Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please can you assist me it's taxation the text I'm using is silke SA INCOME TAX 2021 Question 1 Section 23 disallows expenses relating to

please can you assist me it's taxation the text I'm using is silke SA INCOME TAX 2021

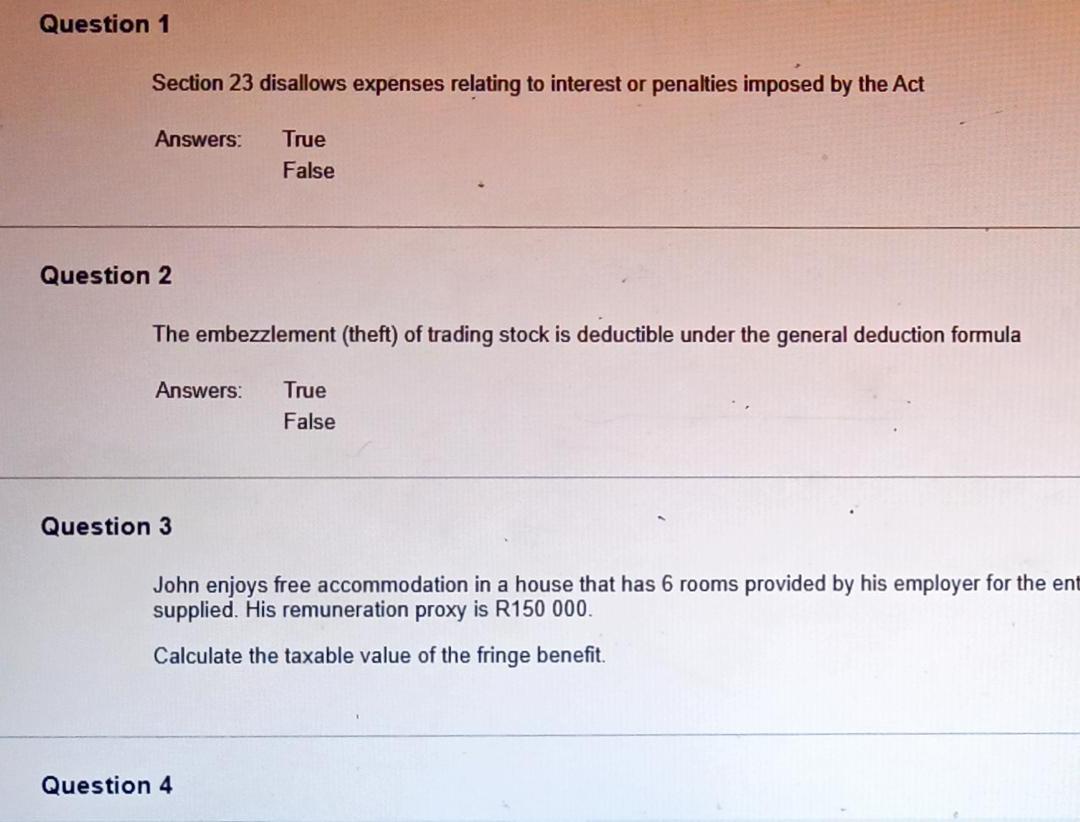

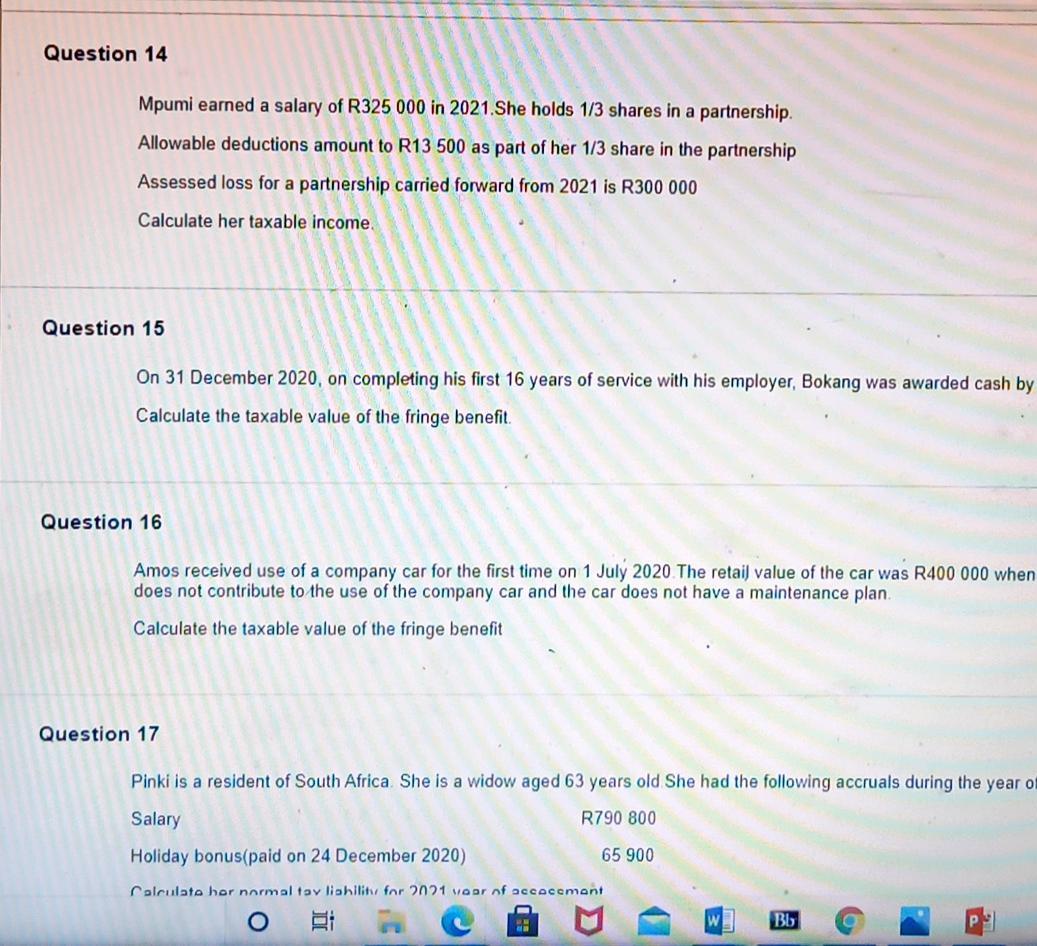

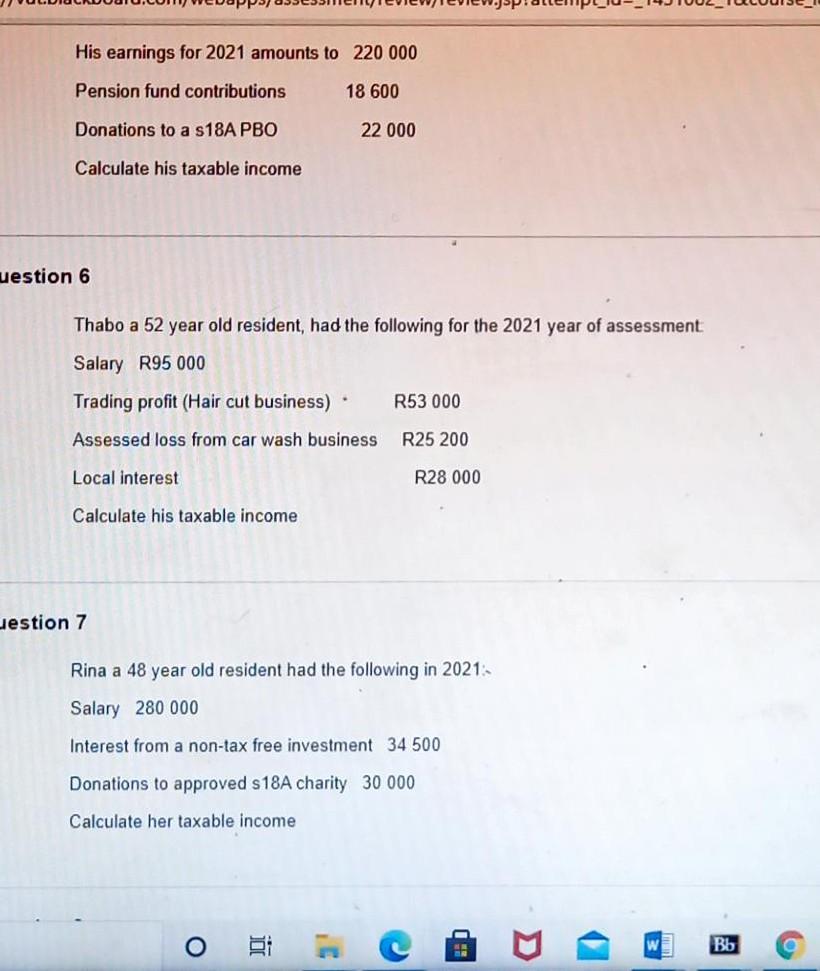

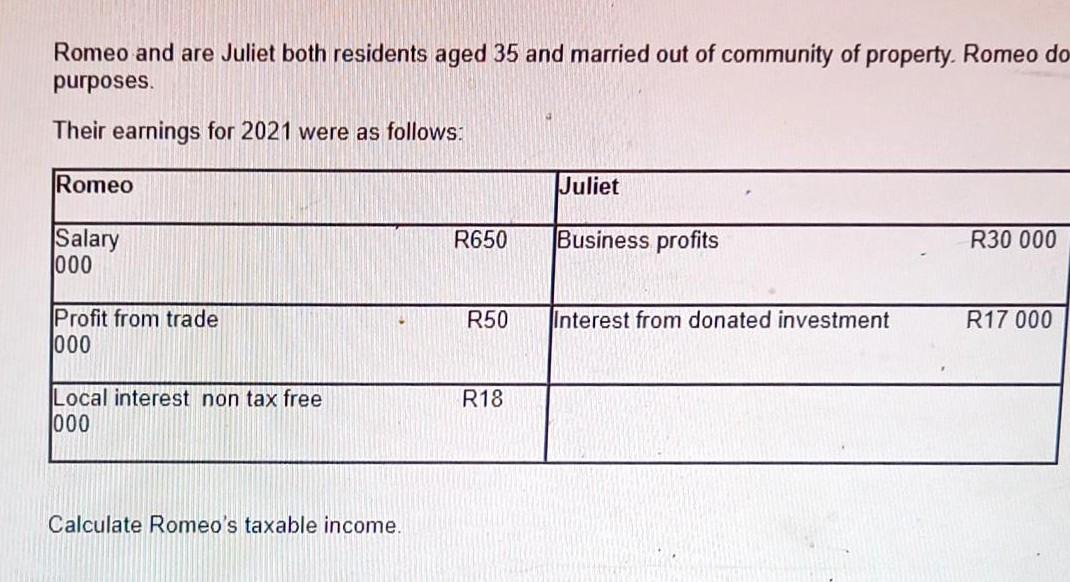

Question 1 Section 23 disallows expenses relating to interest or penalties imposed by the Act Answers: True False Question 2 The embezzlement (theft) of trading stock is deductible under the general deduction formula Answers: True False Question 3 John enjoys free accommodation in a house that has 6 rooms provided by his employer for the ent supplied. His remuneration proxy is R150 000. Calculate