Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please can you but the question number before answering because it becomes confusinbg when there is no numbers to the answered questions. thanks You are

please can you but the question number before answering because it becomes confusinbg when there is no numbers to the answered questions. thanks

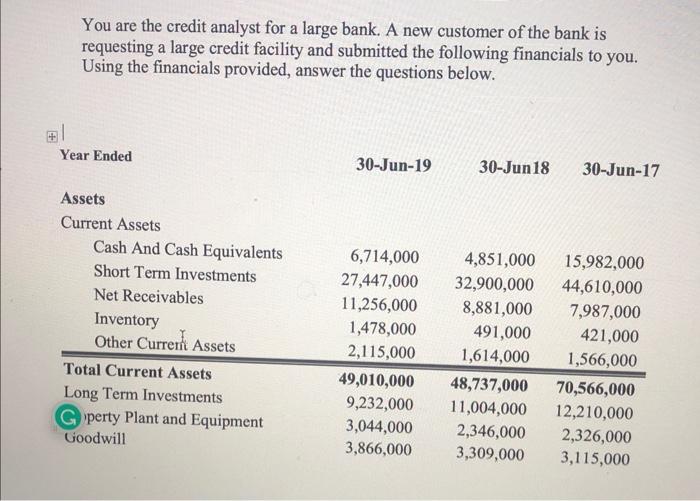

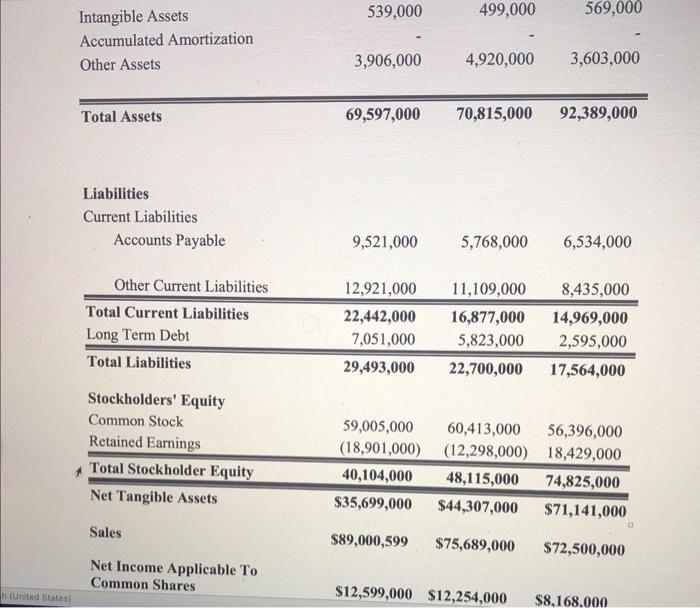

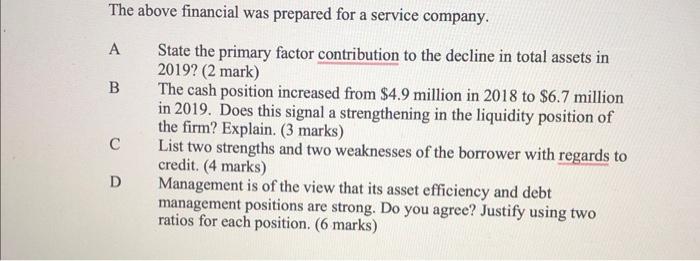

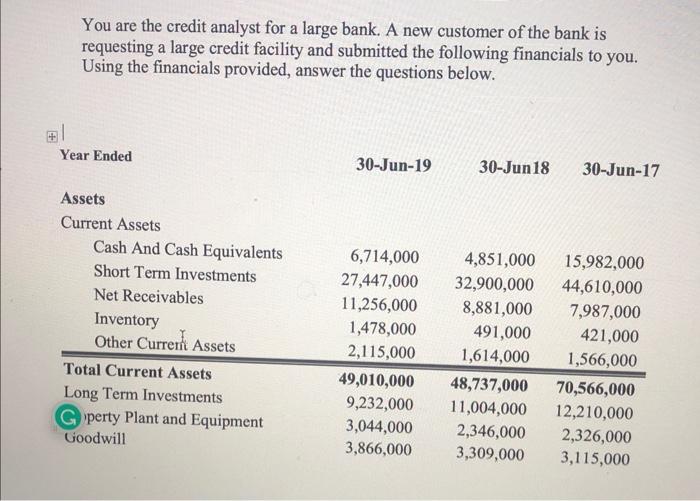

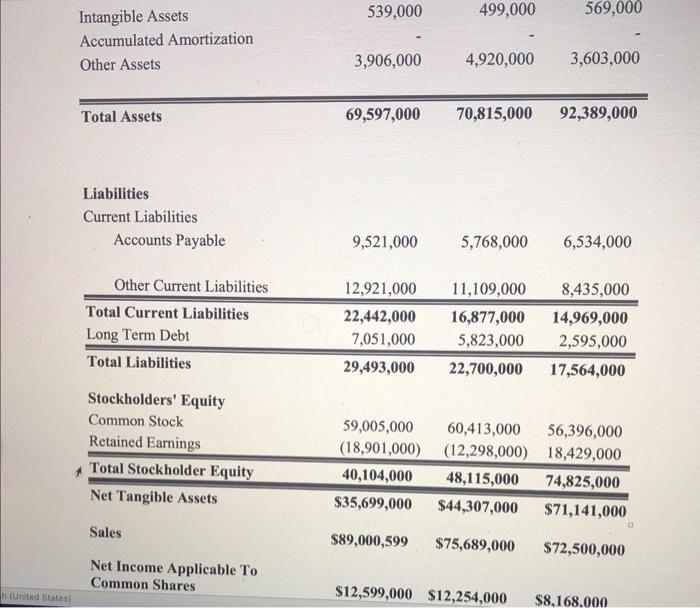

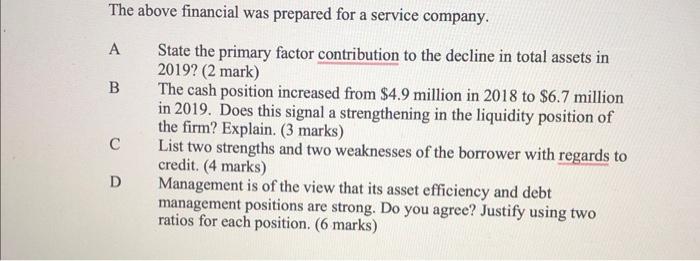

You are the credit analyst for a large bank. A new customer of the bank is requesting a large credit facility and submitted the following financials to you. Using the financials provided, answer the questions below. Intangible Assets Accumulated Amortization Other Assets \begin{tabular}{llll} \hline \hline Total Assets & 69,597,000 & 70,815,000 & 92,389,000 \end{tabular} Liabilities Current Liabilities \begin{tabular}{lrrr} \multicolumn{1}{c}{ Accounts Payable } & 9,521,000 & 5,768,000 & 6,534,000 \\ \multicolumn{1}{c}{ Other Current Liabilities } & 12,921,000 & 11,109,000 & 8,435,000 \\ \hline \hline Total Current Liabilities & 22,442,000 & 16,877,000 & 14,969,000 \\ Long Term Debt & 7,051,000 & 5,823,000 & 2,595,000 \\ \hline \hline Total Liabilities & 29,493,000 & 22,700,000 & 17,564,000 \end{tabular} Stockholders' Equity The above financial was prepared for a service company. A State the primary factor contribution to the decline in total assets in 2019? (2 mark) B The cash position increased from $4.9 million in 2018 to $6.7 million in 2019. Does this signal a strengthening in the liquidity position of the firm? Explain. ( 3 marks) C List two strengths and two weaknesses of the borrower with regards to credit. (4 marks) D Management is of the view that its asset efficiency and debt management positions are strong. Do you agree? Justify using two ratios for each position. ( 6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started