Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please can someone help with these problems 3 Financial Assets 6-6 6-7 6-8 Intermediate Problems 8-16 INFLATION CROSS-PRODUCT An analyst is evaluating securities in a

Please can someone help with these problems

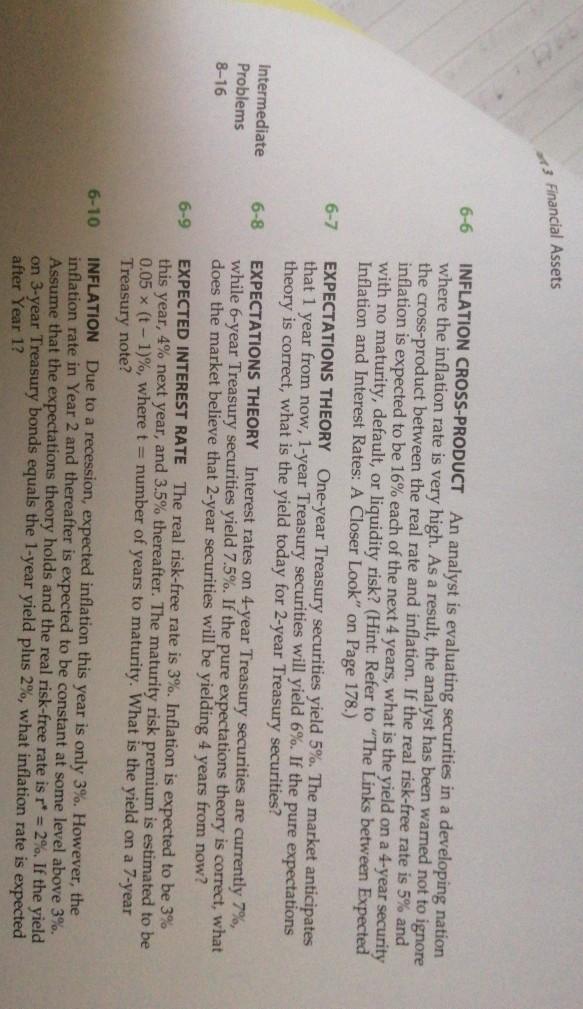

3 Financial Assets 6-6 6-7 6-8 Intermediate Problems 8-16 INFLATION CROSS-PRODUCT An analyst is evaluating securities in a developing nation where the inflation rate is very high. As a result, the analyst has been warned not to ignore the cross-product between the real rate and inflation. If the real risk-free rate is 5% and inflation is expected to be 16% each of the next 4 years, what is the yield on a 4-year security with no maturity, default, or liquidity risk? (Hint Refer to "The Links between Expected Inflation and Interest Rates: A Closer Look" on Page 178.) EXPECTATIONS THEORY One-year Treasury securities yield 5%. The market anticipates that 1 year from now, 1-year Treasury securities will yield 6%. If the pure expectations theory is correct, what is the yield today for 2-year Treasury securities? EXPECTATIONS THEORY Interest rates on 4-year Treasury securities are currently 7%, while 6-year Treasury securities yield 7.5%. If the pure expectations theory is correct, what does the market believe that 2-year securities will be yielding 4 years from now? EXPECTED INTEREST RATE The real risk-free rate is 3%. Inflation is expected to be 3% this year, 4% next year, and 3.5% thereafter. The maturity risk premium is estimated to be 0.05 x (t-1)%, where t = number of years to maturity. What is the yield on a 7-year Treasury note? INFLATION Due to a recession, expected inflation this year is only 3%. However, the inflation rate in Year 2 and thereafter is expected to be constant at some level above 3%. Assume that the expectations theory holds and the real risk-free rate is r* = 2%. If the yield on 3-year Treasury bonds equals the 1-year yield plus 2%, what inflation rate is expected after Year 12 6-9 6-10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started