the taxable value of the fringe benefit. Question 4 Question 14 Mpumi earned a salary of R325 000 in 2021. She holds 1/3 shares in a partnership Allowable deductions amount to R13 500 as part of her 1/3 share in the partnership Assessed loss for a partnership carried forward from 2021 is R300 000 Calculate her taxable income Question 15 On 31 December 2020, on completing his first 16 years of service with his employer, Bokang was awarded cash by Calculate the taxable value of the fringe benefit Question 16 Amos received use of a company car for the first time on 1 July 2020 The retail value of the car was R400 000 when does not contribute to the use of the company car and the car does not have a maintenance plan Calculate the taxable value of the fringe benefit Question 17 Pinki is a resident of South Africa. She is a widow aged 63 years old She had the following accruals during the year of Salary R790 800 Holiday bonus(paid on 24 December 2020) 65 900 Calculate her normal tay liability for 2021 voor of accocement 3 O PH Bb P His earnings for 2021 amounts to 220 000 Pension fund contributions 18 600 Donations to a s18A PBO 22 000 Calculate his taxable income uestion 6 Thabo a 52 year old resident, had the following for the 2021 year of assessment Salary R95 000 Trading profit (Hair cut business) R53 000 Assessed loss from car wash business R25 200 Local interest R28 000 Calculate his taxable income Jestion 7 Rina a 48 year old resident had the following in 2021 Salary 280 000 Interest from a non-tax free investment 34 500 Donations to approved s 18A charity 30 000 Calculate her taxable income ORI c BbStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started