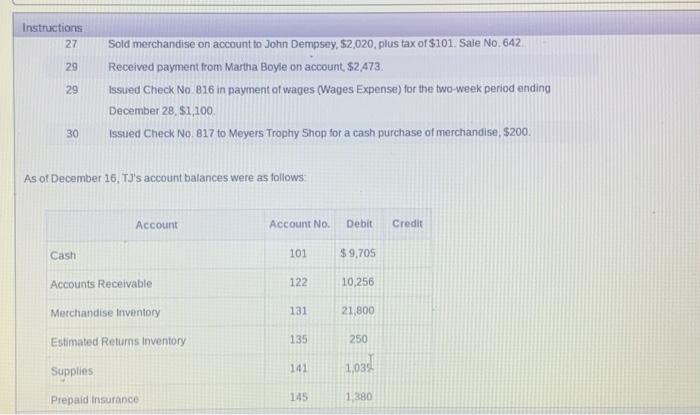

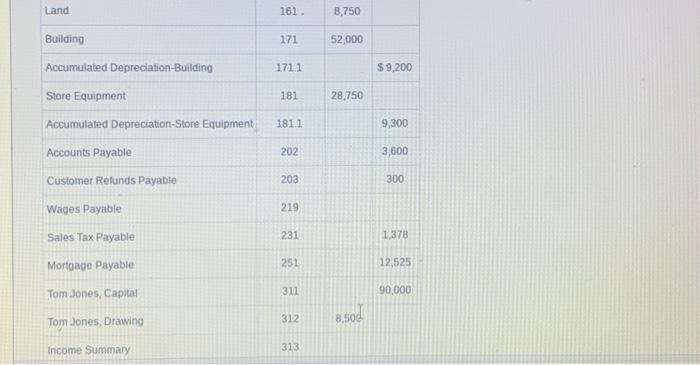

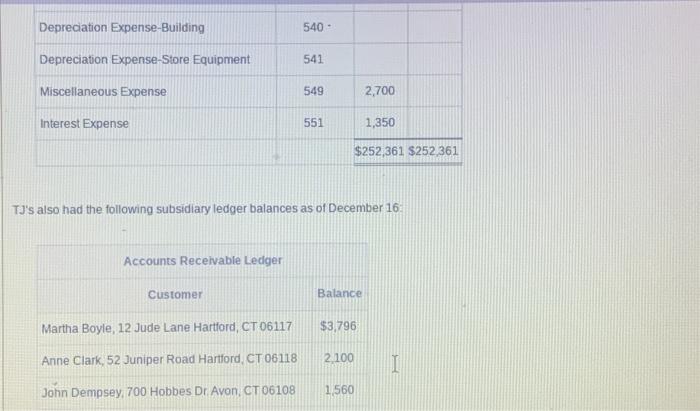

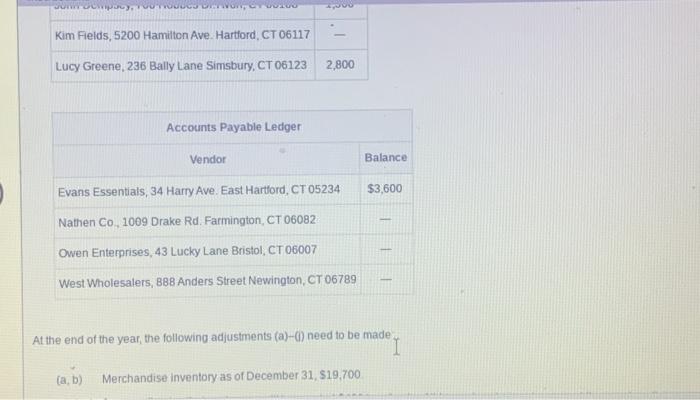

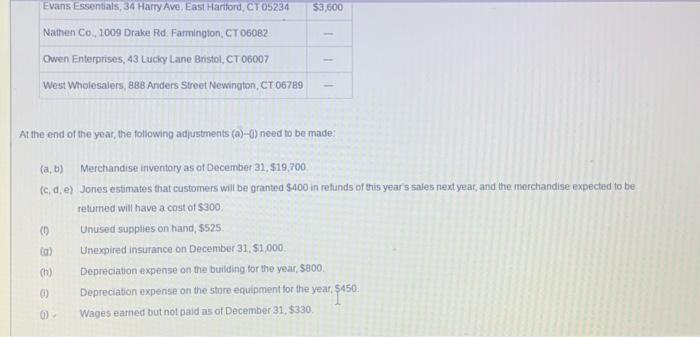

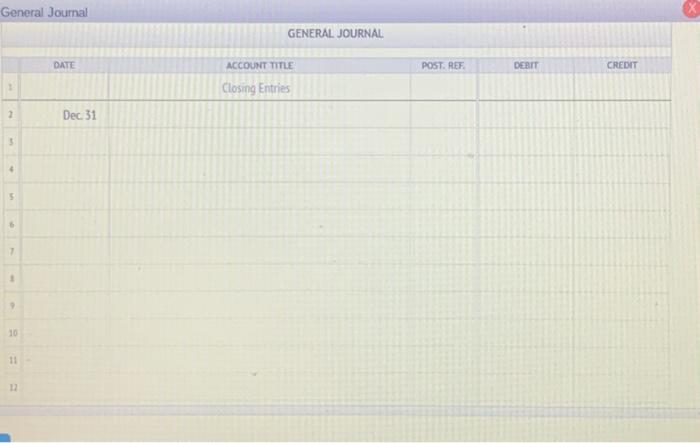

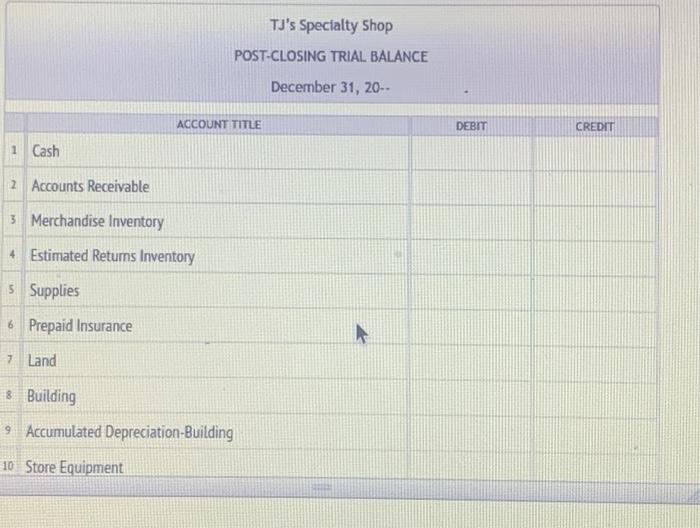

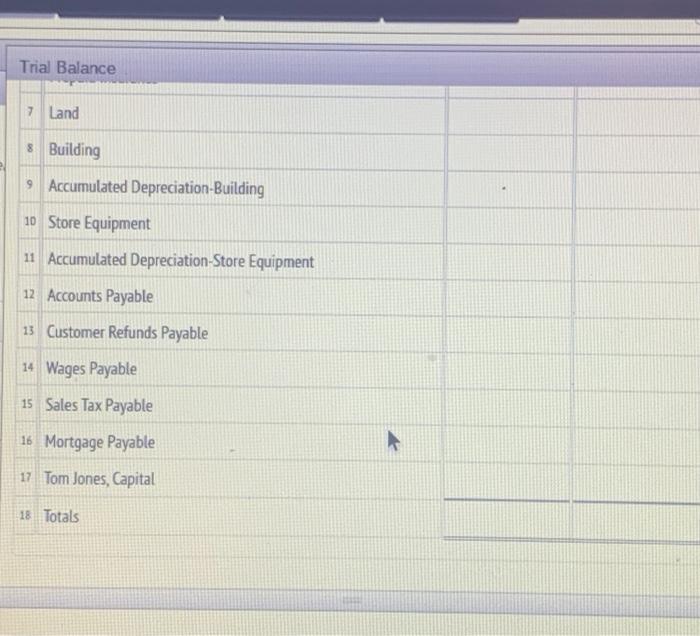

During the second half of December 20-1, Tis Specialty Shop engaged in the following transactions: Dec: 16 Received payment from Lucy Greene on account, $1,960 16 Sold merchandise on account to Kim Fields, \$160, plus sales tax of \$8. Sale No, 640. 17. Returned merchandise to Evans Essentals for credit, $150. 18 Issued Check No. 813 to Evans Essentals in payment of December 1 balance of \$1,250, less the credit received on December 17. 19 Sold merchandise on account to Lucy Greene, \$620, plus tax of \$31. Sale No 641. 22 Recelved payment trom John Dempsey on account, 51,560. 23 Issued Check No.814 for the purchase of supplies, \$120. (Debit Supplies) 24 Purchased merchandise on account trom West Wholesalers, $1,200, invoice No. 465, dated December 24 , termis n/30 26 Purchased merchandise on account trom Nathen Co, 5800 . Invoice No. B17. dated December 26. terms 210,83 27 Issued Check No. 815 to KC Power \& Light (Uulites Exlyense) for the month of December, 5630 27 Sold merchandise on account to John Dempsey, $2,020, plus tax of $101. Sale No. 642. As of December 16,TJ s account balances were as follows TJ's also had the following subsidiary ledger balances as of December 16: At the end of the year, the following adjustments (a)-(i) need to be made (a, b) Merchandise inventory as of December 