Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please can you answer this question, thank you File 5 - Elton Jack Elton, aged 81, is considering his Inheritance Tax position. He estimates that

Please can you answer this question, thank you

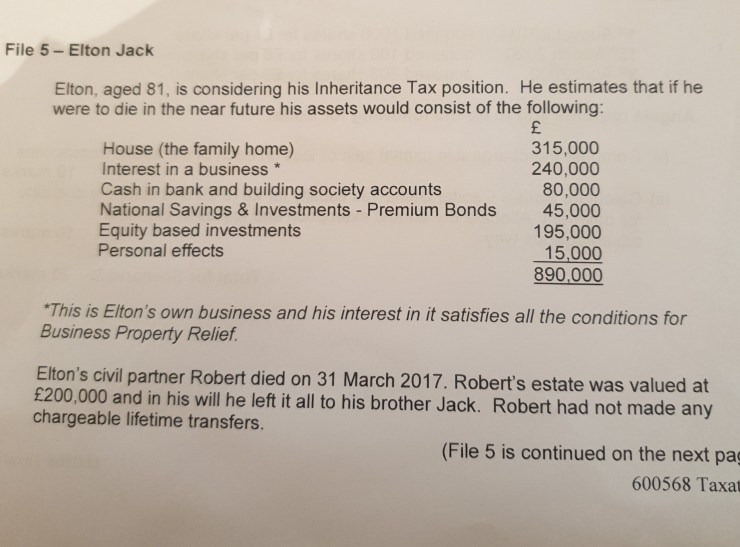

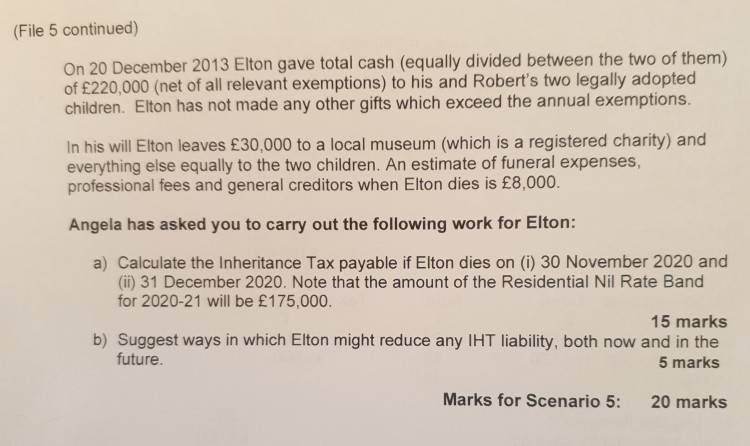

File 5 - Elton Jack Elton, aged 81, is considering his Inheritance Tax position. He estimates that if he were to die in the near future his assets would consist of the following: House (the family home) 315,000 Interest in a business * 240,000 Cash in bank and building society accounts 80,000 National Savings & Investments - Premium Bonds 45,000 Equity based investments 195,000 Personal effects 15,000 890,000 *This is Elton's own business and his interest in it satisfies all the conditions for Business Property Relief. Elton's civil partner Robert died on 31 March 2017. Robert's estate was valued at 200,000 and in his will he left it all to his brother Jack. Robert had not made any chargeable lifetime transfers. (File 5 is continued on the next pag 600568 Taxat (File 5 continued) On 20 December 2013 Elton gave total cash (equally divided between the two of them) of 220,000 (net of all relevant exemptions) to his and Robert's two legally adopted children. Elton has not made any other gifts which exceed the annual exemptions. In his will Elton leaves 30,000 to a local museum (which is a registered charity) and everything else equally to the two children. An estimate of funeral expenses, professional fees and general creditors when Elton dies is 8,000. Angela has asked you to carry out the following work for Elton: a) Calculate the Inheritance Tax payable if Elton dies on (1) 30 November 2020 and (ii) 31 December 2020. Note that the amount of the Residential Nil Rate Band for 2020-21 will be 175,000. 15 marks b) Suggest ways in which Elton might reduce any IHT liability, both now and in the future. 5 marks Marks for Scenario 5: 20 marks File 5 - Elton Jack Elton, aged 81, is considering his Inheritance Tax position. He estimates that if he were to die in the near future his assets would consist of the following: House (the family home) 315,000 Interest in a business * 240,000 Cash in bank and building society accounts 80,000 National Savings & Investments - Premium Bonds 45,000 Equity based investments 195,000 Personal effects 15,000 890,000 *This is Elton's own business and his interest in it satisfies all the conditions for Business Property Relief. Elton's civil partner Robert died on 31 March 2017. Robert's estate was valued at 200,000 and in his will he left it all to his brother Jack. Robert had not made any chargeable lifetime transfers. (File 5 is continued on the next pag 600568 Taxat (File 5 continued) On 20 December 2013 Elton gave total cash (equally divided between the two of them) of 220,000 (net of all relevant exemptions) to his and Robert's two legally adopted children. Elton has not made any other gifts which exceed the annual exemptions. In his will Elton leaves 30,000 to a local museum (which is a registered charity) and everything else equally to the two children. An estimate of funeral expenses, professional fees and general creditors when Elton dies is 8,000. Angela has asked you to carry out the following work for Elton: a) Calculate the Inheritance Tax payable if Elton dies on (1) 30 November 2020 and (ii) 31 December 2020. Note that the amount of the Residential Nil Rate Band for 2020-21 will be 175,000. 15 marks b) Suggest ways in which Elton might reduce any IHT liability, both now and in the future. 5 marks Marks for Scenario 5: 20 marksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started