please can you answer question 10-18

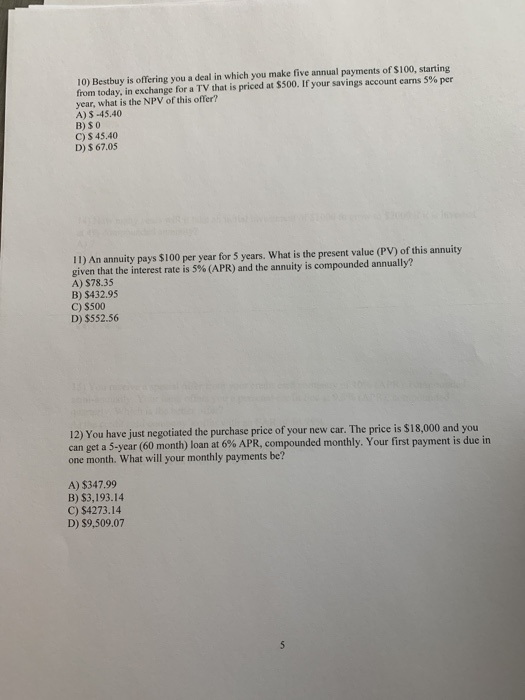

10) Bestbuy is offering you a deal in which you make five annual payments of S100, starting from today, in exchange for a TV that is priced at $500. If your savings account earns 5% per year, what is the NPV of this offer? A) S-45.40 B) SO C) S 45.40 D) $67.05 TI) An annuity pays $100 per year for 5 years. What is the present value (PV) of this annuity given that the interest rate is 5% (APR) and the annuity is compounded annually? A) $78.35 B) $432.95 C) $500 D) $552.56 12) You have just negotiated the purchase price of your new car. The price is $18,000 and you can get a 5-year (60 month) loan at 6% APR, compounded monthly. Your first payment is due in one month. What will your monthly payments be? A) $347.99 B) $3,193.14 C) $4273.14 D) 59,509.07 13) If the real interest rate is around 2.3% and the inflation rate is around 4%, what is the nominal interest rate? Choose the closest answer. A) 0.98% B) 6.30% C) 6.39% D) 1.06% 14) How many years will it take an initial investment of S1000 to grow to $2000 if it is invested at 4% compounded annually? A) 7 B) 11 C) 18 D) 25 15) You receive a special offer from your credit card company of 10% (APR), compounded semi-annually. Your bank offers you a personal credit line at 9.5% (APR), compounded quarterly. Which is the better offer? A) the credit card company's offer with an EAR of 10.25% B) the bank's offer with an EAR of 10.25% C) the credit card company's offer with an EAR of 9.8% D) the bank's offer with an EAR of 9.8% 16) What is the goal of a financial manager? A) Maximize profits B) Increase market share C) Maximize growth D) Maximize shareholder's wealth 17) Which of the following is TRUE? i) Cash flows and earnings are equal. ii) Receiving $100 lump sum today is better than receiving S10 every year for 12 years. iii) Real income is nominal income adjusted by the inflation rate. A) i B) ii C) iii D) None of the above 18) You are asked to invest S1000 in a friend's business with the promise that the friend will repay $1200 in one year's time. Your alternative investment opportunity in the market pays a 30% return in one year's time and the money market fund offers a rate of retum of 8%. What is the opportunity cost of capital in this case? A) 0.08 or 8% B) 0.2 or 20% C) 0.30 or 30% D) 0.38 or 38%