Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please can you answer question 26-31? thanks pension obligation during the year? a. Benefits paid to the retirees b. Interest cost c. Actual return on

Please can you answer question 26-31? thanks

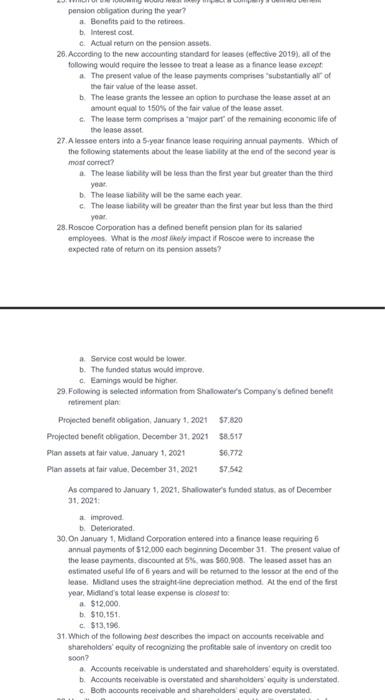

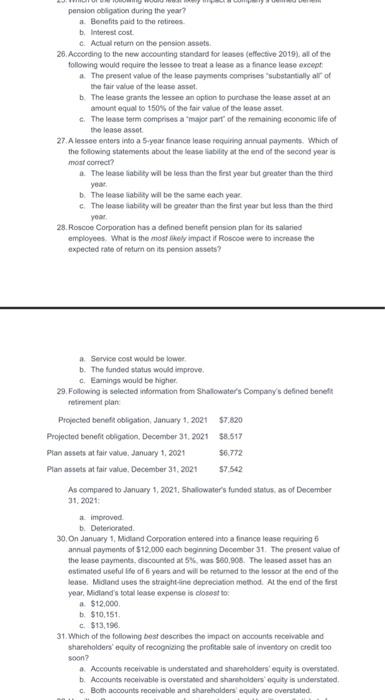

pension obligation during the year? a. Benefits paid to the retirees b. Interest cost c. Actual return on the pension assets. 26. According to the new accounting standard for leases (effective 2019), all of the following would require the lessoo to treat a lease as a finance lease except The present value of the lease payments comprises substantially all of the fair value of the lease asset b. The lease grants the lessee an option to purchase the lease asset at an amount equal to 150% of the fair value of the lease asset The lease term comprises a major part of the remaining economic life of the lease asset 27 Alessee enters into a 5-year finance lease requiring annual payments. Which of the following statements about the feaser liability at the end of the second year is most correct? The lateliability will be less than the first year but greater than the third b. The lease liability will be same each year The lease liability will be greater than the first year but less than the third your 28. Roscoe Corporation has a defined benefit pension plan for its salaried employees. What is the most shely impact it Roscoe were to increase the expected rate of return on its pension assets? year Service cost would be lower b. The funded status would improve Earings would be higher 29. Following is selected information from Shallowater's Company's defined beneft retirement plan Projected benefit obligation, January 1, 2021 $7.820 Projected benefit obligation. December 31, 2021 88.517 Plan assets at fair value January 1, 2021 $6.772 Plan assets at fair value, December 31, 2021 $7.542 As compared to January 1, 2021. Shaliowater's funded status, as of December 31, 2021 at improved b. Deteriorated 30. On January 1, Midland Corporation entered into a finance lease requiring annual payments of $12.000 each beginning December 31. The present value of the lease payments, discounted at 5% was 580,908. The leased asset has an estimated useful life of 6 years and will be returned to the lessor at the end of the lease. Midland uses the straight-ine depreciation method. At the end of the first year, Midland's totallase expense is closest to a $12.000 b. $10,151 C. $13,196 31. Which of the following best describes the impact on accounts receivable and shareholders equity of recognizing the profitable sale of inventory on credit to soon? a Accounts receivable is understated and shareholders equity is overstated Accounts receivable is overstated and shareholders' equity is understated c. Both accounts receivable and shareholders equity are overstated. pension obligation during the year? a. Benefits paid to the retirees b. Interest cost c. Actual return on the pension assets. 26. According to the new accounting standard for leases (effective 2019), all of the following would require the lessoo to treat a lease as a finance lease except The present value of the lease payments comprises substantially all of the fair value of the lease asset b. The lease grants the lessee an option to purchase the lease asset at an amount equal to 150% of the fair value of the lease asset The lease term comprises a major part of the remaining economic life of the lease asset 27 Alessee enters into a 5-year finance lease requiring annual payments. Which of the following statements about the feaser liability at the end of the second year is most correct? The lateliability will be less than the first year but greater than the third b. The lease liability will be same each year The lease liability will be greater than the first year but less than the third your 28. Roscoe Corporation has a defined benefit pension plan for its salaried employees. What is the most shely impact it Roscoe were to increase the expected rate of return on its pension assets? year Service cost would be lower b. The funded status would improve Earings would be higher 29. Following is selected information from Shallowater's Company's defined beneft retirement plan Projected benefit obligation, January 1, 2021 $7.820 Projected benefit obligation. December 31, 2021 88.517 Plan assets at fair value January 1, 2021 $6.772 Plan assets at fair value, December 31, 2021 $7.542 As compared to January 1, 2021. Shaliowater's funded status, as of December 31, 2021 at improved b. Deteriorated 30. On January 1, Midland Corporation entered into a finance lease requiring annual payments of $12.000 each beginning December 31. The present value of the lease payments, discounted at 5% was 580,908. The leased asset has an estimated useful life of 6 years and will be returned to the lessor at the end of the lease. Midland uses the straight-ine depreciation method. At the end of the first year, Midland's totallase expense is closest to a $12.000 b. $10,151 C. $13,196 31. Which of the following best describes the impact on accounts receivable and shareholders equity of recognizing the profitable sale of inventory on credit to soon? a Accounts receivable is understated and shareholders equity is overstated Accounts receivable is overstated and shareholders' equity is understated c. Both accounts receivable and shareholders equity are overstated

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started