31, $19,700 At the end of the year, the following adjustments (a)=(j) need to be made: (a, b) Merchandise inventory as of December 31, $19,700 (c, d, e) Jones estimates that customers wil be granted $400 in rehunds of this year s sales next year, and the merehandise expected to be returned will have a cost of $300. (1) Unused suppiles on hand, $525 (a) Unexpired insurance on December 31, $1,000. (h) Depreciation expense on the building tor the year, $800. (i) Depreciation expense on the store equipment tor the yeat, $450. (i) - Wages eamed vut not paid ns of December 31,$330. General Journal GENERAL JOURNAL \begin{tabular}{|l|l|} \hline & TJ's Specialty Shop \\ \hline \end{tabular} Trial Balance 7 Land 8 Building 9. Accumulated Depreciation-Building 10 Store Equipment 11 Accumulated Depreciation-Store Equipment 12 Accounts Payable 13 Customer Refunds Payable 14 Wages Payable 15 Sales Tax Payable 16 Mortgage Payable 17 Tom Jones, Capital 18 Totals During the second half of December 20-1, Tis Specialty Shop engaged in the following transactions: Dec: 16 Received payment from Lucy Greene on account, $1,960 16 Sold merchandise on account to Kim Fields, \$160, plus sales tax of \$8. Sale No, 640. 17. Returned merchandise to Evans Essentals for credit, $150. 18 Issued Check No. 813 to Evans Essentals in payment of December 1 balance of \$1,250, less the credit received on December 17. 19 Sold merchandise on account to Lucy Greene, \$620, plus tax of \$31. Sale No 641. 22 Recelved payment trom John Dempsey on account, 51,560. 