please can you answer question 19-25

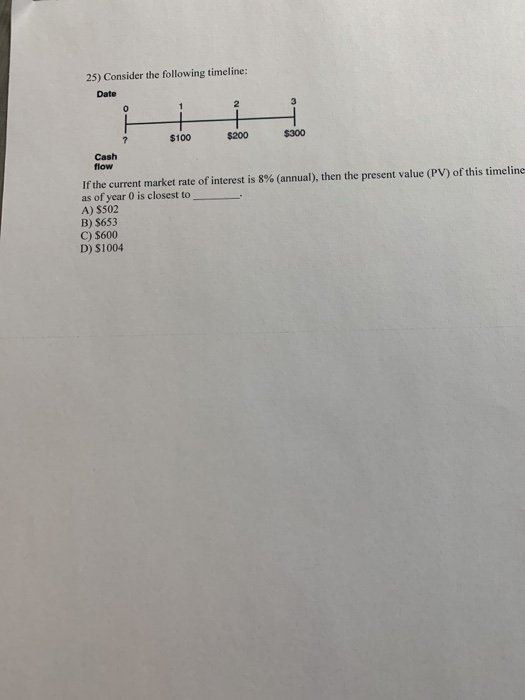

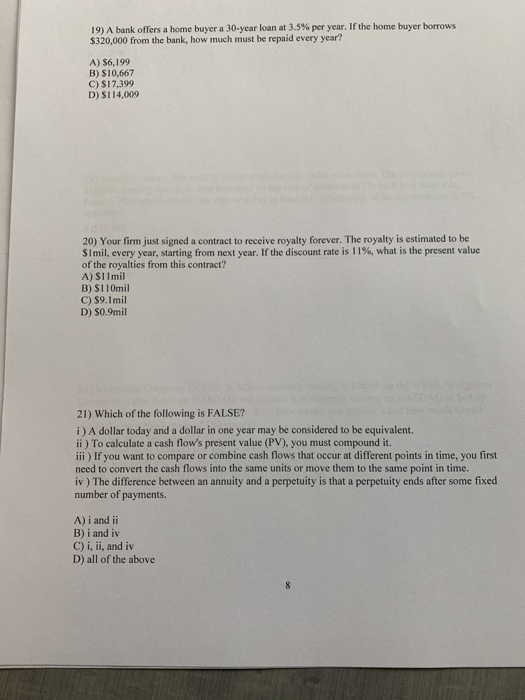

19) A bank offers a home buyer a 30-year loan at 3.5% per year. If the home buyer borrows $320,000 from the bank, how much must be repaid every year? A) $6.199 B) $10,667 C) $17,399 D) ST14,009 20) Your firm just signed a contract to receive royalty forever. The royalty is estimated to be Simil, every year, starting from next year. If the discount rate is 11%, what is the present value of the royalties from this contract? A) S11mil B) $110mil C) $9.1 mil D) S0.9mil 21) Which of the following is FALSE? i) A dollar today and a dollar in one year may be considered to be equivalent. ii) To calculate a cash flow's present value (PV), you must compound it. iii) If you want to compare or combine cash flows that occur at different points in time, you first need to convert the cash flows into the same units or move them to the same point in time. iv) The difference between an annuity and a perpetuity is that a perpetuity ends after some fixed number of payments. A) i and ii B) i and iv C) i, ii, and iv D) all of the above 22) The effective annual rate (EAR) for a loan with a stated APR of 8% compounded monthly is closest to: A) 8.30% B) 8.33% C) 8.00% D) 8.24% 23) After retirement, you want to create a scholarship under your name. The scholarship gives $10,000, starting next year, and increases by the rate of inflation of 2% each year after that, forever. How much should you endow today to fund this scholarship, if the discount rate is 7% annually? A)$10,000 B)$100,000 C)$142,857 D)$200,000 24) Walgreens Company (NYSE: WAG) is currently trading at $48.85 on the NYSE, Walgreens Company is also listed on NASDAQ and assume it is currently trading on NASDAQ at $48.50. Does an arbitrage opportunity exist and, if so, how would you exploit it and how much would you make on a block trade of 100 shares? A) No, no arbitrage opportunity exists. B) Yes, buy on NASDAQ and sell on NYSE, make $35. C) Yes, buy on NYSE and sell on NASDAQ, make $35. D) Yes, buy on NASDAQ and sell on NYSE, make $350. 25) Consider the following timeline: Date $100 $200 $300 flow If the current market rate of interest is 8% (annual), then the present value (PV) of this timeline as of year 0 is closest to A) S502 B) $653 C) $600 D) $1004