please can you answer 1 to 11

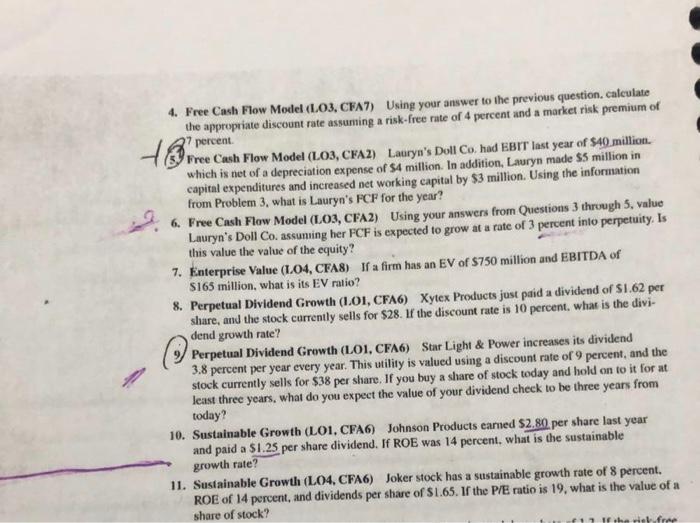

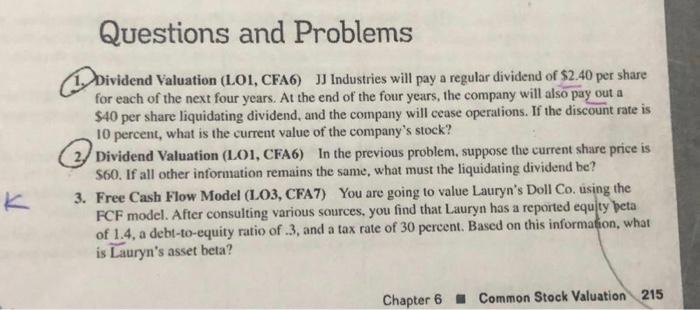

4. Free Cash Flow Model (LO3, CFA7) Using your answer to the previous question. calculate the appropriate discount rate assuming a risk-free rate of 4 percent and a market risk premium of 27 percent 1(3) Free Cash Flow Model (LO3, CFA2) Lauryn's Doll Co. had EBIT last year of $40 million. which is net of a depreciation expense of $4 million. In addition, Lauryn made $5 million in capital expenditures and increased net working capital by $3 million. Using the information from Problem 3, what is Lauryn's FCF for the year? 6. Free Cash Flow Model (LO3, CFA2) Using your answers from Questions 3 thruugh 5, value Lauryn's Doll Co. assuning her FCF is expected to grow at a rate of 3 percent inlo perpetuity. Is this value the value of the equity? 7. Enterprise Value (LO4, CFA8) If a firm has an EV of $750 million and EBITDA of S165 million, what is its EV ratio? 8. Perpetual Dividend Growth (1.O1, CFA6) Xytex Products just paid a dividend of $1.62 per share, and the stock currently sells for $28. If the discount rate is 10 percent, what is the dividend growth rate? 9. Perpetual Dividend Growth (LO1, CFA6) Star Light \& Power increases its dividend 3.8 percent per year every year. This utility is valued using a discount rate of 9 percent, and the stock currently sells for $38 per share. If you buy a share of stock today and hold on to it for at least three years, what do you expect the value of your dividend check to be three years from today? 10. Sustainable Growth (LO1, CFA6) Johnson Products earued \$2.80 per share last year and paid a $1.25 per share dividend. If ROE was 14 percent, what is the sustainable growth rate? 11. Sustainable Growth (LO4, CFA6) Joker stock has a sustainable growth rate of 8 percent. ROE of 14 percent, and dividends per share of $1.65. If the P/E ratio is 19, what is the value of a share of stock? Questions and Problems 1. Dividend Valuation (LO1, CFA6) JJ Industries will pay a regular dividend of $2.40 per share for each of the next four years. At the end of the four years, the company will also pay out a $40 per share liquidating dividend, and the company will cease operalions. If the discount rate is 10 percent, what is the current value of the company's stock? 2. Dividend Valuation (LO1, CFA6) In the previous problem, suppose the current share price is S60. If all other information remains the same, what must the liquidating dividend be? 3. Free Cash Flow Model (LO3, CFA7) You are going to value Lauryn's Doll Co. using the FCF model. After consulting various sources, you find that Lauryn has a reported equity beta of 1.4 , a debt-to-equity ratio of .3 , and a tax rate of 30 percent. Based on this informafion, what is Lauryn's asset beta? 4. Free Cash Flow Model (LO3, CFA7) Using your answer to the previous question. calculate the appropriate discount rate assuming a risk-free rate of 4 percent and a market risk premium of 27 percent 1(3) Free Cash Flow Model (LO3, CFA2) Lauryn's Doll Co. had EBIT last year of $40 million. which is net of a depreciation expense of $4 million. In addition, Lauryn made $5 million in capital expenditures and increased net working capital by $3 million. Using the information from Problem 3, what is Lauryn's FCF for the year? 6. Free Cash Flow Model (LO3, CFA2) Using your answers from Questions 3 thruugh 5, value Lauryn's Doll Co. assuning her FCF is expected to grow at a rate of 3 percent inlo perpetuity. Is this value the value of the equity? 7. Enterprise Value (LO4, CFA8) If a firm has an EV of $750 million and EBITDA of S165 million, what is its EV ratio? 8. Perpetual Dividend Growth (1.O1, CFA6) Xytex Products just paid a dividend of $1.62 per share, and the stock currently sells for $28. If the discount rate is 10 percent, what is the dividend growth rate? 9. Perpetual Dividend Growth (LO1, CFA6) Star Light \& Power increases its dividend 3.8 percent per year every year. This utility is valued using a discount rate of 9 percent, and the stock currently sells for $38 per share. If you buy a share of stock today and hold on to it for at least three years, what do you expect the value of your dividend check to be three years from today? 10. Sustainable Growth (LO1, CFA6) Johnson Products earued \$2.80 per share last year and paid a $1.25 per share dividend. If ROE was 14 percent, what is the sustainable growth rate? 11. Sustainable Growth (LO4, CFA6) Joker stock has a sustainable growth rate of 8 percent. ROE of 14 percent, and dividends per share of $1.65. If the P/E ratio is 19, what is the value of a share of stock? Questions and Problems 1. Dividend Valuation (LO1, CFA6) JJ Industries will pay a regular dividend of $2.40 per share for each of the next four years. At the end of the four years, the company will also pay out a $40 per share liquidating dividend, and the company will cease operalions. If the discount rate is 10 percent, what is the current value of the company's stock? 2. Dividend Valuation (LO1, CFA6) In the previous problem, suppose the current share price is S60. If all other information remains the same, what must the liquidating dividend be? 3. Free Cash Flow Model (LO3, CFA7) You are going to value Lauryn's Doll Co. using the FCF model. After consulting various sources, you find that Lauryn has a reported equity beta of 1.4 , a debt-to-equity ratio of .3 , and a tax rate of 30 percent. Based on this informafion, what is Lauryn's asset beta