23 Issued Check No.814 for the purchase of supplies, \$120. (Debit Supplies) 24 Purchased merchandise on account trom West Wholesalers, $1,200, invoice No. 465, dated December 24 , termis n/30 26 Purchased merchandise on account trom Nathen Co, 5800 . Invoice No. B17. dated December 26. terms 210,83 27 Issued Check No. 815 to KC Power \& Light (Uulites Exlyense) for the month of December, 5630 27 Sold merchandise on account to John Dempsey, $2,020, plus tax of $101. Sale No. 642. As of December 16,TJ s account balances were as follows TJ's also had the following subsidiary ledger balances as of December 16: At the end of the year, the following adjustments (a)-(i) need to be made (a, b) Merchandise inventory as of December 31, $19,700 At the end of the year, the following adjustments (a)=(j) need to be made: (a, b) Merchandise inventory as of December 31, $19,700 (c, d, e) Jones estimates that customers wil be granted $400 in rehunds of this year s sales next year, and the merehandise expected to be returned will have a cost of $300. (1) Unused suppiles on hand, $525 (a) Unexpired insurance on December 31, $1,000. (h) Depreciation expense on the building tor the year, $800. (i) Depreciation expense on the store equipment tor the yeat, $450. (i) - Wages eamed vut not paid ns of December 31,$330. General Journal GENERAL JOURNAL \begin{tabular}{|l|l|} \hline & TJ's Specialty Shop \\ \hline \end{tabular} Trial Balance 7 Land 8 Building 9. Accumulated Depreciation-Building 10 Store Equipment 11 Accumulated Depreciation-Store Equipment 12 Accounts Payable 13 Customer Refunds Payable 14 Wages Payable 15 Sales Tax Payable 16 Mortgage Payable 17 Tom Jones, Capital 18 Totals thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started